The past year has offered investors a masterclass on the value of staying invested in the face of profound uncertainty and noise.

2025 witnessed the reshaping of the political landscape, rippling shocks to the machinery of global trade, a steep correction in stocks, an overhaul of the US tax code, and the longest government shutdown in US history.

And yet, nearly every major asset had delivered positive returns for the year as of mid December. Most broad categories of stocks—including US large caps, US small caps, international developed markets, and emerging markets—were up by double-digit percentages.

Some of the key drivers of those stellar stock market results? Earnings, earnings, and earnings. Strong earnings might seldom make front-page news. But amid a turbulent year, corporate earnings growth has been the stealthy motor driving the market—compounding value and helping investors quietly build wealth.

As investors look to 2026 and beyond, there are no signs of turbulence subsiding. The global stage remains tense, and the US role on that stage is in flux. Domestic politics remain fraught and deeply polarized. The US federal government digs deeper into debt, with no easy way out. Technology is evolving at a blinding pace—with workers, investors, and companies racing not to get left behind.

And yet? 2026 could turn out to be another wonderful year to be invested. The market has the wind at its back. Companies are only beginning to see the benefits of the new corporate tax breaks passed in 2025—which could add fuel to earnings momentum. The Fed has been cutting rates, with more cuts on the table. The economy has been continuing to grow. And a renaissance in corporate investment (i.e., capital expenditures, or “CapEx”) has been laying the groundwork for future potential growth.

In a noisy world, investors can profit by focusing on the signal. Read on for more on the key drivers—amid the distractions—that could truly steer markets in the coming year.

Signal: Broad-based earnings growth

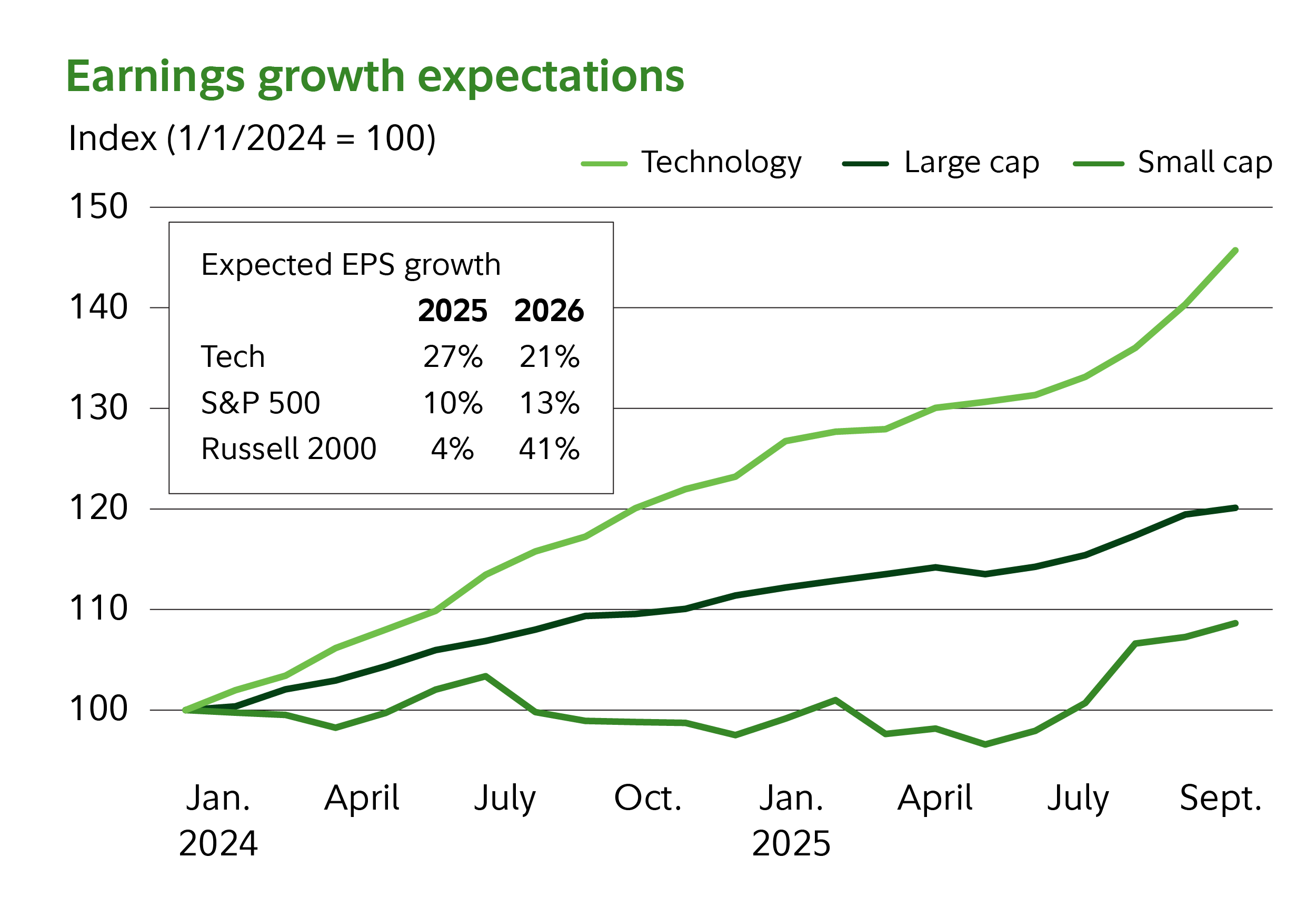

The earnings growth that has driven stocks in 2025 shows no signs of flagging heading into 2026. In fact, not only do analysts expect strong growth to continue—but there are also signs that the earnings picture is becoming healthier, with a broader range of companies participating in that growth.

Analysts expect companies in the S&P 500® Index will end up clocking in double-digit earnings growth for the 2025 calendar year.1 For 2026, they expect another year of double-digit earnings growth for the group—potentially with an acceleration over 2025.2

For much of 2025, earnings growth was disproportionately driven by a very small number of large tech companies. In the second quarter, for example, Magnificent 7 companies generated 27% earnings growth, while profits at the 493 other companies in the S&P 500 grew by 8.1%.3 But that gap appears to be narrowing, with stronger growth expected in 2026 for non-tech companies and for smaller companies.

“Earnings growth expectations are very, very robust for 2026—and not just for the S&P 500,” says Anu Gaggar, vice president of capital market strategy with Fidelity Institutional. “Earnings expectations have inflected much higher for both mid- and small-cap stocks.”

Denise Chisholm, Fidelity’s director of quantitative market strategy, notes that earnings have already crossed a key threshold for this type of broadening: Median-stock earnings growth finally turned positive in 2025, after a 3-year contraction.

“Until recently, this earnings recovery has looked strong at the top, but weak underneath,” Chisholm says. “This shift in median earnings growth marks a turning point in what’s been the narrowest earnings recovery in history.”

Of course, there are no guarantees that earnings growth will come in as strongly as expected for 2026. But barring any surprises the overall economic outlook appears strong.

“In the big picture, the US and global economies remain in expansion,” says Jake Weinstein, senior vice president on Fidelity’s Asset Allocation Research Team (AART). Despite weakness in the second half of 2025 in the job market, near-term recession risks appear low, while near-term chances of continued economic expansion appear favorable.

Signal: Tailwinds from tax and interest rate cuts

One key signal to watch for in 2026 will be the earnings lift from corporate tax cuts enacted by the One Big Beautiful Bill Act, which was signed into law in July 2025.

Although the tax law did not reduce the statutory federal corporate tax rate, which was permanently lowered to 21% in 2019, it’s expected to reduce the effective tax rate through changes in the treatment of certain corporate deductions and expenses—perhaps by as much as 7%, according to some estimates.

“The US tax-cut package is expected to be very positive for both corporate cash flows and profitability,” says Dirk Hofschire, managing director of research with Fidelity’s AART.

Even though the law was passed months ago, most of its economic impacts have yet to be felt. In addition to corporate tax breaks, which can provide a direct lift to company profits, the law provides a boost to US consumers through a variety of new and expanded deductions—potentially helping to stimulate consumption and the US economy more broadly.

“The stimulus starts in the fourth quarter of 2025, but the really significant stimulus will flow in during 2026,” says Gaggar.

While further rate cuts from the Fed aren’t guaranteed, both the Fed’s own projections and market expectations have suggested additional rate cuts could be on the table. Lower rates could help support interest-rate-sensitive segments of the market—such as the housing sector and small companies, which have both struggled in recent years. Historically, when the Fed has been able to cut rates amid an economic expansion, US stocks have gone on to see gains fueled by both rising earnings and rising price-earnings ratios (P/Es).

Potential noise: Worry over high stock-market valuations

By many measures, US stocks are not cheap.

The S&P’s forward P/E ratio (meaning, price divided by estimated earnings for the next 12 months) was recently 21.95, compared with a 10-year average of 18.7.4 Stock prices look even more expensive when measured against normalized earnings (meaning, smoothed long-term profits). By this metric, US stocks recently traded at a P/E ratio of 37.5

If valuations stay high or increase in 2026, investors could hear increased speculation that markets are in a bubble or that stocks must be due for a fall.

However, high valuations do not, in and of themselves, cause stocks to pull back. In fact, Chisholm says that history shows high valuations have often been a vote of confidence in future earnings power. “Right now, there is a lot of visibility into future earnings,” she says. “Valuations might just stay higher for longer.”

This is not to say that valuations don’t matter. As Hofschire explains, high valuations imply that more good news is already priced into the market. They can make stocks more susceptible to a pullback when something goes wrong or deepen the severity of such a pullback. But, “on their own, they're not a near-term catalyst,” Hofschire says.

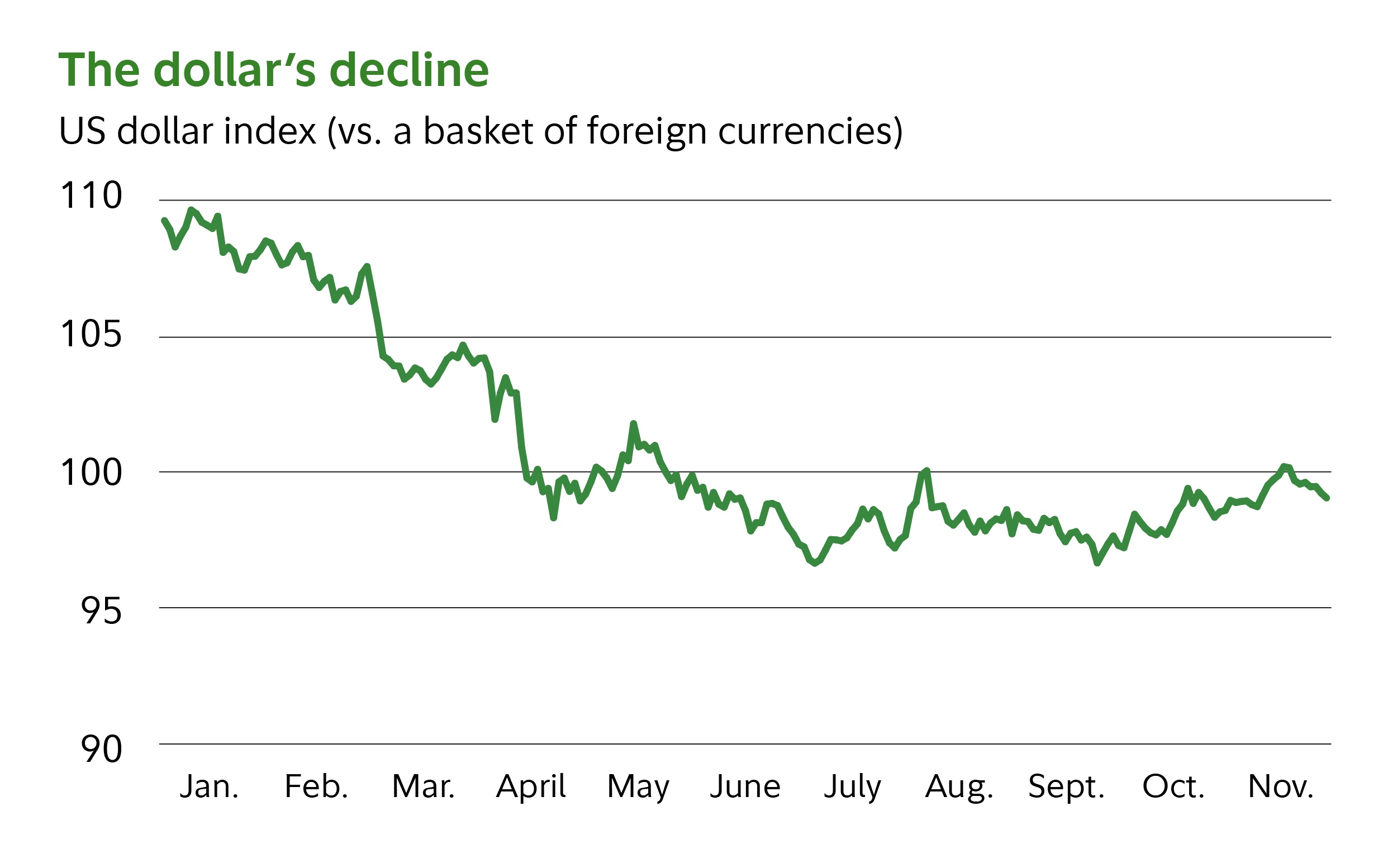

Signal: The global dollar-diversification trade

One of the most significant market stories in 2025 was the decline of the US dollar. As of mid December, the US dollar was down by 8.7% for the year, relative to a basket of global developed-market currencies. This decline was a key driver of the outperformance of non-US stocks in the past year—with developed-market international stocks up by 28% in dollar terms from the start of 2025 through mid December.

Currency movements are notoriously difficult to predict in the short term. But the forces that have fueled the dollar’s decline so far appear intact, and could prompt further depreciation in 2026 and beyond.

“There are several reasons why the rest of the world might want to diversify some of its dollars,” says Gaggar. The globe continues to shift away from US dominance toward a more multipolar balance of power. Many central banks around the world have begun diversifying their large holdings of US Treasurys. Coming off of several decades of inflows to US-dollar assets from foreign investors, the dollar remains expensive relative to many other major currencies. And many foreign nations are now spending on their home economies in ways that might help repatriate local investors’ assets.

“On the margins, some non-US investors may be more inclined to seek opportunities in their home countries,” says Hofschire. “Some of the issues that were initially seen as challenges to these countries—like a reduction in trade with the US or defense assistance from the US—may be spurring domestic spending and helping create new growth opportunities.”

For US investors, continued dollar weakening might be most immediately felt with higher returns on investments denominated in other currencies (such as non-US stocks). Counterintuitively, Gaggar notes that a weaker dollar can also help many large-cap US companies—by boosting the value of revenues earned abroad, once these revenues are translated into dollars.

“This may be a long-term theme that plays out over several years, or even decades,” says Gaggar.

Potential noise: Headlines on transitions at the Fed

Questions about the Fed’s continued political independence gained attention in 2025 and are almost certain to persist through 2026. The Fed’s composition faces multiple potential transition points in the year ahead, including a vacancy on the Board of Governors in January, the end of Jerome Powell’s term as Chair in May, and a forthcoming Supreme Court decision regarding Lisa Cook's status as a Governor.

Although the future of the Fed is certainly of interest to the market, the question of its independence is unlikely to hinge on one or two appointments. “It’s like redirecting a large ship,” says Jurrien Timmer, Fidelity’s director of global macro. “It’s not easy to suddenly go from one direction to another.”

Instead of focusing on noise around appointments or court battles, investors should watch for any signals that the ship is turning—such as shifts in the Fed’s focus as an institution. Such shifts might look like an increased bias toward cutting rates even if inflation is elevated, or a rethinking of the Fed’s 2% inflation mandate. Another signal could be if the Fed begins to place more focus on controlling long-term interest rates, such as 10-year Treasury rates.

A marginal loss of independence for the Fed would not be unprecedented. “Central bank independence is a relatively recent principle,” says Kana Norimoto, macro analyst on Fidelity’s fixed income team. “If you look back through history, countries do go through periods when their central banks are less independent—as the Fed was in the World War II period,” she says.

The big question for investors will be if any concerns around independence stir a market reaction, which could occur if the Fed were to pursue policies that appear at odds with its mandate of controlling inflation.

Signal: Dynamics in the US Treasury market

While the near- to intermediate-term outlook for stocks generally appears quite bright, it’s also undeniable that longer-term forces of change are building pressure under the surface. Will concerns about Fed independence begin to worry the markets? Could changes in the Fed’s focus lower the economy's defenses against inflation? And how can the US continue to finance and manage its growing debts?

The fault lines for these complex forces all intersect in the US Treasury market. For 2026 and beyond, investors should watch Treasury market dynamics for any signs that such risks may be moving to center stage.

Take Fed independence. If the Fed were to lower the federal funds rate below a level justified by the economic data, it could stoke investor fears about long-term inflation and the Fed’s credibility in fighting inflation. These fears could first surface in the Treasury market, as investors demand higher long-term interest rates to compensate for the risk of higher inflation.

Or consider the conundrum of US debt and deficits. Markets have generally been complacent about the US debt picture, and could remain unbothered for many years to come. But if that were to change, the first signs might emerge in the Treasury market, such as with rising Treasury yields or even challenges at Treasury actions. (Learn more about why investors may need a new diversification in the face of the risks posed by high government indebtedness.)

Any such volatility in the Treasury market can have spillover effects into other markets, as higher interest rates generally push down on stock valuations and prices. Timmer notes that a 5% interest rate on 10-year Treasurys has been a key threshold for the market in recent years—with stocks suffering brief selloffs when the 10-year rate has neared that mark. If volatility in the Treasury market stems from deeper concerns—like doubts about the US government’s ability to meet its debt obligations—it could trigger even sharper disruptions across other asset classes.

It's always possible that 2026 may be a quiet year for the bond market, with none of these issues bubbling to the surface. But investors concerned about such issues should watch the bond market for clues.

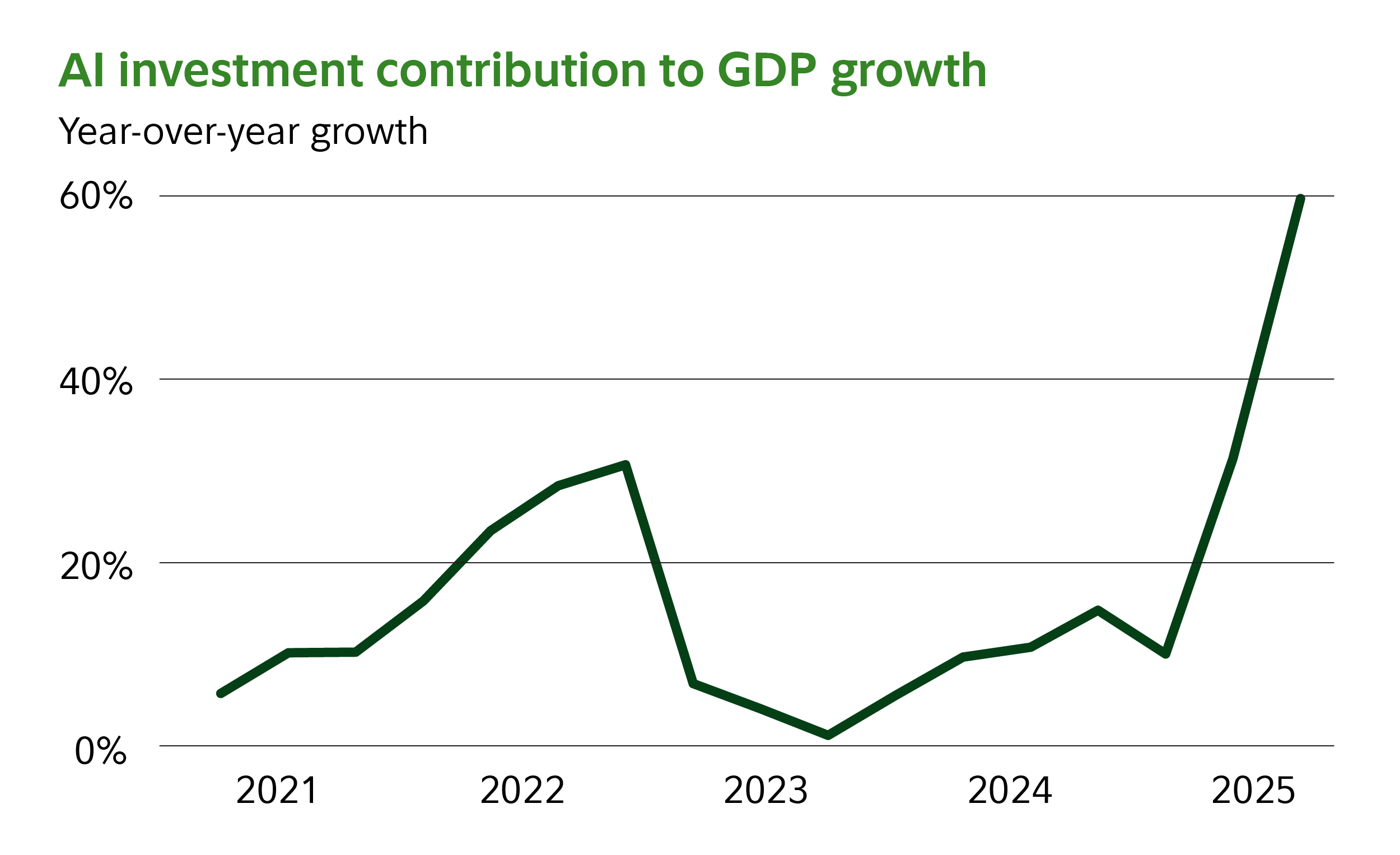

Signal: The AI boom

The impact of AI on most Americans’ daily lives is still relatively small, so it’s easy for the ubiquity of AI hype to start sounding like a lot of hot air.

But behind the scenes, the impact on the US economy and markets has already been so extensive that the scale is difficult to convey. Investments in AI infrastructure (i.e., CapEx) have accounted for roughly 60% of recent US economic growth.6 According to some estimates, global investments in AI infrastructure may top $2 trillion in 2026.7

This spending generally reflects companies building out the infrastructure they’ll need for their expected future usage of AI—the data centers, chip solutions, cooling systems, energy and electricity access, and more—rather than from using AI in their business processes. To draw a historical parallel: It’s like companies are still building out the transcontinental railways—but not yet transporting goods on them.

A key difference from railways, of course, is that no one can yet say for sure exactly how AI will be used to make money. In that sense, the internet boom might be the better comparison.

“In the late 1990s, it was really hard for investors to imagine what types of business models and companies would get created,” says Sonu Kalra, manager of the Fidelity® Blue Chip Growth Fund (

Although some companies are starting to monetize AI at the margins, for most the payoff timeline is still unclear. “You’re definitely still investing in front of the future potential growth,” says Chris Lin, manager of Fidelity® OTC Portfolio (

Those future use cases may be hard to imagine today, but that doesn’t mean they won’t arrive. “Nobody knows how long it will take to play out, but I believe most investors are underestimating how impactful AI will ultimately be,” Lin says. “In the long term, we’re just getting started. Everything starts with intelligence.”

(Learn more about how Fidelity’s managers are hunting for winners amid the AI technological revolution.)

Potential noise: Talk of an AI bubble

It’s entirely possible that AI enthusiasm could eventually lead to excessive valuations and other hallmarks of a bubble. And there’s a risk that in the race not to get left behind, companies may end up over-investing in their AI infrastructure—precipitating earnings challenges if profits are thinner or slower to materialize than expected.

But compared with the late 1990s internet bubble, the AI landscape still looks “very early and benign,” says Jurrien Timmer. “Valuations today are not even close to what’s been experienced during bubble extremes of the past.”

Denise Chisholm agrees—noting that unlike the excesses of the late 1990s, the current AI build-out has been overwhelmingly funded with cash flow rather than with debt. “Is there a chance we could start to see excesses in 2026? Maybe,” she says. “But I don’t see it yet in earnings, in the IPO market, in the SPAC market, or in any other indicators I follow.”

To be sure, investors should still watch valuations and other signs of potential speculative market dynamics in 2026. But as Timmer says, “bubbles usually don’t burst while everyone is bracing for one. They burst when the skeptics who saw one coming and sold too early succumb to their FOMO and get back in at the top.”

A year rich with risk and opportunity

The year ahead is certain to bring more challenging headlines—whether on known risks like politics, trade, or inflation, or on unforeseen turns of events. “Every year, there are so many moving parts,” says Gaggar.

But for investors who can stay disciplined and focused on their financial plan, 2026 could bring opportunities to benefit from a dynamic time in the markets.

“In no single year is the market ever calm,” says Gaggar. “Volatility is a given. But volatility is also what we thrive on.”

If you need help developing a financial plan that you can stick with through the unpredictable ups and downs of 2026 and beyond, learn about how we can work together. If you’re ready to take action, you can find a planning consultant near you.