In 2025, AI dominated headlines and investing themes. But it wasn’t the only industry undergoing major changes.

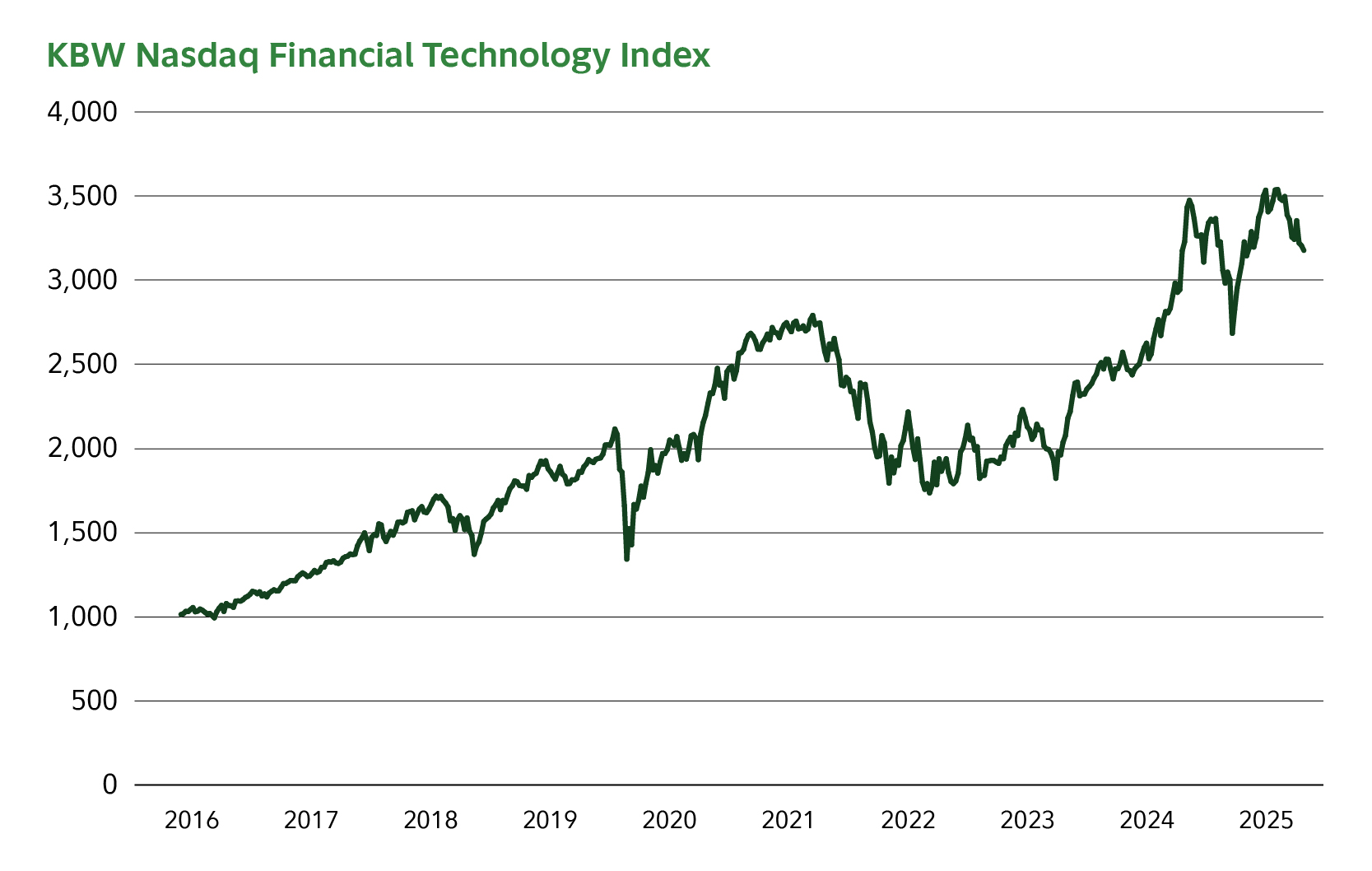

Beneath the surface, the financial industry has rapidly evolved. Innovations in fintech (short for “financial technology”) are making the world of finance faster, easier, and more customized to your specific needs. So how might you use these developments as tailwinds for your portfolio? Let’s explore what the potential investing implications could be in 2026.

How fintech is changing the game

Hailing a ride across town used to require standing on the side of the road and flagging down a cab. If no cab happened to be in the area, you might not have made it to your destination on time. Uber and Lyft’s technological solutions fixed many aspects of this issue, making the process faster and smoother.

A similar phenomenon is happening in the financial services industry, where technology is simplifying formerly complex processes in areas like banking, payments, and investing. Traditionally cumbersome tasks, like applying for and managing bank accounts, paying for goods, and accessing investment opportunities—all of which could require in-person processes and long wait times—are becoming increasingly manageable via mobile apps and other emerging financial technologies.

“Some of these trends are easier to see, like the ability to pay, borrow money, interface with your account, and transact across new asset classes like crypto,” says Matthew Reed, who co-manages the Fidelity® Select Financials Portfolio (

You may have already seen the impact of new fintech innovations in your everyday life, most prominently through your smartphone. “The latest evolution in financial services has been centered on the consumer, leveraging mobile technology to make financial services more intuitive and easier to use, as well as available on demand,” says Ruth Nagle, who manages the Fidelity® Select FinTech Portfolio (

According to Nagle, fintech’s impact on the financial services sector has been the result of 3 key factors:

- Technological investments: For example, banks are investing heavily in technology that incorporates cloud computing, big data analytics, AI, and blockchain. These tools help them create apps and other customer-focused products that improve efficiency and usability without sacrificing security.

- Strategic partnerships: For example, many established banks are choosing to collaborate with existing fintech companies rather than compete, which allows them to incorporate existing tools into their product offerings more efficiently.

- Adopting new business models: User demand has forced both emerging companies and existing major players to integrate new technologies rather than resist them.

Investment themes to watch in 2026

Reed thinks investors looking to capture fintech’s momentum can keep tabs on multiple segments of the financial services sector, including:

- Digital payments and payment processing: The world continues to shift away from cash and toward digital tools. This includes mobile payments, peer-to-peer transfers, and online payment processing. Examples of these types of companies include Block (

),1 Klarna ( ),2 Visa ( ),3 and Mastercard ( ).4 - Personal finance: From banking to wealth management and financial planning, aspects of personal finance that traditionally required in-person interactions are increasingly becoming digital and AI-driven. And sometimes these services are all accessible from one app. Examples of companies offering these types of services include SOFI (

) and Chime ( ).5 - Insurance: Like the evolution seen in personal finance, the insurance industry is increasingly leveraging AI to improve analytics operations. The aim is to provide more affordable and transparent solutions to customers. Examples include Neptune (

) and Lemonade ( ). - Trading and investing: Exchanges that enable investors to trade stocks, crypto, and other assets are becoming more accessible. Most trading transaction fees are much lower than they were in the past, and new features are being opened to a wider range of users. For example, eToro (

)6 now enables customers to copy trade high-performing investors. - Financial services for businesses: In light of the changes throughout the industry, solutions that enable financial services to operate more efficiently and securely are growing as well. Companies to watch include BILL Holdings (

)7, Figure ( )8, Marqeta ( ),9 and Fiserv ( ),10 and Corpay ( ).11

A longer-term play: Tokenization

In addition to the trends above, investors looking for exposure to an emerging fintech theme might consider tokenization.

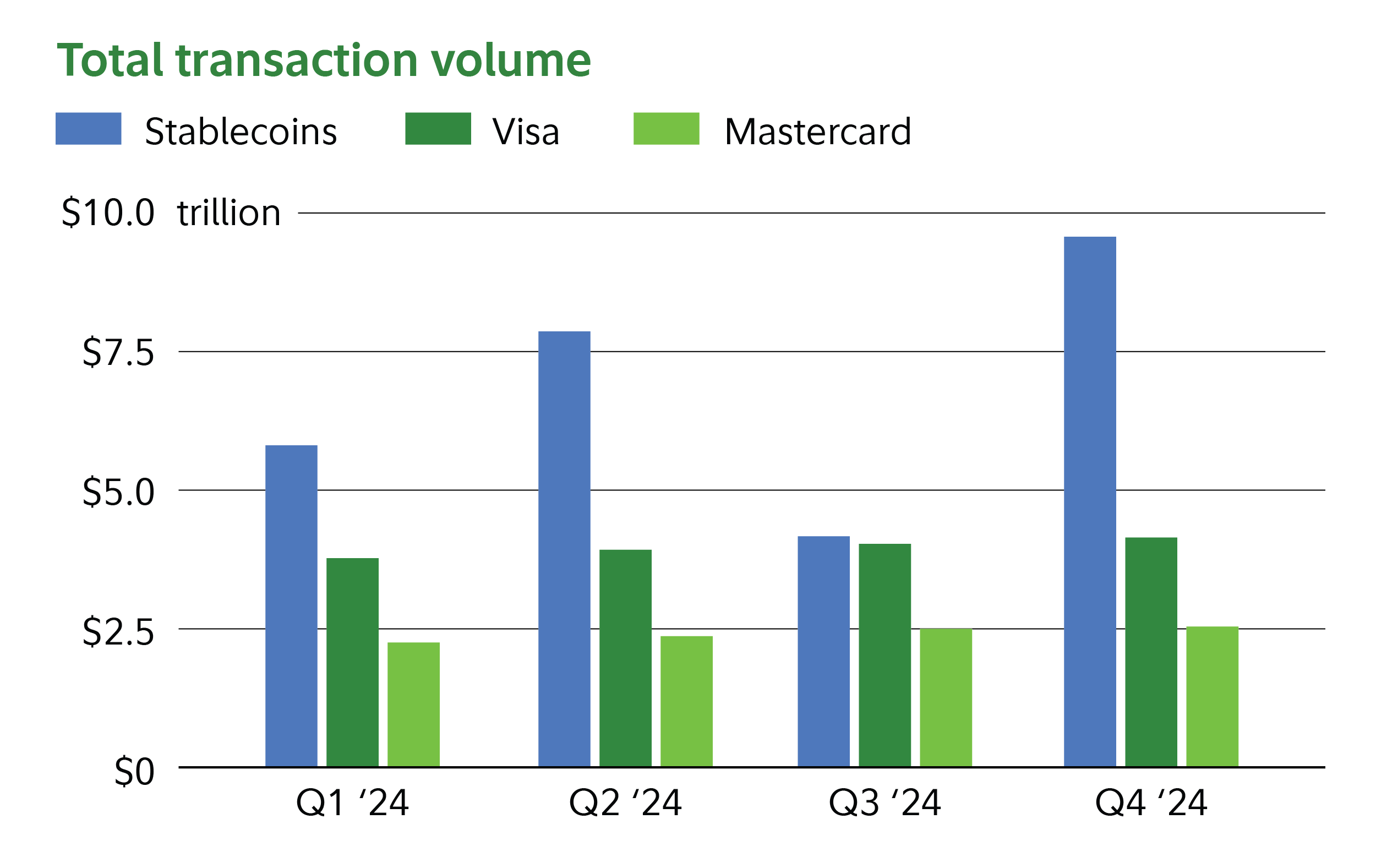

This technology is built on blockchains and smart contracts, and it enables 2 consenting parties to transfer ownership of assets to each other without third-party middlemen. One growing use case in this area is stablecoins, which are, in most cases, tokenized US dollars. In 2024, the total transaction volume of stablecoins surpassed that of all Visa and Mastercard transactions combined.12 And in July, the GENIUS Act was signed into law, establishing the first regulatory guidelines for stablecoin operations in the US. Advocates believe it’ll catalyze stablecoin use cases in 2026 and beyond.

“Tokenization of assets has taken off as a theme in late 2025 and looking into 2026. Many financial and fintech institutions have been working on and sometimes partnering to test where this technology can be used most effectively to boost efficiency or unlock new market opportunities,” Reed notes.

While the use cases are growing, Coby Powers, a crypto analyst with Fidelity, believes widespread adoption of tokenization may be a longer-term theme. “I think adoption will be very incremental, and it’ll happen in niches,” says Powers. “The most prominent use cases, like banking, retail, and corporate banking tokenization efforts, could be slow burns relative to the pace of adoption for other fintech."

Nevertheless, with regulatory tailwinds like the GENIUS Act in play, investors may want to keep tokenization on their radars.

More on the funds mentioned above

Investors can learn more about the mutual funds mentioned in this article, including fund objectives and most recent complete holdings, by visiting the fund summary pages on Fidelity.com:

- Fidelity® Select Financials Portfolio (

) - Fidelity Disruptive Finance ETF (

) - Fidelity® Select FinTech Portfolio (

)