Saving for a child’s future is about to get a new option. Starting July 5, 2026, Trump Accounts will join other ways to save for children like 529 plans, UGMA/UTMA accounts, and custodial Roth IRAs. But they come with unique rules and benefits. If you’re wondering what Trump Accounts are, who qualifies, and how they work, here’s what is known so far. Some details are still to come.

What are Trump Accounts?

A Trump Account is a traditional IRA established for a child and designated as a Trump Account at the time of opening, according to IRS guidance. The child for whom the account is opened is the beneficiary and the legal owner of the account.

Think of Trump Accounts as starter IRAs for kids. These new accounts operate in a custodial-style structure: The assets are owned by the child, while an adult—typically a parent or guardian—is authorized to act on the child’s behalf until the beneficiary reaches age 18.

Trump Accounts are designed to help families start saving and investing for a child’s future early, using a familiar retirement-account framework.

Read Fidelity Smart Money: What is a traditional IRA?

Under the new program, the Treasury Department will create and administer the initial accounts. Over time, families will be able to roll over the account to a financial provider that has a Trump Account product.

Who is eligible for a Trump Account?

Children under age 18 with a Social Security number are eligible for Trump Accounts. The Treasury’s pilot program adds a one-time $1,000 seed contribution for US citizens born between January 1, 2025, and December 31, 2028, when a tax election is filed on the child’s behalf. Only one funded Trump Account is allowed per child.

Children who aren’t eligible for the seed contribution can also get a Trump Account—they just won’t receive the $1,000 contribution. Families may still find good reasons to consider it.

How do Trump Accounts work?

Trump Accounts operate much like a custodial IRA, but with special rules for contributions, withdrawals, and investments. Families can fund the account through individual contributions, employer programs for both employee and employer contributions, or even charitable sources—each with its own tax treatment.

Who can contribute to a Trump Account?

Several sources can fund a Trump Account, making it flexible for families. Contributions can come from individuals, employers, and even charitable organizations. Each source has its own rules and tax treatment, so it’s important to understand how they work.

How much can you contribute to a Trump Account?

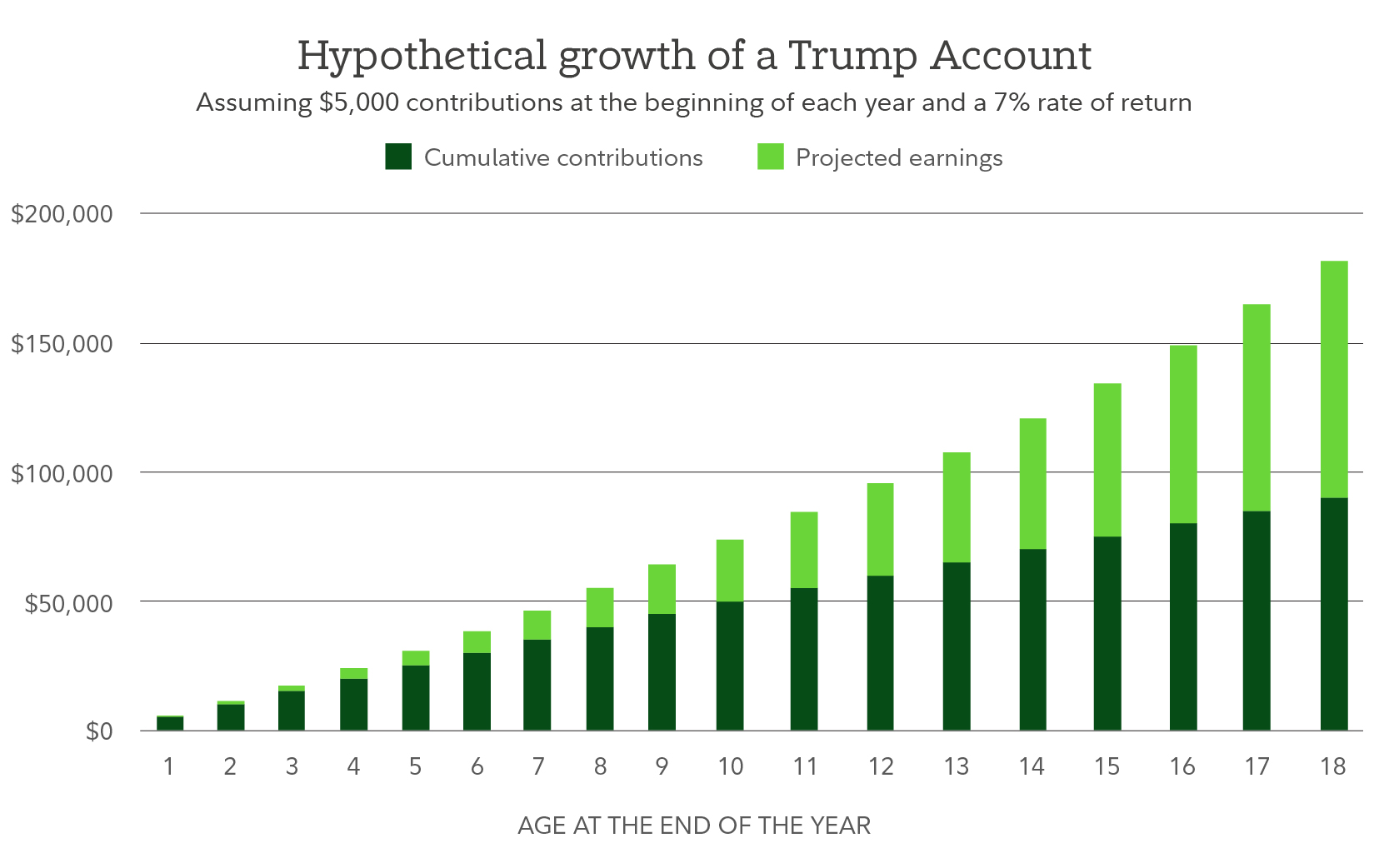

The total that can be contributed to a Trump Account is $5,000 per year. Multiple sources can contribute each year. Contribution limits apply across all sources combined with one exception: The government seed amount and qualified general contributions (i.e., from charitable organizations) don’t count toward the annual limit, which can make a big difference for eligible families.

- Government seed (pilot): A one-time $1,000 contribution for eligible newborns; it does not count toward annual limits. This one-time contribution plus any other qualified general contributions will be taxable when withdrawn.

- Individual contributions: Any adult can contribute, up to a combined total of $5,000 per year for the account (indexed for inflation after 2027). There’s no earned income requirement for the child. These contributions are made on an after-tax basis and are not taxable when withdrawn.

- Employer contributions and employee deferrals: A unique feature of the Trump Account is that it can be funded by both your employer and/or by you through a pre-tax payroll deduction option—similar to other benefit elections. As with other benefits, not every employer or plan may offer this feature.

- Employer-funded contribution: An employer may choose to contribute up to $2,500 per year per employee (indexed for inflation). If an employee has multiple children, the employer may split the contribution among children. For example, if you have 2 children, it could be split $1,250 per child. Employer contributions are excluded from the employee’s income, are made on a pre-tax basis, and count toward the child’s $5,000 annual contribution limit.

- Employee salary reduction: Employees can elect to redirect part of their pay pre-tax into a child’s Trump Account through their employer’s benefits plan. Combined employer and employee contributions cannot exceed $5,000 per child per year.

- Both types of contributions, employer and employee, count toward the $5,000 annual limit per child, and withdrawals are taxable because the contributions were made pre-tax.

- General funding contributions: States, local governments, and 501(c)(3) charities may contribute. These do not count toward annual limits and are taxable when withdrawn.

- Rollovers: From another Trump Account, with tax basis carried over based on the source contributions in the original account.

Important: Contribution sources determine how future taxes apply to distributions. Keeping accurate records is essential. Regardless of source, earnings are taxable when withdrawn.

When can you withdraw from a Trump Account?

Trump Accounts are designed for long-term savings so withdrawals are highly restricted before age 18.

Before that age, distributions are generally not allowed except for limited rollovers.

On January 1 of the year the beneficiary turns 18, the account could transition to a standard traditional IRA but it is not a requirement and will be dictated by the terms of the IRA agreement with the custodian or trustee. The standard rules for traditional IRAs include a limit on withdrawals before age 59½. Early withdrawals are typically taxable and may face a 10% penalty unless an exception applies—such as certain education expenses, first-time home purchase (up to $10,000), birth or adoption costs (up to $5,000), qualifying medical expenses, disability, or terminal illness.

Visit IRS.gov to learn more about the exceptions: Retirement topics – Exceptions to tax on early distributions.

Required minimum distribution (RMD) rules apply.

What happens to Trump Accounts after the child beneficiary turns 18?

Once the beneficiary reaches age 18, families have several options:

- Keep the account as a Trump Account under general IRA rules. Though Trump Accounts will mostly follow traditional IRA rules, it could remain a separate type of account. Trump Accounts are not grouped with IRAs when determining how much of a withdrawal is taxable. In the case of multiple IRAs, the IRS uses the aggregation rule to determine the taxable amount of a withdrawal.

- Roll over the balance to a traditional IRA or another eligible retirement account or in some cases a workplace retirement plan. Note: A Trump Account may not automatically become a traditional IRA. You may need to take action if you want to roll over or convert the account.

- Consider a Roth conversion, if appropriate for the former minor’s tax situation.

How can you invest in a Trump Account?

Investment options for Trump Accounts are intentionally straightforward:

- Mutual funds or ETFs that track the S&P 500 or another equity index for which regulated futures contracts are traded, with at least 90% invested in US companies.

- No leverage is allowed in the investments, meaning borrowed funds cannot be used to purchase securities.

- Expense ratio cap: 0.10% (10 basis points) or less.

- Trustees may offer multiple options and must designate a default investment. Families can allocate across the menu within the constraints above.

This design aims to promote long-term, broad market exposure with very low costs and minimal complexity.

Summary of Trump Account features

| Benefits of Trump Accounts | What to consider |

|---|---|

| Tax-deferred growth potential | Limited investment menu |

| No earned income requirement for contributions | No withdrawals before age 18 |

| $1,000 government seed contribution for eligible newborns | Annual contribution cap of $5,000 per child |

| Low-cost index fund/ETF investment options | Distribution will be taxed as income at child’s tax rate |

| Flexible funding sources | Employer payroll feature depends on plan adoption |

How do you open a Trump Account?

Opening a Trump Account starts with an election process through the IRS—either by filing Form 4547 or using the upcoming online tool at trumpaccounts.gov. Elections are scheduled for mid-2026, with accounts becoming available July 5, 2026. Once the election is complete, the Treasury will provide instructions to activate the account.

The IRS is expected to issue more guidance for rollover accounts at financial institutions, which can only be opened after the initial Treasury account exists. These details will be clarified as the program expands.

This hypothetical example assumes the following: (1) annual contributions of $5,000 on January 1 of each year for ages 1 through 18, with no withdrawals through age 18, (2) an annual nominal rate of return of 7%, and (3) no taxes on any earnings within the account. The ending values do not reflect taxes, fees, or inflation. If they did, amounts would be lower. Earnings and pre-tax contributions from Trump Accounts are subject to taxes when withdrawn. Distributions before age 59½ may also be subject to a 10% penalty. Systematic investing does not ensure a profit and does not protect against loss in a declining market.

This example is for illustrative purposes only and does not represent the performance of any security. Consider your current and anticipated investment horizon when making an investment decision, as the illustration may not reflect this. The assumed rate of return used in this example is not guaranteed. Investments that have potential for a 7% annual nominal rate of return also come with risk of loss.

How will Trump Accounts be rolled out to the public?

The Trump administration has indicated plans for significant rollout activity focused on the $1,000 pilot seed contribution, employer programs, and charitable contributions. Early signals include:

- A launch of trumpaccounts.gov and ongoing IRS guidance (with public comment periods).

- Charitable commitments to broaden access.

- Outreach to employers and industry participants to support payroll and platform capabilities.

Financial institutions—including brokers, banks, and recordkeepers—have expressed interest in roles ranging from initial trustees to rollover trustees. Expect more details to be posted on trumpaccounts.gov as the Treasury finalizes trustee selections, technical standards, and proposed regulations.

Trump Accounts vs. 529s vs. custodial accounts

When deciding how to save for a child, consider your goals, flexibility, taxes, and investment options. Choosing an account depends on your goals and circumstances. Here’s how common choices compare to Trump Accounts:

- Custodial Roth IRA: Requires earned income by the minor, offers tax-free growth potential on qualified withdrawals, and provides broad investment menus. Unlike Trump Accounts, Roth IRAs allow tax-free withdrawals when certain requirements are met, and contributions can be withdrawn at any time, tax- and penalty-free.

- 529 plans: Designed specifically for education savings, any earnings grow federal income tax–deferred, plus withdrawals are tax-free for qualified education expenses. Contributions to a state 529 plan may offer state tax benefits. Trump Accounts differ because they’re not limited to education and follow IRA rules after age 18.

- UTMA/UGMA custodial accounts: Flexible way to save and invest on behalf of a child, and funds must be used for the child's benefit. There are no annual contribution limits (gift tax rules apply), but any growth is taxable under kiddie tax rules.

- Teen brokerage accounts: For teens (generally 13–17) with a parent or guardian; taxable investing in a simplified brokerage framework. Taxation on growth occurs under kiddie tax rules. Trump Accounts offer tax-deferred growth potential but restrict withdrawals until age 18.

To learn more, read Fidelity Viewpoints: 2 ways to help kids invest

Trump Accounts are distinctive in that they do not require earned income to receive individual contributions, limit investments to low-cost index funds/ETFs, and enforce no withdrawals before 18, followed by IRA rules thereafter.

That combination may make them a complement to Roth IRAs, 529s, and UTMAs depending on the family’s goals. Details and guidance from the IRS are still needed to better understand how to make the most of these new accounts and how they may work with existing accounts.

Tax implications of Trump Accounts

Wondering how Trump Accounts are taxed? Here’s what to know. Because of the tax on a child’s investment and other unearned income, also known as the kiddie tax, a seemingly small withdrawal from a Trump Account could have a larger-than-expected tax bill.

The kiddie tax applies when kids have unearned income, not wages. Withdrawals from accounts funded with pre-tax dollars count as unearned income, so a portion of those withdrawals could be taxed at the parent’s tax rate—not the child’s (presumably) lower tax rate.

This can be particularly crucial for college students and their parents. To learn more, read Fidelity Viewpoints: What to know about the kiddie tax

When does the kiddie tax apply?

- If your child turns age 18 by year-end and earns less than half of their own support.

- Age 19–23 and a full-time student with most support coming from a parent or guardian.

Why it matters: Even allowable withdrawals that avoid penalties can trigger the kiddie tax. It does not apply to qualified withdrawals from a Roth IRA or 529 plan. Other accounts—like UGMAs/UTMAs and teen brokerage accounts—can also be subject to kiddie tax treatment on investment gains.

What families should know about Trump Accounts

- Stay informed: Watch for Treasury and IRS updates on eligibility, elections, and timing for online tools on the website, trumpaccounts.gov.

- Consider funding sources: If eligible, plan to invest the $1,000 seed credit, and discuss individual or employer contributions within annual limits.

- Coordinate with other accounts: Align Trump Account contributions with 529, Roth IRA, or UGMA/UTMA strategies to help balance tax benefits and future flexibility, depending on your savings goals.

- Keep records: Keep careful documentation of contribution sources; this matters for future distribution taxes and rollover reporting.

The bottom line on Trump Accounts

Trump Accounts could offer families a straightforward, low-cost path to begin investing for a child’s future—with strict no-withdrawal rules before age 18 and traditional IRA rules thereafter. If you’re planning for a newborn or young child, keep an eye on official launch dates and tools. Coordinating with your education, retirement, and tax strategies can help you make the most of this new account.

As more details are finalized, Fidelity will share practical guidance on elections, funding, investments, and rollovers, and how a Trump Account can fit into a family’s broader financial plan.