With 2026 underway, there are plenty of questions. What will happen with the global economy? Will volatility return to the stock market? What will happen next with interest rates? While we can never know the future, it can be valuable to focus on things for which we can prepare—taxes, for example. While you generally can't avoid taxes, you may be able to reduce them with a bit of thoughtful planning. That may be particularly important as new tax legislation goes into effect this year.

Here are 7 tax-smart steps to consider early in the year that are designed to help you keep more of your money—and put your savings in a position to grow too.

1. Be aware of available deductions

This year there is some good news for taxpayers. The IRS has widened tax brackets—meaning potentially lower income taxes for many—and increased the standard deduction and many savings incentives.

Inflation adjustments to tax brackets mean people may have more taxable income before being bumped into a higher tax bracket. Additionally, the standard deduction for 2026 is $32,200 for married couples filing jointly, an increase of $700. For single filers, it increased by $350 to $16,100.

For nonitemizers

If you are age 65 or older there’s an additional senior deduction worth $6,000 ($12,000 for joint filers). It’s good for tax years 2025 through 2028, and you don’t need to itemize to qualify for it. However, the deduction begins to phase out for single filers if modified adjusted gross income (MAGI) is $75,000 or more and $150,000 or more for married joint filers. Good to know: The new senior deduction is in addition to the existing deduction normally available to people who are 65 and older, equal to $2,000 for single filers and $3,200 for married filers if both are 65 or older. This deduction does not have a phaseout for income levels.

In 2026 single filers who don’t itemize may also claim a new $1,000 deduction for cash charitable donations ($2,000 if married filing jointly).

For itemizers

Consider your possible itemized deductions this year. The major ones include state and local taxes, medical and dental expenses, home mortgage interest, charitable donations, and deductions for casualty and theft losses from a federally declared disaster. If you have the means and think these may exceed the standard deduction, you may also want to consider bunching enough charitable donations in 2026 to capture a larger write-off by itemizing deductions. This is a possible strategy to become an itemizer when your typical annual itemized deductions would not normally be enough.

However, there is a new 0.5% income floor on itemized charitable deductions in 2026. The floor could be a further reason to bunch, instead of making smaller donations each year, but it may reduce the value of itemizing charitable contributions overall. Additionally, high earners in the top tax bracket (37%) will see the value of their deduction capped at an effective rate of 35%. The 60% adjusted gross income (AGI) limit for cash gifts to public charities is now permanent.

Find out more about tax changes to charitable deductions in Viewpoints: 3 big changes to charitable giving.

Itemizers can also donate appreciated assets held longer than one year to a qualified public charity and deduct the fair market value of the asset without paying capital gains tax. The donation is generally subject to a 30% adjusted gross income limitation. Any excess deductible amount can be carried over for up to 5 years.

(Try Fidelity Charitable's charitable giving tax savings calculator to determine the potential impact that bunching donations may have on your taxes.)

2. Make the most of higher saving incentives

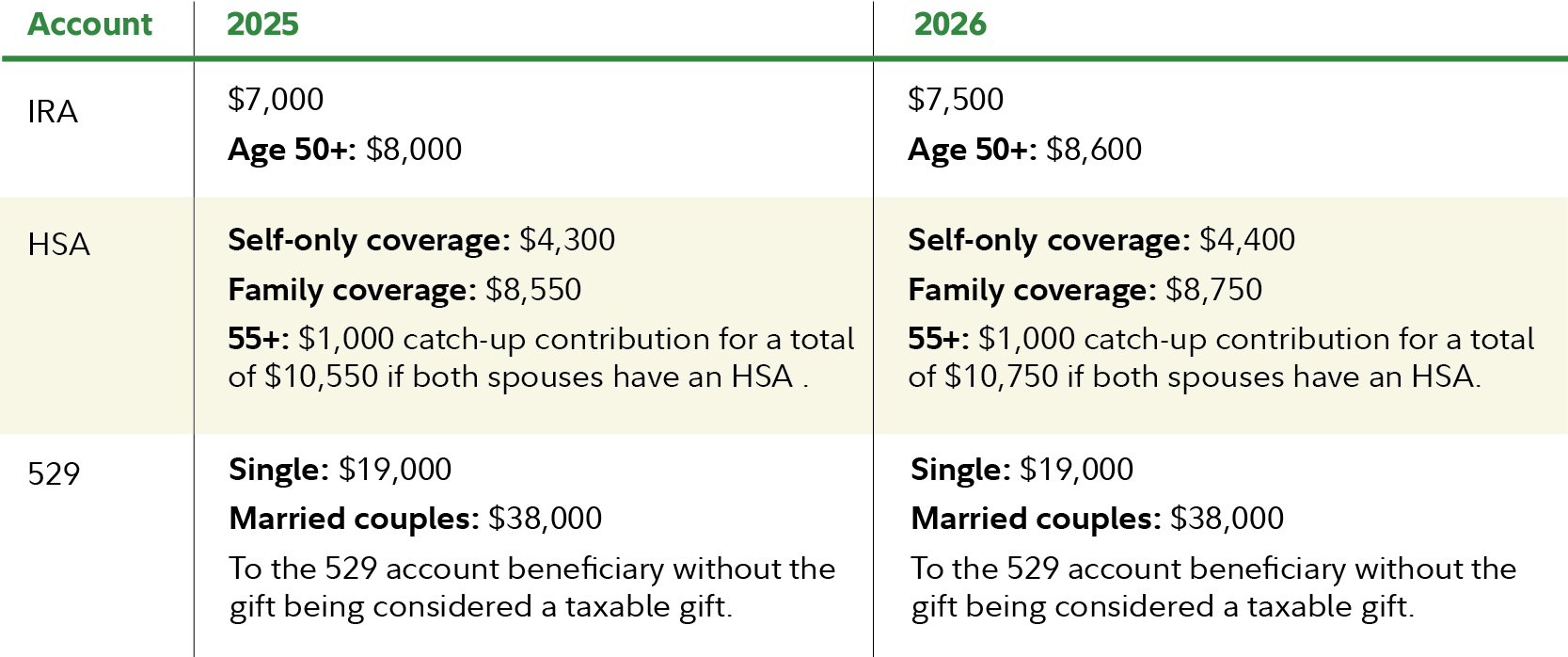

If you haven't contributed to an IRA or a health savings account (HSA) for 2025, you have until April 15 of 2026 to do so. If you're a resident of a state with a federal disaster designation in 2025, or are a resident of California affected by wildfires, you may have additional time to file and make tax payments, including estimated tax payments. For 529 college savings accounts, deadlines for contributions may vary by the state in which the plan is based. But if you know how much you'd like to contribute for the year, consider making 2025 contributions earlier in the year, giving you more time to potentially grow your money tax-deferred. Good to know: While most states have 529 contribution deadlines of December 31, some states may still allow contributions for 2025 until their tax-filing deadlines. Check with your state and consider making 2025 contributions before making contributions for 2026.

- IRAs: You can contribute $7,500 to an IRA for tax year 2026, an increase of $500 from tax year 2025. And if you're over 50, you can contribute an additional $1,100 per individual.

- HSAs: If you are eligible to contribute to an HSA, contribution limits are $4,400 for self-only coverage and $8,750 for family coverage for 2026. That's up from $4,300 for self-only coverage and $8,550 for family coverage in 2025. If both spouses are covered by an HSA-eligible health plan, have their own HSA, and are age 55 or older, they are both eligible to make a catch-up contribution of $1,000. The maximum contribution limit to be allocated between them is $10,750.

- 529s: If you have children, grandchildren, or are considering further education for yourself, consider contributing to a 529 college savings account, where earnings and withdrawals are federal income tax-free when used for qualified education expenses. While aggregate contribution limits to 529s are governed by state tax laws and are usually quite high, individuals may contribute up to $19,000 ($38,000 per married couple filing jointly) to any number of recipients in 2026, likely without it being considered a taxable gift. That's the same nontaxable gifting limit as in 2025.

And once inside the account, the money is not considered part of your estate. You can also accelerate 5 years’ worth of annual gifts for a total of up to $95,000 per person ($190,000 combined for spouses who gift split), per beneficiary in 2026 without incurring gift taxes.1 However, after that, you won't be able to make gifts under the annual exclusion to the same beneficiary for the subsequent 4 years without triggering the gift tax. Note: If the donor dies within 5 years of making the accelerated gift, the value of the gifts attributable to the years after the owner dies will be brought back into the donor's estate.

Contributions to a traditional IRA or HSA may reduce your current taxable income, as long as you are eligible to contribute and to take a deduction. You can also make a Roth IRA contribution. It’s important to note, however, that traditional IRA and Roth IRA contributions are aggregated and can’t exceed the annual limit. Although contributions to a Roth IRA are not deductible, any earnings grow tax-deferred and can be withdrawn tax-free, if you meet the income requirements and follow the distribution rules.2

3. Put your savings to work

If you were able to sock away extra savings in the last few years, you may want to put those dollars to work for you with tax-efficient investing.

In any market, there are opportunities to help grow your money. This year, the stock market may continue to be challenging and the prospect of decreasing interest rates may mean you want to lock in rates now for individual bonds and certificates of deposit (CDs). Where you hold those assets can also help you keep more of your earnings after taxes. In line with your portfolio level asset allocation, holding investment products that generate taxable interest income, like bonds and CDs, in tax-deferred accounts like IRAs can help minimize taxes. On the other hand, stocks, where long-term gains are taxed at lower capital gains rates, may be better held in taxable accounts.

For more on tax-efficient asset location, read Viewpoints: Are you invested in the right kind of accounts?

4. Tax-loss harvesting

For taxable accounts, you might also want to consider year-round tax-loss harvesting where you use realized losses to offset realized gains, plus up to $3,000 of ordinary income depending on filing status. After offsetting your realized gains and ordinary income up to allowable limits, if you still have a net realized loss on the year, you can carry it forward to future years. If you've got investments that are below their cost basis, and there's another similar investment (but not a substantially identical security), you could use it to replace the sold asset without a material impact to your investment plan. Consult your tax advisor about your situation and beware of the wash-sale rule.

5. Consider a Roth conversion

A Roth conversion involves transferring money in a traditional, or pre-tax, IRA to a Roth IRA, and then paying taxes on the pre-tax, deductible portion of the converted amount. After that, the money grows tax-deferred and the earnings on converted balances have the potential to be tax- and penalty-free if the distribution is considered qualified, meaning the 5-year aging rule for the account has been met and the account owner is 59½, or another exemption applies, including disability or death.3

Another bonus: Roth accounts are not subject to required minimum distributions (RMDs) for the life of the original owner. If you have inherited a Roth account, however, the distribution rules can be complex, so consider consulting a tax professional. Without further action from Congress this year, tax rates are set to increase in 2026, so you could end up paying higher rates if you wait to convert your traditional IRA until the next tax year.

Estimate the potential effect of retirement income strategies on your taxes with Fidelity's retirement strategies tax estimator.

6. Do a checkup

Doing a financial checkup periodically throughout the year can help you to pay the right amount of taxes as you go. The IRS has a handy tool to help taxpayers check their federal income tax withholding. Consult your state tax authorities to check your state tax withholding.

You can also potentially reduce your tax burden if you take the time for some thorough bookkeeping to make sure you're claiming all the deductions and credits that you can.

One potential area for adjustment, given that many workers still work remotely either full or part time, is to take a close look at your residence. If you are still working remotely in a lower tax state from where you usually work, you may want to take a deeper look at your residency options and make a long-term decision about the best choice for your situation.

7. Revisit your estate plan

The One Big Beautiful Bill Act ("OBBBA") increased the lifetime estate and gift tax exemption to $15 million (indexed for inflation starting in 2027) and there are continuing estate planning provisions that can help you make the most of the lifetime exemption. You can gift up to $19,000 per donor to as many individuals as you like in 2026 and if you're married, each person in the couple can gift this amount without the gift being considered taxable.

Bottom line

Tax planning is not a one-and-done exercise. To help reduce taxes, it makes sense to be planning throughout the year. Need help? A tax advisor and financial professional can help you build a tax-smart investing plan that works for you.