Some investors spend untold hours researching stocks, bonds, and mutual funds with good return prospects. They read articles, watch investment shows, and ask friends for help and advice. But many of these investors could be overlooking another way to potentially add to their returns—tax efficiency.

Investing tax-efficiently doesn't have to be complicated, but it does take some planning. While market volatility and inflation are likely at the top of many investors' minds, better tax awareness does have the potential to improve your after-tax returns. There are several different levers to pull to try to manage federal income taxes: selecting investment products, timing of buy and sell decisions, choosing accounts, taking advantage of realized losses, and specific strategies such as charitable giving can all be pulled together into a cohesive approach that can help you manage, defer, and reduce taxes.

Investment decisions should be driven primarily by your goals, financial situation, timeline, and comfort with risk.

Manage your taxes

The decisions you make about when to buy and sell investments, and about the specific investments you choose, can impact your tax burden. While tax considerations shouldn't drive your investment strategy, consider incorporating these concepts into your ongoing portfolio management process.

Tax losses. A loss on the sale of a security can be used to offset any realized investment gains. If there are excess losses, up to $3,000 can be claimed against taxable income in the current year, and the rest of the loss can be carried forward to offset future realized gains or income.

To learn more about tax-loss harvesting read Fidelity Viewpoints: How to reduce investment taxes

Capital gains. Securities held for more than 12 months before being sold are taxed as long-term gains or losses with a top federal rate of 23.8%, versus 40.8% for short-term gains (that is, 20% and 37% respectively, plus 3.8% Medicare surtax). Being conscious of holding periods is a simple way to avoid paying higher tax rates, and note that federal tax rates are subject to change. Taxes are only one consideration. It's important to consider the risk and return expectations for each investment before trading. Special rules may apply to shares acquired through tax qualified equity compensation plans.

Fund distributions. Mutual funds distribute earnings from interest, dividends, and capital gains every year. Shareholders are likely to incur a tax liability if they own the fund on the date of record for the distribution in a taxable account, regardless of how long they have held the fund. Therefore, mutual fund investors considering buying or selling a fund may want to consider the date of the distribution.

Tax-exempt securities. Tax treatment for different types of investments varies. For example, municipal bonds are typically exempt from federal taxes, and in some cases receive preferential state tax treatment. Conversely, real estate investment trusts and bond interest are taxed as ordinary income. That's where asset location comes in. Holding municipal bonds in a taxable account may make more sense than in a tax-advantage account, since municipal bonds are already inherently tax advantaged. Investors may also want to consider the role of qualified dividends as they weigh their investment options. Qualified dividends are subject to the same tax rates as long-term capital gains, which are lower than rates for ordinary income.

Fund or ETF selection. Mutual funds and exchange-traded funds (ETFs) vary in terms of tax efficiency. In general, passive funds tend to create fewer taxes than active funds. While most mutual funds are actively managed, most ETFs are passive, and index mutual funds are passively managed. To add, there can be significant variation in terms of tax efficiency within these categories, so consider the tax profile of a fund before investing.

Employer stock plans. Participation in your employer's stock plan benefit may carry nuances, and potentially significant considerations both when selling company stock or filing taxes.

Defer taxes

Among the biggest tax benefits available to most investors is the ability to defer taxes offered by retirement savings accounts, such as 401(k)s, 403(b)s, and IRAs. If you are looking for additional tax-deferred savings, you may want to consider health savings accounts (HSAs). You may also want to consider tax-deferred annuities, which have no IRS contribution limits and are not subject to required minimum distributions (RMDs). Deferring taxes may help grow your wealth faster by keeping more of it invested and potentially growing.

You may be familiar with tax-advantaged retirement saving accounts.

| 2026 Contribution Limits | RMD rules | Contribution Treatment | |

|---|---|---|---|

| Employer-sponsored plans [401(k)s, 403(b)s] |

|

Traditional 401(k): Required Roth 401(k): No RMDs* |

Traditional 401(k): Pretax Roth 401(k): After-tax |

| IRAs (Traditional1 and Roth2) |

|

Traditional IRA: Required Roth IRA: No RMDs |

|

| Tax-deferred annuities | No contribution limit** |

No RMD rules for nonqualified assets |

After-tax |

|

*The change in the RMD age requirement from 72 to 73 only applies to individuals who turn 73 on or after January 1, 2023.

**Issuing insurance companies reserve the right to limit contributions.

***Contributions to Traditional IRAs are generally made with after-tax dollars; however, a full or partial tax-deduction is available for those under certain MAGI thresholds. For those who earn too much for the deduction, their Traditional IRA contributions retain the after-tax treatment. There is no tax-deduction for Roth IRAs and contributions are always treated as after-tax.

|

|||

Account selection. When you review the tax impact of your investments, consider locating and holding investments that generate certain types of taxable distributions within a tax-advantaged account rather than a taxable account. That approach may help to maximize the tax treatment of these accounts.

To learn more about after-tax returns, read Viewpoints: Why asset location matters

Stock options. If you receive stock options from your employer, you may have the opportunity to manage taxes by planning ahead on your exercise strategy. One risk to timing your stock plan transactions around taxes is building up excess exposure to one company or concentration, so always consider all aspects of your investments, and not only the tax implications.

Reduce taxes

Charitable giving The United States tax code provides incentives for charitable gifts—if you itemize taxes, you can deduct the value of your gift from your taxable income (limits apply). These tax-aware strategies can help you maximize giving:

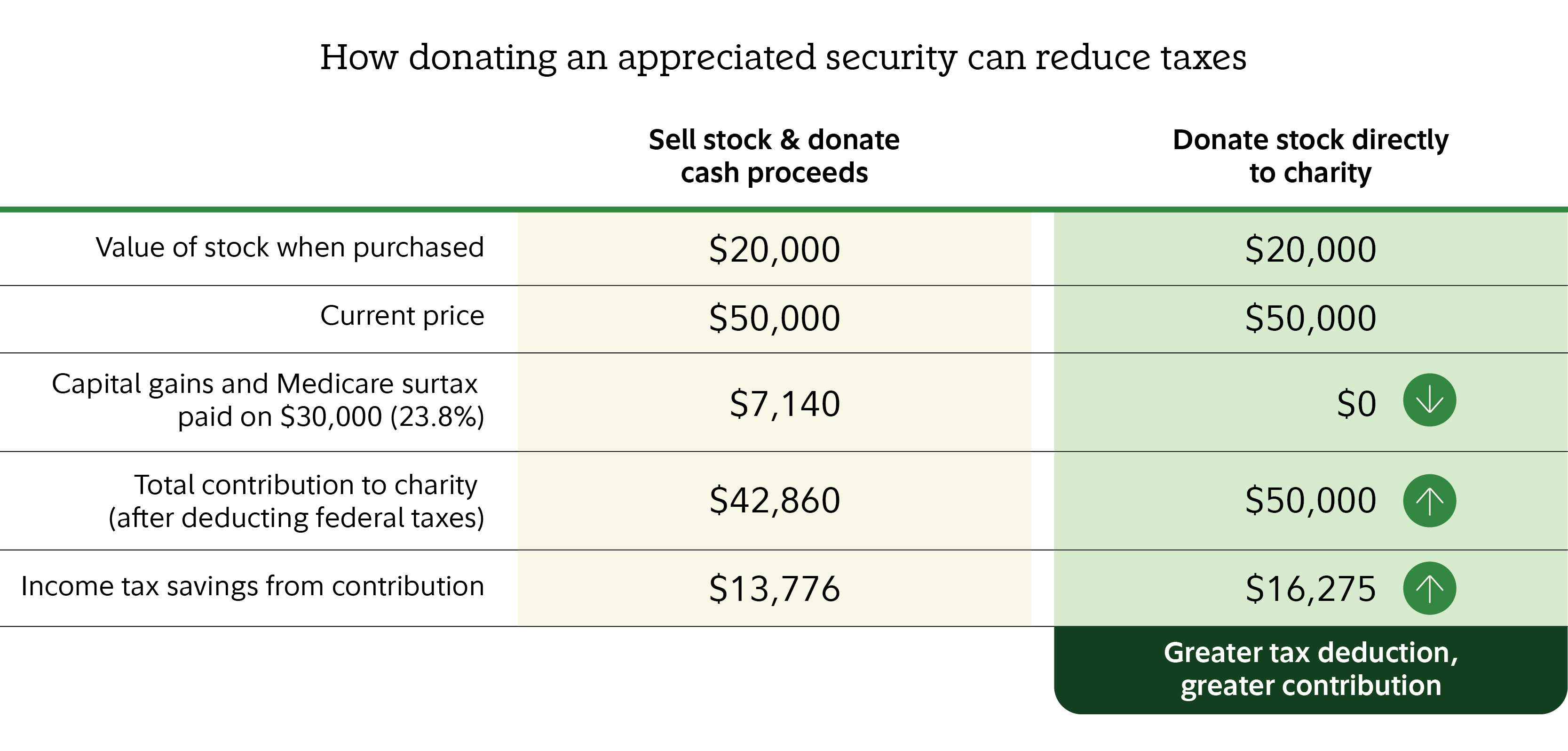

- Contribute appreciated stock instead of cash: By donating long-term appreciated stocks, mutual funds, or cryptocurrency to a public charity, you are generally entitled to a fair market value (FMV) deduction, and you may even be able to avoid capital gains taxes on the donated securities. Together, that may enable you to donate up to 23.8% more than if you had to pay capital gains taxes.2

- Contribute real estate or privately held business interests (e.g., C-corp and S-corp shares; LLC and LP interests): Donating a non-publicly traded asset with unrealized long-term capital gains also gives you the opportunity to take an income-tax charitable deduction and eliminate capital gains taxes. Shares acquired through an employer stock program are generally good candidates for donation if held long-term and can reduce a concentrated position.

- Accelerate your charitable giving in a high-income year with a donor-advised fund: You can offset the high tax rates of a high-income year by making charitable donations to a donor advised fund. If you plan on giving to charity for years to come, consider contributing multiple years of your charitable contributions in the high-income year. By doing so, you maximize your tax deduction when your income is high, and will then have money set aside to continue supporting charities for future years.

- Making cash donations provides a write of for non-itemizers. Starting in the 2026 tax year, non-itemizers will be able to claim deductions for cash donations to charity—up to $1,000 for single filers and $2,000 for married couples filing jointly.

-

To learn more read Fidelity Viewpoints: Strategic giving: Think beyond cash

-

Starting in the 2026 tax year, the value of itemized deductions will be capped at 35%, and a new floor of .5% of adjusted gross income (AGI) will be imposed on charitable contributions. This means that in tax year 2026 potential donors in the 37% tax bracket would receive only 35% of their potential donations as deductions, and only charitable contributions that exceed .5% of the donor's adjusted gross income can be deducted.

The chart assumes that the donor is a single filer in the 37% federal income bracket with an AGI of $700,000. State and local taxes and the federal alternative minimum tax are not taken into account. Please consult your tax professional regarding your specific legal and tax situation. Information herein is not legal or tax advice. Assumes all realized gains are subject to the maximum federal long-term capital gains tax rate of 20% and the Medicare surtax of 3.8%. Does not take into account state or local taxes, if any. (This is a hypothetical example for illustrative purposes only.)

Roth conversions

Contributing to a Roth account does not accelerate taxes; however, performing a Roth conversion would. A Roth conversion involves taking traditional assets which are pre-tax and converting them to a Roth after-tax balance, with the resulting converted balance being tax and potentially penalty free upon withdrawal. Any evaluation of a potential Roth conversion should include input from a financial professional, along with a tax and/or estate planning attorney.

To learn more read Fidelity Viewpoints: Answers to Roth conversion questions.

529 savings plans3

The cost of education for a child may be one of your biggest single expenses. Like retirement, there are no shortcuts when it comes to saving, but there are some options that can help your money grow tax-efficiently. For instance, 529 accounts will allow you to save after-tax money, but get tax-deferred growth potential and federal income tax-free withdrawals when used for qualified expenses including college up to $20,000 per student per year in qualified K–12 tuition and expenses.

For other changes to 529 plans, read Fidelity Viewpoints: New tax law: 4 big changes for families

Health savings accounts (HSAs)4

Health savings accounts allow you to save for current or future health expenses in retirement. These accounts have the potential for a triple tax benefit: you may be able to deduct current contributions from your taxable income, your savings can grow tax-deferred, and you may be able to withdraw your savings tax-free, if you use the money for qualified medical expenses.

To learn more read Fidelity Viewpoints: 5 ways HSAs can fortify your retirement

The bottom line

Your financial strategy involves a lot more than just taxes, but by being strategic about the potential opportunities to manage, defer, and reduce taxes, you could potentially improve your bottom line.