Are you one of the many people who wonders if you could retire early, say, at 62 and enjoy a long retirement—on your own terms?

For a small percentage of people with very large nest eggs, pensions, and retiree health coverage, the answer is an easy yes. For many others, retiring early means finding ways to generate income from savings until they can claim Social Security at their full retirement age (FRA) or age 70 when benefits top out.

Increasing your lifetime Social Security benefit

Since Social Security is the only inflation-adjusted guaranteed source of income most people have throughout their retirement, wouldn't it make sense to maximize your Social Security income by waiting to claim until FRA or even age 70?

If you start taking Social Security at age 62, rather than waiting until your FRA, typically 66 to 67 depending on your birth year, you can expect up to a 30% reduction in monthly benefits with lesser reductions as you approach FRA.

Waiting to claim your Social Security benefit will result in a higher monthly benefit. For every year you delay past your FRA, you get an 8% increase in your monthly benefit. That could be up to a 24% higher monthly benefit if you delay claiming until the maximum age, which is 70.

Tip: Delaying your claim may not be right for everyone. Make sure to evaluate your claiming decision based on your expectations for longevity, your other sources of income in retirement, how much you've saved for retirement, and your investment strategy.

How long will I live?

This is not an easy question to answer. That's why it's important to plan for different scenarios (and a financial professional can help you evaluate the various planning options). Health status, longevity, and retirement lifestyle are 3 key factors that can play a role in your decision on when to claim your Social Security benefits.

While these variables are hard to predict with certainty, you can rely on the simple fact that if you claim early versus later, you will likely have lower benefits from Social Security to help fund your retirement over the next 20–30+ years.

Bottom line: If you don't have sufficient savings and need Social Security income to pay for your regular expenses immediately— or if you don't have longevity in your gene pool and are managing a number of health issues, it may not make sense to delay claiming Social Security. Otherwise, delaying as long as possible until 70 is generally the better strategy.

Meet Sasha: A 60-year-old who plans to retire in 2 years

Let's consider the hypothetical scenario for Sasha who recently celebrated her big "six-oh" (60th) birthday. She's single, still working, and currently earns $100,000 per year. She has saved $600,000 in her 401(k) and also has accumulated another $250,000 in her brokerage account (which includes 6 months of emergency savings). She plans to continue contributing 3% of her income to her 401(k) each year, receive a 3% employer match, and save 3% of her income in the brokerage account. She also intends to retire at 62 and expects to live until age 95 for retirement planning purposes.1 (Why plan to age 95? Because 1 of 3 women who make it to age 65 will live to age 90 and 1 of 9 women who reach age 65 will live past age 95, according to SSA.gov.2) Her retirement expenses are currently estimated to be $3,600/month for essential (must-have) expenses and $1,000/month allocated to discretionary (nice-to-have) outlays.

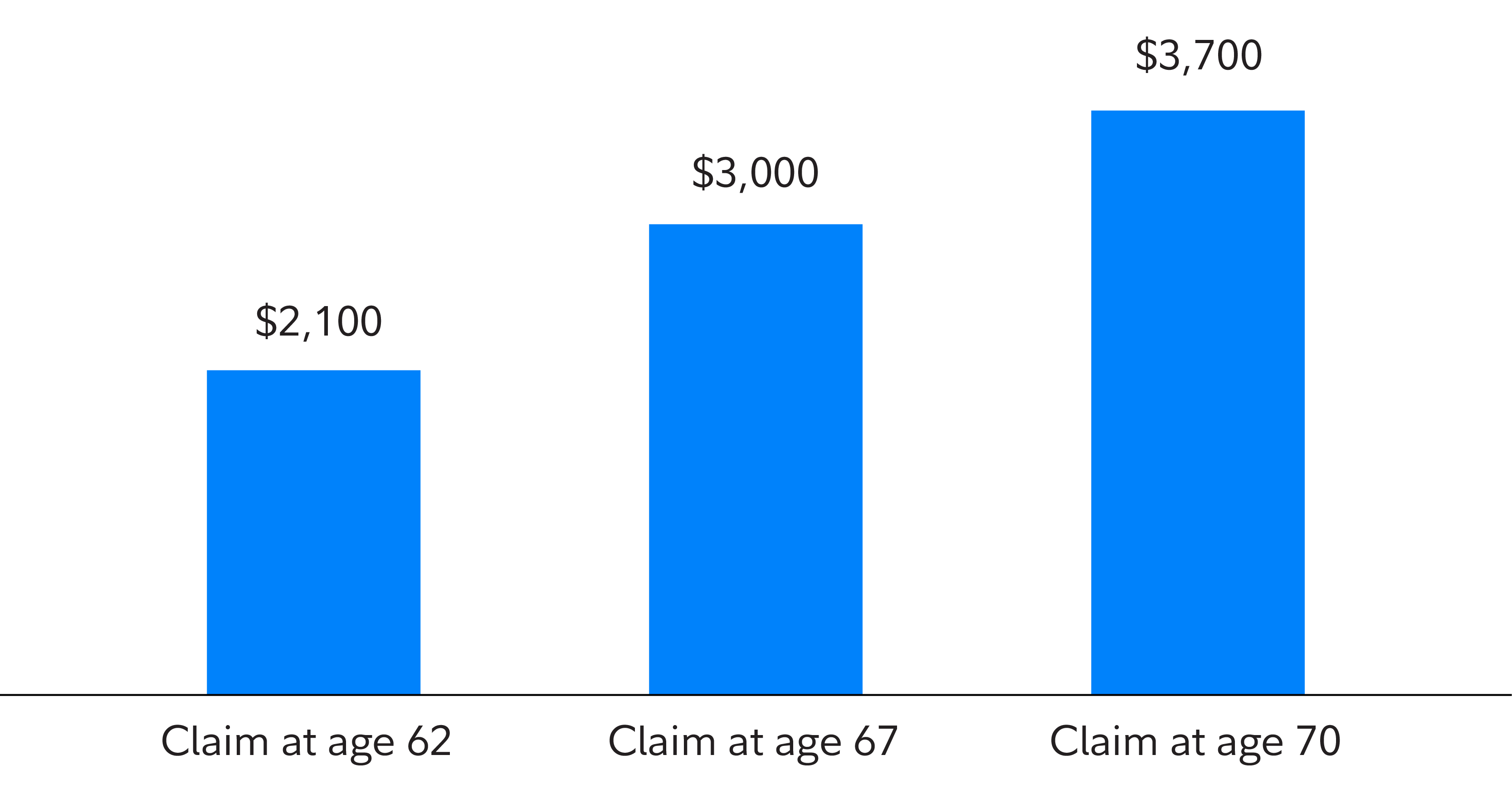

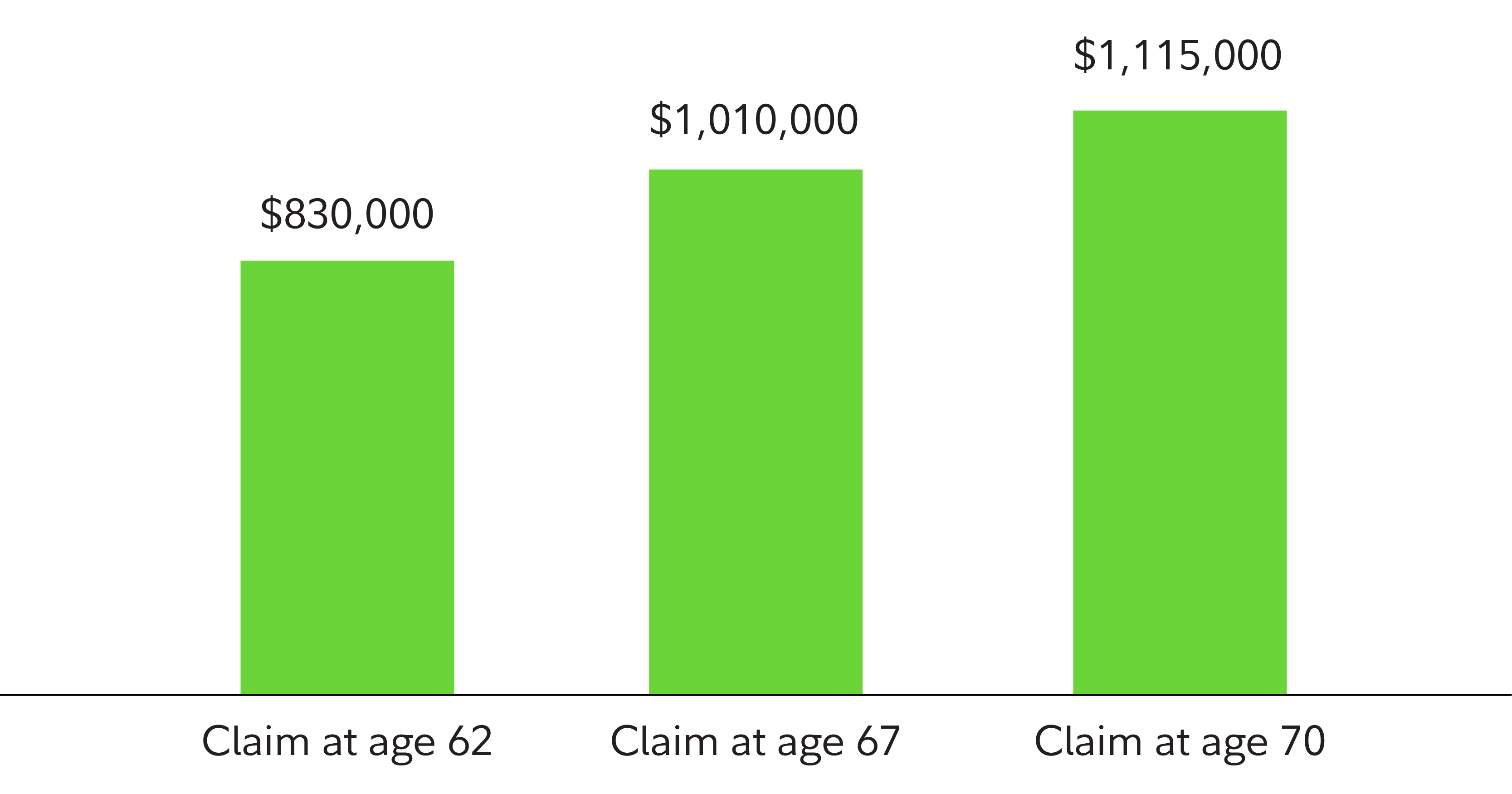

First, let's examine the basics. If Sasha claims Social Security at age 62, she’d receive approximately $2,100 a month. If she waits until 67, she’ll get about 45% more, or $3,000 a month. If she waits until age 70, her monthly benefits at $3,700 per month will be about 75% greater than if she claimed at age 62. If she lives until 95, her lifetime benefits from Social Security would total approximately $1.1 million (all numbers are rounded to the nearest 100).

Sasha's estimated monthly Social Security benefit

Sasha's estimated lifetime cumulative Social Security benefit

Big concern for many retirees: Risk of running out of money

Claiming your Social Security needs to be considered within the broader context of evaluating how much income can be generated by your retirement accounts, other personal savings, and additional sources of income. One of the most common questions that customers ask a Fidelity financial professional is: How long will my money last in my retirement? Of course, there are a myriad of variables to consider, so planning out different options is a good idea. Here are 3 ways that it could play out for Sasha:

- If she stops working and claims Social Security early at age 62 a. She will have to start drawing down her savings sooner and need to withdraw more to make up for her reduced Social Security benefits. b. In this estimate she winds up with $15,000 in assets in her retirement plan at age 95.

- If she delays claiming until her FRA of 67 a. She still has to withdraw from her savings to cover expenses between 62 and 67, but then she can withdraw less once she starts collecting Social Security. b. In this case she will have amassed $180,000 at age 95, after continuing to pay essential and discretionary expenses.

- If she delays claiming Social Security to age 70 (the last possible age) a. She will have an estimated $310,000 in her retirement plan at age 95. b. She will also have up to 35% more lifetime income than if she claimed at 62.

Sasha's estimates for claiming Social Security at age 62 vs. 67 vs. 704

| Cumulative income from Social Security | Account balance remaining in Sasha’s retirement plan at age 95 | |

|---|---|---|

| Scenario 1 Claim Social Security at age 62 | $830,000 | $15,000 |

| Scenario 2 Claim Social Security at age 67 | $1,010,000 | $180,000 |

| Scenario 3 Claim Social Security at age 70 | $1,115,000 | $310,000 |

But how do you use retirement savings to bridge an income gap between when you retire and when you can maximize your Social Security benefit? You might be able to cut spending or boost income, perhaps by taking on part-time work or generating rental income if you own real estate. But if those strategies don’t produce enough income, here are 3 investment options to consider, along with some pros and cons.

1. Withdrawal from savings

A simple approach to providing income until you claim Social Security is a plan to make periodic withdrawals from your savings. You can automatically take money out of Fidelity (or other) accounts on a regular basis (monthly, quarterly, yearly) to help pay for your ongoing expenses in retirement.

Remember, you may have to sell securities on a regular basis and, if taken from a Traditional IRA or Traditional 401(k), the full amount of your withdrawal will typically be taxed as ordinary income. For example, gains on securities held in brokerage accounts are taxed at long-term capital gains rates if the position is held longer than 1 year.

Tip: We suggest planning conservatively, so you may want to compare how long your savings might last in a good market vs. a bad market.

Read Viewpoints on Fidelity.com: Tax-savvy withdrawals in retirement

2. Deferred or immediate period certain annuity

Another option to consider is a deferred period certain annuity5. It's an insurance contract designed to pay a fixed amount of income, with a specific start and end date (a certain period of time). If you want to delay the claiming of Social Security benefits from say, age 62 to age 70, you could purchase this type of annuity several years before your retirement date (typically 5 to 10 years before you are ready to retire). Then it would start making payments when you turn 62 and end 8 years later when you reach age 70.

A period certain annuity offers an income guarantee, no matter what economic or market conditions you may be faced with over the length of the period you select. Like other annuities, this shifts market risk off your shoulders and onto the issuing insurance company, but you will have limited flexibility to withdraw the money to address emergency expenses with this portion of your money.

Similar to a deferred income annuity you may consider an immediate income annuity which starts your income within 12 months of your investment versus having a deferral period. In the event you experience an unexpected lifestyle change and are no longer working, an immediate income period certain annuity provides guaranteed income for a specific period of time until you claim Social Security.

Tip: Planning ahead with a deferred income annuity may be worthwhile since they usually provide a higher income amount, for the same investment amount, than an immediate income annuity. Read Viewpoints on Fidelity.com: Create future retirement income

3. Bond or CD ladder

If you tend to be a DIY investor and have experience purchasing bonds or CDs, you might consider a bond or CD ladder. To create a predictable income stream that serves as a short-term bridge, you could buy a series of bonds or CDs with maturity dates that extend into the future and span the period of the bridge. The bonds or CDs pay a fixed income from their coupons and the return of principal as each bond matures.

Although some bond ladder strategies involve replacing maturing bonds with new bonds, under the bridge strategy, maturing bonds contribute toward the income stream. Say you need a 10-year bridge to Social Security. Starting at age 60, you would buy a series of bonds or CDs that mature each year from the age of 61 until age 70.

By holding the bonds to maturity, you can receive the full income from the coupons and maturing principal during the years you want to supplement your cash flow.

Remember, while the final maturity value of your bonds will be predictable in advance, before the bonds mature they could vary in value, either up and down. When you hold each bond to maturity, the funds are paid back to you and the payout should be what you originally expected.

The advantage of a ladder over an annuity is that you have access to your money. However, there are no income guarantees, and maintaining a bond ladder takes time and attention. If you do not have the will, skill, and time, you might want to consider professional management.

Read Viewpoints on Fidelity.com How and why to build a bond ladder

Quick look: Pros and Cons of 3 bridge strategies

| Withdrawals from savings plan | |

Pros

|

Cons

|

| A period certain income annuity | |

Pros

|

Cons

|

| Bond or CD ladder | |

Pros

|

Cons

|

In summary, the advantage of annuities is guarantees7, but you can't withdraw the principal, and only have limited flexibility to accelerate income payments if you need access. When looking at total income, annuities and bond ladders would generally perform better than automatic withdrawal from savings in poor markets, while a withdrawal approach would offer the potential to outperform the other options in strong markets.

Plan ahead

What strategy is best for you? That depends on your priorities, early retirement options, and your stomach for market ups and downs, among other factors.

For many people, delaying Social Security can help forge a solid retirement. But, you can't wait until age 62 to figure it out. Bridge strategies can be complex, so consider working with a professional early to weigh your options and build a plan.