If you’re ready to save for your retirement, you may want to consider an IRA (individual retirement account). An IRA can be a way to save if you don’t have a workplace plan like a 401(k) or 403(b).

A traditional IRA helps you save money for your future. You can open one if you’re 18 or older and have earned income. Your contributions may be tax-deductible, and your money grows tax-deferred until you withdraw it (ideally after age 59½).1 At age 73, the IRS requires you to take annual withdrawals, called required minimum distributions.

Keep reading to learn how to open a traditional IRA—and how Fidelity® can help you put your contributions to work.

6 steps to open a traditional IRA

Follow these 6 steps when you’re ready to open a traditional IRA.

- Pick where you want to open your account

Take a look at a few different companies to see what they offer. Think about what’s most important to you; i.e., helpful support, an easy-to-use app or website experience, and whether they charge any fees. If you already have a retirement account with a provider, it might be simpler to go with them. Looking for a company with no fees or minimums to open an account?2 Check out opening a traditional IRA at Fidelity.

- Choose the right type of IRA

There are different types of IRAs. Most people first research a Roth IRA vs. traditional IRA to see what’s best for their situation. Each IRA has its own rules around eligibility and how much you can contribute. You may find out you’re eligible to contribute to more than one type of IRA. Check how much money you’re allowed to contribute annually to an IRA, as the Internal Revenue Service (IRS) does have contribution limits.3 If you don’t qualify to deduct your traditional IRA contributions or if you’re not eligible to open a Roth IRA, you might consider a backdoor Roth IRA.

- Gather your information and fill out the application

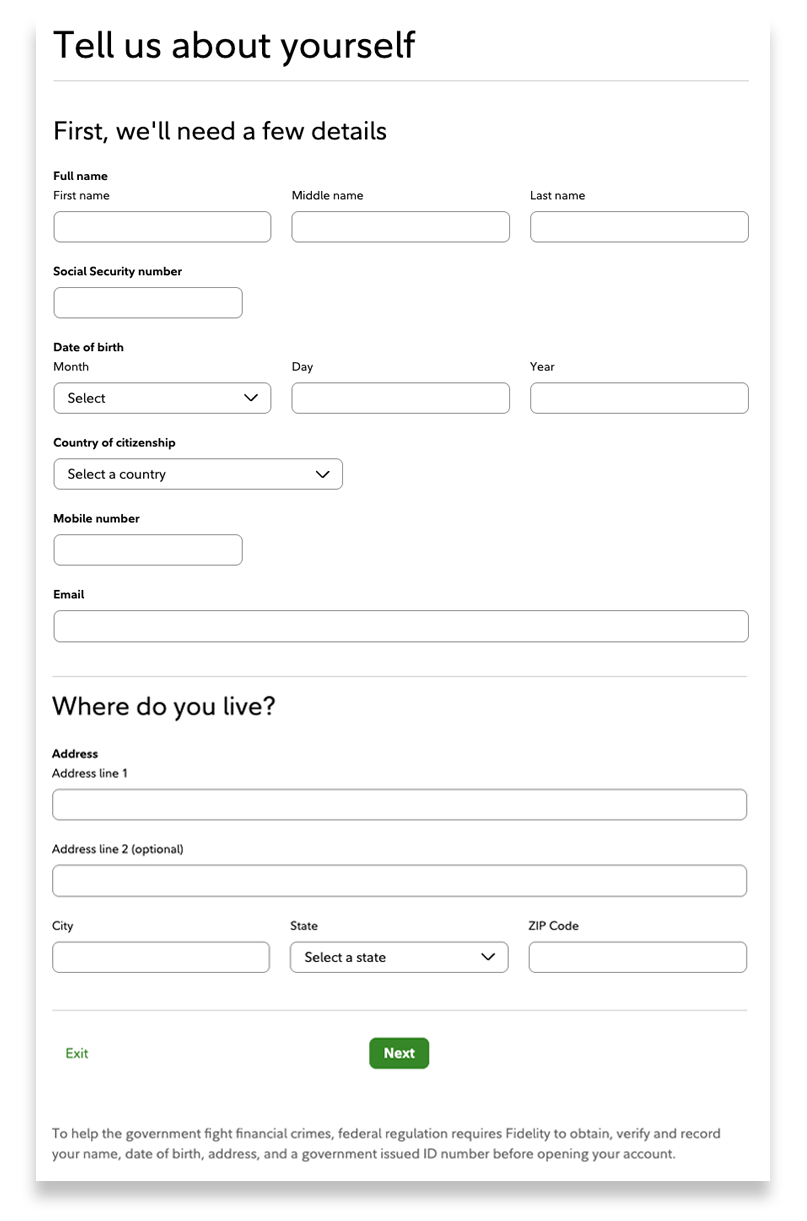

Once you’re ready to open an account, having this info on hand can help keep the process simple:

- Your Social Security number or tax ID

- Information for any beneficiaries (names, addresses, birthdates, and Social Security numbers)

- The investment or bank account details (routing and account numbers) to fund your IRA

- A government-issued ID (like a driver’s license or passport) may be needed to verify identity

This information helps confirm your identity and makes sure you’re eligible to open the account.

- Decide how much you want to contribute—and how often

Opening a traditional IRA is easy—most people qualify, and Fidelity doesn’t require a minimum deposit. If you’re not sure how much to save for retirement, you’ll want to establish your personal target savings rate.

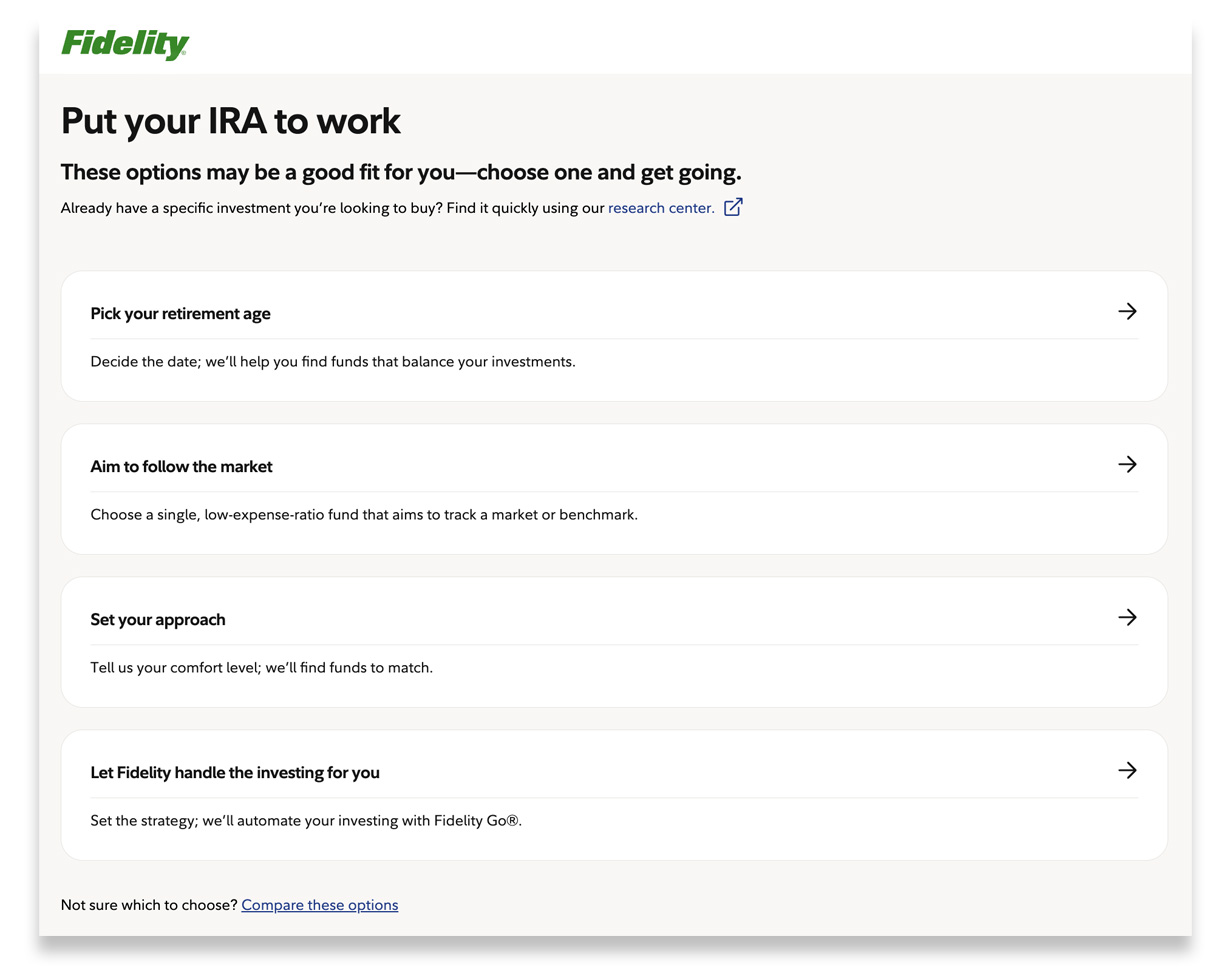

- Choose your investments

Once your account’s funded, you’re ready to start putting your money to use. That means choosing how you want to grow your money—whether it’s investing in stocks, mutual funds, ETFs, or other options. If you’re not sure where to start, many providers offer an option for professional investment management,1 so you don't need to do it on your own.

- Set a check-in schedule

Every so often, take time to review your traditional IRA. Depending upon how the market’s doing, you may wind up taking on more or less risk than you planned to. It’s worth checking in annually to see if the contribution limits have changed and making sure you are within the limits. And here’s what to do if you accidentally overcontribute to your IRAs.

How to open a traditional IRA with Fidelity

If you’ve decided that opening a traditional IRA with Fidelity is the right move for you, here’s how to get started.

1. Visit Fidelity.com.

2. Select Open an account.

3. Find Retirement & IRAs and select Open an account.

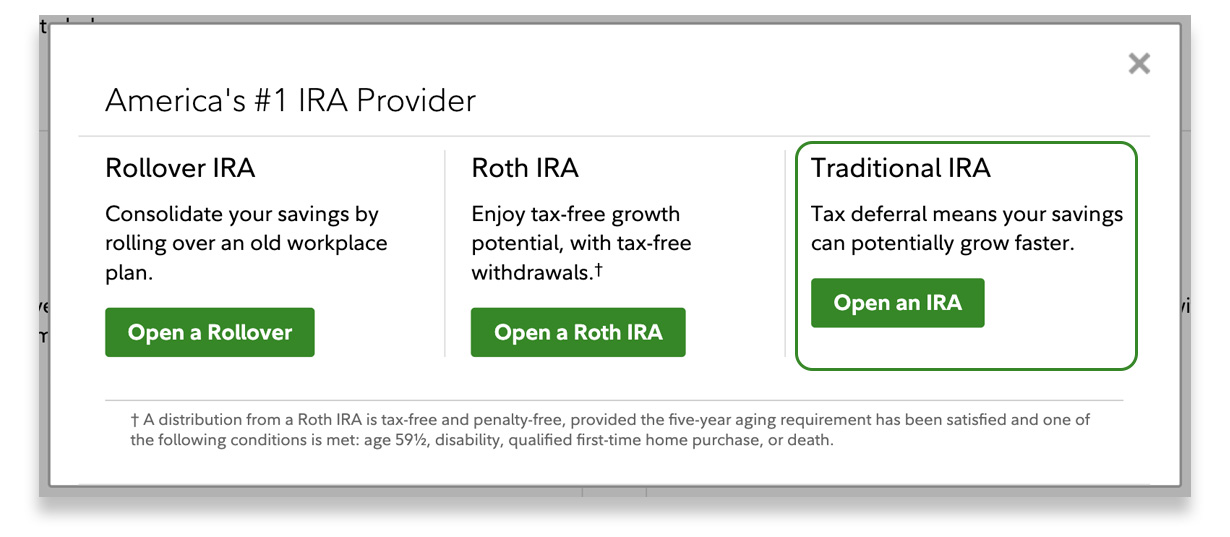

4. From the list of options, find traditional IRA and select Open an IRA.

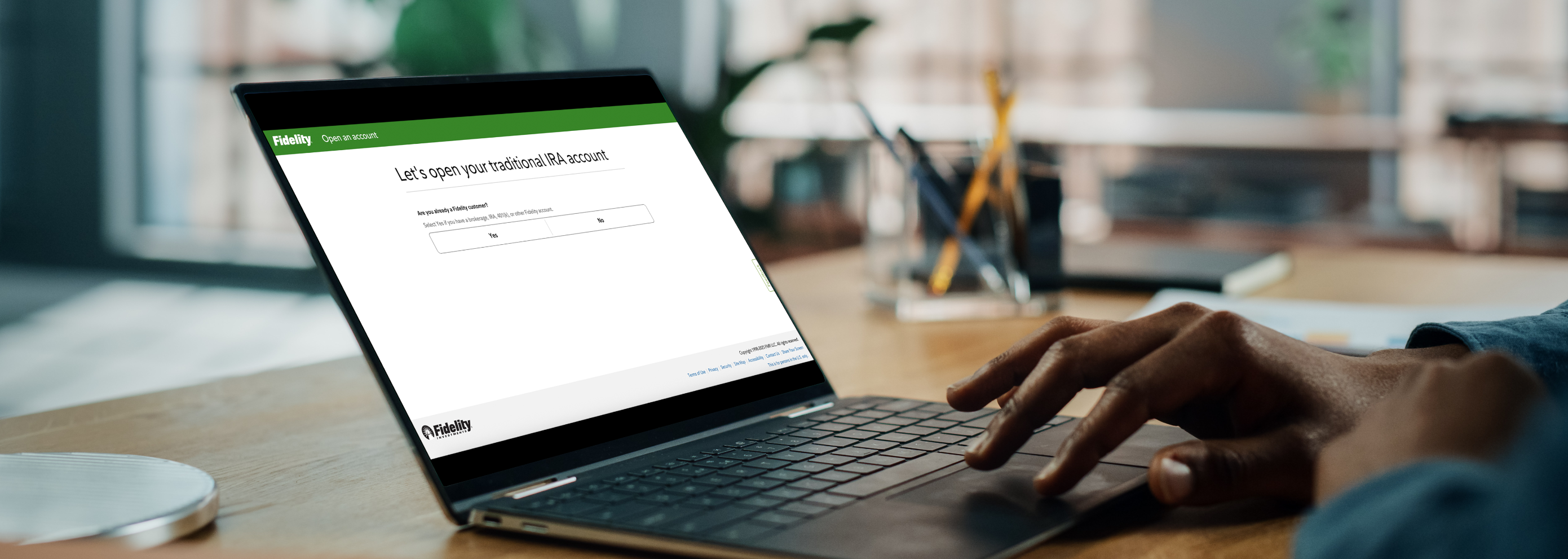

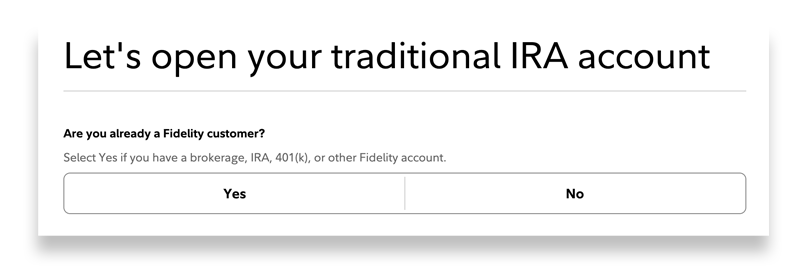

5. Answer Yes or No to the question about whether you’re already a Fidelity customer.

Already a Fidelity customer? Just log in and skip ahead to step 8.

6. Fill in the required personal information.

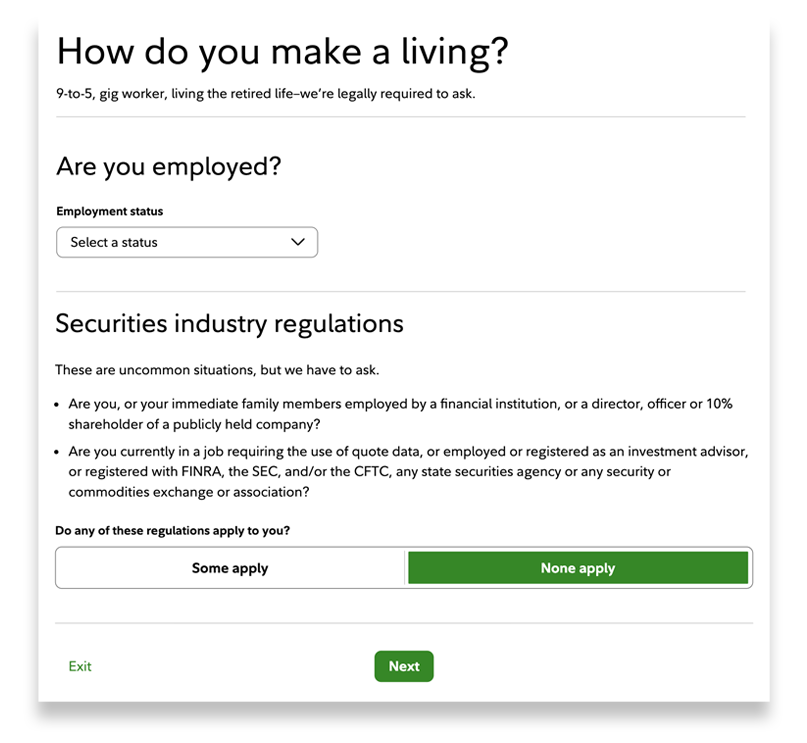

7. If you’re new, you’ll be asked for some employment details.

8. Review your information to make sure it’s correct.

9. Select Open an account—and you’re all set!

What to do next after you’ve opened your traditional IRA

New to Fidelity? You need to set up your login to access your traditional IRA. After that, you’re all set to add money to your account and choose how you’d like to invest it.

Not sure where to start? You may want to check in with a financial pro. Here are some investment ideas to consider that might fit your investing goals.

Opening your traditional IRA and choosing investments helps to put you on the path toward saving for retirement. Explore different ways to add to your traditional IRA and check out other retirement accounts you can open.