It can pay to save in an IRA when you're trying to accumulate enough money for retirement. There are tax benefits, and your money has a chance to grow. Every little bit helps.

If your employer doesn't offer a retirement plan—or you're self-employed—an IRA may make sense. And if you have a 401(k), an IRA can help you build your nest egg faster.

Read Viewpoints on Fidelity.com: No 401(k)? How to save for retirement

For the 2025 calendar year, the contribution window will be open through April 15, 2026. Here are 3 reasons to contribute to an IRA now.

1. Put your money to work

For the 2025 tax year, eligible taxpayers can contribute up to $7,000 or their taxable compensation for the year (whichever is less), to a traditional or Roth IRA, or $8,000 if they have reached age 50 (assuming they have earned income at least equal to their contribution).

Another important consideration is that if a married couple files jointly, a nonworking spouse may be able to contribute to their own IRA if the couple's total compensation (minus any potential IRA contributions from the working spouse) is at least equal to the contribution.

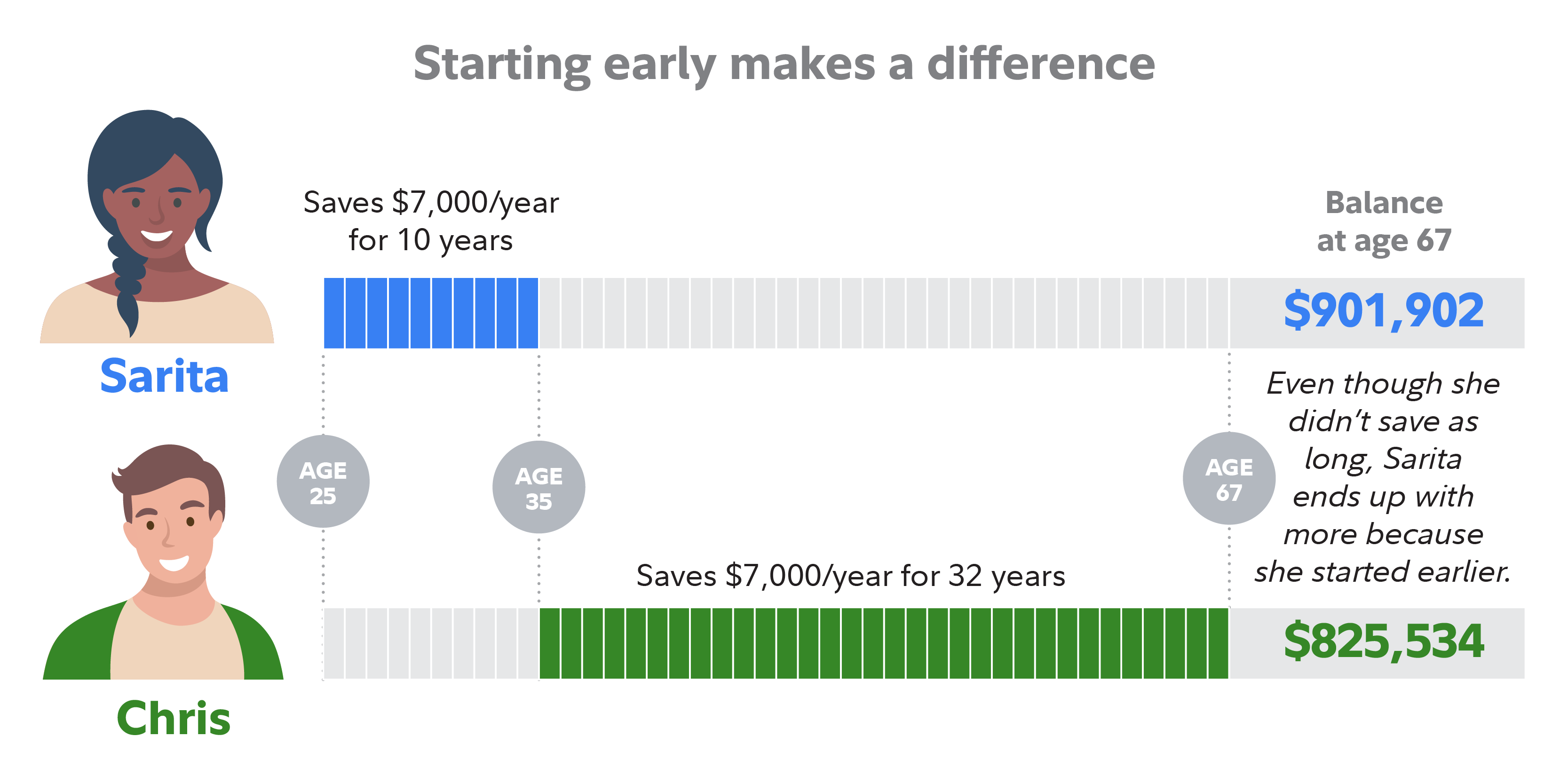

The age you start investing in an IRA matters: It's never too late, but earlier is better. That’s because time is an important factor when it comes to compound growth. Compounding is what happens when an investment earns a return, and then the gains on the initial investment are reinvested and begin to earn returns of their own. The chart below shows just that. Even if you start saving early and then stop after 10 years, you may still have more money than if you started later and contributed the same amount each year for many more years.

2. You don't have to wait until you have the full contribution

The $7,000 (or your total taxable compensation) IRA contribution limit is a significant sum of money, particularly for young people trying to save for the first time.

The good news is that you don't have to put the full $7,000 into the account all at once. You can automate your IRA contributions and have money deposited to your IRA weekly, biweekly, or monthly—or on whatever schedule works for you.

Making many small contributions to the account may be easier than making one big one.

It's important to note that you don't have to contribute up to the limit each year. Save what you can on a regular basis—even small amounts can make a big difference over time. One thing to be aware of—be sure not to contribute more than the annual limit. There can be a tax penalty levied each year on the excess until it's corrected.

Read Smart MoneySM: What happens if you overcontribute to an IRA?

3. Get a tax break

IRAs offer some appealing tax advantages. There are 2 types of IRAs, the traditional and the Roth, and they each have distinct tax advantages and eligibility rules.

Contributions to a traditional IRA may be tax-deductible for the year the contribution is made. Your income does not affect how much you can contribute to a traditional IRA—you can always contribute up to the annual limit as long as you have enough earned income to cover the contribution. But the deductibility of that contribution is based on your modified adjusted gross income (MAGI) and the access you and/or your spouse have to an employer plan like a 401(k). If neither you nor your spouse are eligible to participate in a workplace savings plan like a 401(k) or 403(b), then you can deduct the full contribution amount, no matter what your income is. But if one or both of you do have access to one of those types of retirement plans, then deductibility is phased out at higher incomes.1 Earnings on the investments in your account can grow tax-deferred. Taxes are then paid when withdrawals are taken from the account—typically in retirement.

Just remember that you can defer, but not escape, taxes with a traditional IRA: Starting generally at age 73, required minimum distributions (RMDs) become mandatory, and these are taxable (except for the part—if any—of those distributions that consist of nondeductible contributions). If you need to withdraw money before age 59½, you may be hit with a 10% penalty unless you qualify for an exception.2

On the other hand, after-tax contributions to a Roth IRA are not allowed to be deducted on your income taxes. Contributions to a Roth IRA are subject to income limits.3 Earnings have the potential to grow tax-deferred, and in retirement, qualified withdrawals from a Roth IRA are potentially tax-free. Plus, there are no mandatory withdrawals during the lifetime of the original owner. If you need to take a withdrawal from a Roth IRA, your contributions can be taken out at any time without any tax or penalty, but nonqualified withdrawals of earnings from those contributions, or of converted balances, may be subject to both taxes and penalties.4

As long as you are eligible, you can contribute to either a traditional or a Roth IRA, or both. However, your total annual contribution amount across all IRAs is still $7,000 in 2025 ($8,000 for age 50 and up).

What's the right choice for you? For many people, the answer comes down to this question: Do you think you'll be better off paying taxes now or later? If, like many young people, you think your tax rate is lower now than it will be in retirement, a Roth IRA may make sense.

Need help deciding? Read Viewpoints on Fidelity.com: Traditional or Roth IRA, or both?

Make a contribution

Your situation dictates your choices. But one thing applies to everyone: the power of contributing early. Pick your IRA and get your contribution in and invested as soon as possible to make the most of the tax-advantaged compounding power of IRAs.