Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

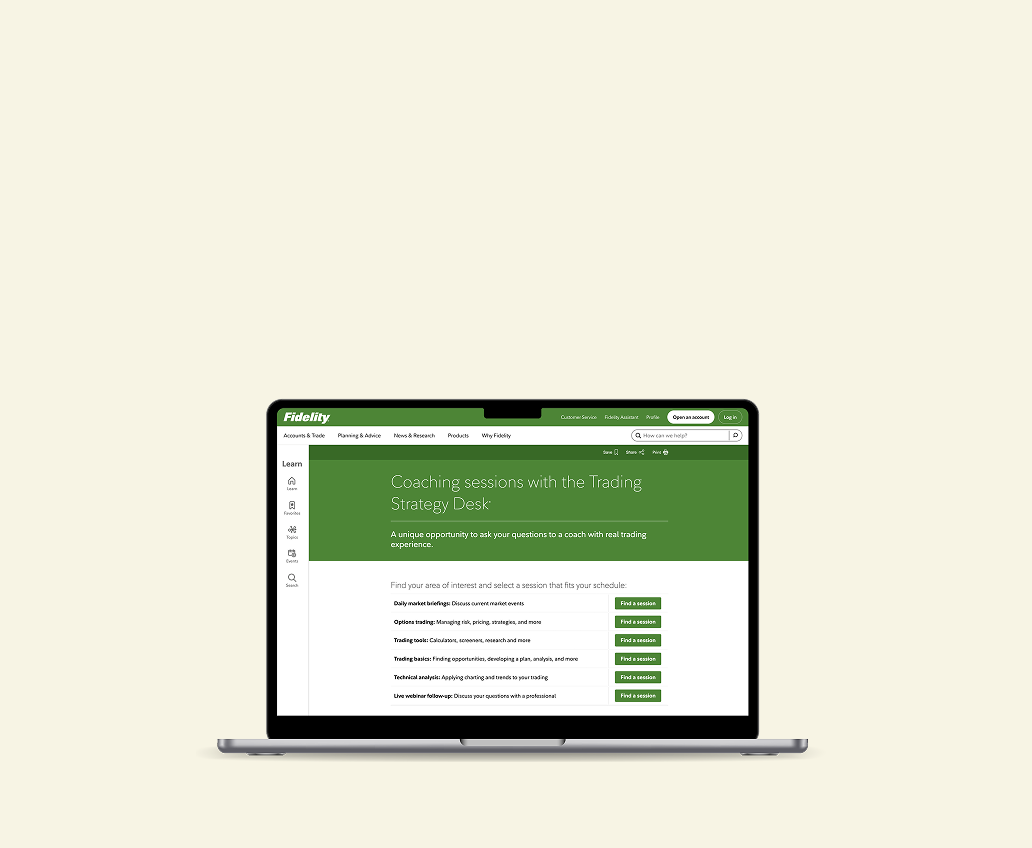

Join Fidelity’s Trading

Strategy Desk® for a 4-week

virtual course.

Stay informed on current market events — join morning, midday, or after-market sessions.

Our most advanced investment insights, strategies, and tools.

Looking for more ideas and insights?

You might like these too:

Make the most of your money in 2026 with insights into the market, taxes, and more.

Get timely insights on investing in today’s market and the themes shaping tomorrow.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917