The Roth IRA is famous for offering an incredible tax benefit: tax-free income in retirement.

If you aren't already a fan, you may be soon. Here's what to know: A Roth IRA allows you to contribute money after you've paid income tax on it (there's no deduction as there can be with a traditional IRA). Once the 5-year aging rule has been met and you satisfy one of the qualified distribution requirements (for instance, you're over age 59½), withdrawals are tax-free.1

Learn more about the differences between these two types of IRAs in Viewpoints on Fidelity.com: Traditional or Roth IRA, or both?, and check out our IRA contribution calculator to see which IRA might be right for you and how much you may be able to contribute.

Consider: $1,000 of after-tax money contributed to a Roth IRA at age 25 could grow to $14,974 by age 65, assuming a 7% annual rate of return and no withdrawals.

That is a pretty good deal by itself, but that isn't all the Roth IRA offers. There are also features that can help you manage your finances today or help you plan for future financial needs.

Consider these 3 flexible benefits of the Roth IRA.

1. Withdraw contributions at any time—tax- and penalty-free

Contributions are the funds you've deposited into the account. Once your money is invested, it has the opportunity to earn a return. Before the end of the 5-year aging period, any earnings cannot be withdrawn without taxes and a 10% early withdrawal penalty under normal circumstances (there are some exceptions to that rule below). But you can take out your contributions at any time with no taxes or penalty.

The Roth IRA is one of the few tax-advantaged accounts that allows this move. As a result, if you need money in an emergency, you can access some of your savings. Your contributions to a Roth IRA could get you through a serious cash crunch without adding to debt or liquidating assets that could have tax implications.

In general, it's best to build your emergency savings separate from your long-term retirement savings. Fidelity suggests aiming to save enough to cover at least 3 to 6 months of essential expenses. If that seems like a daunting goal, start by saving $1,000 and going from there.

There are some caveats to potentially turning to your Roth IRA in an emergency:

- You can only withdraw the amount you've contributed without taxes and penalty, so it's important to keep track of how much you've put in.

- If you need to sell investments in order to withdraw your money, you will need to wait for the trade to settle and the cash to become available.

- If you've converted contributions from a traditional IRA or 401(k) to a Roth IRA, withdrawing those converted amounts may incur the 10% penalty if it has not been 5 years since the beginning of the year in which the conversion or rollover took place.

Each conversion or rollover comes with its own 5-year waiting period before balances from that source can be withdrawn penalty-free. If your Roth IRA has contributions from multiple sources, you should know that there is a set order in which Roth assets are distributed, and that order determines the taxable amount. Generally, regular contributions are withdrawn first, followed by converted and rollover amounts. Earnings on contributions are distributed last.

Withdrawals from a Roth 401(k) are treated differently: Roth 401(k) withdrawals are subject to proration. This means that any contributions withdrawn also have a portion of earnings withdrawn as well.

In an ideal world, you could leave your Roth IRA money invested for growth potential and working for your future. But sometimes life throws you a curveball and the Roth IRA may be able to help.

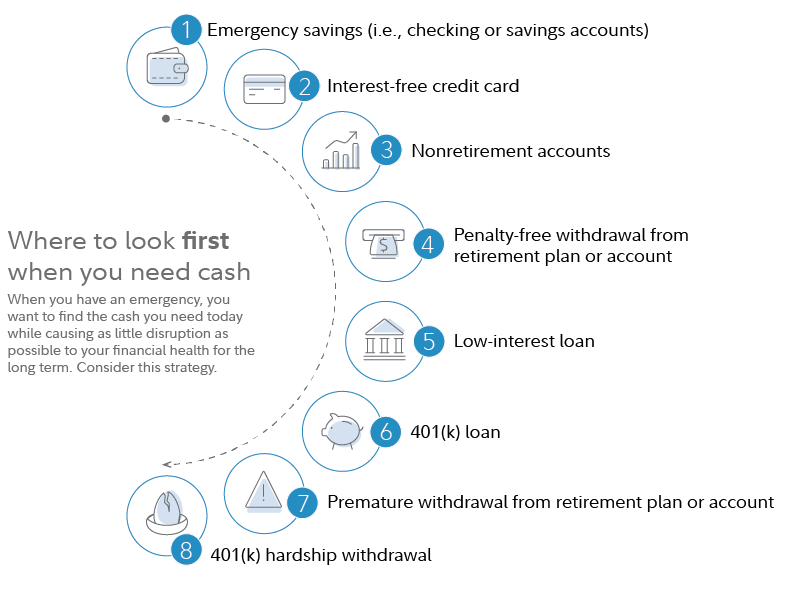

Facing a sudden cash emergency? Consider tapping these sources first. Read Viewpoints on Fidelity.com: Where to find cash, fast

To learn more about building an emergency fund, read Viewpoints on Fidelity.com: How much to save for emergencies

2. Withdraw up to $10,000 of earnings tax- and penalty-free for a first-time home purchase—if your account has been open for 5 years

The 5-year rule comes into play if you are interested in using the first-time homebuyer exception. If it has been 5 years since the beginning of the tax year in which you first contributed, you may be able to include earnings from the account without taxes or the 10% early withdrawal penalty.

This is known as a qualified withdrawal.

Read Viewpoints on Fidelity.com: What to know about the Roth IRA 5-year aging rule

If you're the planning type and think you may be interested in making use of this exception in the future, it can make sense to open a Roth IRA sooner rather than later. By making any contributions, you can get the 5-year clock started, and save for your future. At Fidelity there are no fees to open an account or account minimums and you can start investing with as little as $1.

If it has not been 5 years since the beginning of the tax year of your first contribution, you may still withdraw earnings from the account but taxes will be owed. You will avoid the 10% penalty however.

There are other exceptions that allow you to withdraw money penalty-free but not tax-free.

In addition to the first-time home purchase, the most common exceptions are:

- A birth or adoption expense (up to $5,000)

- A qualified education expense

- For health insurance (if you are unemployed)

- Some medical expenses over 7.5% of your adjusted gross income (AGI)

- Disability or terminal illness

- Expenses related to certain federally declared disasters (up to $22,000)

- Withdrawals for victims of domestic abuse (the lesser of $10,000 or 50% of the vested balance)

Learn more by reading: Early withdrawals from an IRA

3. No withdrawals are required in your life

Unlike traditional IRAs, Roth IRAs have no required minimum distributions (RMDs) for the original owner. So you can leave your money invested as long as you want. As long as you're over 59½ and the 5-year aging rule has been met, you can take out your money when you need it.

That means you can use your money as you see fit—for instance, if your income from taxable sources is high one year, potentially spilling into a higher marginal tax bracket, you have the option of withdrawing money from a Roth account. Or you may prefer to leave it as a tax-free bequest to your heirs. Inherited Roth IRAs do have required minimum distributions, so that is something to be aware of.

Navigate challenges and opportunities with a Roth IRA

Most people have multiple financial goals and challenges. It can sometimes be difficult to juggle all of them. With a Roth IRA you may not have to limit yourself to just one goal, as the flexibility of the account can help you navigate today's challenges, fund your retirement, or leave a tax-free gift to the next generation.