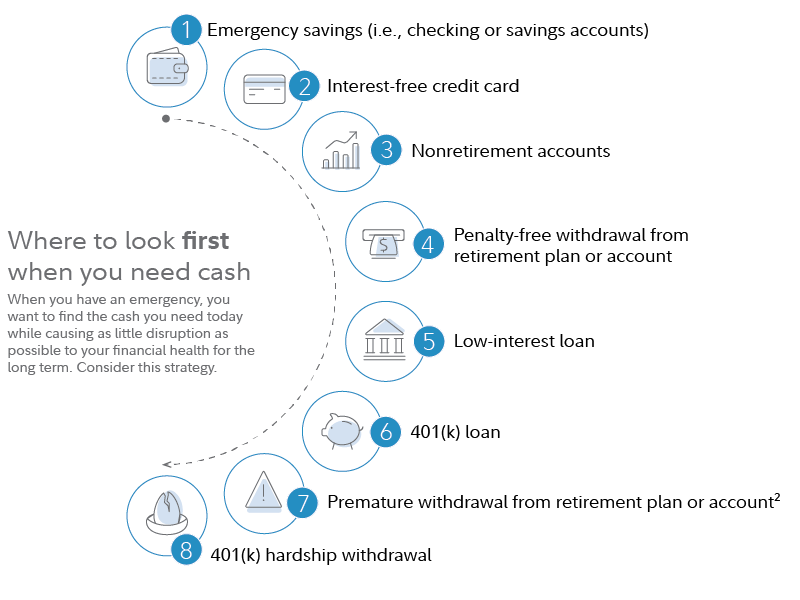

Financial emergencies have a way of catching you off guard. You can't necessarily budget for a tree falling on your house, a loved one needing a costly medical treatment, or a sudden change in your family's financial circumstances.

The prospect of raising cash in a hurry can be daunting, and if you act too quickly, without considering all your options, it can even lead to costly financial mistakes. We put together this guide to help you figure out where to look first when you need cash. These steps are designed to help you find the cash you need, while seeking to cause minimal disruption to your financial health.

Step 1: Using emergency savings

If you've been maintaining a healthy cash savings in case of emergencies, this is the time to use it. (We generally recommend keeping 3 to 6 months of expenses in cash, such as in a checking or savings account, as emergency savings.) Remember, if you begin to deplete your cash savings, you should start to replenish it once the immediate financial difficulty has passed.

Step 2: Consider if you could use a credit card interest-free

Using a credit card for emergency expenses comes with a very large caveat: You should generally only do so if you feel confident you can pay off the full tab before it begins to accrue interest—which typically means before your next payment due date. (If you have a credit card with a temporary 0% interest rate, then make sure to fully pay it off before the 0% rate expires.)

Credit cards often come with double-digit interest rates. That's why carrying a balance on a card is the financial equivalent of playing with fire. Be cautious with this option, and if it isn't a fit, move on to the next step.

Medical emergency?

Step 3: Look to nonretirement accounts

In Step 1 you considered your emergency savings. Now it's time to consider any investment accounts you own (not counting accounts like 401(k)s, IRAs, or 529s, which are earmarked for specific purposes). The most common type of account in this category would be a taxable brokerage account. If you work for an employer that offers some form of stock compensation, you could also consider tapping any vested restricted stock, vested stock options, or shares you've purchased through an employee stock-purchase plan.

Again, this step comes with a caveat. Selling stocks or other investments to raise cash will affect your asset allocation and may generate a tax bill. However, that doesn't mean you shouldn't do it, but it does mean you should think through those implications and whether you need to make any other adjustments to keep your portfolio or tax planning on track.

Step 4: Check if you're eligible for a penalty-free withdrawal

If you've gone through steps 1 to 3 and you still haven't found enough cash, you can now start to evaluate the role of your retirement accounts. In this step, you should only consider withdrawals you could take penalty-free. Here's when that might apply, for 3 of the major account types:

- 401(k): You're at least 59½ years old (just make sure your plan offers "in-service withdrawals" if you’re still working).

- Traditional IRA: You're at least 59½ years old, you've recently become permanently disabled, you're facing significant unreimbursed medical expenses, or you meet one of the other IRS-specified exceptions.1

- Roth IRA: You only withdraw an amount equal to or less than what you've contributed—i.e., you don't withdraw any of the returns you've earned on your contributions. If you've had the account open for at least 5 years and you meet one of the specific exceptions for penalties on early withdrawals, then you may be able to withdraw earnings as well as contributions penalty-free.2 (Other withdrawals will generally incur a penalty and are covered in Step 7.)

All of these choices still entail some additional planning. With a traditional IRA or 401(k), you may still owe income tax on your withdrawal. Even with a Roth IRA, you may owe tax if you withdraw earnings before you've had the account open at least 5 years. With any of these moves, you may need to boost your retirement savings once your emergency has passed, to recover from the withdrawal.

Step 5: Consider a low-interest loan

With Step 2 you considered a 0%-interest loan. In this step, you could now consider a low-interest loan, such as one with a rate of up to about 6%. This might be an option if you're a homeowner and you can access a home equity line of credit at a favorable rate, or if a bank or other financial institution you work with will grant you a personal line of credit. It may also be an option if you feel comfortable asking for a loan from family or friends, and can come up with loan terms that work for everyone involved.

Step 6: Look into a 401(k) loan

While a 401(k) loan shouldn't be taken lightly, it can be a much better option than some alternatives (like borrowing with a high-interest credit card). The interest you pay on the loan goes into your own 401(k), rather than to a bank or credit-card issuer. You don't owe taxes or penalties on the amount of the loan.

However, there are quite a lot of rules and details for these loans to keep track of (learn more about taking money from a 401(k)), and each plan can potentially have slightly different terms. Read up on the rules and look into what your plan allows before you make a final decision.

Step 7: Think about a premature IRA withdrawal

Withdrawing from your traditional IRA before age 59½, and without meeting one of the other specific exceptions, means you'll pay income taxes and a 10% penalty on your withdrawal.

If you have a Roth IRA, you could consider withdrawing investment earnings in this step. If you've owned your account for at least 5 years, then you generally won't owe income taxes but will still owe a 10% penalty on the withdrawal (unless you meet one of the specific exceptions for penalties on early withdrawals2).

Step 8: Evaluate a 401(k) hardship withdrawal

The final step to consider is whether you can qualify for a hardship withdrawal from your 401(k). Under IRS rules, you may qualify for one if you're facing an immediate and heavy financial need.3 However, it's typically up to your employer to decide whether your personal situation qualifies.

Even if you qualify, with a traditional 401(k) you will generally still owe income taxes and a 10% penalty on the amount you withdraw. You may also be prohibited from contributing to your 401(k) for a period of time afterwards, meaning you'll miss out on any employer match. Because of those reasons, we consider this as a last resort option.

Building back after a financial emergency

- First, building up a small cash buffer of at least $1,000 in case other expenses come your way

- Making sure you’re contributing enough to your 401(k) to capture any employer match

- Eliminating any credit card debt

- Fully funding your emergency savings