A Roth IRA can be a great way to put money away for retirement, letting you save and invest dollars you've already paid taxes on, and potentially freeing you from worry about taxes in retirement when you withdraw the money.

But many Roth IRA account owners may not understand the 5-year aging requirement, also known as the 5-year rule, which can have a big impact on withdrawals from these accounts. Falling afoul of this rule can result in taxes or penalties—possibly both.

Roth IRAs explained

A quick refresher: Unlike a traditional IRA, where you may receive a tax deduction for contributions (depending on income), a Roth IRA does not provide tax deductions on contributions. While contributions are made with money you've already paid taxes on, earnings can potentially grow tax-free with no obligation for required minimum distributions (RMDs), which are withdrawals you must take or face penalties beginning at age 73.

You can withdraw your contributions from a Roth IRA tax-free and penalty-free at any time. The same does not apply to account earnings, however, which must meet the 5-year rule.

What is the 5-year aging rule?

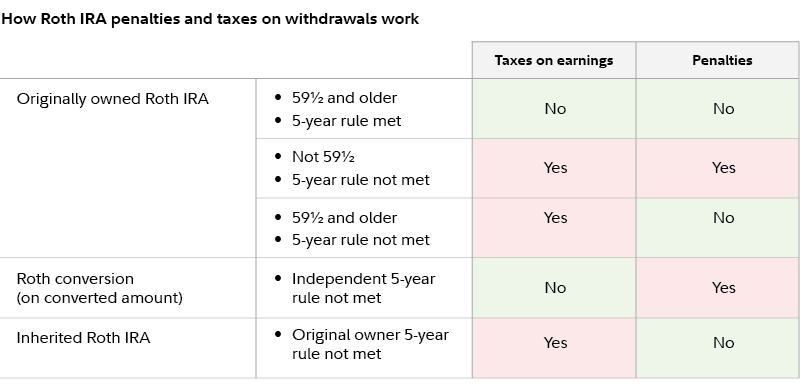

The 5-year rule for Roth IRAs means that at least 5 years must elapse between the beginning of the tax year of your first contribution to a Roth account and withdrawal of earnings. If fewer than 5 years have passed before you make a withdrawal of earnings, the withdrawal is considered a nonqualified distribution and may be subject to either taxes or penalties (or both).

Once the 5-year rule has been met and the account owner is age 59½ or older, among other exceptions, they may make what's known as a qualified distribution of earnings exempt from both taxes and penalties.1

Note: The 5-year aging requirement applies to all Roth IRAs. In addition to withdrawals from originally owned Roth IRAs, it covers inherited Roth IRAs based on when the original owner made the first contribution. Even if the 5-year aging requirement is not met and you owe income taxes, you may not owe penalties due to a variety of exceptions—death, disability and turning age 59½ among them. A separate 5-year aging rule covers converted balances from traditional IRAs to Roth IRAs and to Workplace Roth account contributions.

You can also contribute to a Roth IRA for a given tax year up until its filing deadline. Since the 5-year rule starts the clock on January 1 of the tax year of your first contribution, this may, in practice, help you meet the aging requirement sooner. For example, if you contribute to a Roth IRA in April 2026 for the 2025 tax year, you may meet the 5-year rule in a bit under 4 years.

Roth conversions and the 5-year rule

The Internal Revenue Service (IRS) requires a waiting period of 5 years before withdrawing balances converted from a traditional IRA to a Roth IRA, or you may pay a 10% early withdrawal penalty on the conversion amount in addition to the income taxes you pay in the tax year of your conversion. There are a variety of exemptions to this penalty, however, including death, disability, and turning age 59½. Also note that the 5-year waiting rule does not apply to the amount originally converted; it only applies to the earnings portion of the converted amount.

Keep in mind that Roth conversions can only be attributed to the year in which they take place (not tied to the filing deadline like contributions). If you convert at any time in 2025, the 5-year rule starts in January 2025, but you cannot convert in 2026 and attribute it to 2025.

Important to know: The 5-year rule is counted separately for each conversion. The same rules apply to so-called backdoor Roth IRAs.

Read more about Roth IRA conversions in Viewpoints: Why consider a Roth conversion now?

What about inherited Roth IRAs and the 5-year rule?

As previously noted, the 5-year aging rule applies to inherited Roth IRAs as well, and rules around them can be complicated. To make qualified distributions, it must be 5 years since the beginning of the tax year when the original account owner made the initial contribution, even if the new owner is 59½ or older. Withdrawal of earnings may be subject to income tax if the 5-year rule is not met, although penalties never apply for withdrawals due to death (as is the case for withdrawals from any inherited account).

What are the penalties if you don't meet the 5-year rule for Roth IRAs?

If you don't meet the 5-year rule, your withdrawal is a considered a non-qualified withdrawal and you may pay a 10% early withdrawal penalty to the IRS for distributions of earnings or converted balances prior to the 5-year aging requirement. You may also owe tax at your ordinary income tax rate on distributions of earnings.

What other rules may apply to Roth IRAs?

Exceptions to the Roth IRA 5-year aging requirement

Some exceptions to the 5-year rule may apply, allowing you to make withdrawals without paying a penalty (but taxes may still apply). These include withdrawals up to $10,000 made for a first home purchase, if you become permanently and totally disabled, or for educational expenses.

Roth IRA ordering rules

Distributions from your Roth IRA that are considered nonqualified—meaning they haven't met the 5-year aging rule and you are not age 59½ or older, among other conditions—may be fully or partially taxable. In fact, there is a set order in which Roth IRA assets are distributed, and that order determines the rules that apply. Generally, regular contributions are withdrawn first, followed by converted and rollover amounts. Earnings on contributions are distributed last.

Understanding how much you have of contributions, converted or rolled over amounts, and earnings will help you determine the potential tax consequences of withdrawing from your Roth account.

Roth IRA contribution limits

Roth IRAs have the same contribution limits as traditional IRAs. For 2025, those limits are $7,000, or $8,000 for those 50 or older. For 2026, those limits increase to $7,500 and $8,600, respectively. However, your annual income may reduce or eliminate your ability to contribute that amount to the Roth IRA. 2025 contribution limits begin to phase out at $150,000 in modified adjusted gross income if you file taxes as a single person, $236,000 if you are married and file jointly, and at your first dollar if you are married and file separately. 2026 contribution limits begin to phase out at $153,000 in modified adjusted gross income if you file taxes as a single person, $242,000 if you are married and file jointly, and starting with your first dollar if you are married filing separately.

Roth IRAs can be an important addition to your retirement savings plan that can help you meet your retirement goals by providing tax-free income. Always consult a tax or financial professional to understand the implications of Roth IRA withdrawals. By understanding the 5-year rule, you can minimize the pain of penalties and taxes.