The inflation rate has slowed from the blistering highs set in 2022 but inflation is still a real concern for many.

If you're already retired and living off your investment income, you may be especially worried, regardless of the size of your nest egg. Will your retirement plan be able to withstand higher prices in the future? Perhaps most importantly, could it impact your lifestyle?

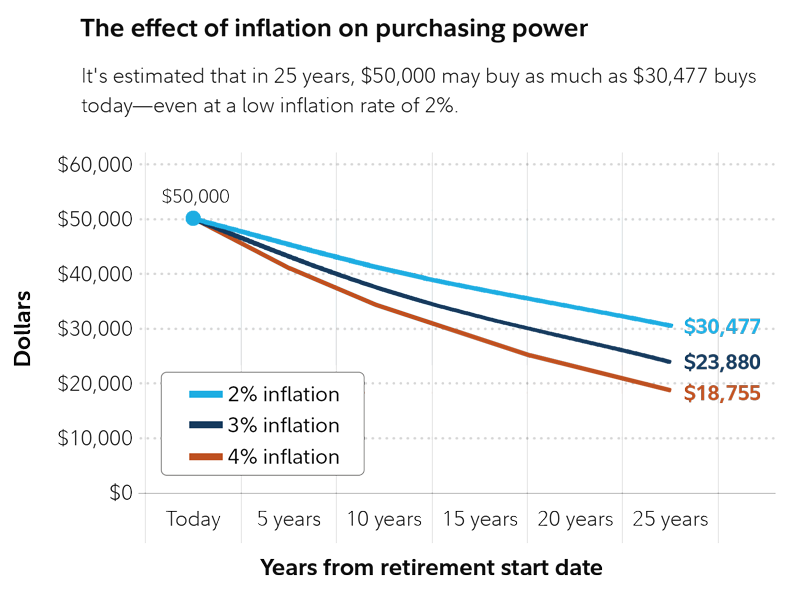

Because financial plans work within ranges of possibilities, they are designed to withstand bumps in the road. Fidelity's retirement analysis within the Planning & Guidance Center currently assumes 2.5% inflation when assessing retirement goals. Of course, if you believe long-term inflation is likely to be higher, you can work with a Fidelity professional to adjust your plan accordingly.

Here's how having a diversified investment plan—and the appropriate insurance and estate planning strategies—can help address some of your top concerns regarding rising prices and your lifestyle and legacy.

Should I change my mix of investments?

Most retirees already have some inflation-adjusted protection through Social Security, and some may have inflation-adjusted defined benefit pensions or annuities with cost-of-living adjustments.

If you assume that inflation will average 2% to 2.5% in the upcoming years, your investment goal would be to earn a return of at least that much or greater. If you think inflation is going to go up beyond that—either temporarily or long term—you may want to consider inflation-resistant investments for your portfolio and diversify across asset classes to help reduce inflation risk further.

"Even though inflation has been higher recently than what we’ve become used to over the last couple of decades, the US Federal Reserve believes that inflation is likely to gradually head lower over the coming years," says Naveen Malwal, an institutional portfolio manager at Fidelity's Strategic Advisers LLC. "So you don't have to drastically change your allocations if they are already diversified. For example, within our clients' accounts, we currently have modest exposures to investments that have historically done well when inflation has been rising. But these accounts are still largely allocated to traditional stocks and bonds, because historically, diversified portfolios have generally delivered positive returns even through periods of higher inflation."

Here are some options included in Fidelity managed account portfolios that individual investors can consider:

- US stocks can grow through inflationary periods, as businesses can pass on higher prices to their customers.

- International stocks can also do well, particularly when inflation is specific to the US economy.

- Investments tied to commodity prices have historically benefitted from inflation, as demand rises for things like aluminum, copper, gas, or corn.

- With bonds, you might want to think about Treasury Inflation-Protected Securities (TIPS), which can perform well as inflation rises.

And if the inflation outlook radically shifts higher because of unforeseen circumstances? The same strategies would still apply.

"As long as you are diversified across a broad number of asset classes, you are likely managing a large degree of inflation risk," says Malwal.

Do keep in mind that diversification and asset allocation do not ensure a profit or guarantee against loss.

Should I have more in cash or less?

If you think your retirement lifestyle is going to cost more in the future because of inflation, your instincts might be telling you that you need more cash available for everyday expenses.

For some retirees, that cash allotment is just a few months of spending, or maybe the amount needed yearly as a required minimum distribution from their IRA or 401(k) accounts. For the more conservative, it could amount to a few years of living expenses or more, depending on how they feel about the potential for withstanding a market downturn.

But assuming you have a solid cash plan in place now, you might want to consider doing just the opposite if you are particularly worried about inflation: Hold less cash and invest for growth potential.

"Unless our assets grow at the same rate as inflation or greater, we're going to feel like we can't afford as much a few years from now," says Malwal. "That’s where holding a lot of cash or other short-term investments can carry some risk. That’s because the low returns on those assets may have a harder time keeping up with inflation."

Can annuities help reduce the impact of inflation?

Periods of high inflation may be easier to live through if your essential expenses are covered by guaranteed income—particularly if there is a cost of living adjustment (COLA) selected. When guaranteed income covers one's essential income need, it provides an income floor so one is no longer as dependent on income drawn from sources that are tied to the markets. As a result, short-term fluctuations are easier to live through, and the money staying invested provides the added benefit of outpacing inflation. COLAs are very helpful, but they generally don't offer much help in temporary high inflation periods because they simply don't keep up.

Unlike investments, fixed income annuity payments are not dependent on the markets and they continue making regular and predictable payments in any market environment. If you're interested in receiving payments that help keep pace with inflation, a cost of living adjustment1 is an optional feature that may be available. Of course, there are trade-offs: Most income annuities restrict or even eliminate your access to your assets, and are subject to the claims-paying ability of their issuers.

Overall, we believe that annuities, together with other guaranteed income sources like Social Security and pensions, can be the best way to cover essential expenses.

How can I insure against the unknown?

Rising costs for a trip to Hawaii are one thing. Rising costs for prescription drugs and hospital care are on another level. Health care costs have been rising faster than the rate of inflation for years, and will likely continue to do so.

On average, according to the 2025 Fidelity Retiree Health Care Cost Estimate, a 65-year-old individual may need $172,500 in after-tax savings to cover health care expenses in retirement.

These estimates do not include the cost of long-term care, so depending on your needs and your financial situation, you might want to consider long-term care insurance. "Even if today you think you have enough to cover the costs involved, you may have to lower your standard of living or adjust what you plan to leave to heirs in order to spend more on health care, especially if that care is going to run higher than the industry averages," says David Peterson, head of wealth planning at Fidelity.

You might also want to assess your life insurance and disability insurance needs, especially if you are still working in retirement in some capacity and count on that income to cover your spending. To learn more about health care expenses in retirement, read Viewpoints: How to plan for rising healthcare costs.

Will inflation limit my legacy?

Even if your personal purchasing power isn't really affected by inflation, you may still be worried about the overall economy. If the stock market falters or the economy snags, it could affect your overall wealth and limit what you can leave to heirs or charity.

This is the kind of worry that Viktor Misko, a vice president and wealth management advisor at Fidelity, is hearing a lot of right now, with inflation worries mixed in with concerns about the markets and the changing tax and estate planning landscape. The headlines are hard for people to ignore, and the COVID-19 pandemic has changed people's priorities and made them worry about all sorts of things.

"Almost every conversation begins and ends with some level of uncertainty. I focus with clients on what we know and what can impact their own financial plans," Misko says.

Because estate planning is by nature a long-term process, there are multiple factors that may have an impact on it, including inflation concerns. As a result, an estate plan should be constructed in a flexible enough way so that the plan can adapt to changes while still accomplishing a client's goals. A plan that is too restrictive may require more frequent updating (with the associated legal expenses) or risk not being as successful as originally intended.

Inflationary concerns and the potential impact on the overall economic environment may ultimately prove to be less influential than, for example, a potential change in estate tax law.

"The key is to not make short-term decisions," says Misko. "If you're worried about what lies ahead, you can be proactive about it, and make changes that might fit a number of potential scenarios."

Whatever direction inflation eventually goes, the key is having a plan that can enable you to live the life you want. Working with a professional can help you find the strategy that works for you. Your attorney and tax professional can help you consider changes consistent with your unique situation.