While prices that consumers pay for products and services aren't rising as sharply as they were several years ago, they are still going up. Add to that new tariffs on imported goods, and you may want to consider adding some inflation protection to your portfolio.

Collin Crownover of Fidelity's Asset Allocation Research Team expects the Bureau of Economic Analysis Personal Consumption Expenditure (PCE) measure of inflation to remain around 3% for most of the year ahead. Crownover says this persistent inflation may help reduce the historical tendency of bond and stock prices to move in opposite directions. That matters because many investors rely on a mix of stocks and bonds to smooth out returns from their portfolios, with bonds rising when stocks fall and vice versa. In this environment, Crownover says that investors might consider adding positions in Treasury Inflation-Protected Securities (TIPS) to their portfolios.

Why inflation matters for bond investors

Inflation is bad news for most types of bonds because it makes their fixed-interest payments less valuable. Bonds generally offer a series of fixed-interest payments that represent a percentage of the face value of the bond. When inflation picks up and prices rise, the purchasing power of the interest payment decreases, meaning those fixed payments buy less stuff.

To help reduce the risk that inflation poses to bondholders, the US Treasury created TIPS in 1997. These are bonds whose principal and interest payments are designed to rise when inflation does. They are available in 5-year, 10-year, and 30-year maturities.

How TIPS adjust to inflation

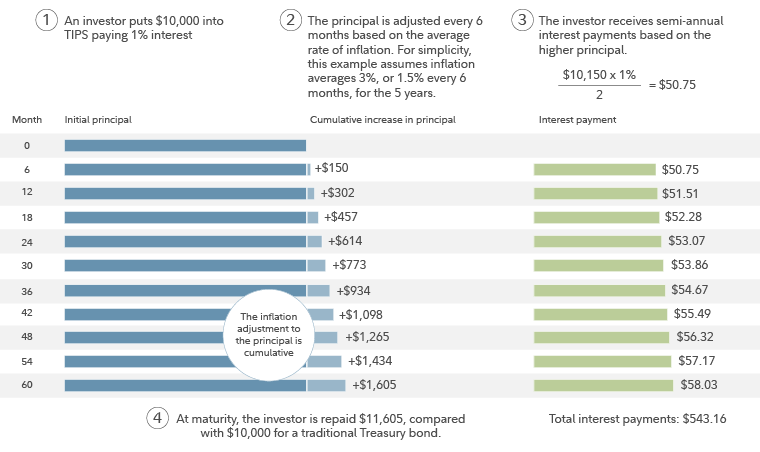

TIPS' yields are based on their current amount of principal. When inflation rises, the principal of TIPS adjusts higher, and the payments go up along with it. Let's look at a hypothetical example to understand how TIPS do this.

Risks of TIPS

TIPS pose very little risk of default because they are backed by the full faith and credit of the US government. However, they do not protect bondholders from all types of risk. If inflation were to give way to deflation, principal and interest rate payments on TIPS would adjust downward, and investors may wish they held conventional bonds instead. It's also possible to lock in a loss in real terms if you buy a TIPS with a negative real yield and hold it to maturity.

TIPS are also subject to interest rate risk, just like other bonds. That means when interest rates rise, the market value of bonds is likely to fall. Rate risk may be managed by holding individual TIPS bonds to maturity, as in a bond ladder. If you hold TIPS until they mature, you will receive either the adjusted principal or the original principal, whichever amount is greater.

TIPS and taxes

Semi-annual interest payments on TIPS are subject to federal income tax, just like payments on conventional Treasury securities.

Any increase in the value of the TIPS principal is subject to federal tax in the year that it occurs—even though you won't receive any income from the increase. On the other hand, when the TIPS matures or is sold, you will only pay federal tax on the final year's increase in principal while receiving the full increase in principal since the date of initial purchase. Like all Treasury securities, TIPS are exempt from state and local income taxes. Investors should consult their tax advisors regarding their specific situation prior to making any investment decisions with tax consequences.

Watching the breakeven rates

One way investors can determine whether TIPS or conventional Treasurys may make more sense for their portfolios is to look at what is called the breakeven inflation rate. This is the rate of inflation at which a TIPS and a conventional Treasury of the same maturity would both deliver the same inflation-adjusted return until they mature. For example, if a 5-year TIPS yielded 1.28% while a conventional 5-year Treasury bond paid 3.72% as of November 3, 2025, the breakeven for the 5-year bonds would be 2.44%. If actual inflation exceeds the breakeven rate in the future, the adjustment to the TIPS will eventually provide a higher real return than the conventional bond. However, if inflation comes in lower than the breakeven rate, the conventional bond will provide a better return.

Finding ideas

Investors interested in diversifying their portfolios with TIPS can choose from individual bonds, mutual funds, or exchange-traded funds. The approach you choose should reflect your ability and interest in researching your investments, your willingness to track them on an ongoing basis, the amount of money you have to invest, and your tolerance for various types of risk. There are pros and cons for both individual bonds and bond funds. In some cases, it may make the most sense to own both. Learn more about the differences between individual bonds and funds here: Bonds vs. bond funds

TIPS are also used by professional investment managers to help protect portfolios from specific risks, says Lars Schuster, institutional portfolio manager with Strategic Advisers, LLC. "While higher inflation can be problematic for some bonds, TIPS exposure might help protect the value of the fixed income portion of a well-diversified portfolio," he says.

You can buy TIPS directly from the US government at auctions spread throughout the year and at Fidelity.com. You can also buy and sell individual TIPS with various maturities and prices from other investors in the secondary market. Fidelity.com does not charge fees or mark-ups on these transactions.

Fidelity also offers research tools including the Mutual Fund and ETF evaluators on Fidelity.com.