Millions of Americans became caregivers for the first time in their lives during the COVID pandemic. However, even before the pandemic, many people took on caregiving responsibilities for their aging loved ones, and even those with special needs. They reduced their hours or left the workforce entirely, taking a major financial hit, including to their retirement savings.

A caregiving roadmap can include building out a financial plan and knowing how, who, and when to ask for help from others—both at home and at work. A financial caregiving roadmap is like a guide that helps caregivers with the complexities of navigating finances that can include establishing legal support, understanding benefits, management of your loved one's finances, and more. Your roadmap can also help you understand your current financial position — knowing how much you spend and save can provide some key insights into your financial health.

Now may be the ideal time for caregivers, (especially those juggling work and family demands) to hit the reset button and find ways to lower their stress levels, tend to their own mental well-being, and better manage their personal finances.

The financial impact of caregiving

The most recent stats indicate that majority of caregivers rely now or plan to rely on a combination of their work income and another family member's income, or government benefits to pay for care. According to Fidelity Investments® 2022 American Caregivers Study, 77% of caregivers rely on a combination of income, while 74% on government benefits.

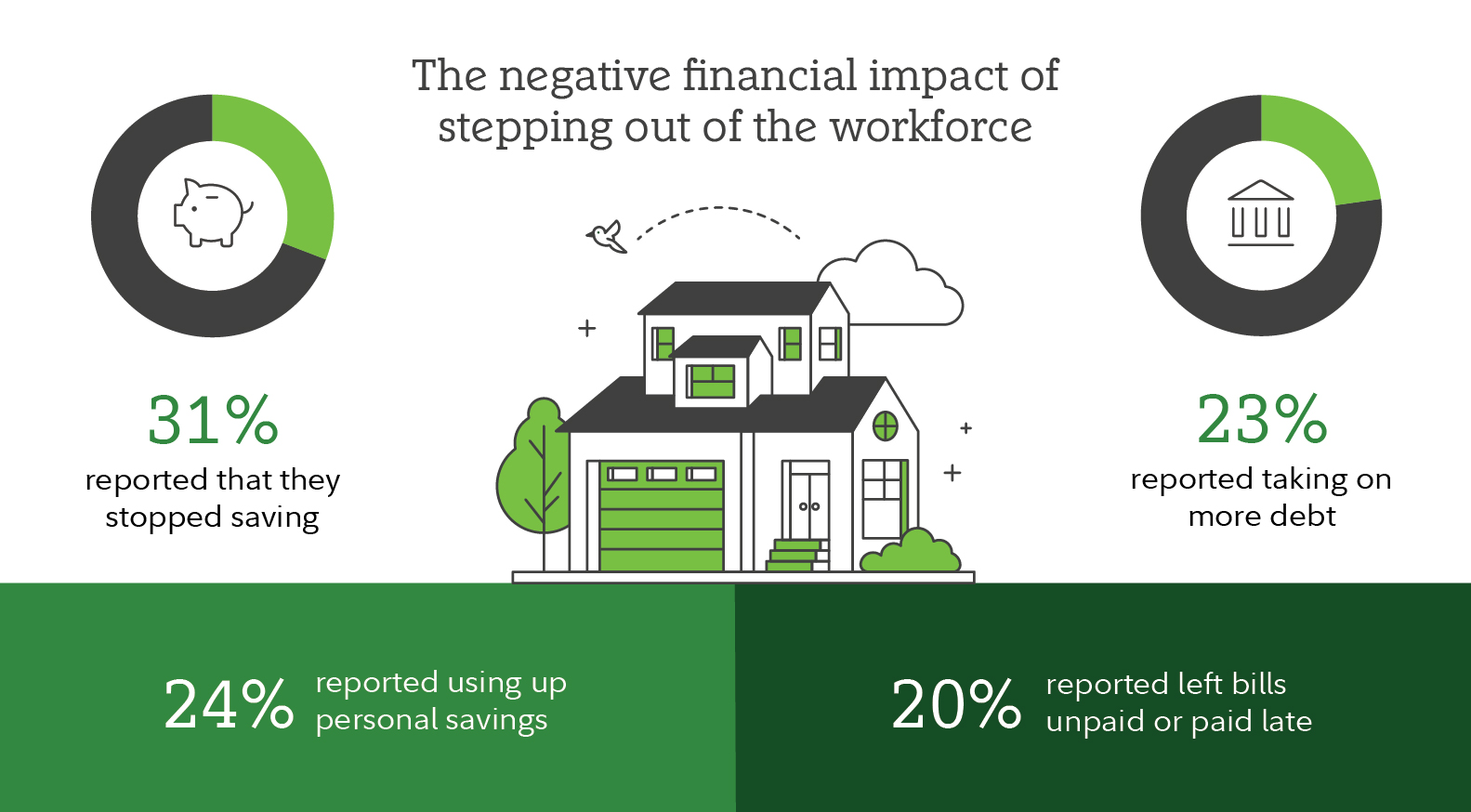

The financial burden on family caregivers can be significant. It's not uncommon for caregivers to experience one or more negative financial impacts — such as depleting savings, acquiring more debt, and leaving bills unpaid or paying late — due to care responsibilities.

The hidden cost of leaving the workforce

With hours of care ranging from 27 -40 hours a week2, it comes to no surprise that the stress of balancing work and providing care may impact a caregiver's decision to leave the workforce. Research findings reveal that among employed caregivers: 16% took a leave of absence, 18% shifted to part-time work, and 9% gave up work entirely as a result of caregiving obligations.2

Although not an exhaustive list, some hidden costs of caregiving are absenteeism, reduced productivity, lost wages, and even emotional exhaustion (with 70% of caregivers admitting to focusing more on caregiving duties and putting off their own needs1).

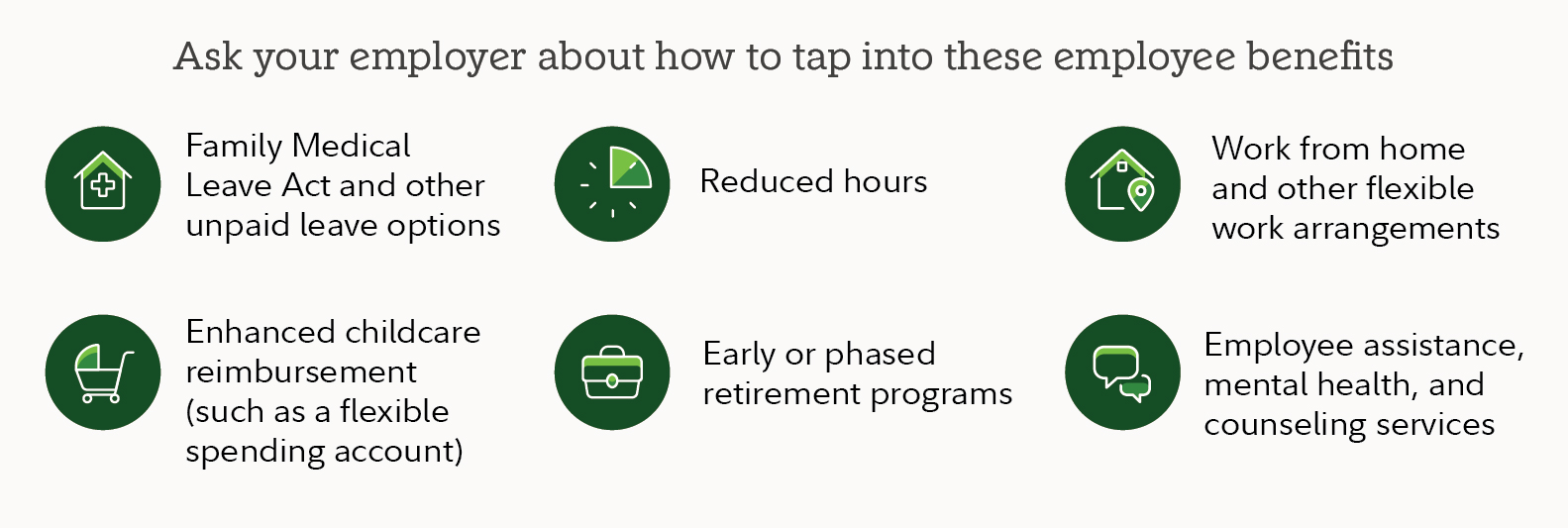

The decision to leave the workforce brings with it other hidden financial costs, including the adverse impact it may have on potential raises and promotions, or participating in a variety of important financial employee benefits such as:

- 401(k) or workplace savings program (with an employer match)

- Health insurance coverage and employer contributions to health savings accounts (HSAs)

- Tuition reimbursements

- Employee stock purchase plans

- Financial wellness coaching

Caregivers may overlook the opportunity to seek out help from their employer and take advantage of a number of employee benefits, which may include greater flexibility, as well as financial and emotional support benefits.

An effective caregiving roadmap requires honest conversations

When caregiving needs become front and center for the family, it's important to communicate with other family members involved. Sometimes, hard and honest conversations may be required and may even be helpful in brainstorming the best ways to offer the financial support and guidance that may be needed. Some questions to explore:

- How to pay for costs associated with providing care

- How to maintain the home or apartment of a loved one

- How to manage the finances and pay the ongoing bills of a loved one

- How to manage medical or health needs in providing care

- How to balance work vs. caregiving responsibilities

- How to set up legal documents, including wills or powers of attorney

Again, an important part of having a caregiving roadmap is having a financial plan. Understanding your current financial position can provide a solid foundation for your financial planning process. Knowing how much you spend and save can provide some key insights into your financial health. To add, whether you work with a financial professional or on your own, it's important to review the basics of financial planning, such as your health care expenses, life and auto insurance, college savings, will, and more.

Put a financial plan in place

While it's true, the pandemic made things harder for caregivers, with 33% having permanently lost or reduced their source of work income1, a financial plan can have a measurable impact on your finances.

Creating a financial plan can help reduce worry and anxiety, and putting one in place may be easier than expected too. On average, 34% of caregivers who have acted found that creating a plan for current and future expenses was easier than expected — 32% found that it was more difficult than expected.1

Your financial plan can include tips and resources to maintain the best possible financial health for you. Helpful suggestions:

- Consider organizing or creating a system for your loved one's expenses and records, or any documents you may need to manage their finances. You could create a checklist or use an excel spreadsheet — any tool that will help you stay on track to manage money, help you budget, and spend sensibly. This could also mean evaluating if it's a good idea to not mix your loved one's finances with your own. It could be more helpful for tracking and accountability purposes to keep expenses, debt, and other financial documents, separate.

- Don't be afraid to ask for help. If possible, and if your comfort level allows, share your experiences with trusted family members, friends, community leaders, or even non-profit resource organizations for aging adults who may be able to offer financial support.

- Remember, a key component of your financial plan is to ensure you have the proper legal authority to handle your loved one's finances. Without being named as "financial caregiver," it's possible that completing certain tasks could take longer, become cumbersome, or even be impossible. It's a good idea to know your options, discuss them with your loved one, and determine what works best for your situation.

- Become familiar with some of the types of caregivers: power of attorney, guardian, trustee, trusted contact person, Veteran Affairs fiduciary or Social Security Administration payee. Do you research and determine what works best for your situation.

Fidelity resources to help you plan and thrive:

- Fidelity's Life Events, an online experience designed to help people plan, anticipate, and react to expected and unexpected events in life.

- The Aging Well guide, a planning, conversation and resource tool designed to help people build a comprehensive plan.

- Read Viewpoints: How to take care of aging parents and yourself

- Read Viewpoints: The hidden costs of caregiving

- Read Viewpoints: Should you become a caregiver or keep your job?