Social Security is one of the few sources of guaranteed, inflation-adjusted income that lasts as long as you live. But how and when you claim can significantly affect your lifetime benefits—and how much of those benefits you keep after taxes.

While many people default to claiming early or at full retirement age (which is 67 for most people), savvy retirees know there are strategic claiming techniques that can significantly increase lifetime benefits and potentially provide greater financial security.

Here are 6 strategies to help you make the most of your Social Security benefits.

1. Delay claiming until age 70—using a bridge strategy if needed

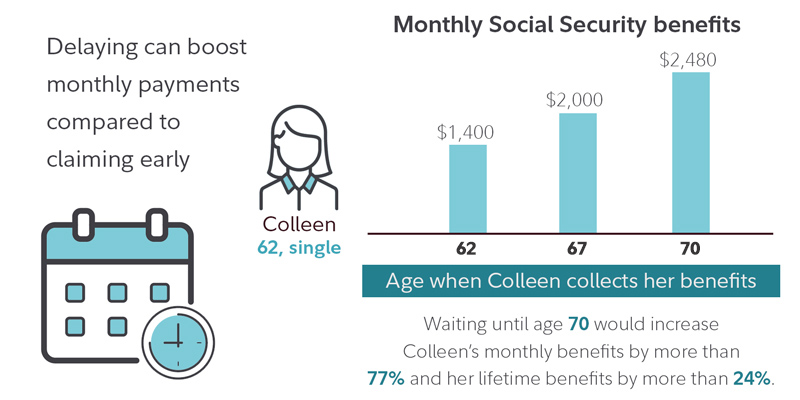

Delaying your Social Security benefit until age 70 can significantly increase your monthly benefit.

While it may be tempting to start receiving checks at 62, when you first become eligible, your monthly benefit increases for each year you delay until 70—even before the impact of annual cost-of-living adjustments (COLAs). Over a long retirement, the difference in monthly income could translate into substantial additional income, depending on how long you live. And because Social Security is adjusted annually for inflation, the larger base benefit means larger dollar increases from COLAs over time.

But what if you want or need to retire before 70? That’s where a “bridge strategy” comes in. This involves drawing from other sources of income or from retirement savings—such as 401(k)s, IRAs, or taxable brokerage accounts—to cover expenses in the years before you claim Social Security. Learn more about how to build an income bridge to support you during these years.

One important caveat is that delaying claiming may not maximize lifetime benefits for those with a shorter life expectancy. That’s why health status and longevity should also be important considerations in deciding when to start benefits. Read more about whether you should take Social Security at 62.

2. Claim, suspend, restart: A strategic reset

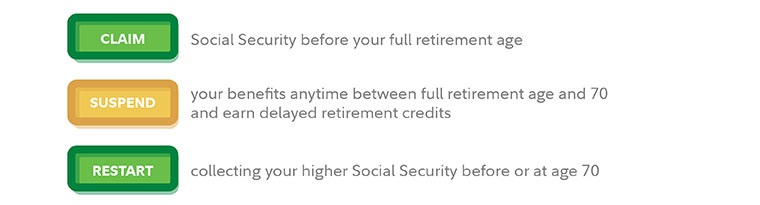

If you claimed Social Security early but then find you don't yet need the income, you may be able to “reset” your benefit. This can provide an opportunity to let monthly benefits grow further, even for those who have already started receiving benefits.

There are potentially 2 ways to do this. If you’ve changed your mind during the first year of receiving benefits, Social Security allows you to cancel or withdraw your benefits application and reapply later. You may only do this once, and you must repay everything you’ve already claimed that year.

Another way is to use a “claim, suspend, restart” strategy. Once you reach full retirement age (FRA), you can voluntarily suspend your benefit and allow it to grow again, then restart benefits at a higher level later (at age 70, or sooner if needed). Suspending benefits at or after FRA allows you to earn delayed retirement credits, which increase your benefit by 8% per year until age 70. This strategy can be especially useful if your financial situation improves—for example, if you return to work or receive an inheritance—and therefore don’t need your Social Security benefits during those years.

However, there are some caveats. If you suspend your benefit, any spousal or dependent benefits based on your record will also be suspended. Find out more about how the claim, suspend, restart strategy works.

3. Manage provisional income to help reduce taxes on benefits

Some retirees are surprised to learn that up to 85% of their Social Security benefits may be taxable. The IRS uses a “combined income formula” (also known as provisional income) to determine if you must pay taxes on your benefits. Combined income includes common types of income such as wages, interest, dividends, pension payments, and taxable distributions from traditional 401(k)s and IRAs (less adjustments), as well as nontaxable interest and half of Social Security benefits.

Reducing your income from such sources can be crucial to managing the taxes you may owe on your Social Security benefits. However, this can take planning, as some strategies may be most effective if they are put into place in the years before claiming Social Security.

One approach may be to strategically convert some amounts held in traditional 401(k)s and IRAs to Roth accounts. Roth accounts can give retirees more control and flexibility over their income in retirement, because these accounts do not have required minimum distributions (RMDs). Additionally, any withdrawals from such accounts are potentially tax-free1 and won’t impact the taxation of Social Security benefits. Again, the strategy may be most impactful if it’s considered well before claiming Social Security.

Another way to help reduce taxes may be to consider a tax-savvy withdrawal strategy, which can be helpful for retirees who hold multiple retirement savings accounts with differing tax treatments. For example, a proportional-withdrawal strategy entails taking regular withdrawals from every account—in an amount based on each account’s percentage of overall savings. This strategy could potentially reduce total taxes paid in retirement. However, there are nuances to the strategy and some retirees could benefit more from a different withdrawal strategy. Read more about tax-savvy withdrawals.

Qualified charitable distributions from IRAs can help reduce taxable income, and potentially taxes on Social Security, if you are facing RMDs but do not need the money to meet your living expenses.

Learn more about 2 ways to help reduce taxes on Social Security.

4. Coordinate spousal claims to maximize survivor benefits

For married couples, coordinating when each spouse claims can impact both total household income—and survivor benefits. The key principle is that the surviving spouse receives the higher of the 2 spouses’ benefits.

This can be a strong reason for the higher-earning spouse to delay taking Social Security until age 70. No matter which spouse passes away first, the survivor will receive that larger benefit for the rest of their life. This approach can be particularly important for couples where one spouse is expected to live significantly longer. It also takes advantage of COLAs, which are applied to the higher benefit and can compound over time, further increasing the survivor benefit.

Get more Social Security tips for couples.

5. Sequence survivor and personal benefits strategically

Widows and widowers have unique flexibility when it comes to Social Security, because survivor benefits and personal retirement benefits accumulate separately. While they can’t be claimed at the same time, they can potentially be sequenced to allow for higher lifetime income.

Another point of flexibility is that survivor benefits may be claimed as early as age 60 (or 50, if the survivor is disabled). So if, for example, your survivor benefit is lower than your own retirement benefit, you might claim the survivor benefit first and switch to your own benefit at age 70, when it has grown due to delayed retirement credits.

Conversely, if your own benefit will be lower than your survivor benefit, even if you delay, you could claim your own benefit early and switch to the survivor benefit at full retirement age (survivor benefits do not grow beyond FRA).

6. Don’t overlook options for divorced spouses

If you’re divorced, you may still qualify for spousal or survivor benefits based on your ex-spouse’s work record—even if you got divorced a long time ago. You may qualify if you and your ex were married for 10 consecutive years or longer, if both you and your ex-spouse are at least 62, and if you meet certain other criteria.

While you cannot claim both your personal benefits and spousal benefits, you can claim whichever is the higher of the 2 options. If your ex-spouse earned significantly more, your spousal benefit could be the higher option (the maximum spousal benefit is 50% of the other spouse’s full benefit). Moreover, spousal benefits max out at your full retirement age (FRA) and do not increase if you delay beyond that point. Therefore, if you are eligible for a divorced spousal benefit and it is higher than your own, there is no advantage to waiting past FRA to claim it.

Finally, ex-spouses who meet the eligibility requirements may be entitled to the same survivor benefits as widows and widowers—including the option of sequencing personal and survivor benefits strategically.

Read more about Social Security for divorced spouses.

In conclusion

Maximizing Social Security isn’t necessarily just about delaying your claim—it’s about making strategic decisions that align with your specific situation. Knowing your options, comparing them, and understanding when you can change your claiming strategy can be key to making the most of the benefits available to you.

To estimate and compare your options, try Fidelity’s Social Security benefits calculator. Or, for a more comprehensive retirement income plan, learn about how we can work together.