Married couples may have some advantages when deciding how and when to claim Social Security. Even though the basic rules apply to everyone, a couple has more options than a single person because each member of a couple1 can claim at different dates and may be eligible for spousal benefits.

Making the most of Social Security requires some strategy to take advantage of the basic benefit rules, however. After you reach age 62, for every year you postpone taking Social Security (up to age 70), you could receive up to 8% more in future monthly payments. (Once you reach age 70, increases stop, so there is no benefit to waiting past age 70.) Members of a couple have the option of claiming benefits based on their own work record or up to 50% of their spouse's benefit at full retirement age, typically referred to as a spousal benefit. For couples with big differences in earnings, claiming the spousal benefit may be better than claiming your own.

What's more, Social Security payments are reliable and should generally adjust with inflation, thanks to cost-of-living increases. Because people are living longer these days, a higher stream of inflation-protected lifetime income can be very valuable.

But to take advantage of the higher monthly benefits, you may need to accept some short-term sacrifice. In other words, you'll have less Social Security income in the first few years of retirement in order to get larger benefits later.

"As people live longer, the risk of outliving their savings in retirement is a big concern," says Ann Dowd, a CFP® and vice president at Fidelity. "Maximizing Social Security is a key part of how couples can manage that risk."

A key question for you and your spouse to discuss is how long you each expect to live. Deferring when you receive Social Security means a higher monthly benefit. But it takes time to make up for the lower payments foregone during the period between age 62 and when you ultimately chose to claim, as well as for future higher monthly benefits to compensate for the retirement savings you need to tap into to pay for daily living expenses during the delay period.

But when one spouse dies, the surviving spouse can claim the higher monthly benefit for the rest of their life. So, for a couple with at least one member who expects to live into their late 80s or 90s, deferring the higher earner's benefit may make sense. If both members of a couple have serious health issues and therefore anticipate shorter life expectancies, claiming early may make more sense.

How likely are you to live to be 85, 90, or older? The answer may surprise you. Longevity has been steadily increasing, and surveys show that many people underestimate how long they will live. According to the Society of Actuaries, a man turning 65 today will live to be 87 on average and a woman will live to be 89 on average. For a couple at age 65, at least one person, on average, will survive to age 93. Further, 1 in 4 65-year-old males today will live to 93, and 1 in 4 females will live to 95.2

Tip: To learn about trends in aging and people living longer, read Viewpoints on Fidelity.com: Longevity and retirement

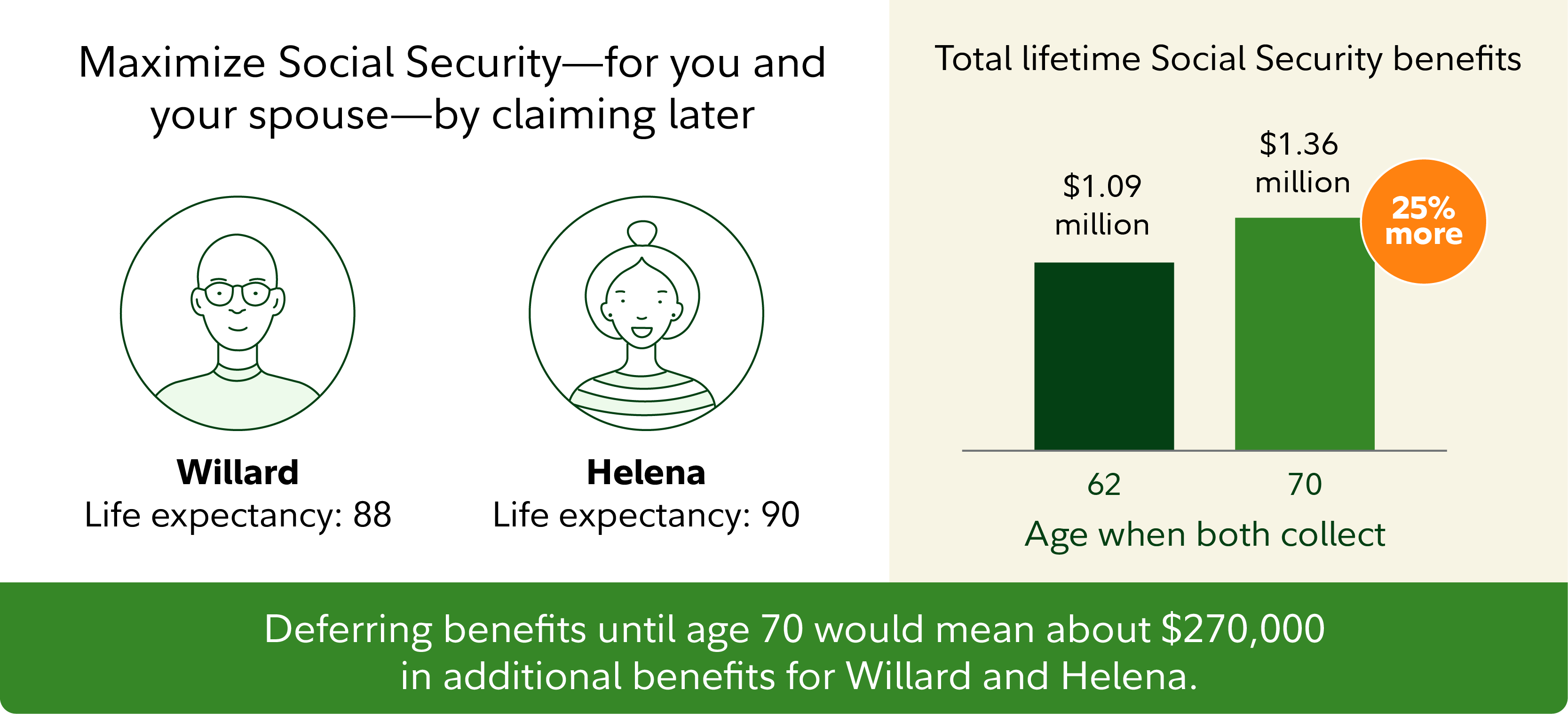

A couple with similar incomes and ages and long life expectancies may maximize lifetime benefits if both delay.

How it works: The basic principle is that the longer you defer your benefits, the larger the monthly benefits grow. Each year you delay Social Security from age 62 to 70 could increase your benefit by up to 8%.

Who it may benefit: This strategy works best for couples with normal to high life expectancies with similar earnings, who are planning to work until age 70 or have sufficient savings to provide any needed income during the deferral period.

Example: Willard's life expectancy is 88, and his income is $75,000. Helena's life expectancy is 90, and her income is $70,000. They enjoy working.

Suppose Willard and Helena both claim at age 62. As a couple, they would receive a lifetime benefit of about $1,090,000. But if they live to be ages 88 and 90, respectively, deferring to age 70 would mean about $270,000 in additional benefits.

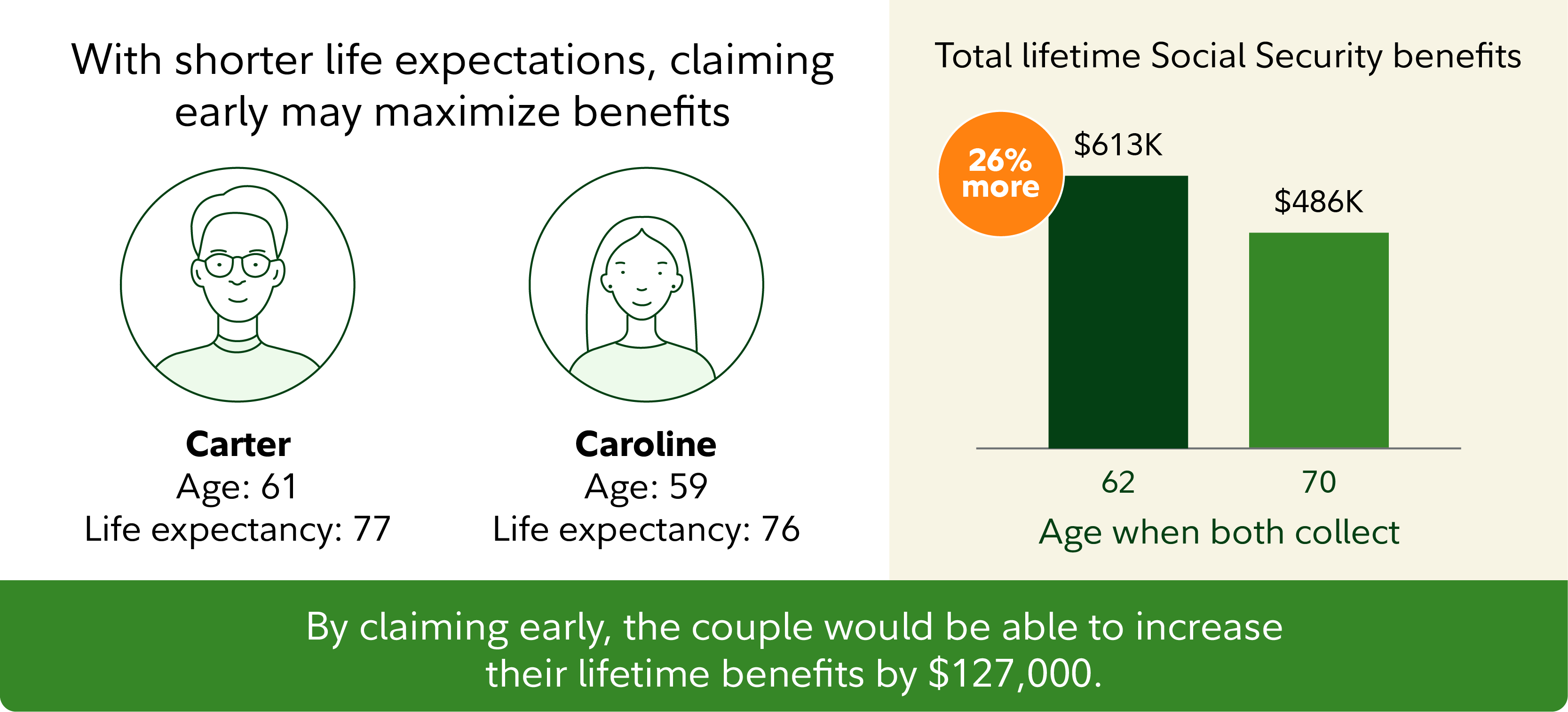

A couple with shorter life expectancies may want to claim earlier.

How it works: Benefits are available at age 62, and full retirement age (FRA) is based on your birth year.

Who it may benefit: Couples planning on a shorter retirement period may want to consider claiming earlier. Generally, one member of a couple would need to live into their late 80s for the increased benefits from deferral to offset the benefits sacrificed from age 62 to 70. While a couple at age 65 can expect one spouse to live to be 85, on average, couples who cannot afford to wait or who have reasons to plan for a shorter retirement, may want to claim early.

Example: Carter is age 61 and expects to live to 77. He earns $70,000 per year. Caroline is 59 and expects to live until age 76. She earns $80,000 a year.

By both claiming at age 62, Carter and Caroline are able to maximize their lifetime benefits. Compared with deferring until age 70, both taking benefits at age 62 would yield an additional $127,000 in benefits—an increase of over 26%.

Maximize Social Security—for you and your spouse—by claiming later.

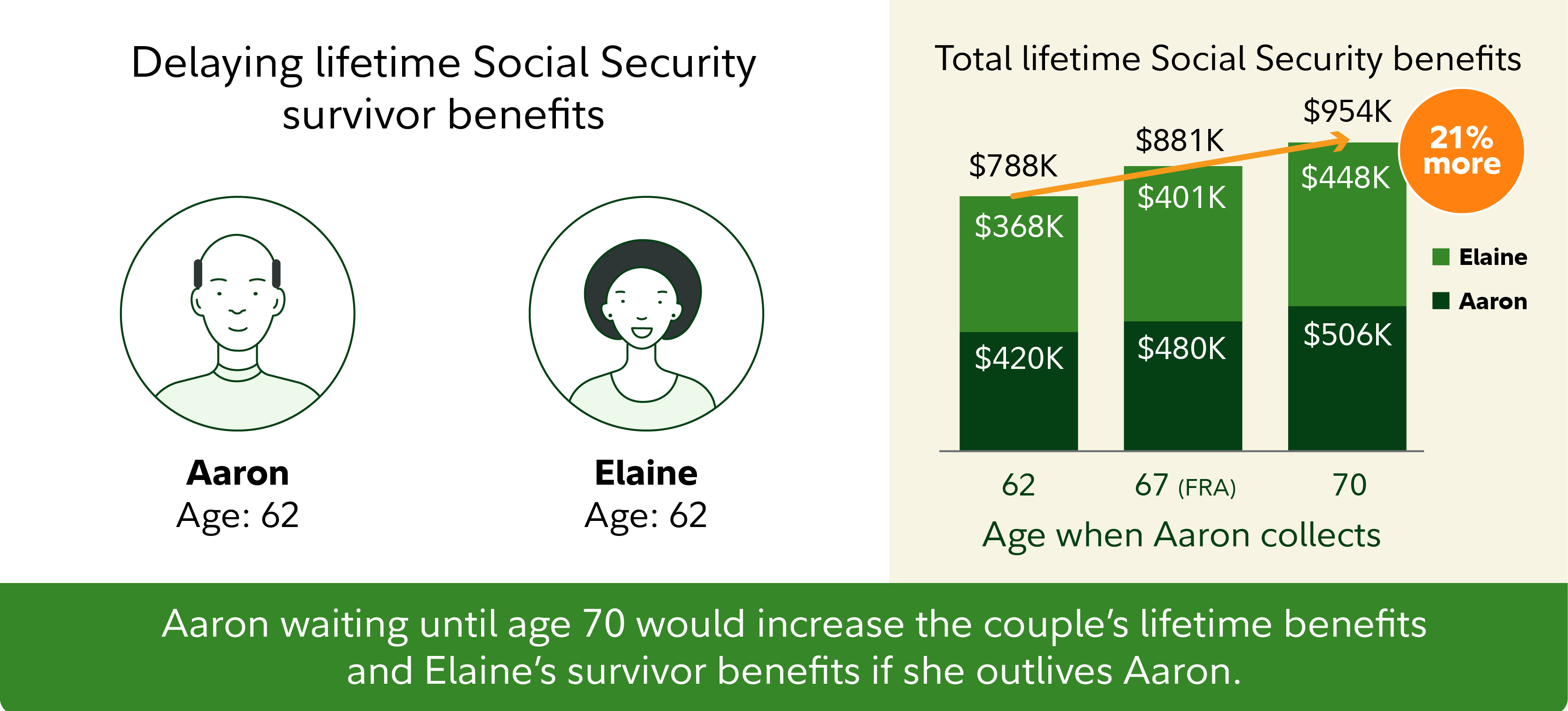

How it works: When you die, your spouse is eligible to receive your monthly Social Security payment as a survivor benefit, if it's higher than their own monthly amount. But if you start taking Social Security before your full retirement age (FRA), you are permanently limiting your partner's survivor benefits. Many people overlook this when they decide to start collecting Social Security at age 62. If you delay your claim until your full retirement age—which ranges from 66 to 67, depending on when you were born—or even longer, until you are age 70, your monthly benefit will grow and, in turn, so will your surviving spouse's benefit after your death. (Get your full retirement age)

Who it may benefit: This strategy is most useful if your monthly Social Security benefit is higher than your spouse's, and if your spouse is in good health and expects to outlive you.

Example: Consider a hypothetical couple who are both about to turn age 62. Aaron is eligible to receive $2,000 a month from Social Security when he reaches his FRA at age 67. He believes he has average longevity for a man his age, which means he could live to age 87. His wife, Elaine, will get $1,000 at her FRA of 67 and, based on her health and family history, anticipates living to an above-average age of 95. The couple was planning to claim at 62, when he would get $1,400 a month, and she would get $700 from Social Security. Because they’re claiming early, their monthly benefits are 30% lower than they would be at their FRA. Aaron also realizes taking payments at age 62 would reduce his wife’s benefits during the 9 years they expect her to outlive him.

If Aaron waits until he’s 67 to collect benefits, he’ll get $2,000 a month. If he delays his claim until age 70, his benefit—and his wife’s survivor benefit—will increase another 24%, to $2,480 a month. (Note: Social Security payout figures are in today’s dollars and before tax; the actual benefit would be adjusted for inflation and possibly subject to income tax.)

Waiting until age 70 will not only boost his own future cumulative benefits and it will have a significant effect on his wife’s benefits. In this hypothetical example, her lifetime Social Security benefits would rise by about $80,000, or about 22%, relative to Aaron claiming at age 62.

Even if it turns out that Elaine is overly optimistic and she dies at age 89, her lifetime benefits will still increase approximately 8% and she would collect approximately $20,000 more in Social Security benefits if Aaron claims at age 70 instead of age 62, assuming Elaine continues to claim at age 62.

In situations where the spouse's Social Security monthly benefit is greater than their partner's, the longer a spouse waits to claim Social Security, the higher the monthly benefit for both the spouse and the surviving spouse. For more on why it's often better to wait until at least your FRA before claiming Social Security, read Viewpoints on Fidelity.com: Should you take Social Security at 62?

In conclusion

Social Security can form the bedrock of your retirement income plan. That's because your benefits are inflation-protected and will last for the rest of your life. When making your choice, be sure to consider how long you may live, your financial capacity to defer benefits, and the impact it may have on your survivors. Consider working with your Fidelity financial advisor to explore options on how and when to claim your benefits.