Prepare for tomorrow. Even as priorities change today.

Create a free personalized plan1

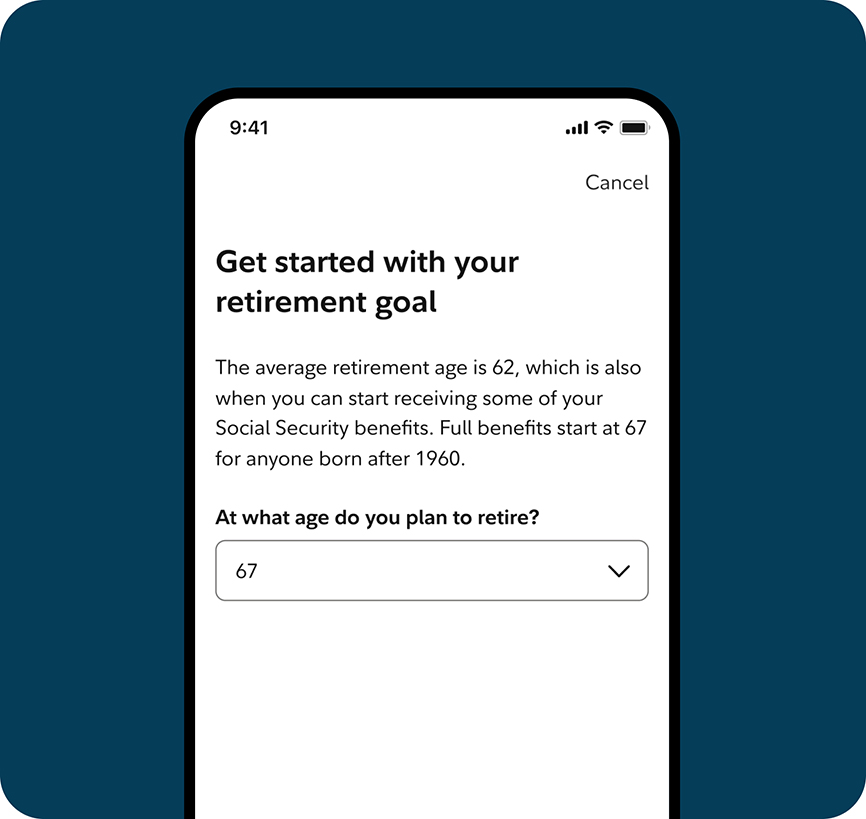

Set your goals and path to getting there—and make changes as your life evolves.

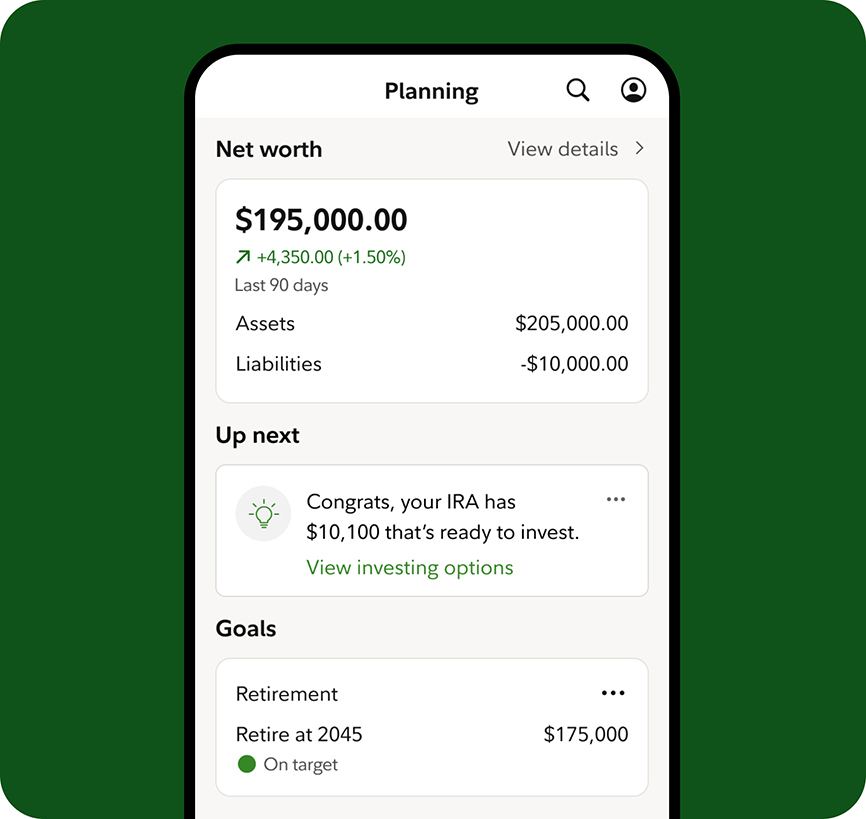

Track your progress

Know where you stand and get suggested next steps for long and short-term goals.

Get help when you need it

Connect with Fidelity’s financial pros to answer your retirement planning questions.

Get clear answers

Our financial professionals are here for you 24/7 to help answer questions as you save for retirement.

Call

Speak with our financial professionals at 1-800-343-3548

Accounts to help with your retirement savings

You have retirement goals; we've got the solutions to help you achieve them. And to open most retirement accounts, there are no account fees or minimums.2

ROTH IRA

Save tax-free with access to your contributions

Once you contribute to your Roth, potential growth within the account is tax-free. Contributions you add to your account may be withdrawn at any time, penalty-free.

TRADITIONAL IRA

Save for tomorrow and potentially reduce taxable income today

Reduce your taxable income by deducting your contributions, if eligible, and your potential earnings grow tax-deferred.3

ROLLOVER IRA

Combine your accounts and focus on growth in one place

If you are looking to move your old 401(k) and workplace accounts into one IRA, you can do so without taxes or penalties.4

Retirement savings resources

Fidelity tips for retirement savings

For investors of all experience levels, read about Fidelity strategies to help you build retirement savings.

Find out which IRA is right for you

Answer a few questions and we'll show you the accounts and amounts that are possible for you.