Rollover IRA Simplify your retirement savings

When leaving a job or retiring, take charge of your old 401(k) or workplace savings with a rollover IRA, letting you use your money today—while still building for tomorrow.

What is a rollover IRA?

A rollover IRA is a retirement account that allows you to move money from your former employer-sponsored plan to an IRA—tax and penalty-free1—while keeping your money's tax-deferred status.

Benefits of a rollover IRA

Tax savings

You won't pay taxes on potential growth until you make withdrawals—and can still make contributions to the account.

Access to your money

Withdraw penalty-free for certain life events, like a first-time home purchase, a birth, or college expenses.2

Investing options

You can generally choose from a wider range of investments than you can in an employer's retirement plan.

Compare your 4 options for an old 401(k) or workplace savings account

See how rolling over compares to your other options for your workplace savings, helping you make the right decision for your specific needs.

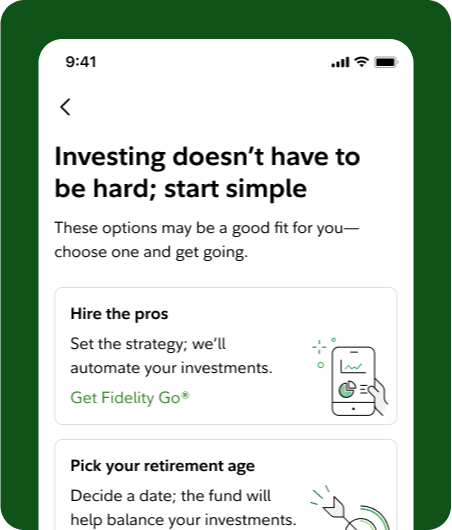

Pick the Fidelity rollover IRA that fits you best

Whether you want to be a hands-on or hands-off investor, Fidelity offers a range of IRA options to help you make the most of your rollover money.

Ready to start your rollover?

We'll guide you down the path.

Let's walk through the 3-step rollover process: opening your new IRA, contacting your old provider to move the money, and then depositing at Fidelity. All the way, we're here with support when you need it—including moving your money tax-free and penalty-free to your new Fidelity IRA.

Unlock your rollover IRA's full potential by investing

Your new rollover IRA is an opportunity to help you build for the future. To take advantage, investing is the smart next step.

We'll help you choose from Fidelity's wide range of investing options, including ones that let Fidelity do the investing for you.

Frequently asked questions

-

Can I roll over assets into my Traditional IRA?

Yes, you can but it's important to be aware that if you do roll pre-tax 401(k) funds into a traditional IRA, you may not be able to roll those funds back into an employer-sponsored retirement plan. Contact your tax advisor for more information.

-

Will I owe taxes on my rollover?

Generally, there are no tax implications if you complete a direct rollover and the assets go directly from your employer-sponsored plan into a Rollover, Traditional, or Roth IRA (as applicable) via a trustee-to-trustee transfer.

However, if you choose to convert some or all of your savings in your employer-sponsored retirement plan directly to a Roth IRA, the conversion would be subject to ordinary income tax. Contact your tax advisor for more information.

If you withdraw the assets from your former employer‑sponsored retirement plan, the check is made payable to you, and taxes are withheld, you may still be able to complete a 60-day rollover. Within 60 days of receiving the distribution check, you must deposit the money into a Rollover IRA to avoid current income taxes.

If taxes were withheld from the distribution, you would have to replace that amount if you want to roll over your entire distribution to your Fidelity IRA. If you hold the assets for more than 60 days, your distribution will be subject to current income taxes and a 10% early withdrawal penalty if you are under age 59½.

-

What tax forms will I receive for my rollover IRA?

If you rolled over your employer-sponsored plan account directly into a Fidelity IRA, you will receive Form 1099-R from the trustee of the plan showing the distribution, as well as Form 5498 in May from Fidelity showing the IRA rollover. Form 5498 summarizes your IRA contributions, rollovers, and fair market value. This form does not need to be filed with your taxes. For help with this tax form, see the IRS Instructions for Form 5498 (PDF).

-

Can I move an existing IRA from another institution to Fidelity?

Yes, visit IRA Transfers for a quick overview of the online process.

-

Can I roll my money into a Roth IRA?

Most people are eligible to convert their 401(k) to a Roth IRA; however, it is important to be aware of the potential tax implications. If you have money in a designated Roth 401(k), you can roll it directly into a Roth IRA without incurring any tax penalties. However, if the 401(k) funds are pre-tax, then converting to a Roth IRA will be a taxable event. Nevertheless, a conversion has the potential to help reduce future taxes and maximize retirement savings. There are several factors to consider when deciding if converting to a Roth IRA may be right for you. Call Fidelity for more information about converting your savings to a Roth IRA.

-

Can I roll my money into a small business retirement plan?

If you're self-employed, then yes, you may be able to roll over your 401(k) into your own small business retirement plan, such as a SEP IRA or a self-employed 401(k). Learn more about self-employed rollover options.

-

How do I know if I am eligible for a rollover?

Generally there must be a distributable event. The most common eligibility event is when an individual leaves the service of their employer. Other reasons may include attainment of age 59½, death, or disability. Please contact your plan to determine whether or not you are eligible for a distribution and, therefore, a rollover.

-

Can I add more money to my IRA later?

Yes, you can add money to your IRA with either annual contributions or you can consolidate other former employer-sponsored retirement plan or IRA assets. Some people choose to make their annual contributions to their IRA so that they only have to keep track of one account. This may be right for you if you have no desire to roll these assets back to a qualified retirement plan at a future employer. Assets can be commingled and still be eligible to roll into another employer plan in the future; however, it is at the discretion of the receiving plan to determine what type of assets can be rolled over.

-

Can I leave my former employer-sponsored retirement plan assets in my current plan indefinitely?

No, generally you must begin to take withdrawals, known as required minimum distributions (RMDs), from all your retirement accounts (excluding Roth IRAs) no later than April 1st of the year following the year in which you turn age 73. If you wait until April 1st, you will then be required to take your second distribution by the end of that year.

Check with your plan administrator to see if there are any other rules that may require the money to be taken out prior to you turning age 73. For example, many plans require that accounts smaller than $5,000 be cashed out or rolled over. Learn more about RMDs.

-

Can I leave a portion of my 401(k) in an old employer's plan and roll the remaining amount to an IRA?

Plans have different rules and requirements for 401(k) assets. Some 401(k) plans offer equal flexibility to both current and former employees while others place restrictions on withdrawal types and frequency. For example, some plans may allow partial withdrawals while others may require that you either leave all the funds in the plan or perform a full rollover or cash payout. Please check the plan's rules for more information.

-

Can I roll over my existing 401(k) assets into an IRA while I'm still working?

Generally, you cannot roll over funds from your active 401(k), but there are some exceptions. For example, some plans allow for "in service" withdrawals at age 59½. If you are under age 59½, or if your plan does not have that withdrawal provision, you may be able to withdraw (or roll over) specific types of contributions. For example, if in the past you rolled money directly from an old 401(k) into your current plan, you may be able to move that money out of your plan into an IRA.

-

Can I roll over an old 401(k) that has both pre-tax and after-tax money in it?

You can, but it is important to select the right IRA for your needs. A Traditional (or Rollover) IRA is typically used for pre-tax assets because savings will stay invested on a tax-deferred basis and you won't owe any taxes on the rollover transaction itself. However, if you roll pre-tax assets into a Roth IRA, you will owe taxes on those funds. For after-tax assets, your options are a little more varied. You can roll the funds into a Roth IRA tax-free. You also have the option of taking the funds in cash or rolling them into an IRA along with your pre-tax savings. If you choose the latter option, it is important that you keep track of the after-tax amount so that when you start taking distributions, you'll know which funds have already been taxed. IRS Form 8606 is designed to help you do just this. Before making a decision, please consult with a tax advisor about your specific situation.

-

What if I hold appreciated employer stock in my plan?

If you stay in your old workplace plan, special tax treatment may be available for your company stock (Net Unrealized Appreciation). Consult your tax advisor for more information.

Questions?

A Fidelity representative can help you understand your options and guide you through each step of the rollover process.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Screenshots are for Illustrative Purposes Only.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917