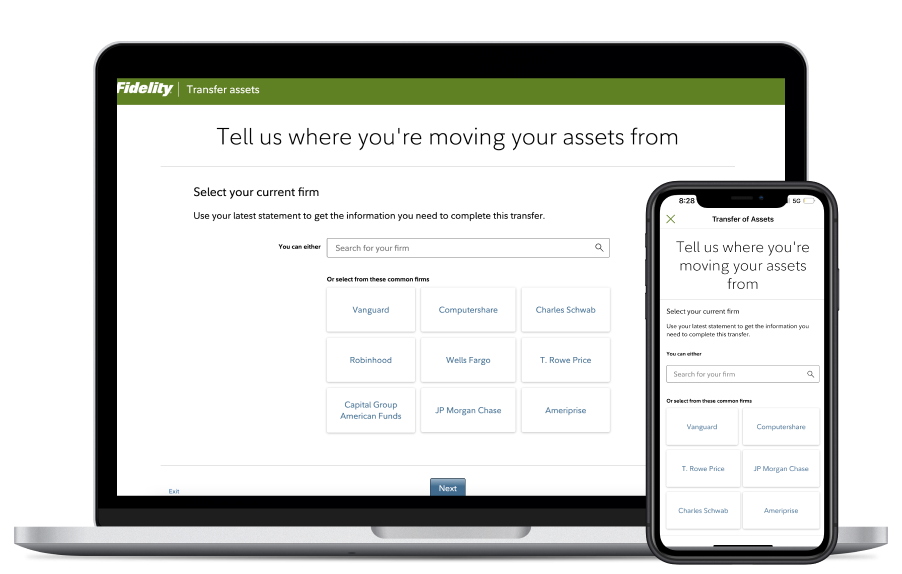

Let's get you started transferring an account to FidelityWe make it easy to transfer all or part of an account to Fidelity—including stocks, bonds, mutual funds, and other security types—without needing to sell your holdings.1 |

Images are for illustrative purposes only

A transfer of assets (TOA) is when you transfer all or part of an account from one financial firm to another without selling your holdings.

You can transfer

All or some of an investment account, including specific investments in kind

Retirement or health savings accounts, like IRAs and HSAs

Liquidated annuities, CDs, or holdings from an investment account

Before you get started

Download a digital statement from your current firm so you can refer to important account information. You may need to upload a copy of this to complete the transfer process.

How long does a TOA take?

Most transfers take 3–5 business days to complete, however some requests may take longer. See “Tracking a transfer of assets” in the FAQ section for more details.

Track a recent transferLog In Required or resume a saved transfer requestLog In Required

How a transfer of assets works

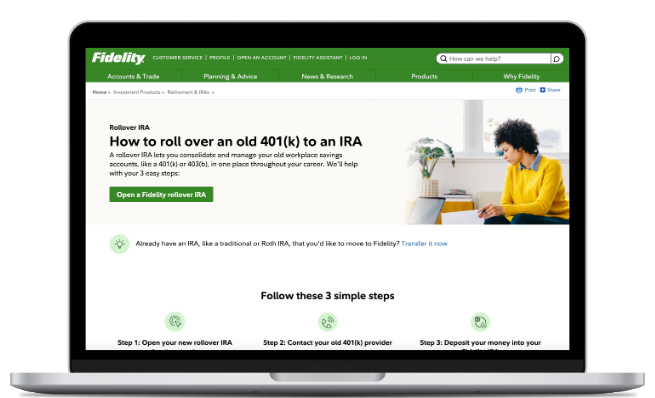

Images are for illustrative purposes only

Transferring a retirement account to Fidelity from a former employer is called a rollover. A rollover IRA allows you to move money from your former employer-sponsored plan to an IRA while keeping your money's tax-deferred status.

Consider all the options available to you before transferring your retirement assets.

Before you get started

If you don't already have a rollover IRA, you'll need to open one—this way, you can move money from your former employer's plan into this account.

How long does a rollover take?

If you have a workplace plan with Fidelity, you can do the entire rollover through your NetBenefits® account. You don’t need any additional paperwork and the money will be transferred within a few days.

Start a rollover from a Fidelity account

It takes 3-5 weeks, or longer, to complete transfers from workplace plans not held at Fidelity.

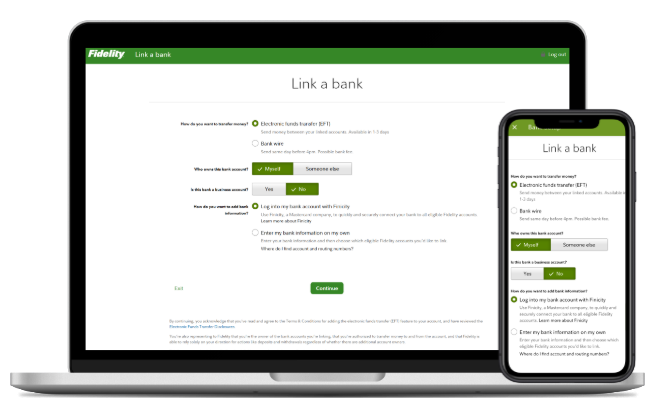

Images are for illustrative purposes only

An electronic funds transfer (EFT) is a digital transfer of money to or from a bank account.

What you need to get started

First, you'll need to link a bank account to a Fidelity account. We'll only ask for a few things:

- A simple verification of your identity.

- Your bank account's routing and account numbers. Alternatively, you can choose to log on to your bank with your username and password for for a faster connection between the accounts.

How long does an EFT take?

Typically, 3-5 business days, but funds may be available for trading sooner.