If you own a traditional IRA or have a pretax employer workplace plan like a 401k or 403b, you have until April 1st of the year after you turn 73 to take your first required minimum distribution (RMD). For workplace plans only, if you are still working past age 73 and do not own 5% or more of the business sponsoring the plan, you can delay RMDs from your plan until the year you retire. To add, December 31 is the deadline for taking subsequent RMDs from your retirement savings.

An RMD is required as part of the federal tax code for retirement accounts such as IRAs, 401(k)s, and 403(b)s. In 2023, RMD age was increased from 72 to 73, and it will increase again in 2033 to 75. If you miss the deadline for 2025, you face a penalty equaling 25% of the amount not withdrawn. The penalty will be reduced to 10% if the account owner withdraws the RMD amount previously not taken and submits a corrected tax return within two years.

"While you were working and putting money into a retirement account, that money was growing tax-deferred," says Monte Warren, an analyst for wealth management and experience at Fidelity. "The IRS doesn't let you hold onto that benefit forever. Eventually, you must start taking money out of the account, paying taxes on any pre-tax contributions and earnings."

It may seem scary to start withdrawing the money you've spent so much of your work life accumulating. Don't worry, if you're confused about basics such as when withdrawals begin, how much you need to take out, the taxes you may owe on distributions, and what you can do with the money once you've taken it out, you're not alone.

People are often confused about some of the essentials governing RMDs. In case you are an IRA holder, it is important to be proactive about the process. IRA plan custodians may send you notices about RMD deadlines, or allow you to set up automatic withdrawals for RMDs, but generally you're in charge of setting everything up.

Note: Employer workplace plans operate somewhat differently and may send RMDs in accordance with plan rules.

That said, with a little preparation, the process can go smoothly, and you'll soon be in the driver's seat. Below are answers to some of the most common questions.

When do RMDs start?

RMDs start the year you turn 73, and the RMD deadline is December 31 each year. The exception is your first RMD, which you may take by April 1 of the year following the year you turn 73.1 It's important to know that if you choose to wait until April 1 for your first RMD, it will mean taking two RMDs that year—one in April, and one by the December 31 deadline. That additional income could have tax consequences for you.

Note: You can't defer taking your RMD. There have only been two 1-year exceptions to this rule. The first was during the 2009 financial crisis, and the second was at the height of the COVID-19 pandemic in 2020. However, retirement plan account owners can delay taking their RMDs until the year in which they retire, unless they're a 5% owner of the business sponsoring the plan or the plan provides otherwise. This exception applies to workplace plans for still-working employees only, so owners of traditional, SEP, and SIMPLE IRA accounts must begin taking RMDs once the account holder reaches RMD age.

Note: The RMD rules do not apply to Roth IRAs or Roth balances (except for inherited Roth balances) in workplace plans while the owner is alive.

Do you really have to take money out?

Yes, you do for traditional IRAs, 401(k) and 403(b) plans, SIMPLE, and SEP IRAs. RMDs are not required for Roth IRAs or Roth balances (except for inherited Roth balances) in workplace plans. The tradeoff you get for letting your savings compound tax-free over the years in these tax-deferred retirement savings accounts is that you must start removing money once you retire, and then pay taxes on any pre-tax distributions and earnings.

What are the penalties for not taking an RMD?

It's important to pay attention to the December 31 deadline. The IRS penalty for not taking an RMD on time, or for taking less than the required amount, is generally hefty: 25% of the amount not taken by the deadline. If the RMD is corrected within two years, the penalty for not fulfilling RMD requirements can be reduced to 10%.

How do you calculate an RMD?

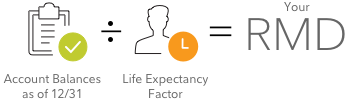

The IRS uses a formula that includes your total account balances, your age, and your life expectancy and your beneficiaries' life expectancies. It then divides your balance total by your life expectancy factor to determine the amount you must withdraw. (Your life expectancy factor is the age to which you're expected to live given your current age.) Here's something else to keep in mind: Your RMD life expectancy factor changes every year, meaning the amount you must take out will also change.

The formula for calculating an RMD is actually pretty straightforward:

For simplicity's sake, let's assume a hypothetical investor has one IRA with an account balance of $100,000 as of December 31 of the prior year. To calculate the RMD the year they turn 73, they would use a life expectancy factor of 26.5. So the RMD would be $100,000 ÷ 26.5, or $3,773.58.

Your life expectancy factor is taken from the IRS Uniform Lifetime Table (PDF) or the IRS Joint Life Expectancy Table (PDF) depending on your age and the age of the beneficiary of your account.

You can also use Fidelity's online RMD calculator to get an idea of your RMD for the year.

Do you take an RMD from each account?

If you own one IRA or 403(b), you'll take your distribution from that account or contract. However, if you have numerous IRAs or 403(b)s, you need to know what the RMD is for each one, and then add them up, to get the final number. While you can withdraw your RMDs from multiple IRA accounts or 403(b)s, you can also withdraw the total amount from just one account or contract—for example, the one with the highest balance—if you wish.

The same isn't true for qualified retirement plans, or plans sponsored by employers, such as 401(k)s or 457(b)s. You must take your RMD separately for each account. This means, if you have five different 401(k)s, you'd need to take your RMD from each, and you'd wind up with five different checks. Additionally, some 401(k) administrators may be proactive and send you money each year—others may not. Check with your plan sponsor to find out their policy.

Good to know

How do you take the money out?

This is one of the questions that confuses people most. Fortunately, you have several options.

- Withdraw cash. Once you know your RMD number, you can sell shares of stock or funds in that amount, if necessary, to generate enough cash for the withdrawal. The process may be slightly different for workplace plans, which frequently offer only mutual funds as investment options. If you enter a trade to buy or sell shares of a mutual fund, your trade will be executed at the next available net asset value, which is calculated after the market closes and typically posted by 6 p.m. ET. This price may be higher or lower than the previous day's closing. As a general rule, you might consider selling shares in proportion to your portfolio's asset allocation so you can stay on target with your investing goals. For example, if a particular fund occupies 20% of your portfolio's value, it could also be 20% of this year's RMD.

- In-kind transfers. If you don't need the money in a particular year, you can consider transferring your shares to a taxable brokerage account, in what's known as an in-kind transfer. An in-kind transfer allows you to transfer an asset in its current form from one account to another without buying or selling shares. In this case, the transfer would be from a tax-deferred account to a taxable account. An in-kind transfer lets you meet your minimum requirement and still stay invested. One downside is that taxes will still be owed, including withholding taxes at the time of the withdrawal, unless you opt out of the tax withholding. You may need to use cash or sell a different asset if funds are fully invested, or be prepared to pay the taxes with nonretirement account funds.

- Give to charity. You can also consider donating your RMD money to charity as a qualified charitable distribution (QCD). These are direct transfers, which are free of federal income tax, and would satisfy your RMD requirement for the year (up to $108,000 annually per individual in 2025), as long as the donation is made by December 31. You wouldn't get a charitable deduction, but your RMD may be met without generating taxable income. Plus, you don't need to itemize to take a QCD, meaning you can still take the standard deduction. Further, recent changes from SECURE Act 2.0 allow a one-time QCD to a charitable gift annuity (up to a lifetime limit of $54,000 per individual in 2025), combining support to a favorite charity and a predictable stream of income.

- Automatic withdrawals. You may be able to set automatic withdrawals for both individual and workplace plans. Such services may calculate RMDs for you, then distribute funds according to your instructions. You can set up automatic withdrawals for your RMD with Fidelity. To get started, visit automatic withdrawalsLog In Required and select the year for your automatic RMD withdrawals to begin.

- Purchase an income annuity. Lifetime income payments from an income annuity automatically satisfy the RMD rules for the assets used to purchase them.2 In addition, the SECURE Act 2.0 that went into effect in January 2023 added other potential benefits for income annuities purchased within an IRA. The Act allows IRA income annuity owners the choice to aggregate their income annuity with their other IRAs for the purposes of determining their required minimum distributions. For more information, read Viewpoints: Create income that can last a lifetime.

- Purchase a Qualified Longevity Annuity Contract. A different, but related strategy is a specific type of deferred income annuity known as a QLAC. This type of annuity allows you to defer your RMD start date from age 73 to up to age 85 for the assets used to purchase the QLAC. For more information, read Viewpoints QLACs: A way to secure retirement income later in life.

How might RMDs affect taxes?

RMDs are taxed as ordinary income, and withdrawals will count toward your total taxable income for the year, subject to your marginal tax rate, as well as any applicable state and local taxes. The additional income might also push you into a higher tax bracket, which could affect taxes on your Social Security benefit, as well as the cost of your Medicare premium.

Taxes on in-kind transfers are calculated based on the value of the shares you transfer at the time of the transfer. If you withdraw more than your RMD to help pay for taxes generated by in-kind transfers, you'll also owe taxes on the full RMD amount, plus the excess. This means, if you paid $5,000 for a particular stock 5 years ago, and the value of the shares you want to transfer now are worth $2,500, you'll pay taxes on the current value. The good news is the new value becomes the basis for your shares going forward. So if you're transferring shares that are worth more now than when you originally bought them, your basis will be increased to the market value at the time of the transfer.

Keep in mind, you can elect to have taxes withheld at the same time you take your RMD. (There is a federal minimum of 10%, but you can elect a higher amount.) Consult your tax advisor to determine what makes sense for your situation.

You should consult a financial professional or tax advisor to help you figure out the amount you need to take each year.

What can you do with the money?

Here's more good news: If you've taken cash out for the year, it's yours to spend or save however you like. You can use it to pay for essential living expenses, or something nonessential (but good for your well-being), like a vacation. You can also reinvest the money in a taxable brokerage account.

Knowledge is power, and now that you have answers to some of the key questions regarding RMDs, you can use your knowledge to build a retirement income plan that works for you. As the end of the year approaches, consider spending time with a tax professional to review all your RMD options. It will help you stay on track to meet your retirement goals, and can hopefully help you avoid any costly tax mistakes in the future.