Here's some good news: Your Social Security payment is about to go up next year. Here's the bad news: Your tax bill may rise along with it.

The annual increase to the Social Security payments, called the cost-of-living adjustment, or COLA, is typically announced in October. This year's Social Security COLA increase of 2.8% is more modest than increases during years of higher inflation, but it could help ease the pain of continuing inflation for many retirees struggling with rising costs.

The COLA can be a helpful boost to your retirement income when inflation is running high. But the increase may also call for some additional tax planning. Here's why, plus some tips on how to manage the potential consequences of this upcoming raise.

Higher expenses, higher income, higher taxes

Even on its own, the extra COLA money could bump some people into a higher tax bracket. But after several years of rapidly rising prices, many retirees may not be able to fully cover higher expenses with the COLA alone, and may also need to increase their withdrawals from retirement accounts. Depending on which accounts they draw from, these extra withdrawals could further increase their combined income, known as "provisional income," which is the income measure that determines taxation of Social Security benefits.

"The more money you withdraw, the higher your combined income will be, and the bigger portion of your Social Security benefit will be taxed as ordinary income," says Brad Koval, director of financial solutions at Fidelity.

If you're facing these circumstances, don't fret. There are ways to plan for the tax increase and to help keep more of your retirement income next year.

How might the COLA affect your taxes?

It might first be helpful to understand more about the COLA, and how different sources of income, including your Social Security, are taxed in retirement.

The COLA, which was introduced during the high-inflation decade of the 1970s, is usually approved in December and goes into effect in January of the next year. The 2023 increase of 8.7%, one of the highest in decades, was approved when inflation was much higher than it has been this year. The Consumer Price Index for all Urban Wage Earners and Clerical Workers, or CPI-W, the inflation gauge used to determine each year's COLA, has increased by 2.9% during the 12 months through September 2025.

An individual's Social Security income is taxed based on a combined income formula.

That includes typical forms of income such as wages, interest, dividends, pension payments, and taxable distributions from traditional 401(k)s and IRAs (less adjustments), as well as nontaxable interest and half of Social Security benefits. If your combined income is above $34,000 for a single person or $44,000 for a couple, up to 85% of your benefit could be taxed.

Read Viewpoints on Fidelity.com: Taxes on Social Security: 2 ways to save

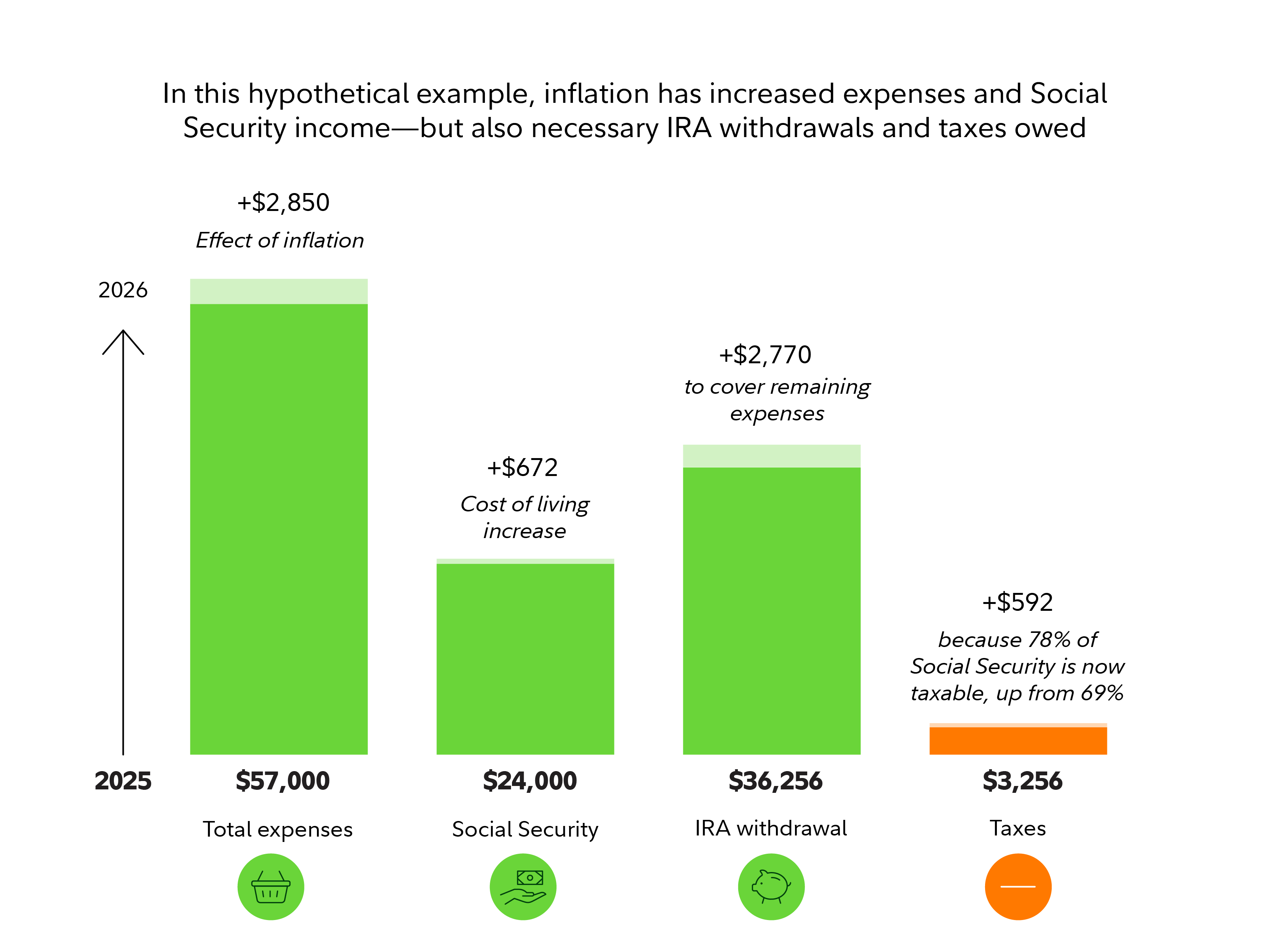

For example, assume that in 2025 a retiree has $57,000 in expenses. To cover them, they withdraw $36,256 from a traditional IRA while receiving $24,000 in Social Security benefits, paying $3,256 in taxes. Under the formula, 69% of their Social Security benefits are taxed.

In 2026, due to inflation, let's assume the person's expenses increase by 5% and they receive $672 more in Social Security for the year from the COLA. They would need to withdraw $39,026 from their IRA to meet after-tax spending needs, causing the taxable portion of their Social Security benefit to jump to 78%, and the amount paid in taxes would increase by about $592.1

Important to know

Strategies to help manage the tax impact

While $592 is not a huge amount, no one wants to pay more than they must. Here are some strategies you and your tax professional may want to consider that might help lower your provisional income for the year:

- Consider distributions from a brokerage account where gains figure into provisional income, but basis does not.

- Try to manage taxable traditional 401(k) or IRA withdrawals, as these are taxed as ordinary income. Be sure to still withdraw enough to meet any required minimum distributions.

-

Read more about strategic RMD withdrawals in Viewpoints: RMD strategies for down markets.

- If you or your spouse is 65 or older, there’s a new senior deduction worth $6,000 ($12,000 for joint filers). It’s good for tax years 2025 through 2028, and you don’t need to itemize to qualify for it. However, the deduction begins to phase out for single filers if modified adjusted gross income (MAGI) is $75,000 or more and $150,000 or more for married joint filers. Good to know: The new senior deduction is in addition to the existing deduction normally available to people who are 65 and older, equal to $2,000 for single filers and $3,200 for married filers if both are 65 or older. This deduction does not have a phaseout for income levels.

- Consider qualified withdrawals from a Roth IRA, a Roth 401(k), or a health savings account (HSA), which would not be subject to federal income tax and wouldn't have an impact on how your Social Security benefit is taxed.2

Figuring out withdrawals from retirement and brokerage accounts can be complicated, so it may help to work with a financial professional. Withdrawals from all 3 types of accounts in the same year can help with the management of combined taxable income.

Should you start collecting your Social Security benefit now?

It can be tempting to start collecting your Social Security benefit as soon as you're eligible. And considering the relatively large COLA increases in recent years, some people may also wonder whether claiming sooner makes more financial sense. The simple answer is probably not. Even with the high COLA, waiting until your full retirement age (FRA) of 67 may be a more cost-effective strategy. And for every year you delay claiming Social Security past your FRA up to age 70, you get an 8% increase in your benefit.

Recent high inflation is a good reminder that having a portion of retirement income in an inflation-protected, lifetime source such as Social Security is valuable. Delaying Social Security can be an effective way to increase your lifetime benefit.

Keep a long-term planning perspective

The COLA for 2026 can help you keep up with higher costs. And in the short run, managing your withdrawals may help you smooth out the tax bumps during a period of high inflation. Long term, however, your tax planning should be multi-year and more strategic. "You want to take a long view and manage your taxes holistically, not just for this year," Koval says.

Whether you're planning for the next year or the next decade, managing taxes throughout retirement can be complicated. Be sure to work with a tax professional to help you understand the potential tax impacts of any planning decisions.