Reaching retirement age can be a financial milestone following years of hard work, but what happens if you retire when markets are volatile? For anyone who’s been saving their whole working life, age 73 is the time you must start withdrawing tax-deferred money from your retirement accounts as your first required minimum distribution (RMD) is due. Taking these withdrawals when markets are down can have a lasting negative impact on your portfolio.

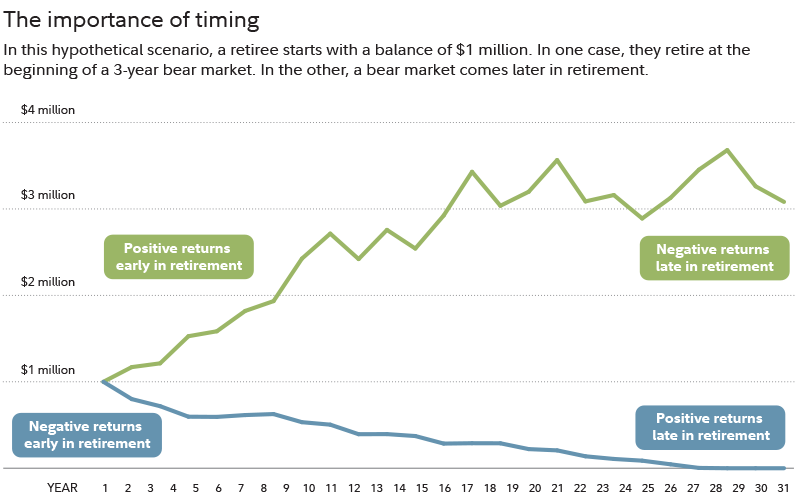

It’s a phenomenon called sequence of return risk, which refers to a timing risk where people who take retirement account withdrawals when markets fall can wind up with substantially less money than people who retire when markets are higher, even though both people may be withdrawing the same amount of money over time.

While a challenging economy and markets might be a cause for concern, a solid financial plan for your RMDs can help you feel more confident. Here are 7 tactics to help minimize the impact of down markets during your RMD years.

1. Consider delaying your first RMD. Generally, you must take your RMD by December 31 each year, and this rule applies to traditional IRAs, workplace 401(k) accounts, and 403(b) accounts, among other retirement accounts.

The amount of your RMD is determined by using one of several Internal Revenue Service (IRS) tables, including the IRS uniform lifetime table, single life expectancy, and joint life and last survivor expectancy tables. The tables provide life expectancy factors that can be used, along with your retirement account balance from December 31 of the prior year, to determine your RMD. And while Fidelity doesn’t recommend either delaying your first RMD or attempting to time the market, if it’s your first RMD year, you can delay your withdrawal until April 1 of the following year, potentially giving markets more time to recover. “Bear in mind, however, that markets can continue to decline,” says Brad Koval, a director of financial solutions for Fidelity. Additionally, by delaying your RMD you would need to take your second RMD the same year and no later than December 31, which could increase your taxable income and possibly put you in a higher tax bracket, Koval adds.

To learn more about RMDs, read Viewpoints: Making sense of RMDs.

2. Consider “dollar-cost averaging” your RMD. Rather than withdrawing the entire amount of your RMD from your retirement account at once, consider taking out smaller amounts each month that will add up to the total RMD by the end of the year. That can help smooth out any market volatility your portfolio might experience and it can also help diminish the risk of market timing.

Dollar-cost averaging is a strategy where you invest your money in equal amounts, at regular intervals regardless of which direction the market or a particular investment is going. Over time, this can help you buy more shares when the price is relatively lower and buy fewer shares when the price is relatively higher. The same can be true, but in reverse, when taking money out of the market. It could help you potentially sell more shares when prices are higher and fewer when prices are lower.

As with dollar-cost averaging when you invest, dollar-cost averaging when you sell shares is not a strategy for deciding what to sell—rather, it can help you take the stress out of deciding when to sell. Using it as part of a comprehensive financial plan that includes a diversified mix of stocks and bonds can help you stay on track toward your long-term financial goals, regardless of what's happening in the market. Keep in mind however that dollar-cost averaging does not ensure a profit or protect against loss.

If you’re already a Fidelity retirement account customer we can help you with RMD calculations and scheduling or setting up periodic withdrawals.

3. Consider your retirement accounts in aggregate. If you have multiple traditional IRAs, you can take your RMD from any one or a combination of accounts. If market fluctuations have affected their values differently, you could consider taking your RMD from the account that’s down the least, although it’s important to consider your target asset allocation and make sure your withdrawal doesn’t interfere with your long-term diversification goals.

This method would not apply to 401(k) workplace savings plans, which don’t allow you to aggregate RMDs and require you to take separate RMDs. Additionally, this alternative distribution approach may not be available for inherited IRAs. It’s best to check with a financial or tax professional to understand the rules.

4. Don’t take more than you need to. If you normally withdraw more than your RMD each year from retirement accounts, consider taking the excess from a savings account or a taxable account, such as a brokerage account, so that your retirement accounts can have more time to recover.

Remember, in taxable accounts capital losses may generally be used to offset only capital gains and, in the case of individuals, small amounts of ordinary income. Up to $3,000 can be deducted in net losses each year and the rest can be carried forward to future years.

If you're already working with Fidelity and have a taxable account with net realized capital gains and unrealized losses, you can try our Tax-Loss Harvesting Tool for step-by-step guidance to see if you can save on taxes while staying invested.

5. Reinvest your RMD. If you don’t need the RMD for expenses, you can reinvest the proceeds in a brokerage account. You will lose the tax-deferral benefits of investments in a workplace plan or IRA, but you will remain in the market, which could be beneficial if your goal is to grow your assets. You can also consider a direct in-kind transfer, where you move assets like securities directly from an IRA to a nonretirement brokerage account without selling them. While you may still owe income taxes on the distribution, you’d be able to avoid the transaction costs associated with purchasing the security again.

6. Consider income from a qualified annuity for RMDs. The SECURE 2.0 Act allows individuals who purchase a qualified income annuity with all or a portion of their retirement account assets to then use excess cash flow from the annuity to satisfy RMD requirements for the qualified purchasing account as well as for the annuity. (The annuity would have a separate RMD requirement.) That means more money can potentially stay invested and grow in your investment portfolio. What’s more, the rule change applies to an annuity you may have purchased today or years ago.

Find out more about this annuity strategy in Viewpoints: A little-known way to satisfy RMDs.

7. Consider a Roth conversion. Roth accounts also have no RMD requirements for the original owner of the account.

If you’re several years away from your first RMD, you could think about converting part of your pre-tax deductible retirement assets to a Roth IRA. You'll pay taxes on the converted amount, but you won't owe any taxes on qualified withdrawals in retirement. Once your money is in the Roth IRA it has the potential to grow tax-free.

Recent stock market volatility means you may be able to reduce your tax bill on converted, pre-tax amounts when stock prices are lower. Since you’d be converting when the value of your pre-tax account is lower, if and when the stock market recovers, both the principal and gains of the account could be withdrawn tax-free, assuming all condition are met, including the 5-year aging rule.2

Regardless of how markets are moving, it’s important to come up with a plan that will help you make the best use of RMDs while meeting your financial goals. Consider consulting a financial and tax professional who can help you understand your RMD options.