When it comes to philanthropy, longtime Natick, MA resident Carol O'Neil "walks the talk." As a homemaker and mother of 4, Carol spent most of her life raising a family and volunteering her time at the local schools and teaching religion at her church. When Carol reached her late 40s, she found herself at a challenging time: approaching midlife, soon to be an empty nester, with a need to reinvent herself, and she "just wasn't feeling super healthy."

Then a friend told her about yoga, and a lot changed. "I went into the class feeling stressed and came out feeling so calm, so at peace, so relaxed," she says. "Yoga made me feel good, more vibrant, stronger, and clear-headed."

After a weekend in 2004 with her sister at the Kripalu Center for Yoga & Health in Stockbridge, MA, a passion was born. Carol is now a 500-hour trained yoga teacher, and yoga informs her strategies for philanthropy.

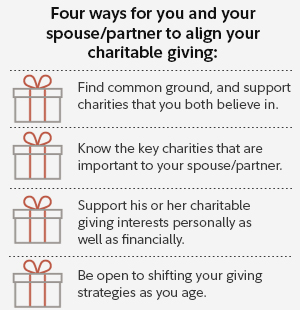

Supporting each other's passions

While Carol and Jack O'Neil share one Giving Account®, they each have charitable causes to which they are particularly devoted. "My husband and I most often share the same interests, but if one of us feels more strongly than the other about supporting a particular mission or initiative, we take the time to discuss all the reasons why, weigh any pros and cons, share concerns, and maintain an open mind once we have made a decision together," says Carol. "The balance comes from respectful listening, discussing desired goals, endorsing each other's preferred charities, and witnessing the genuine passion that we each have for a particular cause. Simply stated, we decide by agreement."

"I am a Kripalu yoga teacher and I know about the ability and power of yoga to enhance one's health and well-being," says Carol. "I want to make it accessible to more and more people, and I'm blessed to have the resources to try to make that happen. That's my passion."

The O'Neils also have common causes, including hospitals, colleges, social services, and charities that help children. They've done everything from supporting an emergency room in an urgent care facility and helping to fund scholarships for inner city students to supporting the work of a yoga research scientist and endowing a college teaching position. The majority of their charitable causes are in Boston and in their local community.

Seeing their philanthropy have a direct impact on an organization has encouraged the O'Neils to increase the amount they donate to Fidelity Charitable®. Adds Carol, "One of the best ways to validate the impact of a contribution is by working closely within the organization and in our case, serving on the board or development committee. This activity has created a personal connection or even a 'calling' to one or more of those causes that ignites our interest and energy. While we may not each have the same level of intensity supporting a specific charity, we both feel supported and encouraged by one another, expanding the diversity of our giving decisions."

Gaining alignment on how to give

Three or 4 times a year, the O'Neils think about which organizations to support and the level of support for each. Then, once a year (usually at the end of the year), they have a fireside chat and plan the grants they will recommend from their Giving Account®.

Early on, Carol and Jack talked about the missions and endeavors they were each aligned with, and then they made donations at a modest level. Says Carol: "For many years, our giving strategy focused on giving to several well-known educational, health, and social services nonprofits. Over the last 5 years or so, we've shifted our strategy to focusing on ones where we believe our philanthropy can make a specific, intentional, and significant impact. This approach allows us to become more involved with and provide more support to a smaller number of nonprofits whose mission resonates profoundly with one of us. With these groups, we volunteer our time and individual talents as well."

"It is also very meaningful to us to assist in facilitating an organization's growth and potential through capital campaigns, innovative research projects, and other initiatives, thus serving future generations for a long-term impact," says Carol. "However, we still care about short-term results and we will continue with traditional giving, making sure current mission-driven needs are also met."

The O'Neils decide if they want to donate appreciated assets from their brokerage account and if so, which ones. As a next step, they then make a grant recommendation via Fidelity Charitable® to a nonprofit charitable organization. Knowing that every dollar counts, they consider carefully where the grants could have the greatest effect, and recommend grants to those organizations.

Read Viewpoints on Fidelity.com: Strategic giving: Think beyond cash

A family foundation for giving

Carol and her husband Jack, a commercial real estate developer, established a Fidelity Charitable® Giving Account® in 2010, and their charitable contributions have been growing over the years. They use the Giving Account to make annual grant recommendations to the charities of their choice. They both feel that Fidelity Charitable provides a seamless, efficient, and supportive way to do that.

Carol and Jack share a pedigree for giving, having come from altruistic families who raised their children to appreciate the importance of helping those in need. The O'Neils have started involving their children in charitable giving and plan to involve their grandchildren, too.

The O'Neils' children are all grown adults. The eldest is already engaged in philanthropy, and the others are prepared to follow suit. "We've started a conversation with them about how they may get involved," says Carol. "Once they turn 30, we ask them to think about a nonprofit charitable organization with which they would like to align themselves. We then have them present to us their ideas on how we can best support these organizations together, as a way for the family to continue our legacy of giving."

Funding what you love

For the O'Neils, charitable giving is about far more than taking a tax deduction: It's about funding what you love.

Carol loves Mother Teresa's quote: "We are not called to do great things. But we can do small things with great love." Carol urges people to get a little more interested and involved in charitable causes in their own communities. "Sometimes the universe presents you with a path to your philanthropic efforts, but you can also go out on your own and see where there's a need," says Carol. Her mantra is simple: "Contribute to what has meaning to you; contribute to what you love."

In addition to working with Fidelity Charitable® to establish and use a Giving Account®, you can also contact Fidelity Philanthropic Consulting, a separate and dedicated team at Fidelity, that can help you build a personalized giving strategy, assess nonprofit organizations, and evaluate what kind of impact you’re making through your charitable work.