For many people who have gap years between when they actually retired and when they had planned to retire, it can become a hurried situation to find affordable, quality health care coverage until they are eligible for Medicare at age 65. Even after Medicare eligibility kicks in, there are still additional costs to cover.

4 key health care options between early retirement and Medicare

With more and more employers dropping their pre-65 retiree medical plans, the questions of where and how to get the right coverage did not disappear with the Affordable Care Act, and may still create indecision and uncertainty in someone who is otherwise ready to retire.

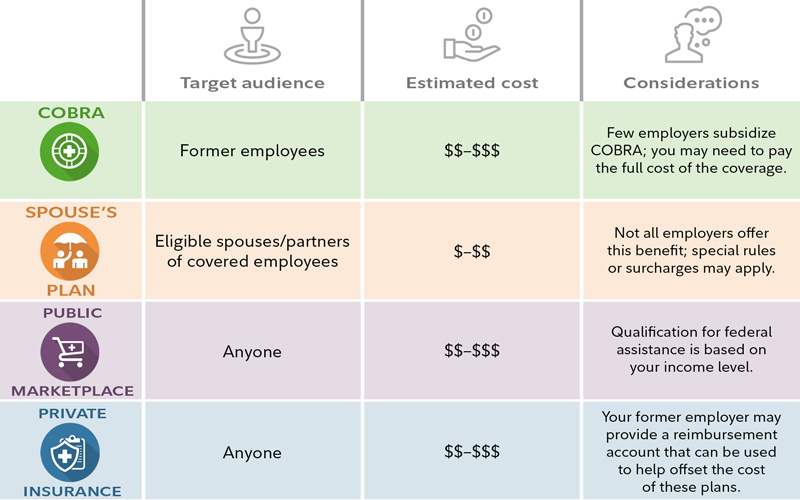

Retiring before 65? Explore health insurance options and estimate potential costs before you’re Medicare-eligible.If you are retiring before age 65 and don't have access to retiree health care coverage from your employer, here are some main ways to obtain health care coverage to bridge the period between retirement and Medicare:

- COBRA coverage. The Consolidated Omnibus Budget Reconciliation Act of 1985, or COBRA, allows you to continue your current health care coverage for a certain amount of time, but you may be required to pay the full cost of your health coverage plus an additional 2% charge. While you are working, your employer will typically cover a significant portion of the cost of your coverage, reducing the cost for active employees, but that is rarely the case for those who continue coverage through COBRA.

- Spouse's plan. If your spouse or domestic partner is employed and has health coverage, you may be able to get covered on their employer's plan—and this may be your best and most cost-effective option. If your spouse or partner is already retired and has retiree medical coverage, you may be able to be added to that coverage as well. Note: Domestic partner health care eligibility may be determined by the state, insurance company, and/or employer.

- Public marketplace. The marketplace was established by the Affordable Care Act and provides plan options available to anyone who is not yet eligible for Medicare. You can no longer be denied coverage for any reason, including a pre-existing condition. Costs for these plans can vary widely, but some people qualify for government-provided subsidies through premium tax credits that can make the coverage more affordable. Under the Inflation Reduction Act of 2022, premium tax credit/subsidies were extended until 2025. As of 2026, the 400% federal poverty level (FPL) income cap will be reinstated, and the contribution percentage will begin to be indexed again.1

- Private insurance. To obtain coverage, you can also look to your local health insurance agent, trade or professional associations, and other "private exchanges" that offer plans from multiple carriers. You may have more plan options available to you through these outlets than the public marketplace, but government-funded premium tax credits cannot be applied to these plans. These plans can be found through insurance companies, agents, brokers, and online health insurance sellers.

The public marketplace is usually a good outlet for pre-65 retirees who do not have access to an employer-sponsored retiree medical plan. These plans, which are sometimes referred to as 'on-exchange' plans, have stabilized since first introduced, but there are other private or 'off-exchange' plans available in every state (except Washington, DC) that provide even more choice and can offer coverage regardless of your health status.

Getting ready for Medicare

Once you've figured out how to bridge the gap to Medicare, you'll need to explore Medicare itself as you approach 65, the age when most people become eligible. If you're like most people, you may be confused about how and when to transition from your interim coverage to Medicare—and when you need to do it. Medicare coverage is provided to each eligible individual who enrolls. You cannot cover your spouse under your Medicare coverage; they will have to enroll on their own when eligible. Here are answers to common questions:

- I'm eligible to claim my Social Security benefit as early as age 62. Will Medicare kick in at the same time? The answer is generally no. The age to qualify for Medicare is 65, with a few exceptions, for example, certain younger people with medical conditions or disabilities.

- Will Medicare contact me directly prior to my becoming eligible? If you are already receiving Social Security benefits or railroad retirement benefits, Medicare will mail you a Medicare enrollment kit a few months before you become eligible. If you are within 3 months of turning age 65, reside in the United States (or one of its territories or commonwealths), and don't want to apply for monthly Social Security retirement benefits, but still want to apply for Medicare benefits, you can enroll in Medicare online.

- Are there deadlines for Medicare sign-up? Yes. Retirees who are already receiving Social Security benefits are automatically enrolled in Medicare Parts A and B, and coverage generally begins the month they turn 65. Generally, retirees who haven't claimed Social Security will need to first sign up for Medicare Part A hospital insurance and Medicare Part B medical insurance. The Initial Enrollment Period (IEP) lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65. If you enroll in Part A and/or Part B during the first 3 months of your IEP, your coverage will begin on the first day of the month you turn 65. If your birthday is the first day of the month, your 7-month period starts 4 months before your 65th birthday and ends 2 months after your 65th birthday. The date your coverage starts depends on which month you sign up during you IEP.2

If you enroll during your birth month or the following 3 months in your initial enrollment period, your coverage will become effective the first day of the next month. If you were born on the first of the month, everything will occur one month earlier. For example, if you were born on September 1, your IEP would begin on May 1. If you enrolled in the first 3 months of your IEP, your coverage would begin on August 1, and your IEP would end on November 30. Regardless of how you get Parts A and B, you must sign up for Part D if you want prescription drug coverage. (Read the section about Medicare Part D for important information about penalties.) If you prefer, sign up for a Medicare Advantage Plan (Medicare Part C), which replaces parts A, B, and often D. Medicare Advantage Plans, a private-sector alternative to original Medicare, has the same initial enrollment period, as does Part D for prescription drug coverage. For more information on avoiding late enrollment penalties, visit Medicare.gov.

If you don't enroll in Medicare during the initial enrollment period around your 65th birthday, you can sign up between January 1 and March 31 each year thereafter for coverage that will begin on the first day of the month after you sign up. However, you could be charged a late-enrollment penalty when your benefit starts. For example, if a penalty applies, monthly Part B premiums increase by 10% for each 12-month period you delay signing up for Medicare after becoming eligible for benefits, and this penalty will remain for as long as you receive Medicare coverage.

- How do I sign up for Medicare if I am still working at age 65? If you retire after age 65 and have employer-sponsored health coverage, you will have an 8-month special enrollment period to sign up for Part A and/or Part B, which starts the month after your employment ends or the group health plan insurance based on current employment ends, whichever happens first. Usually, you don't pay a late-enrollment penalty if you sign up during a special enrollment period.

- Can I make changes every year? Yes. The Medicare annual enrollment period runs from October 15 through December 7 annually. During this period, depending on your situation, you may be able to to re-evaluate your situation every year and make any changes.

- If I retire outside the United States, can I bring my Medicare coverage with me? In most cases, no. The US government generally precludes Medicare from paying for medical services for retirees outside the country and its territories. However, you may be able to purchase affordable health insurance in some countries or tap into their private health care systems. But, some insurance companies operating outside of the United States and its territories may limit your participation or acceptance based on your age.

Remember to also sign up for Medicare Part D

Medicare Part D, the Medicare Prescription Drug Plan offers prescription drug coverage and may be included as part of a Medicare Advantage plan. There are lots of options to compare. When you first enroll in Medicare, it's important to plan for your future needs. Take the time to look into Medicare Part D prescription drug coverage.

Keep these additional things in mind when enrolling in Medicare Part D:

- If you don't enroll in Medicare prescription drug coverage when first eligible, you may be faced with a late-enrollment penalty, which applies for the rest of your life. If you waited 63 days or more since you were first eligible for Part D coverage and did not have "creditable coverage" (such as employer-sponsored coverage with prescription drug coverage, you will be subject to permanent financial penalties of an additional 1% per month that you go without coverage. This penalty is added to the premium for the plan you enroll in. Tip: Don't delay signing up for Medicare Part D if you don't have other prescription drug coverage.

- For stand-alone Part D prescription drug plans, the maximum deductible is $615 in 2026. A deductible is the amount you pay toward your costs before the insurance plan starts to contribute. After reaching your deductible, you'll pay your plan's copays and coinsurance for your covered drugs, based on the tiers within your plan's covered drug list (also known as their formulary) Beginning January 2026, the annual maximum out-of-pocket threshold for all Part D plans will be $2,100. Part D beneficiaries will not be responsible for any cost sharing for drugs covered by Part D above this amount. You can learn more about the different phases of prescription drug costs on the Medicare website. Tip: To consider scheduling a Medication Therapy Management consultation with your local pharmacist to explore combinations of prescriptions that may help you maintain your health, at a lower cost. Then, go back and discuss the pharmacist's recommendations with your doctor. All Medicare prescription drug plans (Part D) cover this consultation.

In addition to needing a strategy to generate retirement income and claim Social Security, you may need to develop a strategy to help you bridge the gap until you are eligible for Medicare coverage at age 65. Once you are eligible to enroll in Medicare, be sure to get the health care part of the equation right.

The Medicare system is different in many ways from employer-sponsored health coverage, so take time to understand the basics. You and your spouse, or domestic partner may have different needs and may be better off choosing different Medicare plans, so compare prices. Remember, as long as you remain enrolled in the Medicare system, depending on your coverage, you may be able to reevaluate and make changes each year as your situation and health care needs change.