Figuring out when and how to take Social Security can be a complicated decision, even if you're single. Here are some strategies to consider to help make the most of your Social Security benefits if you're widowed, divorced, or have never married.

First, some basics

You can start taking Social Security, receiving reduced benefits, when you reach age 62, rather than waiting until your full retirement age (FRA). FRA ranges from 65 to 67, depending on when you were born. (See your full retirement age.) If you take benefits before you reach FRA, Social Security will reduce your monthly payments. If you delay collecting until you reach FRA, the amount of your monthly benefit will increase until you reach age 70.

Generally, the longer you delay taking Social Security until age 70, the higher your monthly benefits may be, and the gains from waiting can be significant.

Of course, if you wait to collect, you may not live long enough to enjoy the added value of increased monthly payments. Because none of us knows when we will die, you need to make some reasonable assumptions about your life span, based on your health and family history.

If you're single

Some people want to retire as soon as they can, for health reasons. But if you don't need to retire right away, consider what you may be giving up if you take Social Security at age 62.

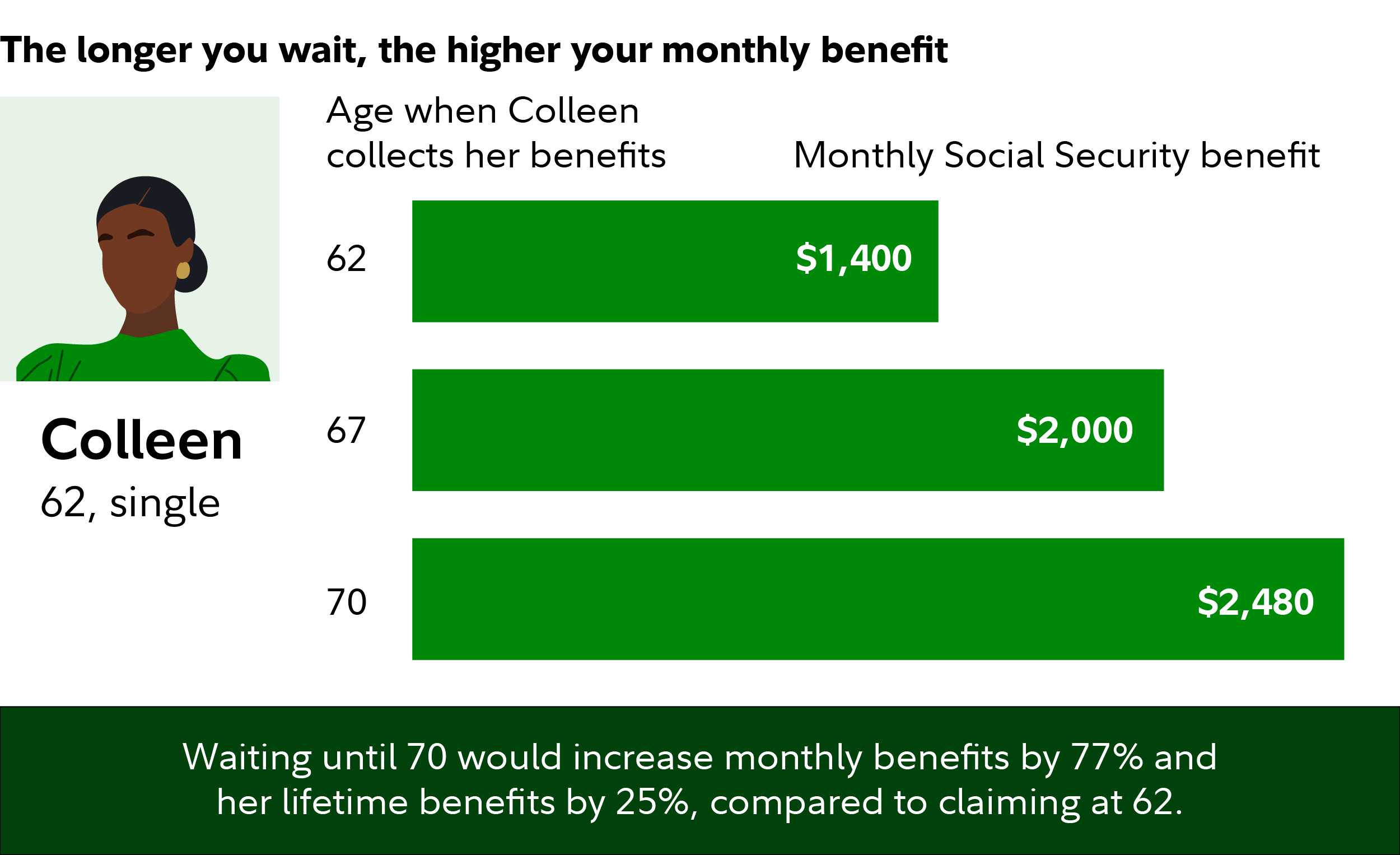

Consider the following hypothetical example. Colleen's FRA is 67. If she starts taking benefits at age 62, she will get $1,400 a month. If she waits until her FRA to collect, she will receive 43% more, or $2,000 a month. If she waits until age 70, her benefits will increase another 34%, to $2,480 a month.1 And if she were to live to age 89, her lifetime benefits would increase by about $112,000. That’s 25% greater than if she had started collecting benefits at 62.2 (Note: All figures are in today's dollars and before tax; the actual benefit would be adjusted for inflation and would possibly be subject to income tax.)

But that's only part of the story. If you're working, you don't have to live on your savings. And if you stop working full time and leave a job with good pay and benefits, it may be difficult to ever regain that level of compensation if you need to return to work later. Also, as you approach retirement, you're often at the peak of your earnings and your ability to build retirement savings. Keep working and you can make "catch-up" contributions to tax-deferred workplace savings plans. Catch-up contributions enable you to set aside larger amounts of money for retirement. For example, the limit on pretax contributions to 401(k) plans is $23,000 in 2024, but if you are age 50 or older, you can contribute an additional $7,500 each year. Note: These amounts are subject to cost-of-living adjustments (COLAs).

If you're widowed

If you're a widow or a widower, you are eligible to collect your late spouse's Social Security payments as a survivor's benefit. Again, if you wait until FRA to take payments, you can receive 100% of that benefit—less if you collect before your FRA. (The rules for survivor's benefits and regular Social Security benefits differ.) You can also take whichever payment is larger: a monthly check based on your own work history, or the survivor’s benefit.

Your choice doesn't have to be permanent. There are 2 strategies worth considering:

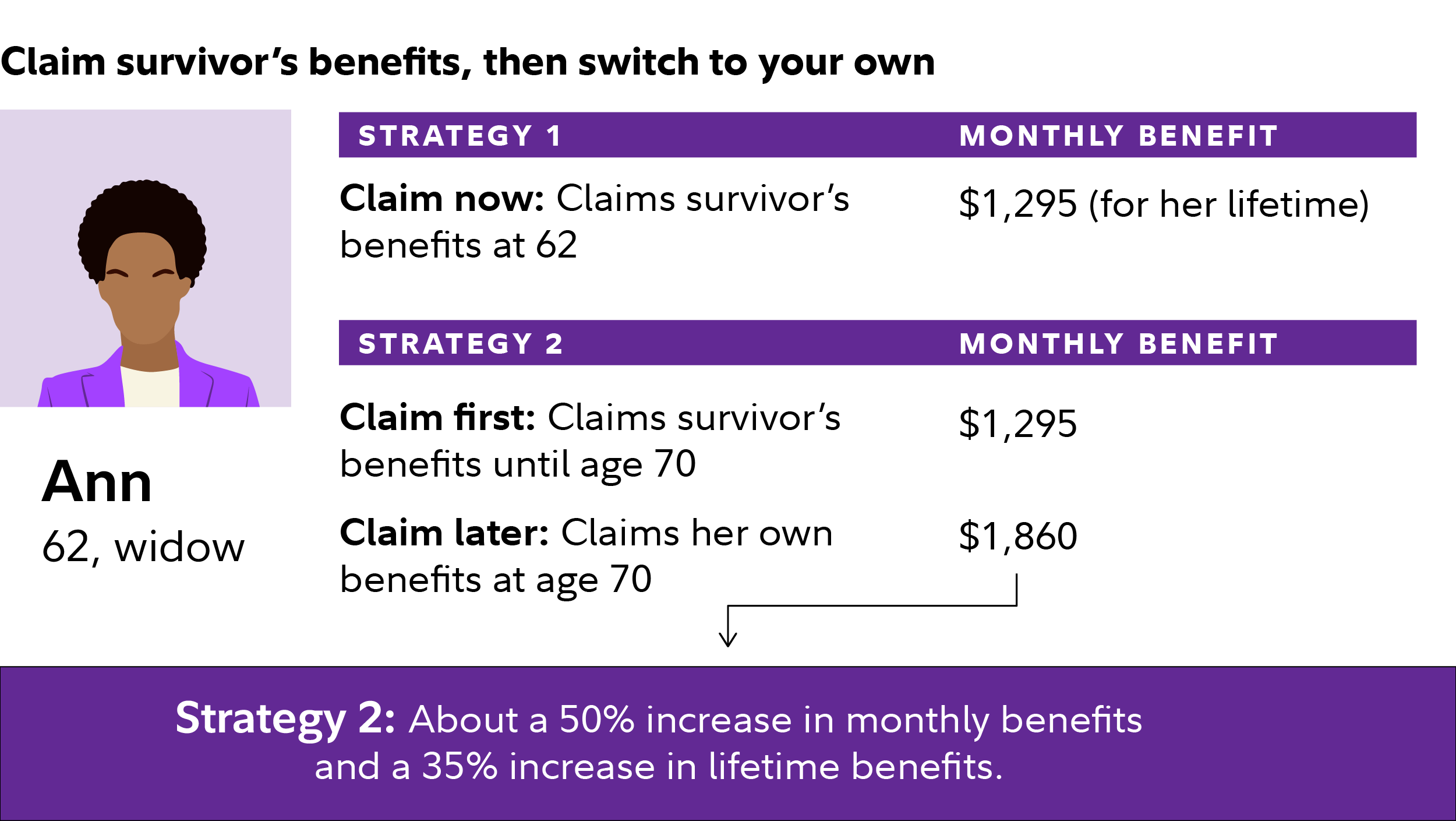

Claim survivor's benefit, then switch to your own. First, you can claim a survivor's benefit, let the amount of your own Social Security monthly benefits grow, and then switch to claiming your benefits later. This may work best if you're under age 70 (because your own payments will only increase until you're 70) and have a relatively high benefit at FRA compared with that of your deceased spouse.

Consider this hypothetical example. Ann is eligible to receive $1,050 if she were to claim her own Social Security benefit at age 62. Her husband, John had begun receiving his monthly benefits of $1,125 at age 62, but he died this year at age 66. If Ann claims her survivor's benefits now before her FRA, she would receive $1,295 per month, an amount higher than her own benefit of $1,050. If you are a surviving spouse, Social Security automatically defaults to the higher amount—in this case, her survivor's benefit. Alternatively, she can elect to receive survivor's benefits until age 70, and then switch to her own benefits. By then her own benefits would have increased to $1,860 a month, a 44% increase in monthly benefits. Ann would earn more than $128,000 in extra payments if she lived to age 89, boosting her lifetime benefits by about 30%.2 These rules are complex, however, and you should consider speaking with a Social Security representative.

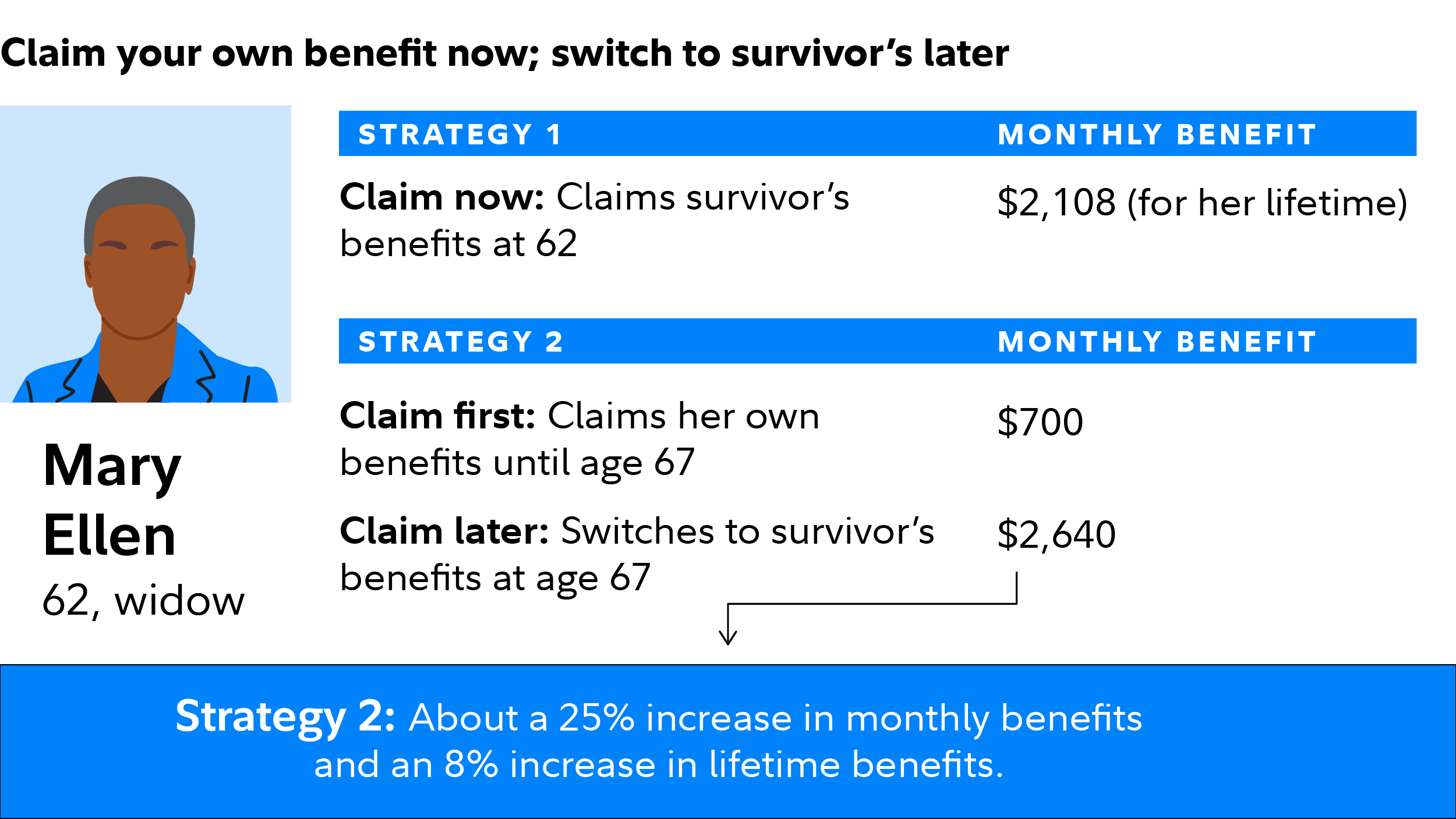

Claim your own benefit now; switch to survivor's later. Many retirees are surprised to learn that survivor's benefits can increase after a spouse dies, but they do—until you reach FRA. This strategy may work best if you're younger than full retirement age and you will have a low monthly benefit at FRA compared with that of your deceased spouse.

For example, Mary Ellen is eligible for $700 a month in benefits if she claims her own benefit at age 62 and $1,000 a month at her FRA. Her husband, Patrick, died this year. As in the previous example, if Mary Ellen claims survivor's benefits at 62 (before her survivor's FRA), she would receive $2,108 a month. If you are a surviving spouse, Social Security automatically defaults to the higher amount—your own or your survivor's benefit. But if Mary Ellen chooses her own lower benefits of $700 for the first 5 years of her retirement, by the time she hits FRA of 67, her survivor's benefit will rise to $2,640 a month, about a 25% increase. She could then switch to that higher amount, and increase her lifetime benefits by about $56,000, or 8%, if she lives to age 89.2

Divorced and still single

If you are single as a result of a divorce and meet the requirements, you may be eligible to claim a higher retirement benefit based on your ex-spouse's work record. This applies to both ex-spouses, whether you are the ex-wife or the ex-husband, and also for divorced spouses in a same-sex marriage.

The basic rules:

- You and your ex must have been married for 10 consecutive years or longer, even if the marriage ended 30 years ago.

- Both you and your ex must be at least age 62 before you can claim as an ex-spouse.

- To collect on an ex's record, you must not be remarried.

- You and your ex must be divorced for 2 years or longer, or your ex must already be claiming retirement benefits.

Tip: You'll only get a retirement benefit based on your ex's wage record if it is a higher benefit amount than you would receive based on your own wage record. You can contact the Social Security Administration and they will let you know if and how to apply for the higher benefit amount.

Find your own strategy

Don't think of Social Security as just a direct deposit once a month; it's a lifetime, inflation-adjusted component of your overall retirement income. Consequently, you should not determine your strategy for Social Security benefits in isolation—instead, you should strive to maximize your total retirement income. Delaying your benefits will boost your monthly payments and, potentially, your total income stream later on.

However, if you wait to age 70 to collect benefits and you are not working, you need to make sure your other sources of income, such as pensions, annuities, and investments, meet your expenses. If you don't do so, delaying Social Security could leave you withdrawing from your other assets more quickly, which could be a problem later in retirement. So, take a few minutes and project your future benefits, based on various scenarios, and consider using the Social Security Benefits Calculator to help determine when it's best to start taking Social Security. Doing so may help you maximize your benefits, which could contribute to your financial wellbeing in retirement.