When it comes to Social Security, it can be tempting to begin withdrawing benefits as soon as you're eligible—typically at age 62. After all, you've likely been paying into the system for all of your working life, and you're ready to receive your benefits. Plus, guaranteed monthly income is nice to have.

Health status, longevity, and retirement lifestyle are key factors that can play a role in your decision about when to claim your Social Security benefits. You may not be able to predict your future health status, but you can be assured that if you claim early versus later, you will likely have lower benefits from Social Security to help fund your retirement over the next 20 years or longer.

If you begin withdrawing Social Security at age 62, rather than waiting until your full retirement age (FRA), you can expect a 30% reduction in monthly benefits with lesser reductions as you approach FRA. You can find your full retirement age on Social Security's website, or have a paper statement mailed to you.

Your annual cost-of-living adjustment (COLA) is based on your benefits. This means, if you begin claiming Social Security at 62 and start with reduced benefits, your COLA-adjusted benefits will be lower too. The COLA feature can be especially valuable when you experience high inflation during your retirement. Delaying Social Security can create a larger retirement income that is protected from inflation.

Waiting to claim Social Security will result in higher benefits. For every year you delay your claim past your FRA, you get an 8% increase in your benefit. However, make sure to evaluate your decision based on how much you've saved for retirement, your other sources of income in retirement, and your expectations for longevity.

While many people could benefit from waiting to age 70 to take Social Security payments, others may need the income sooner to help pay their bills, or they may anticipate not living long enough to reap the rewards of delaying.

The downside of claiming early: Reduced benefits

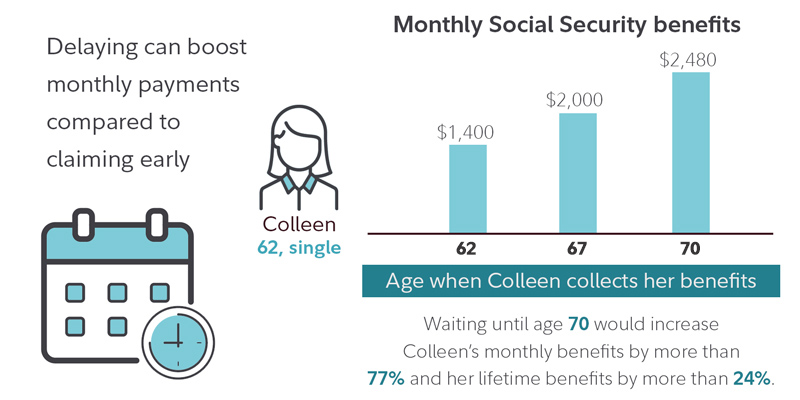

Consider the following hypothetical example. If Colleen, 62, waits until age 67 (her FRA) to collect, she will receive approximately $2,000 a month. However, if she begins withdrawing benefits at 62, she'll receive only $1,400 a month. This "early retirement" penalty is permanent and results in her receiving 30% less year after year.

However, if Colleen waits until age 70, her monthly benefits will increase another 24% over what she would receive at her FRA, to the total benefit of $2,480 per month.1 If she were to live to age 89, her lifetime benefits would be about $112,200 more provided she waited until age 70 to collect Social Security benefits instead of at 62, or about 25% greater.2 (Note: All figures are in today's dollars and before tax. The actual benefit would be adjusted for inflation and would possibly be subject to income tax.)

Spouses and Social Security

You can claim Social Security benefits based on your spouse's work record. If claiming spousal benefits provides more, claiming before your FRA on a spouse's record means you'll lose even more than claiming on your own record—the maximum benefit reduction for a spouse is 35% while the reduction for claiming your own benefit is 30%. For instance, if you're Collen's spouse (from the example above), and you are the same age, you'd be eligible for only $650 a month at age 62—35% less than if wait until your full retirement age.

To learn more about ways that may help maximize your lifetime benefits, read Viewpoints on Fidelity.com: Social Security tips for couples or Social Security tips for singles.

Your decision to take benefits early could outlive you. If you were to die before your spouse, they would be eligible to receive your monthly amount as a survivor benefit—if it's higher than their own amount. However, if you take your benefits early (at 62 versus waiting until age 70), your spouse's survivor Social Security benefit could be 30% less for the remainder of their lifetime.

Bridge to Medicare at age 65

While you are eligible for reduced Social Security benefits at 62, you won't be eligible for Medicare until age 65. This means, you will probably have to pay for private health insurance in the meantime, which can deplete your Social Security payments. However, though, there are other options such as COBRA, a spouse's insurance plan, and public marketplace subsidies.

Retiring before 65? Explore health insurance options and estimate potential costs before you’re Medicare-eligibleFinancial benefits of working longer

Many people want to retire as soon as it is financially feasible to do so, but it's crucial to consider the earning and investing power you may lose if you stop working full-time and take Social Security at 62. If you leave a job with good pay and benefits, it may be difficult to regain that level of compensation if you need or want to return to work later. Of course, not everyone can keep working, but it is something to consider if you are healthy and have the opportunity to stay in the workforce, in either a full-time or part-time capacity.

The compensation benefits of your job could also affect your Social Security. Some companies allow stock awards to continue to vest (pay out, and as a result, incur income taxes) after retirement, and even years to follow. These payouts are considered income, and could cause your Social Security payment to be taxed, or taxed at a higher level than in years after the awards are fully distributed. Delaying Social Security payments until those other income sources have been reported for tax purposes is worth consideration.

Tip: Women often live longer than men, and they're more likely to depend on one income when they're older. Don’t make the mistake of coupling your decision to leave the workforce with your Social Security claiming strategy. Remember, by the time you get into your 80s, you have fewer financial options, so don't jump at the first opportunity to claim Social Security at 62 just because you may want to quit your current job.

Social Security is based on your highest 35 years of earnings, so working a few more years at your highest earning level could increase how much you are eligible to collect. As you approach retirement, you're often at the upper end of your lifetime earnings trajectory—and your ability to save more for retirement. In addition, if you can keep working, you can make "catch-up" contributions to a tax-deferred workplace savings plan like a 401(k) or 403(b) or a traditional or Roth IRA. Catch-up contributions allow you to set aside larger amounts of money for retirement.

Remember, if you decide to stop working at 62, you will cease tax-advantaged saving opportunities. Additionally, if you decide to claim Social Security early, you will cap your Social Security benefits throughout your retirement—and you will have a smaller benefit base for COLA adjustment, which can be disadvantageous during high inflation.

When you factor in longevity, health care, and the cost of your expected lifestyle in retirement, your decision on when to claim Social Security may become clearer.

To learn more, read Viewpoints on Fidelity.com: Social Security tips for working retirees