Depending on your financial situation, you may very well end up working at the same time you claim Social Security benefits. Even if you just have a part-time job or some consulting income, your paycheck can affect the amount you receive monthly, the amount you owe in taxes for the year, and your Medicare premiums.

Reasons abound to keep working, but for many, it simply comes down to the math.

"People are clearly concerned about not having enough savings to last for their lifetime, especially since we're living longer, on average," says Chris Farrell, author of Unretirement: How Baby Boomers Are Changing the Way We Think About Work, Community, and the Good Life.

If you plan to keep working while collecting Social Security, here is what you need to keep in mind:

When you claim matters

If you claim your Social Security benefits before your FRA, or full retirement age (which is between 66 and 67, depending on the year you were born), you will end up with a permanently reduced monthly benefit because of the early age. If you claim at the earliest possible age of 62, your monthly checks could be up to 30% less than at your FRA.1

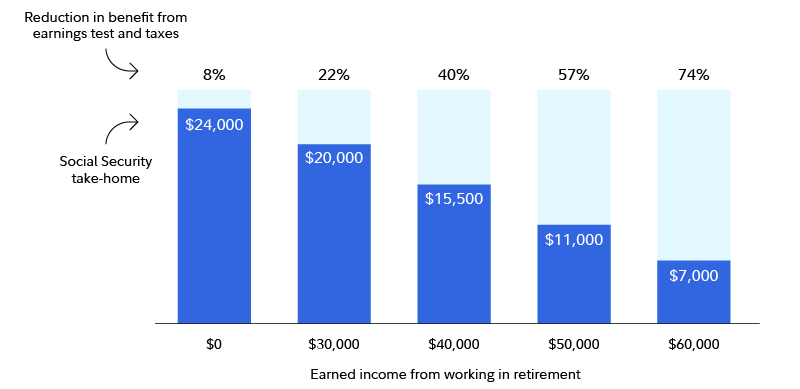

There will also be an earnings test until you reach that FRA: If you have earned income in excess of $23,400 in 2025, your benefits will be reduced by $1 for every $2 of earned income over the limit.

In the year of reaching your FRA, the earnings test limit is $62,160 in 2025, and your benefits will be reduced by $1 for every $3 of earned income over the limit.

These benefits are not truly "lost," however. If your benefits have been reduced due to earning, your monthly Social Security check will be increased after your FRA to account for benefits withheld earlier due to excess earnings. Note that "earned" income includes wages, net earnings from self-employment, bonuses, vacation pay, and commissions earned—because they're all based upon employment. Earned income does not include investment income, pension payments, government retirement income, military pension payments, or similar types of "unearned" income.

After you reach your FRA, there is no earnings test and no benefit reductions based on earned income.

Scenarios: Claiming Social Security at 62 while working

This hypothetical example is calculated by Fidelity Financial Solutions Team, using Social Security and tax tools, and for illustrative purposes only, as your own benefit may earn more or less than this example. The tools are based on data and methodology published by the Social Security Administration (as of March 2025) and Internal Revenue Service (as of March 2025). All benefits are calculated in today’s dollar. The actual benefit would be adjusted for inflation. State/Local taxes are not considered. All the numbers are rounded to the closest $500. Example assumes an individual turning 62 at the end of 2024, makes $100K/year before retirement, $65K/year expenses in retirement, collects Social Security benefits at age 62, single tax filing status, and standard deduction for federal tax purpose. Any additional income needs are covered by withdrawals from tax deferred account, therefore are fully taxable.

Income tax implications

Separate from the earnings test, Social Security benefits themselves are subject to federal income taxes above certain levels of "combined income." Combined income generally consists of your adjusted gross income (AGI),2 nontaxable interest, and one-half of your Social Security benefits.

- For individual filers with combined income below $25,000, none of your Social Security is taxed. For joint filers with combined income below $32,000, none of your Social Security is taxed. (See: Income Taxes And Your Social Security Benefits for more information.)

- For individual filers with combined income of $25,000 to $34,000, 50% of your Social Security benefit may be subject to federal income taxes. If your combined income exceeds $34,000, then up to 85% of your Social Security benefits could be taxed.

- For joint filers with combined incomes of $32,000 to $44,000, 50% of your Social Security benefit may be subject to federal income taxes. If your combined income exceeds $44,000, then up to 85% of your Social Security benefits could be taxed.

Regardless of your income level, no more than 85% of your Social Security benefits will ever be subject to federal taxation.

Additionally, 13 states also tax your Social Security benefits. The rules and exemptions vary widely across this group so it is wise to research the rules for your state or consult with a tax professional if this affects you.3

Social Security and Medicare

In addition to federal and possibly state income taxes, you will pay Social Security and Medicare taxes on any wages earned in retirement. There is no age limit on these withholdings, nor any exemption for any sort of Social Security benefits status.

These earnings can also count toward the calculation of your benefits. The Social Security Administration checks your earnings record each year and will increase your benefit, if appropriate, based on these additional earnings.

If you are making much less in retirement than before, could it hurt your benefits? No, because the benefit payment is still based on your 35 highest years of earnings. At worst, there would be no impact; at best, it could help if this replaces any of the lower 35 years.

Read Viewpoints on Fidelity.com: 6 key Medicare questions

Note, too, that your earnings may not only push you into a higher tax bracket, but also into a higher threshold for your Medicare premiums once you are over 65 and enrolled in Medicare. Medicare sets the cost (premium) for Part B each year at a fixed rate for most participants ($185 a month for 2025), but it increases for individuals with an annual income over $106,000 and married couples with an annual income over $212,000. The cost for these higher-earning participants can range from $259 to $628.90 per month in 2025.

If your income is above a certain level, you may have to pay IRMAA (Income-Related Monthly Adjusted Amount) in addition to your Part B or Part D premium: Consult with a tax professional for more details.

Contributing to retirement accounts

Another key advantage of ongoing earned income even after you collect Social Security is that you can keeping contributing to your retirement savings accounts like traditional IRAs, health savings accounts (HSAs), Roth IRAs, and 401(k)s.

Note: Once you turn age 73, you will have to begin taking RMDs from your traditional IRA. You can delay your first RMD until the following year, but know that you will then be taking 2 RMDs in the same year. (See footnote regarding the RMD age requirement.)

Your traditional 401(k), or similar employer-based retirement plan, is a different story. In general, you can continue stashing away money in your current employer-provided plan as long as you're still working, even part-time, and you can delay taking your RMD until after you retire.

This additional savings can help, especially if your savings are running a bit behind your goals. The combination of the added savings, tax-deferred growth potential, and the ability to defer tapping into your savings can be powerful, even at the end of your working career.