You've been diligent about saving and investing throughout your career, and you feel confident your portfolio will produce enough lifetime income to fund a rewarding retirement.

But will it really be that easy? Could a market downturn derail your plans? Do you have a protection plan in place, something to safeguard your most important plans over the years ahead?

Some investors nearing or just entering retirement may be too conservative in their investment portfolio, or too heavily invested in cash or cash‐like instruments. Others may be too aggressive, or too exposed to the stock market’s sometimes sharp swings. The good news, however, is that there may be a way to consistently manage your portfolio to weather the volatility of the markets—via a “secured income strategy.”

What is a secured income strategy?

This strategy involves taking a portion of your savings—typically from a tax‐deferred retirement account—before or just as you retire, to purchase a deferred variable annuity (VA) with a guaranteed lifetime withdrawal benefit (GLWB). This approach combines growth potential with the ability to "lock in" some of your future retirement income today, protecting it from potential market downturns.

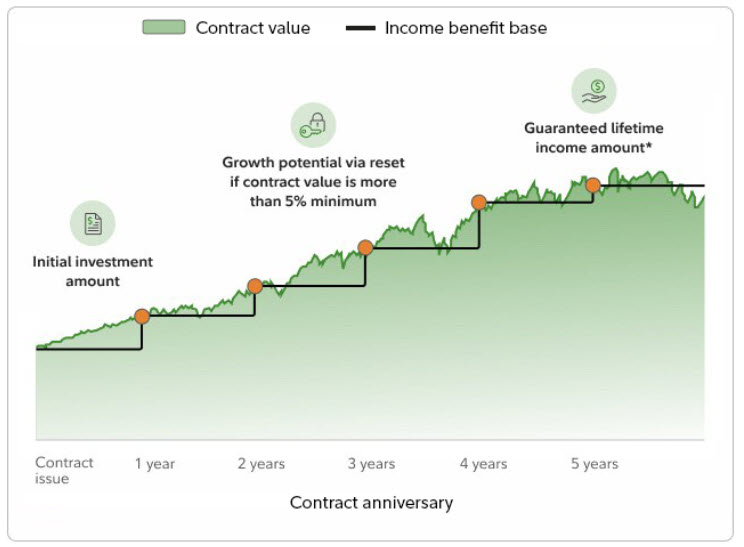

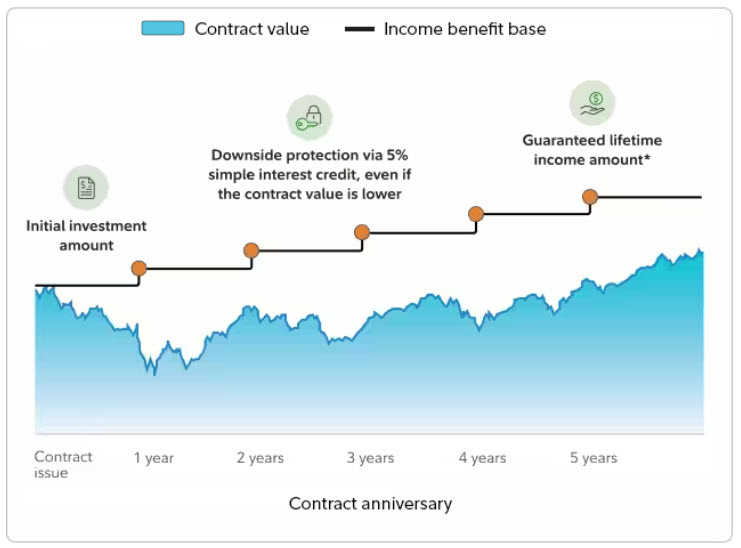

There are many variations of VA GLWBs but they typically consist of two key components: a contract value and an income benefit base. When you purchase a VA GLWB, both the contract value and income benefit base start equal to the premium you paid.

Your contract value is invested in a fund, typically an asset allocation portfolio that includes stocks and bonds. This mix aims to provide market exposure while helping reduce the impact of potential volatility. The insurance company deducts a fee from your contract value for providing the income benefit. This contract value is the amount available to you if you choose to surrender your contract (subject to any applicable charges).

The income benefit base is a notional amount that is used to determine the amount of guaranteed income you’ll receive. This base is separate from your contract value and serves as downside protection. Insurance companies often guarantee growth on this base at a fixed interest rate (e.g. 5% , simple or compound) for a set period (commonly 10 years) prior to starting withdrawals. This is often called the annual credit amount. Depending on the contract, if your contract value exceeds the income benefit base, the base is adjusted upward to match it. However, if your contract value falls below the base, the base remains unaffected as a source of downside protection.

IMAGE 1: On the contract’s anniversary, if the contract value, based on the growth of the underlying fund, is greater than the income base increased at the annual credit amount (e.g., 5%), then the income base locks in the higher amount enabling you to participate in market upside and grow the income base and guaranteed income. Essentially, you have an income floor (i.e., your guaranteed income will not drop below this amount) plus the opportunity for more (i.e., the fund provides growth opportunity).

IMAGE 2: Conversely, if the contract value drops due to a market downturn, but your contract offers an annual credit, your income benefit base will still increase by the guaranteed rate (e.g. 5%)

IMAGE 1

IMAGE 2

How does this strategy help you manage different types of risk?

This approach can help you shelter a portion of your retirement savings from three important risks.

1. Sequence-of-returns risk.No one can predict what the markets will do, and this becomes increasingly more important once you start taking withdrawals from your savings. Positive market returns early on help a portfolio grow throughout retirement, even with ongoing withdrawals. However, negative returns in the early years, on top of taking withdrawals, can drain a retirement portfolio. This is why we believe it is important to have a calculated plan for taking withdrawals in any type of market conditions.

2. Overreacting to short-term market events.Typically, emotional investing spurred by sensationalized news may make timing the market challenging. Particularly in volatile markets, these tendencies may make long‐ term investment discipline and investment success even more difficult to achieve. That’s because the emotional tendencies that define us as human beings tend to hamper our ability as long‐term investors. We can be optimistic when it's unwarranted, exhibit loss aversion, experience regret, and copy the behavior of others in times of stress.3. Longevity risk. This is the risk that you outlive your retirement income sources. On average, a 65‐year‐old woman has another 24 years to live, while a man can expect to live another 22 years.2 But when it comes to retirement income planning, life expectancy figures can be seriously misleading. Half the people born at any given time will outlive their own life expectancies. This means that most people ought to think hard about longevity risk—the real possibility of living 20, 30, or even 40 years past retirement age. Without planning, a longer‐than‐expected life could easily lead to a couple or individual outliving his or her savings. You may think you have an accurate read on your future retirement expenses, and confidence in your ability to fund them, but life – and inflation - can be unpredictable. So, it may be helpful to have a portion of your retirement income guaranteed for life.

How does a secured income strategy help mitigate these risks?

Owning a deferred variable annuity with a GLWB enables you to transfer some of the key risks faced in retirement to the insurance company that issues the annuity. Among the potential benefits:

- Lifetime income stream. The guarantees offered by GLWB products ensure income for the life of the annuity contract owner as well as the life of their spouse, even if the annuity's account balance is exhausted because of a combination of market performance and income withdrawals. These guarantees help to address longevity risk.

- Downside protection. The income produced by this product won’t go down if the market performs poorly. This feature helps protect against sequence‐of‐returns risk. Remember, you are insuring your income, not your contract value, the latter of which will still fluctuate with changing market conditions.

- Upside growth potential. While you’re protecting your income needs against downside market risk, you may still benefit if the market goes up. Most GLWB products allow for potential increases in their guaranteed income in a rising market. Any such increases are also protected against future market declines. Once your income experiences an increase, it cannot be reduced because of any subsequent poor market performance. For this reason these products are sometimes referred to as “a guaranteed income floor plus the potential for more.”

- Additional investment confidence. "The use of a secured income strategy may help conservative investors feel comfortable with a little more risk and, thus, the potential for higher longer‐term returns into their portfolios," says Stefne Lynch, VP, Annuity Product Management & Client Engagement at Fidelity Investments Life Insurance Company.

What type of investor might it be right for?

Lynch says this strategy is for investors who have two complementary needs. First, they know their portfolio will need to create future income to support their retirement lifestyle. And, they know at least a portion of their portfolio should be invested in equities, but are hesitant to do so due to potential market volatility.

“With recent market volatility, people are nervous and either moving or considering moving to safer investments like cash. The challenge is that a portfolio made up mostly of cash has limited growth potential and may be vulnerable to the risk of inflation,” says Lynch. "If you are in your 50s or early 60s you still need to invest sufficiently in equities to make sure your portfolio can generate income to support your lifestyle in retirement.

A secured income strategy allows you to secure your future income paycheck with potential for that paycheck to grow via an underlying investment. You will get a steady level of income no matter what the market does and that income has potential to grow over time through portfolio performance and other features of this approach.”

Important considerations

While this strategy does have potential advantages for some investors, it’s not a strategy for everyone and should be discussed in detail with your financial professional. You should evaluate the costs associated with these types of guarantees in relation to your tolerance for uncertainty.

For some investors, it may be worth paying for guaranteed income and making sure you have the income needed for when you retire. But other investors may not need this protection. If you already have sufficient guaranteed income—possibly a combination of Social Security, pension benefits, and other types of income annuities—or you’ve got reliable income resources that could withstand a significant market downturn and still cover your living expenses, you may not need this additional security.

It’s also important to remember that any guarantees are only as good as the insurance company that backs them. So make sure you choose an annuity that is offered by a company with a strong credit rating. Finally, although you can access your money in a GLWB annuity, if you need to withdraw more than the guaranteed income provided, do so with caution. In most cases, withdrawals in excess of your guaranteed amount and any withdrawals before age 59½ may reduce the guaranteed withdrawal benefit amount and may be subject to surrender fees.3

As you approach retirement, understanding your income needs and setting up reliable sources of income should be top of mind. You should start this process no later than five years before you need the cash flow to start.

If you’ve planned well and saved carefully, you’re almost there. But if market volatility and its potential to derail your retirement plans are keeping you awake at night, you may want to consider the merits of a secured income strategy.

Allowing an insurance company to manage certain risks may help you, in turn, feel more confident, knowing that no matter what the market does, or how long you live, the “check” will be in the mail.