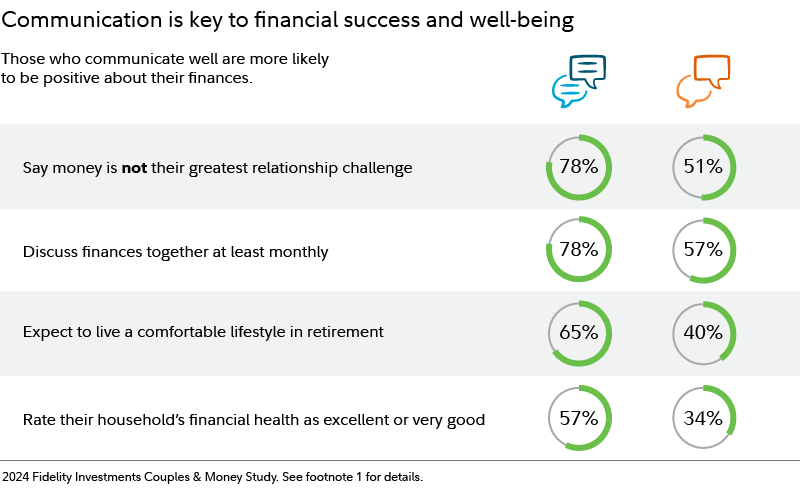

As you start your new life together as a married couple, it can be important to prioritize healthy lines of communication and a sense of joint ownership of your shared financial future. In our most recent Couples & Money Study,1 couples who rated themselves as good communicators reported significantly less financial stress than those whose communication skills could use some improvement.

Despite solid communication, 45% of couples say that they still argue about money at least occasionally.

"Don't let disagreements about spending or different attitudes about money derail your newlywed bliss," says Ann Dowd, CFP®, vice president at Fidelity. "Recognize that you are partners in financial planning, and take that partnership seriously."

Here are 5 ways newlyweds can help set their finances up for lifelong success.

1. Set goals

Spend some time thinking about your future and set some common financial goals, whether buying a home, taking the trip of a lifetime, or planning for retirement.

Next, make disciplined saving a habit. For retirement, we suggest aiming to save 15% of your income, including any employer matching contributions, in an account with tax advantages, like a 401(k) or traditional or Roth IRA. Consider setting up automatic contributions from your paycheck or automatic transfers from your bank account to your retirement savings.

Finally, think about how you can match your investments to your goals. For short-term goals—those less than 2 years away—you may want relatively stable investments, such as money market funds or even shorter-maturity CDs. For longer-term goals—like saving for retirement or college—you and your spouse might consider a mix of stocks, bonds, and short-term investments based on your risk tolerance, financial situation, and time horizon.

Rest assured that coming up with a consistent asset allocation strategy doesn't have to be a heavy lift. If you're building a portfolio from scratch, start by brushing up your knowledge of investing basics. Or, if you're looking for a one-stop option, consider an all-in-one investing solution, whether with an all-in-one mutual fund, digitally managed account, or personalized managed account. (Learn more about managed accounts.)

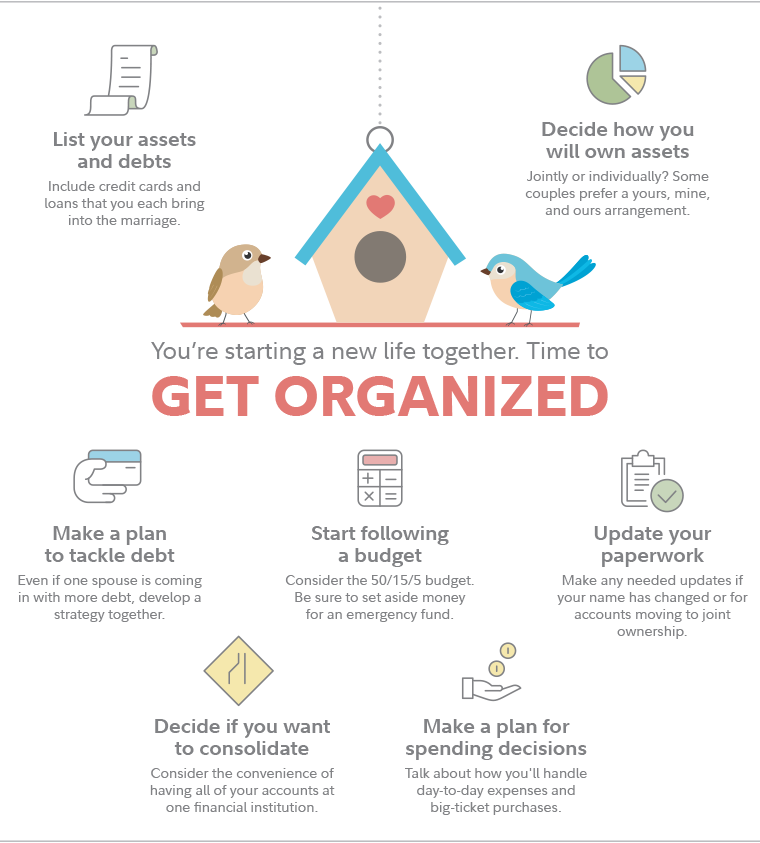

2. Get organized

Much of what couples do together comes down to dollars and cents. To make the day-to-day of your finances run more smoothly, it can help to get organized. Here are some ways to do that.

Once your financial house is in good order, try to keep it that way with regular check-ins. Consider having a regular money date to review your household's cash flow and make sure you're sticking to your budget, as well as staying on top of any other items on your financial to-do list. (For more on creating a budget, read Viewpoints on Fidelity.com: 50/15/5: an easy trick for saving and spending.)

3. Review your taxes

You may need to review your tax withholding and filing status once you're married. This can also be a chance to review your investment accounts to look for additional possible tax savings.

When your marital status changes, you must fill out a new Form W-4, Employee's Withholding Allowance Certificate, with your correct marital status and number of W-2 withholding allowances. These determine the amount withheld from your wages for federal and state income taxes.

As you're reviewing your tax situation, consider whether you're making full use of any tax-advantaged accounts available to you, like workplace savings plans, health savings accounts (HSAs), and IRAs. Earnings in tax-deferred accounts can compound faster than those in taxable accounts. And contributions to these types of accounts are typically made with pretax dollars, which can reduce your taxable income.

4. Protect what matters most

When you get married, it's important to review, update, and in some cases purchase different types of insurance. Here are some of the types to consider:

- Health insurance. Check if you could save by obtaining coverage under the same plan, like if one spouse joins the other's employer-sponsored plan.

- Life insurance. Your employer may provide you with a certain amount of life insurance coverage, but many people find they need to purchase additional coverage on their own. If you do, you'll need to decide between term insurance, which provides coverage for a specified period, and permanent insurance, which remains in effect for as long as you live. (Learn more about types of life insurance.)

- Disability insurance. This usually covers a portion of your salary if you become disabled before retirement. Your employer may provide you with coverage, but make sure it's enough to meet your expenses. If not, consider purchasing additional disability insurance on your own.

Carrying sufficient insurance coverage can be vital to protecting your new family unit's financial security if something unexpected were to happen.

5. Create an estate plan

Even if you already have a will, you'll have to update it when you get married. Your will establishes how you'd like the assets in your estate to be distributed after your death, and dying without one can put a burden on surviving family members. You and your spouse should contact your attorney for more information, and create wills as soon as possible. Then, review them whenever there's a pivotal life event (e.g., birth, death, sale of business, sizable property purchases, etc.) to make sure they address your changing circumstances. (Read about the 3 steps to building an estate plan online or with an attorney.)

It's also crucial to review and potentially update the beneficiary designations on your retirement accounts when you get married, because these designations take precedence over instructions left in a will. Always make sure to keep your beneficiary designations current.

Money discussions aren't always easy for newlyweds. But, as with any marriage issue, it's best to approach them with an open mind and as a team. The more thoughtfully you work together on money matters, the more financial harmony you'll maintain in your life together.