Credit cards are a way of life. Leaving home unburdened by cash is great—and so is getting a free airline ticket or hotel stay, cash back, or other rewards just for spending. Credit cards are easy and convenient to use.

However, there is a downside. Credit cards can be the source of debt troubles, too. That's why it's important to understand their role in your financial life.

"Used wisely, credit is an important tool in your financial toolbox," explains Stefan Ross, vice president of credit cards program delivery at Fidelity. "Using credit cards in the right way can help you build wealth and get better loan terms."

Here are 7 tips to use credit cards safely and effectively, and help you make the most of their benefits.

1. Pay attention to total monthly debt payments

Many financial advisers suggest that your total monthly debt payments including mortgage, car loans, student loans, and credit card payments shouldn't add up to more than one-third of your income. If you are near that number, you might need to pay down other loans or avoid additional credit card purchases. Having more debt than you can handle could jeopardize your long-term financial goals, such as retirement or saving for a child's college education.

2. Check your credit reports regularly

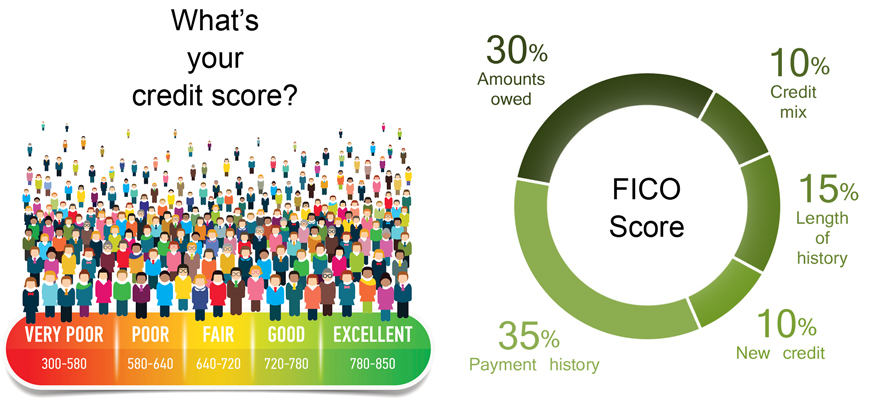

Your credit information is compiled by three credit reporting agencies: TransUnion, Experian, and Equifax. Their reports are the source of your credit score, which potential lenders use to make decisions about whether to lend to you and what interest rate to charge. "Your credit score and history reflect your ability to borrow responsibly," says Ross. "Lenders have a risk-reward ratio they follow, based on your credit history."

Credit reports include the total amount you owe; whether you pay your bills on time; what types of credit you use, such as credit cards, mortgages, and other loans; and how many new credit inquiries you’ve initiated. Errors in any of this information could lead to a lower credit score, which could prevent you from getting attractive interest rates—or from borrowing at all.

It's important to review your report on an annual basis to check for errors. You can request a free copy of each of your three reports once a year at AnnualCreditReport.com. For regular monitoring, review one report from each agency every four months. You are also eligible for a free report if you have been denied credit.

3. Pay on time and think carefully before closing cards you aren't using

The most important factors on a credit report are your debt-to-available credit ratio, or credit utilization, and your payment history. Keeping your debt level low and making on-time payments help make you more attractive to lenders.

How your credit score is determined

Also, it's not negative actions such as missing a payment or carrying a large balance that can damage your credit. Canceling an older card can also lower your credit score. The reason: Lenders care about your credit history, and the longer the history, the better.

The ratio of available credit to the amount of credit you are currently using is another factor that affects your credit score. Closing a rarely used card will lower the amount of credit available to you without reducing the amount of credit you're using, which could skew your credit ratio and make you seem like a riskier borrower.

4. Read the long policy agreements

Not all credit cards are created equal. Some charge annual fees, while others charge fees for balance transfers, cash advances, exceeding your credit limit, or other actions. To keep your fees manageable, choose a card with rates and fee structures that match your expected behavior. For instance, if you can't avoid carrying a balance, choose a card with the lowest interest rate you can find. If you intend to pay off the balance each month, consider looking for a credit card with a rewards program, although it may carry a higher interest rate. Banks are not the only institution to issue credit cards—brokerage firms, travel agencies, and online retailers are just a few.

To decide which card (or cards) may be best for you, you'll need to read and understand the issuer's credit card policy agreement. Look for how and when your interest rate might increase, what actions carry fees, and how the issuer will charge for overseas transactions. If you still have questions, contact the issuer by phone or online. Most issuers have resources to help explain the agreement.

5. Use cards safely

Credit card fraud and identify theft are major risks. Most cardholders aren't liable for fraudulent charges on their cards, but you still have a responsibility to keep your information safe. "Fraud prevention works best when consumers and credit card companies work together," notes Ross.

Be proactive to reduce the risk of fraud by reviewing your monthly credit card statements and checking your account online more frequently. Keep your receipts so you can compare them with your monthly statement and charges. Then, notify your card issuer if you notice any transactions that you don't recognize. Report a lost or stolen card immediately. Many credit card companies also offer text or email alerts when your card has been used. Alerts can be configured for things like types of transactions, such as when your card wasn't physically used, or for specific dollar amounts, or for when your balance exceeds a specified amount.

6. Maximize rewards

Credit card rewards such as points toward merchandise, airline miles, or access to exclusive clubs are popular. A card that offers cash rewards may help you save. "If you are going to be spending money anyway, you might as well get cash back and build wealth from it," says Ross.

You can add to your savings by having the rewards automatically deposited in a checking or savings account, or even into an IRA, brokerage, or 529 savings account—if your financial institution permits it. That way, your credit card purchases can actually help you accomplish other financial goals.

7. Pay off balances strategically

Credit card statements show cardholders how long it will take to pay down their balance if they make only the minimum payment—not to mention how much more it will cost. Naturally, the faster you can pay off balances, the less debt will cost you. If you can't pay a card balance in full each month, review your budget to determine how much you can earmark for that payment without sacrificing other important goals, such as saving for retirement.

Making minimum payments on one card can make sense if it's part of a strategy to pay off higher interest rate cards first, which could save you money over time. Because credit cards typically charge higher rates than other types of debt, it often makes sense to focus on reducing card debt before paying off other loans with extra payments, such as a mortgage or car loan. Plus the interest on credit cards, unlike mortgages, is not deductible. It's important to always continue making at least minimum payments on all your debt, so your credit rating will not suffer.

Although you might use credit cards like cash, they're not only a tool for transactions, they can impact on your financial goals. Take time to consider credit cards in the context of your budget, debt picture, and other financial priorities so you can use them to your advantage. "Be an educated consumer," says Ross. "Figure out what makes the most sense for your situation."