The US bull market turned 3 years old on October 12, as 90 new all-time highs thus far this year have pushed stocks to record levels. The greater-than 12% year-to-date price rally for stocks prior to last week was the biggest third year of a bull market ever.

Of course, the latest tariff threats have derailed some of that momentum, leaving some short-term investors wondering what's next for stocks?

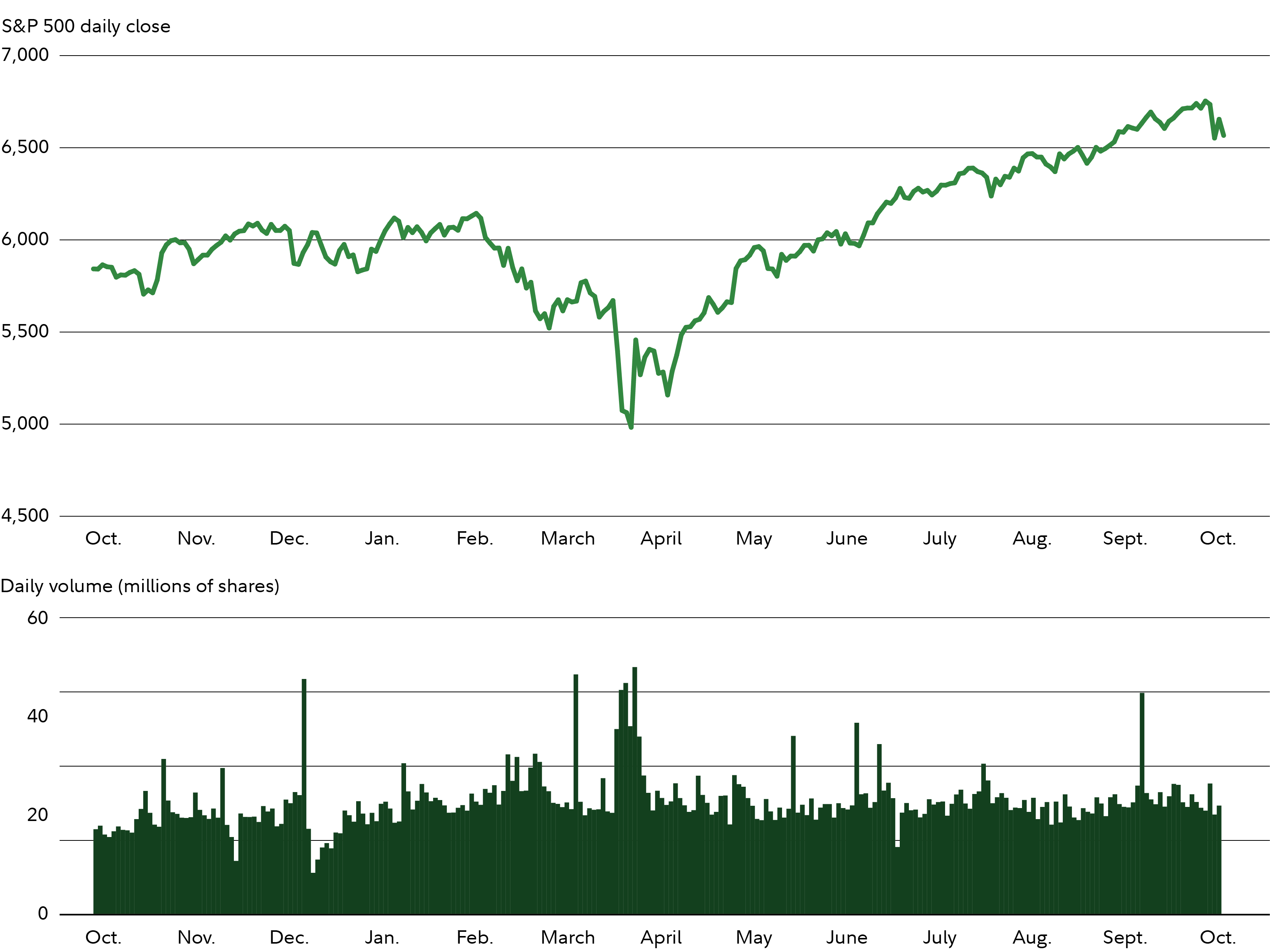

If you are trying to figure out which direction stocks may go over the short term, volume is one of the most important tools for traders that use charts. Based on the charts alone, volume for the S&P 500—which had risen above 6,700 for the first time ever—has been strong relative to the same time last year. If tariff and other market risks subside, this chart signal suggests that stocks could continue to rally.

Volume is vital

Volume is simply the number of shares traded in a particular stock or other investment over a specific period of time. For example, as of October 14, 2025, the most actively traded US stock, based on 90-day average volume, was Opendoor Technologies (

Analyzing trends in volume can help you validate patterns if you use charts and trends in your strategy. Technical analysts believe that volume precedes price; to confirm any trend, volume should increase in the direction of the trend.

For instance, if a stock were to increase from $23 to $25 on high volume relative to the recent trend in volume for that stock, technical analysts would consider this to be a more sustainable bullish trend (i.e., the stock could keep going up over the short term) than if the same price increase were to occur on relatively low volume. If a stock were to decrease from $25 to $23 on relatively high volume, technical analysts would consider this to be a more sustainable bearish trend (i.e., the stock could keep going down over the short term) than if the same price decrease were to occur on relatively low volume.

Price moves made on low volume may be said to "lack conviction" and could be viewed as being less predictive of future returns. You can tell when volume is high or low by comparing the current level to another time period (such as previous days, weeks, or months, depending on your time frame), an average, or some other benchmark. You should also consider seasonal differences in absolute volume amounts and volume trends.

What volume is saying now

Consider the chart below where the top half shows the daily price of the S&P 500 and the bottom half shows the corresponding daily volume.

What are the dominant trends that can be seen? First and foremost is the bullish momentum behind stocks. Stocks have made higher highs since the early-April low, and volume looks higher than it did during the same period a year ago. Based on volume and the direction of the trend, chart users would interpret the bull market to have conviction to continue on a short-term basis.

With that said, market risks have arisen that could derail this momentum. Stocks turned lower over the past week as trade disputes—primarily between the US and China—as well as ripple effects of the US government shutdown, among other factors, pressured markets and the economy.

Volume patterns and indicators

It's worth noting that, for a wide range of other chart patterns, volume is essential. For instance, 2 technical trading patterns that incorporate volume include the head and shoulders and flag and pennant patterns:

- In a head and shoulders pattern, volume usually decreases with each successive peak. If it does not, a trader might not expect the reversal pattern to complete. If volume does decrease with each peak and the pattern completes, the bearish breakout (i.e., a move lower) should then occur on increasing volume. The volume trends through the development of a traditional head and shoulders pattern differ from the reverse version, but a bullish breakout (i.e., a move higher) on a burst in volume after completion of the right shoulder in a reverse head and shoulders pattern would similarly confirm a trend reversal or breakout.

- In flag and pennant patterns (short-term patterns completed in 1 or 2 weeks that are initiated by sharp and nearly straight-line moves), volume usually decreases during the pattern. If it does not, the pattern may not continue as expected. If the pattern completes, the breakout should then occur on increasing volume.

There are also some technical indicators that use volume, rather than price, as the central input. The Arms Index, for example, measures relative volume in advancing stocks versus declining stocks. A value below 1 for this index suggests bullish sentiment and a value above 1 indicates bearish sentiment.

On Balance Volume (OBV) is another indicator that incorporates volume. OBV tries to detect momentum by providing a running total of volume, showing when volume is flowing into or out of a stock or other security. OBV is used to confirm price trends and spot divergences. An upward-sloping OBV would be used to confirm an uptrend, while a downward-sloping OBV might confirm a downtrend. Both OBV and the Arms Index are available in Fidelity Trader+™ Desktop.

Watch and listen

Will stocks continue to push toward new highs to close out the year? We are entering the most bullish 6 consecutive months of the calendar, and so history might suggest that could happen. Of course, there may also be volatility in line, given multiple notable risks.

But if you use charts to assess the market, it may be possible to tune out some of the noise and look to volume for evidence of what stocks might be up to next.