The "should I sell in May and go away" questions came early this year, as tariff-induced volatility cut short the part of the calendar where stocks have historically outperformed. Regardless, the data says no. And there are far more important factors and risks for investors to keep an eye on right now as the spring season unfolds.

What is the "sell in May and go away" theory?

"Sell in May and go away" is a stock market adage based on what the Stock Trader's Almanac calls the "best 6 months of the year." Historical data reveals that the top performing 6-month rolling period, on average, has been November through April. Hence, the (antiquated) saying investors should "sell in May and go away"—and come back in November.

History shows this calendar-based trading theory has flaws. More often than not, stocks tend to record gains throughout the year, on average. Thus, selling in May generally doesn't make a lot of sense. So, why do some investors tailor a part of their strategy to this trading pattern? Well, there is some reasoning behind it.

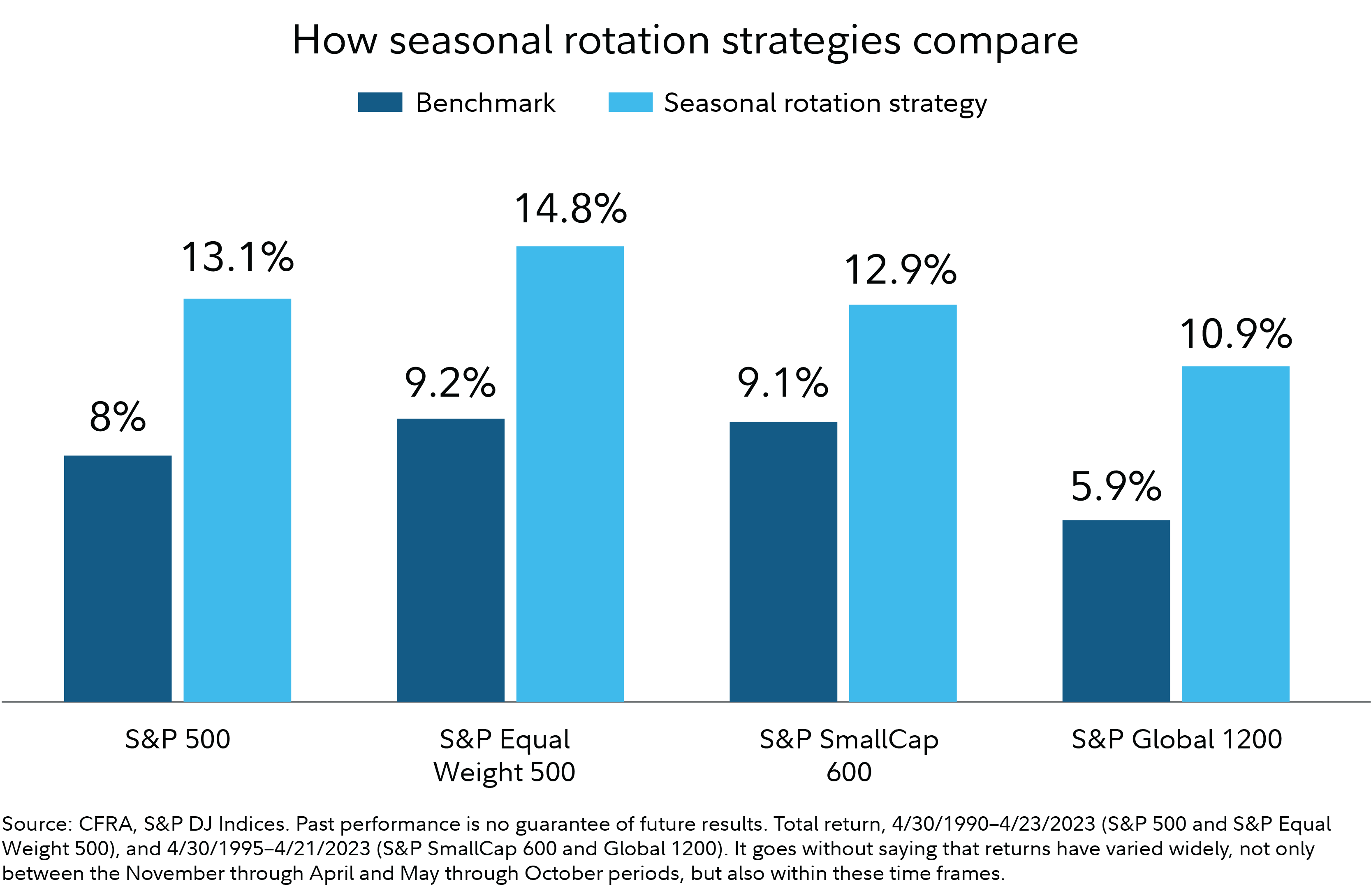

Since 1990, the S&P 500 has gained an average of about 2% from May through October. That compares with a roughly 7% average gain from November through April. This outperformance is seen not just in large caps, but also small-cap and global stocks (as measured by respective S&P indexes). What's more, rotational strategies across market caps have historically shown even better average performance.

If you are making tactical trades with some percentage of your portfolio, and calendar trends are a component of your strategy, sector rotation may be a more appropriate takeaway from the sell in May calendar trend—according to analysis by the Center for Financial Research and Analysis (CFRA). Rather than exit the market, consider a sector rotation strategy. According to CFRA, since 1990 there has been a clear divergence in performance among sectors between the 2 time frames—with cyclical sectors easily outpacing defensive sectors, on average, during the "best 6 months."

Consumer discretionary, industrials, materials, and technology sectors notably outperformed the rest of the market from November through April. Alternatively, defensive sectors outpaced the market from May through October during this period.

If you do have positive gains and want to lock in some of those profits, you could also consider a "sell in May and potentially stay" strategy. In other words, consider selling only those positions in May that you don't want to be in for the long haul, have that cash on hand to adjust your investment mix as needed, and stick with your strategy for the rest of your portfolio.

It's also worth acknowledging that these types of strategies may only be suitable for active investors with shorter investment horizons, and even active investors need to consider their trading strategies within the context of a diversified portfolio that reflects their time horizon, risk tolerance, and financial situation.

Should you sell this May?

Seasonal trends haven't held water the past year. The S&P 500 soared roughly 14% from May 1, 2023, to October 31, 2024, and is down about 5% from Halloween through April.

More importantly, investors can benefit from keeping an eye on critical market factors that are driving stocks to a much greater extent than any calendar trends. Key factors include:

- Tariffs and interest rates. The impact of trade frictions like tariffs, both those that have gone into effect as well as those being proposed or negotiated, may continue to create market volatility. The potential impact of tariffs on inflation may also influence interest rates, which have significant implications for a range of sectors.

- Investor and consumer sentiment. Market breadth has increasingly become an indicator that some investors are watching, along with how consumers are feeling. Notably, consumer sentiment has soured in the most recent Conference Board and University of Michigan surveys.

- Earnings and valuations. Q1 earnings season has gotten off to a mostly positive start, with FactSet reporting as of late April that "the percentage of S&P 500 companies reporting positive earnings surprises is below recent averages, [but] the magnitude of earnings surprises is above recent averages." That may be due in part to effects of new tariff policies not making their way into corporate results in a major way yet.

In sum, should you "sell in May and go away"? Probably not, according to the historical data, as there may be better strategies. Moreover, each market period is unique—which can certainly be said of this one.