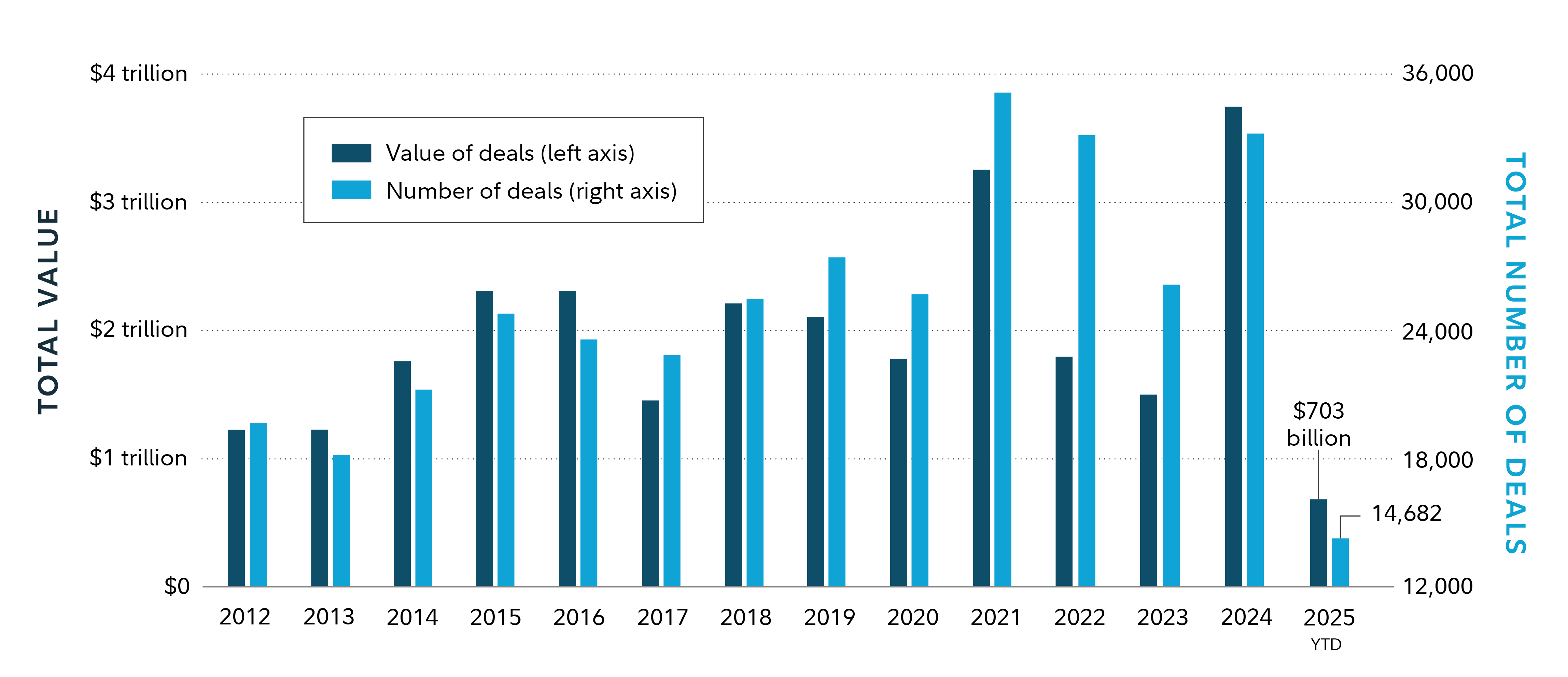

For the first time since 2021, both the number of M&A deals as well as the value of those deals increased last year (see Number and value of M&A deals globally chart).1 While M&A activity this year is not on pace to match last year, recent momentum—plus several factors—may help create a favorable backdrop for dealmaking in the final months of 2025.

Number and value of M&A deals globally

With that said, higher interest rates have continued to make dealmaking more expensive relative to years past. Other factors, like some economic uncertainty and regulatory scrutiny, contributed to the slowdown. But many M&A market watchers see the potential for rates to come down in the near term and an evolving regulatory regime as key factors why deals have sped up over the past year.

The 10 largest completed deals year to date are:1

- X.AI's $45 billion acquisition of X Corp

- Sycamore Partner's $13 billion acquisition of Walgreens

- Johnson and Johnson's $13 billion acquisition of Intra-Cellular

- XQO's $11 billion acquisition of Beacon Roofing

- Brown & Brown's $10 billion acquisition of Accession Risk Management

- NTT $9 billion acquisition of NTT Data Group

- Brookfield Infrastructure's $9 billion acquisition of Colonial Pipeline

- Sanofi's $9 billion acquisition of Blueprint

- James Hardie Industries' $9 billion acquisition of The AZEK Co

- Clearlake Capital Group's $7 billion acquisition of Dun & Bradstreet

M&A performance

The level of M&A activity can be cyclical, tending to be somewhat correlated to the economic environment—factors like GDP growth, corporate earnings growth, interest rates, tax policy, and the regulatory environment.

So who benefits from M&A? While past performance is not a guarantee of future results, several historical studies have shown that owning stocks of takeover targets (prior to a deal announcement) has generally been lucrative 1 and 3 years after a deal announcement, on average.2 That has not typically been the case for shareholders of acquiring firms.

One meta-analysis2 of M&A trends found that these deals have tended to benefit the target company's shareholders significantly in the short run (less than 1 year). For the company being acquired, the final acquisition price has historically been a 30% premium above the stock's pre-announcement price, on average. On the other hand, the acquirer's stock price has historically declined 1% to 3%, on average, 3 years after the deal's announcement. Obviously, the range of returns can vary widely on a deal-by-deal basis.

Another study found that acquiring companies experienced a 4.3% absolute price decline, on average, in the 3 years after an acquisition, with 61% of these companies underperforming industry competitors.3 These studies have suggested that many underperforming acquiring firms have been unable to capture synergies that were expected prior to the deal's announcement.

It goes without saying that each M&A transaction is unique, subsequent stock performance of the acquirer and target could differ (perhaps significantly) from the historical averages of similar M&A deals, and each deal should be evaluated on its own merit. With that said, investors who own shares of either the acquiring or target company should still be prepared for their stock prices to become potentially volatile after a deal is announced.

One reason for a potential increase in volatility is the additional risks created by the deal—including uncertainty about where the stock price will end up if the deal closes, uncertainty about whether regulators will block the deal, or the risk that the target company's shareholders will reject the proposal.

Cash vs. stock

As it relates to the form of M&A financing, another meta-study found that, on average, both the acquirer and the target have historically experienced better stock performance for all-cash deals versus all-share deals over the short run (e.g., under 3 years).4

Acquirer's stock: What to look for

If you own the stock of a company that has offered to buy another company, you may want to do some research to determine if the combined company still supports your reasons for owning the stock. Data from various studies suggests that there are 4 primary characteristics of M&A deals that tend to create value for shareholders (i.e., earnings growth that translates into stock price appreciation) of the acquiring company over the long run:2

- Acquirer's earnings and share price growth rate are above their industry average for the 3 years preceding an acquisition. You can find this information on Fidelity.com on a company's snapshot page.

- The premium paid by the acquirer is relatively low versus comparable deals. You may be able to find the premium paid for comparable deals via a financial data provider, Fidelity's news tab search function, or an internet search.

- The number of bidding companies is "low." Being the lone bidder is optimal for the acquirer's shareholders, with one obvious reason being avoiding a bidding war that might drive up the acquisition price.

- The market's initial reaction is positive. Some studies suggest this can be measured by the acquirer's stock price not closing lower in the 10 trading days after the deal is announced.2

All else equal, acquiring companies (and their associated acquisition processes) that exhibit these 4 traits have historically outperformed the stocks of acquirers that didn't exhibit these traits, on average. Additionally, when a proposal is announced, there are several questions you might consider to help evaluate it. These include:

- Will the deal create synergies (i.e., will the company be worth more after the combination, perhaps due to cost reductions or revenue enhancements)?

- Will the deal help the company achieve growth?

- Will the deal help the company gain market share and/or pricing power?

- Will the deal help the company access unique capabilities and resources?

- Did the acquirer pay fair value for the target business?

It can be difficult for many investors to evaluate some or all of these factors. If you want help navigating the M&A waters, you may want to consider professionally managed M&A investment products or services. Professional managers have the research capability necessary to evaluate the complexity of these types of deals, and the potential impact on the stocks of the acquirer and/or the target.

If you are looking to do this research on your own, there are tools and resources—including company filings, research reports, and analyst opinions—that can help you evaluate an M&A deal. Much of this research can be found in the Stock Research Center on Fidelity.com.

Target stockholders: What to look for

If you are a shareholder of a publicly traded company that is being targeted for an acquisition in the US, for example, it's important to know that state laws and stock exchange regulations mandate the right to vote on a takeover offer.

In addition to voting on the proposed deal, shareholders of the target company can either continue to hold the stock (up until or all the way through the combined entity post-merger) or decide to sell at some post-announcement price. Recall that, based on historical data, the target company's stock price is likely to have increased from the pre-announcement price. Selling your shares can occur via an auction, tender process, or on the market. Any decision you make should be based on careful analysis, and should align with your specific investment objectives, risk tolerance, and tax situation.

If the deal is completed, the stock price will typically move toward the agreed-upon purchase price by the closing date. However, if the deal falls through, the stock could decline—potentially by a large amount, and perhaps even below the pre-announcement price level (more on this later).

Acquiring firm voting rights

While target company shareholders can vote on a proposed M&A deal, this same right does not always exist for the shareholders of acquiring firms. The SEC and major stock exchanges do not require shareholder approval by the acquiring firm, except when, to help finance the deal, new shares are issued in the amount of 20% or more of the common shares outstanding before issuance. In that case, the acquirer must call for a special meeting and obtain shareholder approval. Information for the deal is obtained in the proxy statement.

Targeting M&A

In addition to evaluating individual stocks, there are professionally managed funds, known as merger arbitrage funds, which specifically target M&A deals after they are announced. The NYLI Merger Arbitrage ETF (

Merger arbitrage funds depend heavily on the number of deals available to invest in at a given point in time; many of these funds have relatively high expense ratios, and their performance can be volatile. Among the primary risks of these types of funds is the potential for an announced deal not closing that the fund has invested in.

Despite the risks, merger arbitrage funds have generally grown in size in recent years, based on assets under management. Yet you need to carefully consider the risks of these funds, and if they align with your strategy.

Moreover, FINRA recommends exercising caution in regard to M&A and investing. As noted on FINRA's website, most M&A deals provided little shareholder value, according to research. For all the excitement and headlines surrounding M&A announcements, more often than not M&A deals don't serve acquiring companies as well as executives and shareholders would hope.

Merger fund activities and risks

Short positions pose a risk because they lose value as a security's price increases; therefore, the loss on a short sale is theoretically unlimited. The fund can invest in securities that may have a leveraging effect (such as derivatives and forward-settling securities) that may increase market exposure, magnify investment risks, and cause losses to be realized more quickly. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, economic, or other developments. These risks may be magnified in foreign markets.

M&A investing implications

An M&A announcement is one example of an event that can trigger a reevaluation of your investments. If your strategy involves seeking out high-quality companies trading at attractive valuations, you may end up owning the types of investments that M&A deals tend to involve. The more information you have, the more likely you may be able to manage the potential effect of an M&A deal on your investments.