If you are an active investor, you might be wondering about the strength of the recent downtrend. That's where ADX, a chart indicator that helps measure the strength of a trend, may shed some light. According to ADX, the downtrend is exhibiting relative strength.

How strong are stocks now?

Whereas other chart indicators can help you determine at what price to buy and sell a stock, ADX is used to help determine how strong a trend is. Trend strength can be important as it can help determine if there is momentum behind a market move—whether that is up or down.

To understand why, consider a hypothetical stock that is rising in price. Would you rather own this stock if the uptrend were strengthening or weakening? From a technical analysis perspective, a rising stock in a strong uptrend may suggest greater likelihood of continuing to rise than the same stock whose uptrend is showing signs of weakening. Conversely, a falling stock in a strong downtrend may suggest greater likelihood of continuing to fall than the same stock whose downtrend is showing signs of weakening.

ADX is a short-term indicator that can be used under any type of market conditions (e.g., bull or bear markets, high or low volatility, etc.). It is simply the mean, or average, of the values of directional movement (DM) lines over a specified period. DM lines are calculated using current high and low prices.

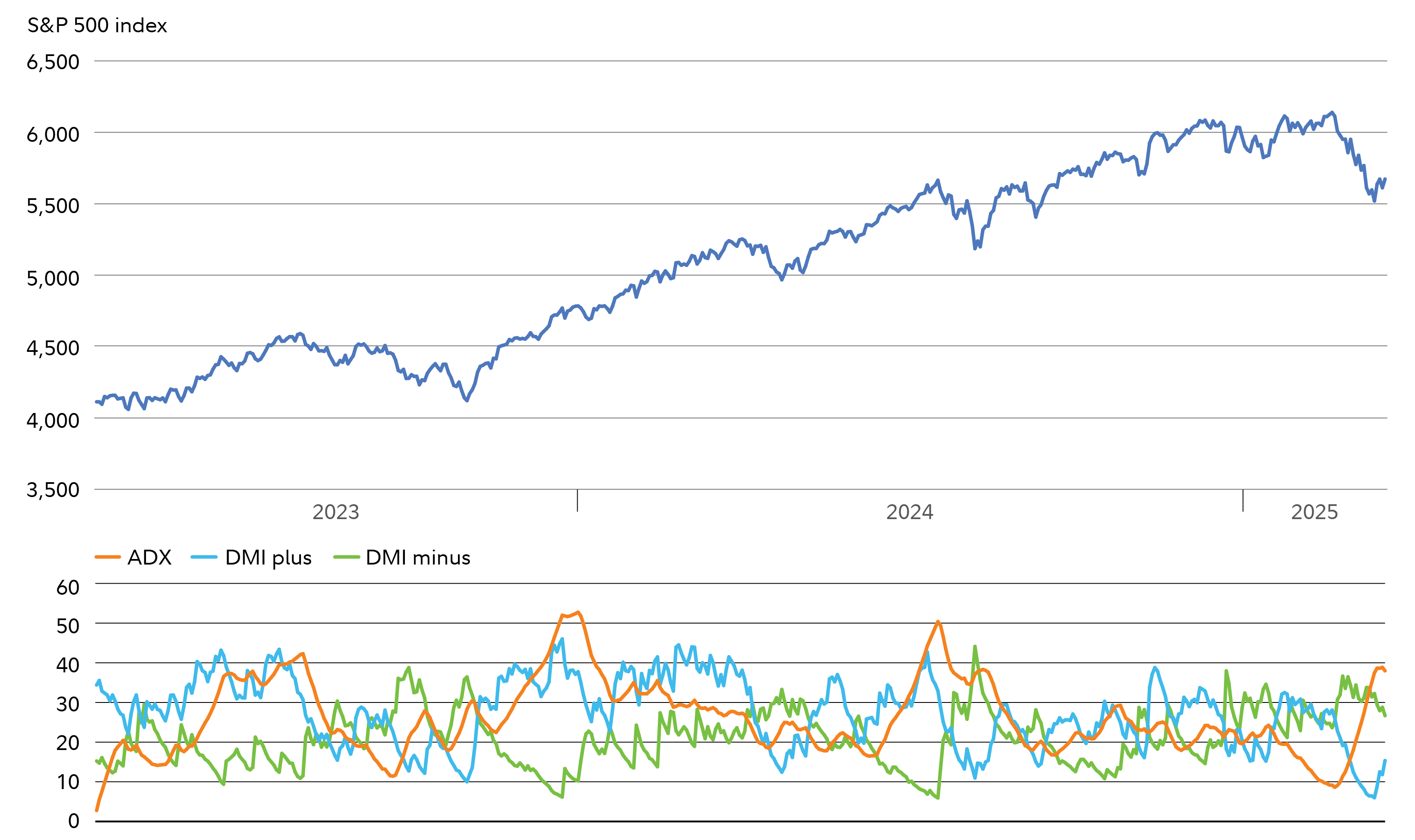

The bottom part of the chart below demonstrates what the ADX indicator looks like. The top half shows that stocks had been in a long-term uptrend until late-February, but have since trended lower.

ADX indicator and the S&P 500

Much like RSI and stochastics, ADX fluctuates between 0 and 100. Unlike other technical indicators, ADX readings above 60 do not occur frequently. In practice, most chart analysts believe a reading above 25 typically indicates a strong trend and a reading below 20 usually suggests there is no trend—with no clear signal interpretation existing between 20 and 25. Currently, ADX (the orange line) is near 38, which suggests a strong trend.

A rising ADX line generally means that an existing trend is strengthening. If ADX suggests the trend is strong (i.e., ADX is rising), then trend-following systems—such as moving averages and channel breakouts—are expected to have more validity. Alternatively, if you see a falling ADX line, which indicates an existing trend is weak or there is no trend, you may not want to place as much value in the signals given by trend-following systems. Since stocks peaked near term in February and turned bearish, the ADX line has steadily risen—suggesting the downtrend was gathering strength. With that said, a recent development that chart watchers may want to monitor has been a flattening of the ADX line, suggesting potential for a reversal of the strengthening bearish trend.

There are actually 3 lines in the ADX indicator. The most important one is the ADX line. In addition, there are 2 other lines: A DMI plus line (sometimes shown on charts as DMI+ or DI+) and a DMI minus line (sometimes shown on charts as DMI- or DI-). DMI stands for directional movement indicator. Whereas the ADX line determines the strength of the trend, the 2 DMI lines complement the ADX line by helping determine the trend's direction.

The direction of the trend is interpreted as positive when the DMI plus line is higher than the DMI minus line. Conversely, the direction of the trend is interpreted as negative when the DMI minus line is higher than the DMI plus line. Based on the DMI plus line currently being lower than the DMI minus line, this confirms the direction of the trend as bearish.

How to use ADX

Indicators like ADX can be useful supplements to your overall investing outlook that should be based primarily on fundamentals of the global economy, the business cycle, and any other relevant factors. ADX is painting a mostly bearish picture, with the latest data giving investors something to keep an eye on. ADX readings over the near term could provide insight into the strength of the latest market trends.