Many investors are concerned about the impact that inflation might have on their ability to reach their goals. While it may not be possible to avoid the effects of inflation completely, there are some things you may be able to do to reduce its sting without making drastic changes to your portfolio.

1. Consider adding some inflation-resistant diversifiers

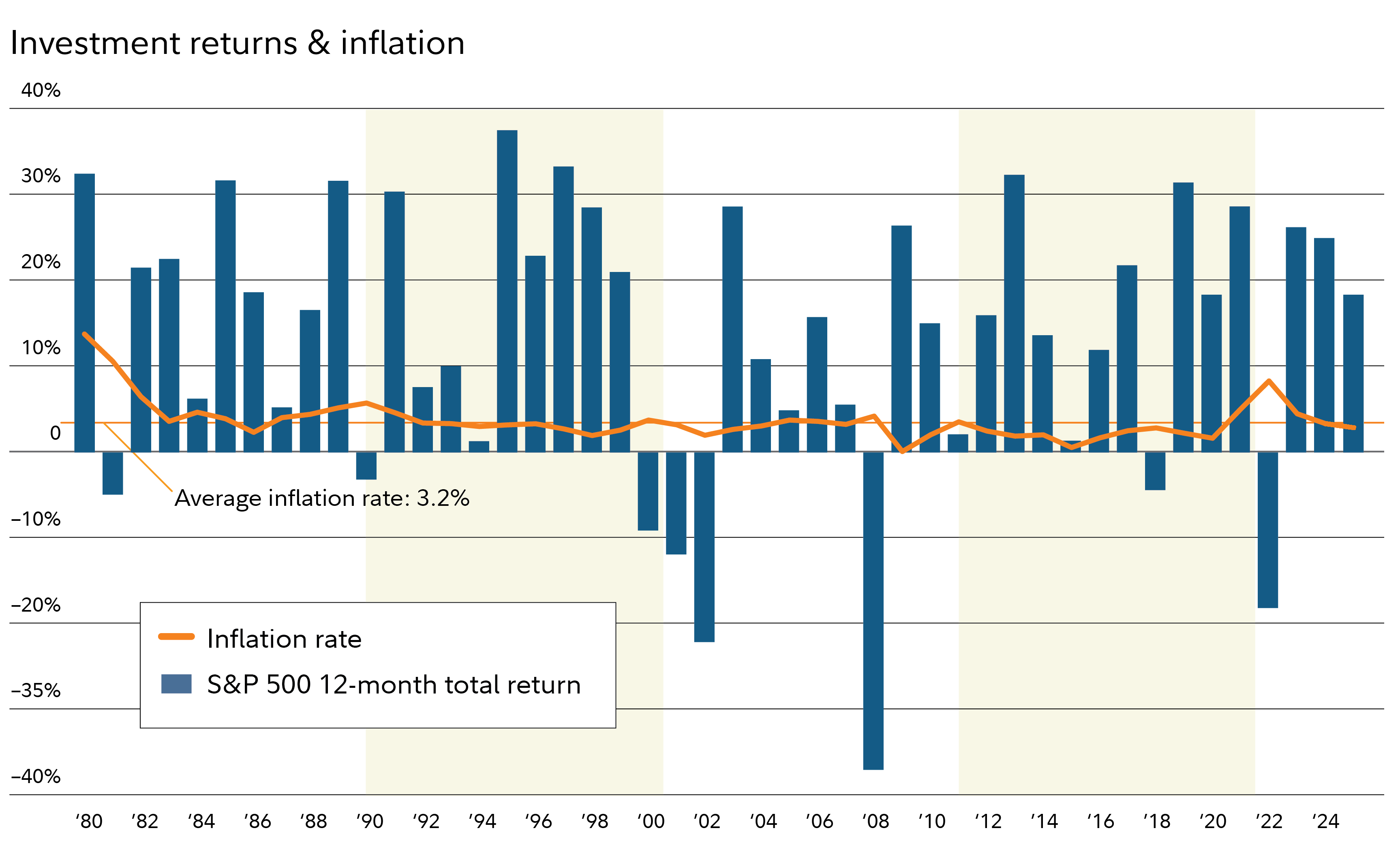

Though rising inflation may be troubling, investors who already have a well-diversified portfolio of traditional stocks and bonds may already have some degree of protection. That's because portfolios like these have historically tended to grow even in periods of high inflation. "We still believe that a mix of stocks and bonds can help investors experience growth while managing risk," says Naveen Malwal, an institutional portfolio manager with Strategic Advisers, LLC.

In periods of elevated inflation, Strategic Advisers, LLC takes specific steps within managed client accounts to help provide additional inflation protection, by emphasizing certain investments that have historically done well in inflationary environments. This has included adding diversified commodities, such as energy, industrial metals, precious metals, and agricultural products, as well as international stocks.

In the bond market, Malwal highlights the utility of high-yield bonds. "While these carry more risk than investment-grade debt, the higher yield may allow them to more easily withstand any increases in interest rates that might occur in response to rising inflation." He also noted that short-term bonds have typically experienced less volatility during periods of higher inflation. "But we may also include some exposure to intermediate- and long-term bonds, as they have historically provided stability within well-diversified portfolios during periods of stock market volatility," says Malwal

2. Take a close look at your budget

David Peterson, head of Wealth Planning at Fidelity Investments, notes that rising prices tend to have a greater impact on discretionary spending, as consumers are likely to cut back on nonessential expenses. Peterson suggests that such changes in spending can be an important lever in reducing the impact of inflation. "Consider what's driving inflation," says Peterson, "and see if you can shift what you're spending your money on, so it has less of an impact."

3. Don't get too comfortable in cash

In times of volatility and uncertainty, it can be tempting to retreat from the market and reallocate some of your assets into a cash position. But in an inflationary environment, holding cash can be counterproductive. "It may feel safe," says Malwal, "because the number in your account appears to be staying stable. But the longer it sits there, the lower your purchasing power can get." Additionally, taking money out of the market can have a substantial effect on long-term performance. A hypothetical investor who missed out on just the five best days over the past 35 years (between January 1, 1988 and December 31, 2024) would have reduced their portfolio’s value by 37%.1 "Investors who can take on even just a bit of risk will typically have a better chance of keeping up with, if not passing, the rate of inflation," says Malwal.

4. Reassess your emergency savings

However, some investors may want to keep more cash on hand in their emergency savings to account for the rising cost of living that comes with inflation. "While it may not be wise to leave a lot of investible assets in cash," says Peterson, "it's still important to be prepared for any short-term liquidity needs. When prices are rising, you may want to add to your emergency savings, to help ensure you're able to cover the costs of an unexpected expense should one arise."

It's generally recommended that you set aside enough to cover 3 to 6 months' worth of essential expenses. If you haven't taken stock of how much your day-to-day expenses are really costing you, your emergency savings may not be ready when you need it most.

5. Watch out for estate tax liabilities

"In some markets, you may see significant increases in home values," says Peterson, "and depending on where you live, the increased value of your home could put you over the estate or inheritance tax exemption for your state."

"It's important to remember that your house is an asset," says Peterson. Because you're not pricing it every day, it may not be top of mind, but it could expose your family to a significant tax bill when it comes time to pass on your estate." Investors who suddenly find themselves at risk due to increased home values may want to consider estate tax reduction or "freeze" strategies, such as utilizing their annual gift exclusion or moving assets into a trust to get incremental growth out of their estate.

6. Reduce your tax drag

"Taxes are one of the main drags on portfolio performance," says Peterson. "The more tax-efficient you are, the better off you're going to be." By taking advantage of market volatility to engage in tax-loss harvesting and properly locating tax-inefficient investments in the appropriate tax-deferred or tax-exempt accounts, you can potentially lower your overall tax bill, which can help offset the bite of inflation.

The best defense is a good offense

"There's not a one-size-fits-all answer," says Peterson. "The best course of action is going to depend on your level of wealth and your stage of life. But having a good, robust financial plan can provide some comfort when the markets seem uncertain."

"In an inflationary environment, being too defensive or having too much of your assets in short-term investments like cash and CDs may be particularly risky," says Malwal. "There's a real risk that being too cautious might result in diminishing the purchasing power of your assets."