Recessions are a natural part of the business cycle, and though they certainly bring a degree of uncertainty and volatility with them, it's important not to let fears of a short-term economic contraction lead you to take your eye off your long-term goals.

Having a plan and remaining invested are 2 important drivers of long-term financial success. It's important to understand what could happen in a recession what that really means for investors. Here are 3 things you should know about recessions, so you can be prepared for what might be in store.

1. Not all recessions are the same

For many investors, the difficulties of the recession that accompanied the 2008 financial crisis loom large in their memories. In reality, that was something of an outlier. Generally speaking, recessions have historically been infrequent and short-lived.

"It's human nature to remember the more recent recessions as typical," says Malwal. "But some recessions have been brief or mild, as stocks experienced gains through those recessions. So presuming that every recession will lead to a deep market correction may lead investors to miss out on long-term gains."

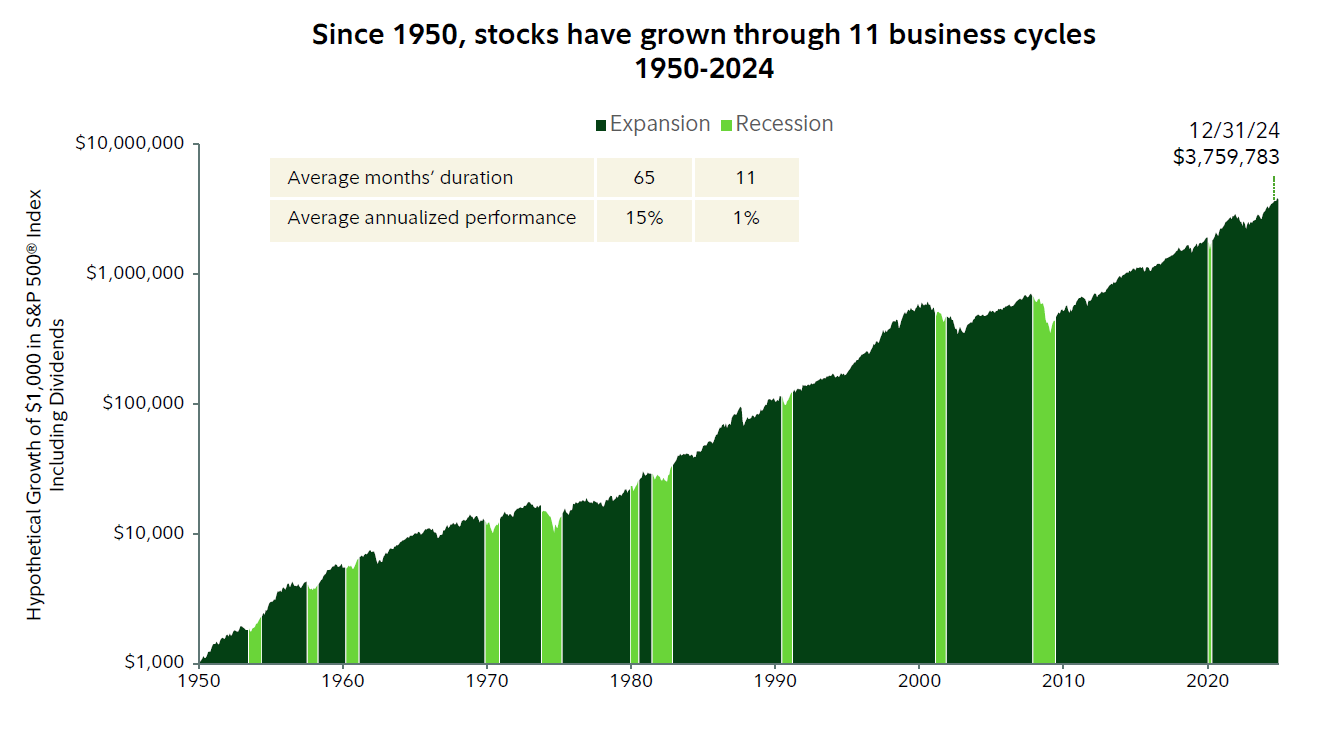

Since 1950, the US economy has experienced 11 recessions. The average length of a recession is 11 months, with the longest lasting 19 months and the shortest only 3.1

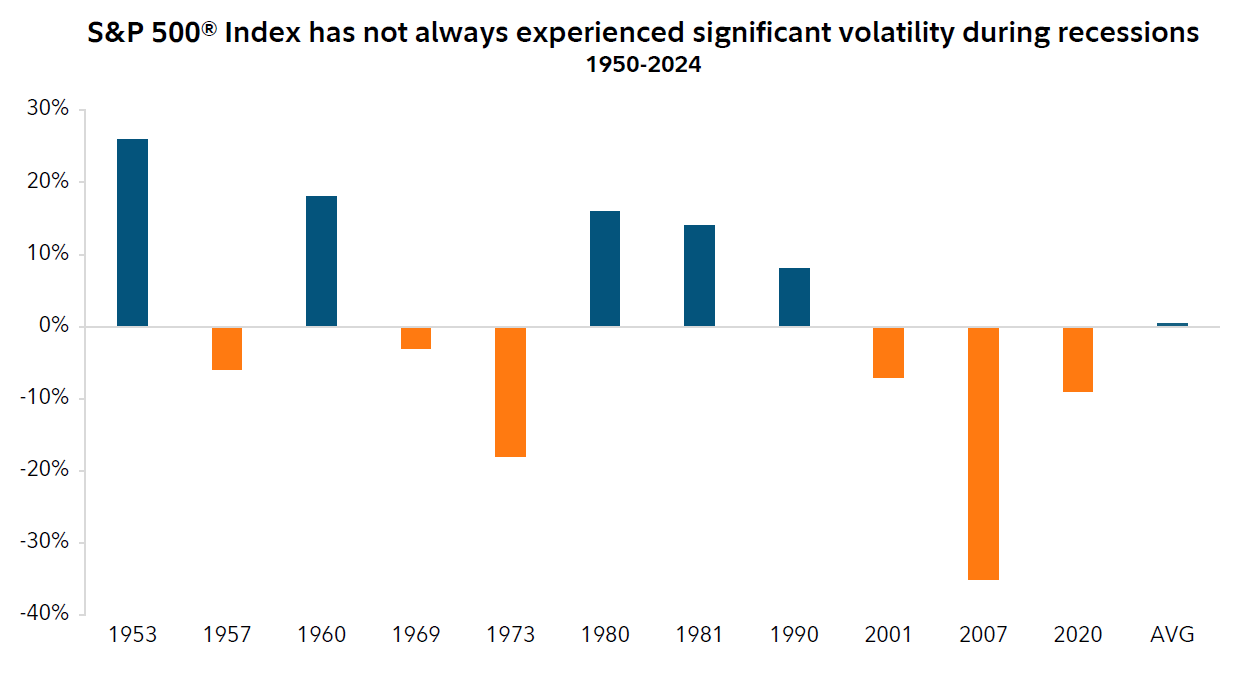

What happens to the stock market in a recession isn't so cut and dry, either. Perhaps counterintuitively, 5 of the 11 recessions we've had since 1950 led to positive stock market returns.1

Generally, stocks have grown more than they've contracted, and when juxtaposed with the long expansionary periods we've seen in the market, the recessions look much less daunting. "Stocks have more typically experienced longer, lasting expansions," says Malwal, "which have more than made up for the relatively short bouts of volatility that investors have experienced during recessions."

Market recoveries can be swift and unexpected and can begin even when what you're reading in the news seems dire. Trying to time the markets or jumping in and out of your investment plan in the hopes of mitigating losses or taking advantage of the dip may be more disruptive than the recession itself and could result in missing out on future gains.

"News headlines can make it very hard to get back into the market as it is recovering after a recession," says Malwal. "For example, a lot of investors were nervous to invest once the US entered a recession in 2020. News headlines about the pandemic, high unemployment, and corporate profit declines persisted throughout the year. Yet, stocks rallied about 70% from March 23 through December 31, 2020. It was similar after 2008: In 2009, stocks rallied about 68% from March 9 through December 31 of that year."2

On average, the total return for the S&P 500® index in the 12 months after the market found its bottom during a recession is 38%.3

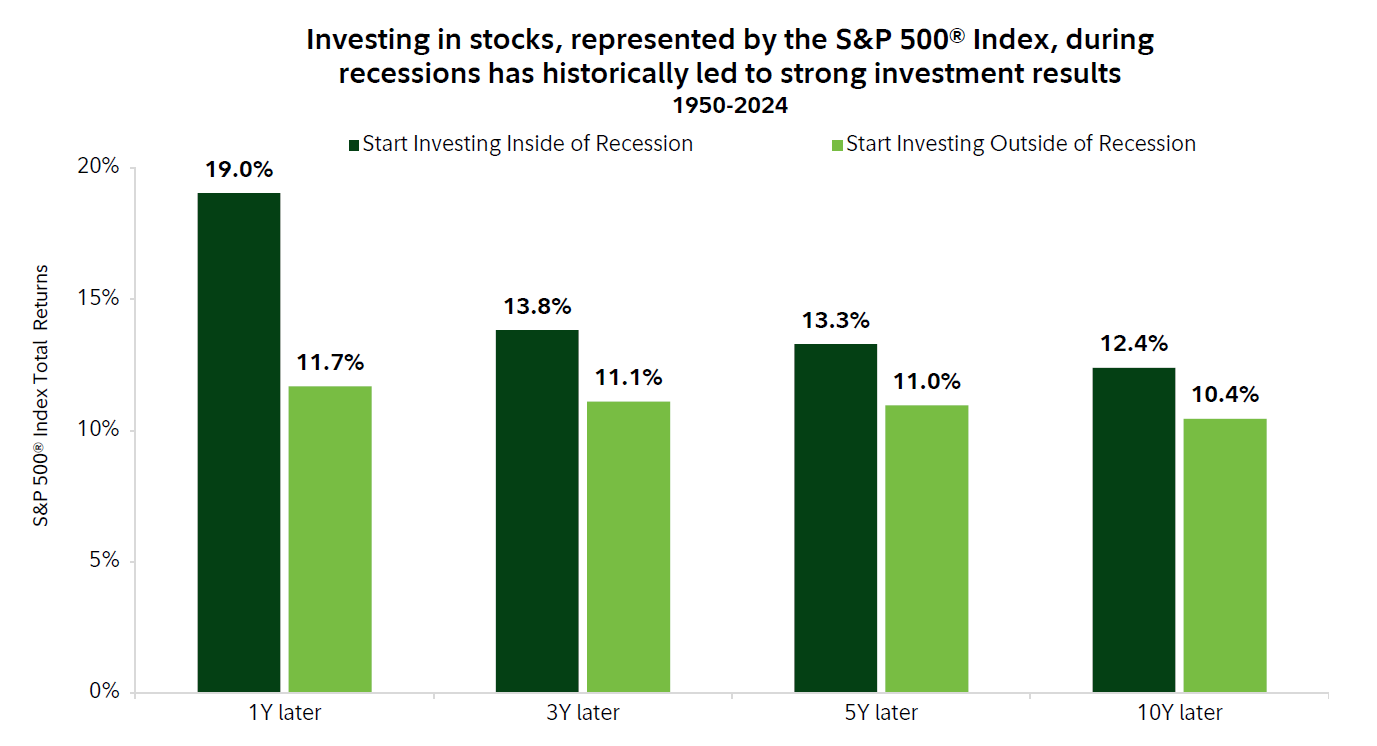

3. Investing during a recession isn't necessarily a bad idea

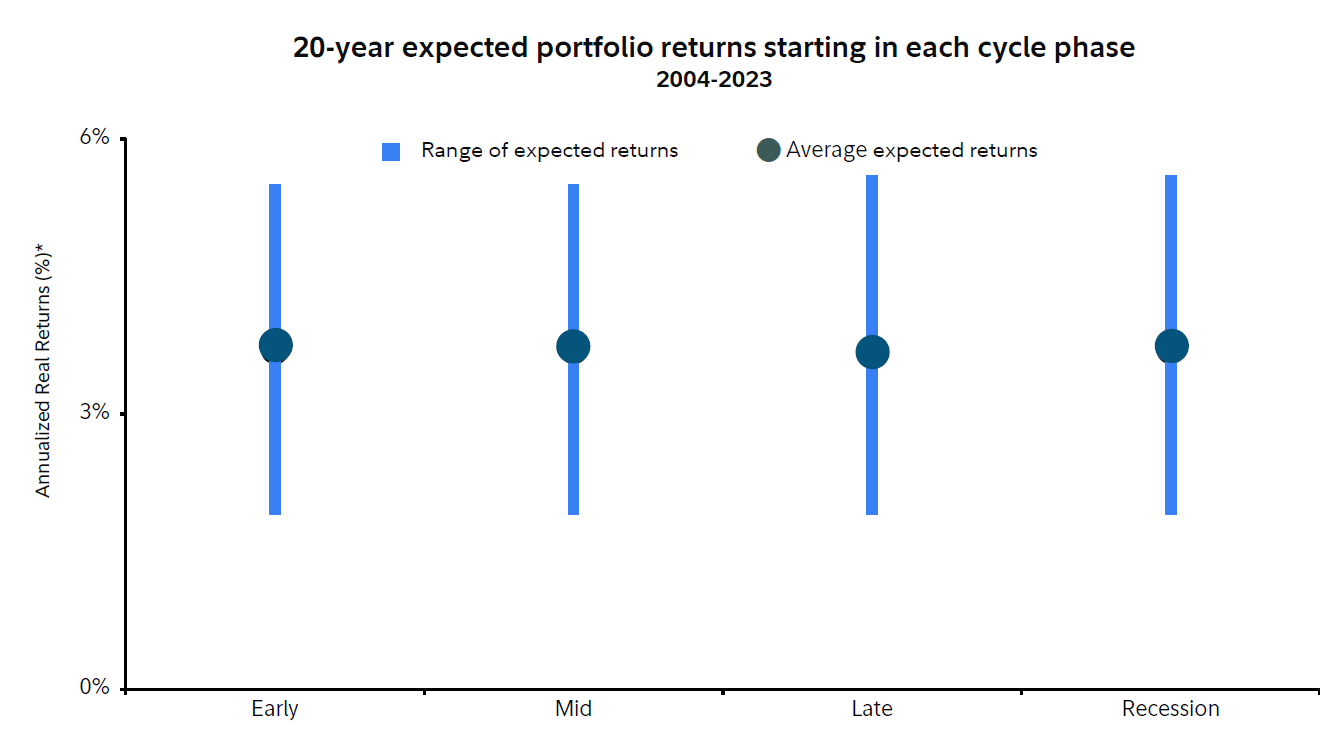

Our research shows that when you invest—that is, which stage of the business cycle you choose to put your money in the market—may have very little effect on the average, long-term performance of your portfolio. This means that making investment decisions based on where you think the US economy is in its business cycle isn't likely to have a dramatic effect on long-term outcomes.

The truth is, when we look at historical trends, economic events such as recessions can be less damaging to the long-term growth of your portfolio than allowing fear and uncertainty to cloud your judgment. Many of the most natural reactions—such as wanting to get out of the market or getting more conservative with your portfolio—may lead to poorer long-term performance.

A disciplined approach may lead to rewards during a recession

Remaining disciplined and sticking to your long-term investment plan may be a more reliable way to achieve your long-term financial goals than making significant changes in an attempt to avoid the short-term pain a recession might bring. We understand that when markets fall, it can be stressful to watch your investments lose value and tempting to abandon your strategy in an effort to stem the decline.

That's why it's important to prepare yourself and your portfolio to withstand that stress, by recognizing and coping with the built-in biases that compel us to make emotional decisions in periods of volatility, maintaining a well-diversified portfolio that can help mitigate the risks we're exposed to, and creating a strong financial foundation that helps us feel secure when confronted with uncertainty in the market.