Stock analysis might sound like something reserved for the finance pros and MBA grads, but we’re here to bust that myth. With the proper tools and information, stock analysis can be a part of anyone’s investing strategy. Ready to level up your financial savvy? Here’s what you need to know to get started.

What is stock analysis?

Stock analysis is the method used to evaluate an investment product (aka stocks, bonds, ETFs), an investment sector, or the market as a whole. The beauty of stock analysis is that it can be used in many scenarios to help estimate where prices might be heading, which ultimately helps guide investment decisions with the goal of achieving better returns than the market. To do this, one must carefully consider past and present market data.

Types of stock analysis

There are 2 main types of stock analysis—technical and fundamental. Technical analysis focuses on the behavior of a stock price, while fundamental analysis measures the financial health of the company. Some investors use fundamental and technical analysis together, determining what to buy through fundamental research and when to buy via technical.

Technical analysis

Technical analysis involves examining various sets of stock data generated through market activities like volume (aka shares traded during a specific period) and price to identify trends and forecast future price direction.

Generally speaking, technical analysis is based on the following beliefs:

- Stock prices reflect all relevant information, meaning the market price of a stock is an accurate depiction of all news or factors that can affect the company.

- Stock prices follow trends, so once a trend is established, future prices tend to follow the direction of that trend.

- History repeats itself, specifically price movement, which technical analysts believe moves in identifiable, consistent patterns.

Here’s an example of what technical analysis could look like in action:

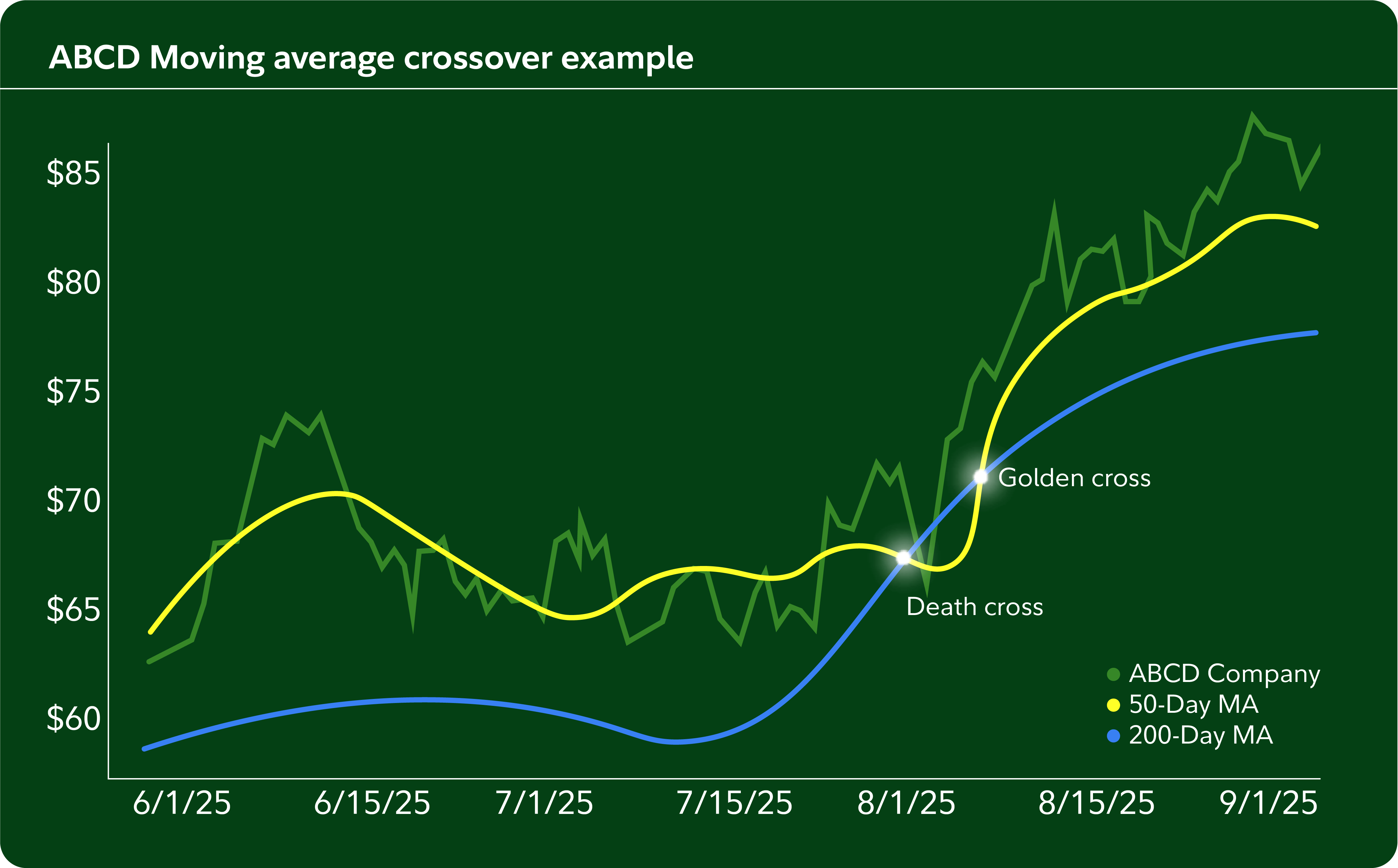

Say you’re watching ABCD stock and want to know if it’s a good time to buy or sell. We’ll use a common technical indicator called moving averages to assess. Moving averages smooth out price data to show trends, as you’ll see in the chart below:

On August 1, a “death cross” occurs, where the 50-day moving average (MA) crosses below the 200-day MA. This signals a potential selling opportunity.

A week later, the 50-day MA crosses above the 200-day MA, creating a “golden cross” which presents a potential buying opportunity.

How do you do technical analysis?

When evaluating stocks with technical analysis, investors usually begin with a stock’s price chart—then, they typically add 2 broad types of indicators, known as overlays and oscillators.

- An overlay is data plotted directly on top of a price chart to help traders analyze price movements and trends. Moving averages are a commonly used overlay, along with Bollinger Bands®, which help determine whether prices are high or low on a relative basis.

- Oscillators, whare are typically below the price chart, are indicators that can help analysts determine oversold or overbought conditions of a stock. Common examples of oscillators are the Relative Strength Index (RSI), which measures the speed and change of price movements, and the Stochastic Oscillator, showing the location of a stock’s closing price relative to its range over a period of time.

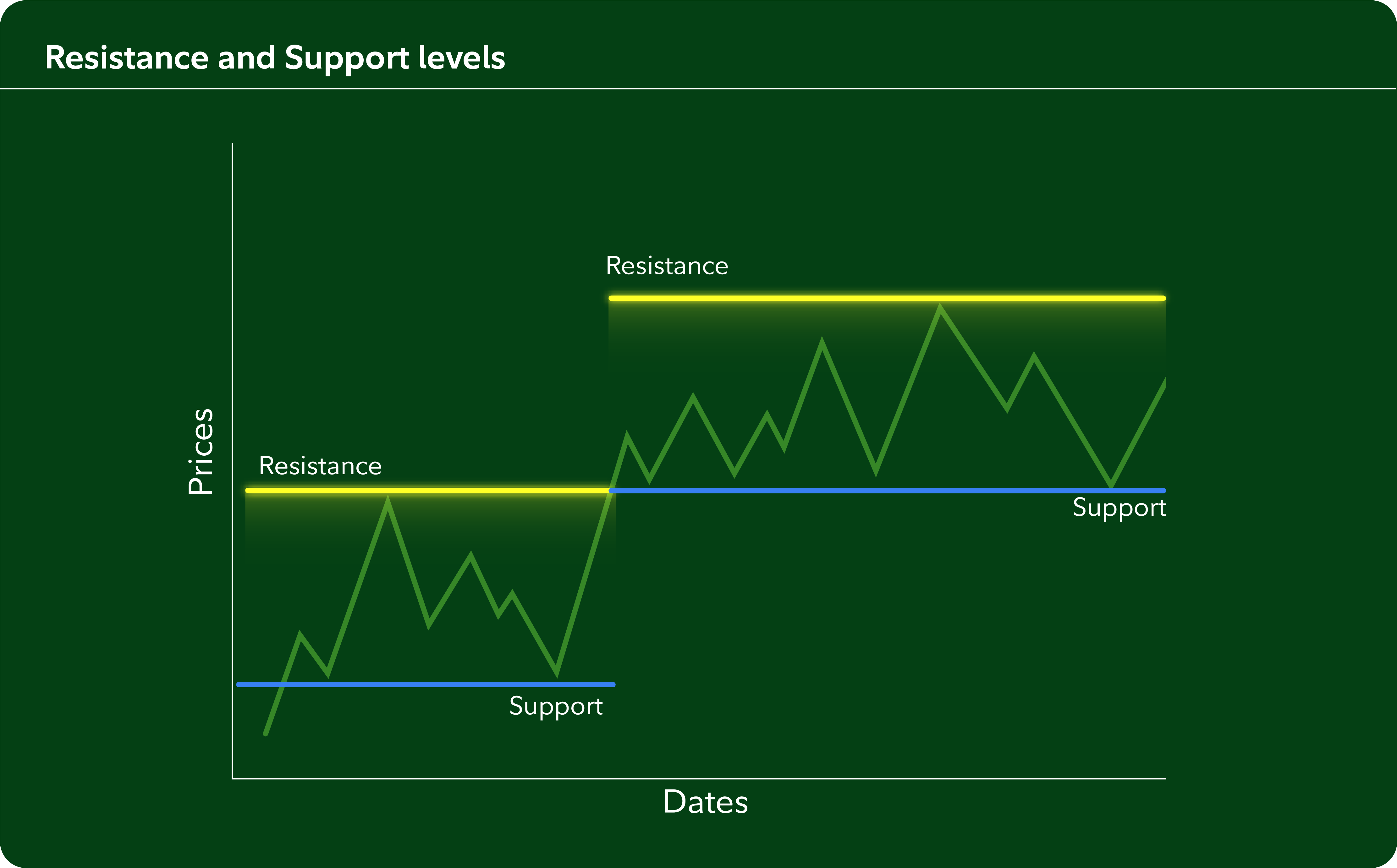

Part of technical analysis involves identifying the relationship between supply and demand in an investment, commonly referred to as support and resistance. For example, a support level is when demand is potentially strong enough to keep a stock's price from falling below its current price point. A resistance level, meanwhile, is when the supply of an investment is strong enough that its price may have a hard time rising any higher.

Fundamental analysis

As its name suggests, fundamental analysis focuses on the foundation of a company's financial standing. That means reviewing a company's financial statements and public filings to assess its financial health to decide if it's potentially overvalued or undervalued. An overvalued stock is considered “expensive,” because its price exceeds its fundamental value—think of a sweater with a hefty price tag at a boutique. An undervalued stock could be seen as a “bargain,” or that same sweater on a sale rack down the street.

Fundamental analysis is used to determine the fair value of a company’s stock price given its recent earnings, past growth rates, the price-to-earnings ratio, debt, and other financial and accounting measures. Unlike technical analysis, fundamental analysis focuses on factors outside of the stock’s price to determine its value.

How do you do fundamental analysis?

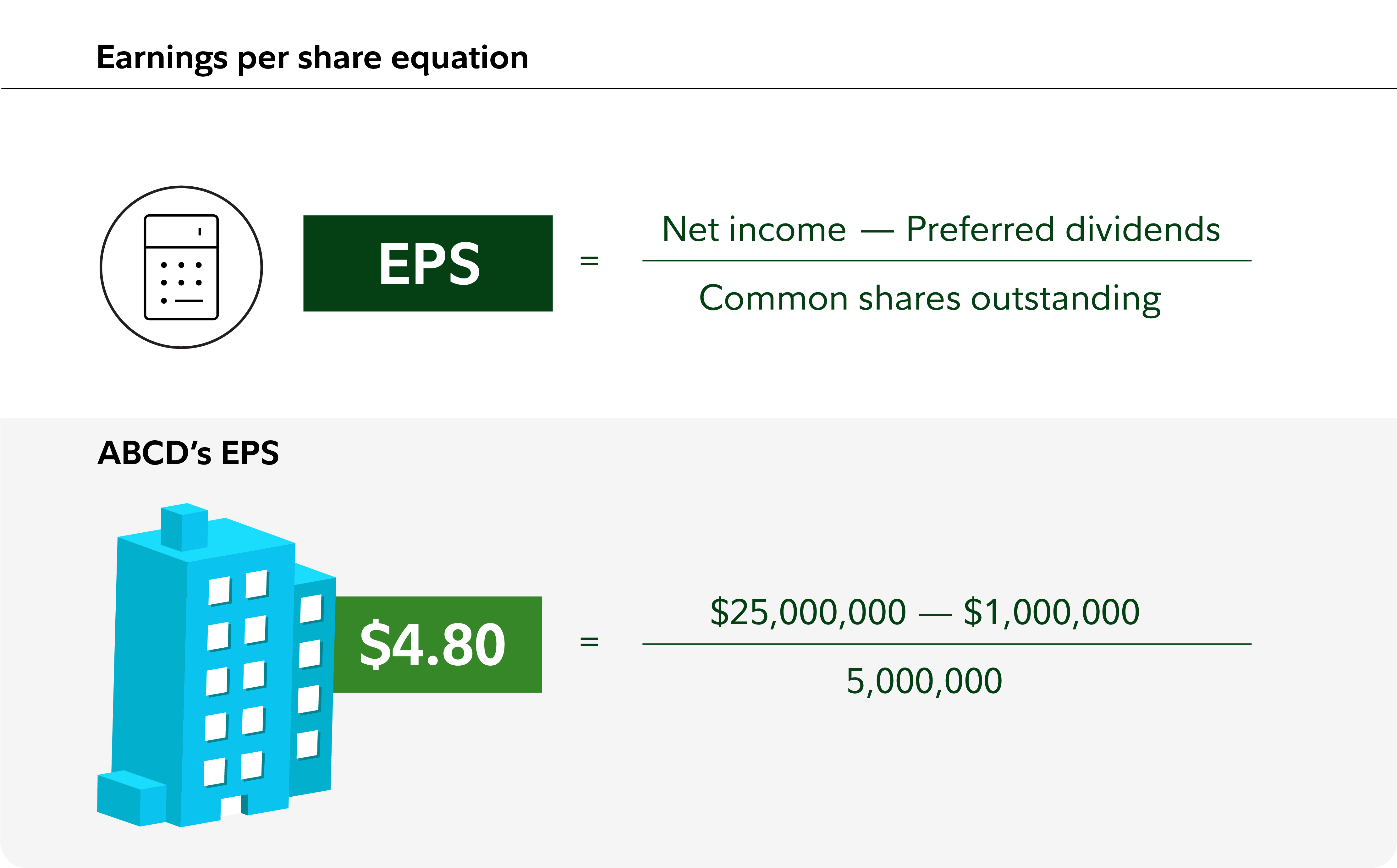

Let’s look at ABCD stock in the manufacturing industry. One of the first things you could check is the company’s earnings per share (EPS), which shows how much profit a company makes for each share of common stock issued. Typically, you can find this in an earnings report or with a quick search on your brokerage platform.

After taking a look at ABCD's earnings report, we find that their EPS is $4.80. To help put context to this number, look at past EPSs to determine whether it’s been growing, which helps solidify that the company is healthy and profitable. It’s also important to compare ABCD’s $4.80 EPS to that of similar manufacturing companies to get a sense of the industry average. A higher EPS is generally a good sign, indicating a company is generating more net profit for each outstanding share of common stock.

Keep in mind, companies can buy back their own stock to reduce the number of outstanding shares, which can make their EPS look more favorable without any corresponding increase in net income. That’s why it’s important to consider other ratios to get a more complete analysis. This is where the price to earnings ratio can help.

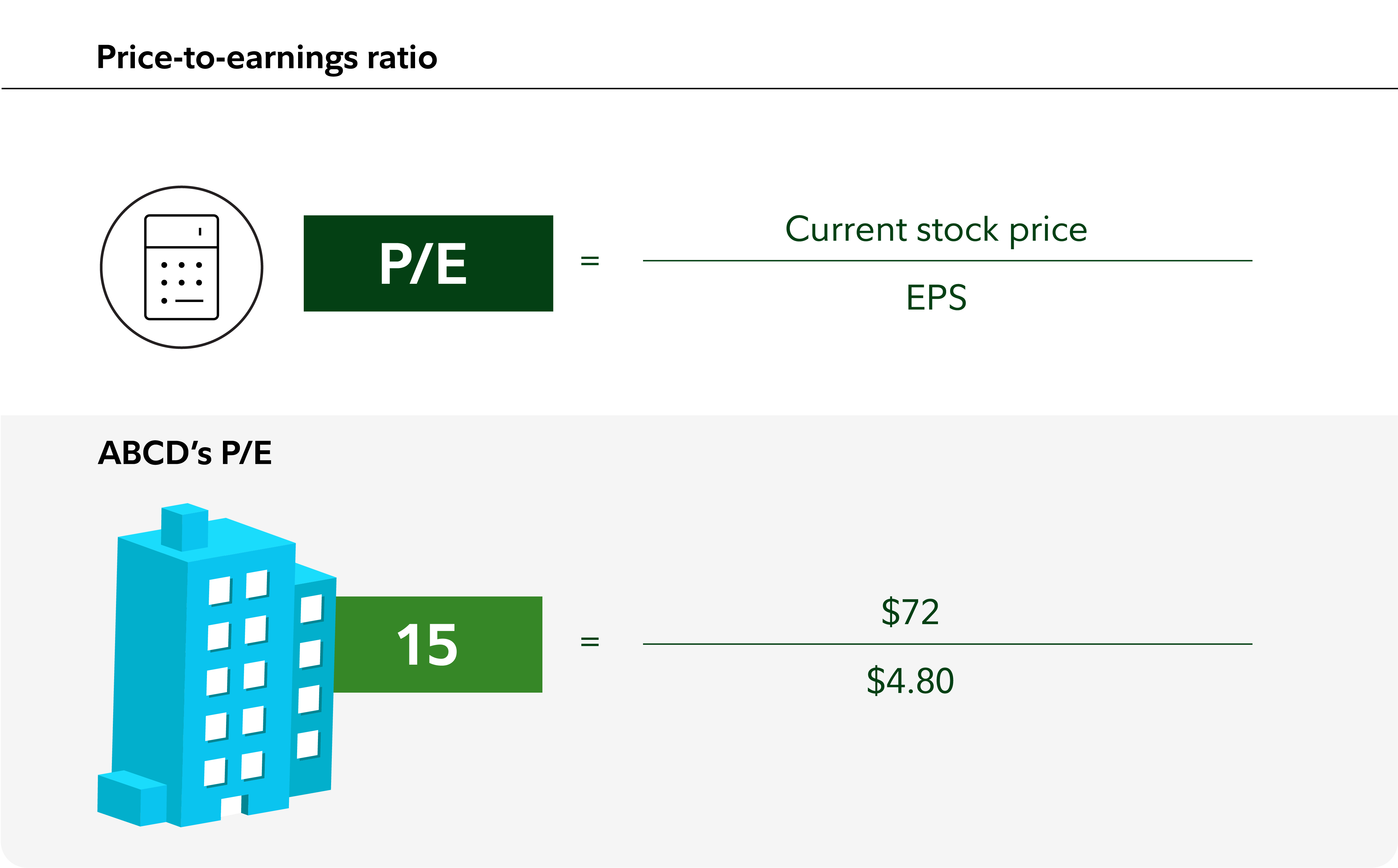

ABCD’s price-to-earnings (P/E) ratio will tell us how much investors are willing to pay for each dollar of a company’s earnings. A high P/E would indicate a pricey stock, while a low P/E could present a bargain, and who doesn’t love a bargain?

A P/E of 15 is generally considered low, which could make this a good deal! But remember, you’d want to compare this number to ABCD's historical P/E and other P/Es in the manufacturing industry to get a better sense of the whole picture.

How to use stock analysis when investing

Both fundamental and technical analysis require time, energy, and resources to make informed investing decisions. You don’t need a finance degree to use these tools, but you should be well versed. If you’re ready to dive in, here’s how you might approach stock analysis in your investing practice

- Step 1: Define your investing goals and time horizon

Get clear on your why and when—this will inform the what and the how. Not sure exactly what this looks like? No worries, this could help get you started.

- Step 2: Pick a company or industry to research that aligns with your goals

Understanding how the company makes money, what the competitive landscape looks like, and how the company is run will help you decide if this is the right investment choice for you.

- Step 3: Perform your analysis

Start with the fundamentals when deciding on a stock—evaluate the company’s financial statements for trends in earnings, revenue, and debt. Calculate ratios (like EPS, P/E, etc.) to gauge valuation.

If you want to get technical about when to buy or sell, analyze charts to find patterns or trends in the stock’s price history or trading volume and use these patterns to help identify potential entry or exit points. For more info and helpful tips, check out Fidelity’s technical analysis class.

- Step 4: Consider external factors

Look at overall stock market outlook and industry trends. Be mindful of how factors like inflation and interest rates could affect the company and the market.

- Step 5: Combine your findings

Once you’ve done all your research and combined all the data, determine whether or not the stock is a good investment for you.

Once you’ve completed your analysis and you’re feeling confident about taking that next step, you may want to consider placing a trade.