You can't escape inflation. You see it every time you stop at the grocery store or shop for a new appliance. Prices are going up everywhere—and that's what inflation is, a general increase in the prices of goods and services.

Inflation also means the erosion of your money's buying power. The $100 you tucked away 20 years ago and forgot about? It's only worth $60.13 today. Here's what you need to know about inflation and how to fight it.

The basics of inflation

Inflation is a general increase in prices of goods and services across the board. It isn't just an increase in the price of one thing, like movie tickets. But there are other types of inflation:

- Hyperinflation is exactly what it sounds like: a period of extremely high inflation, with prices rising by 50% in a year, or doubling in 3 years.

- Deflation is basically the opposite of inflation, when prices are generally falling.

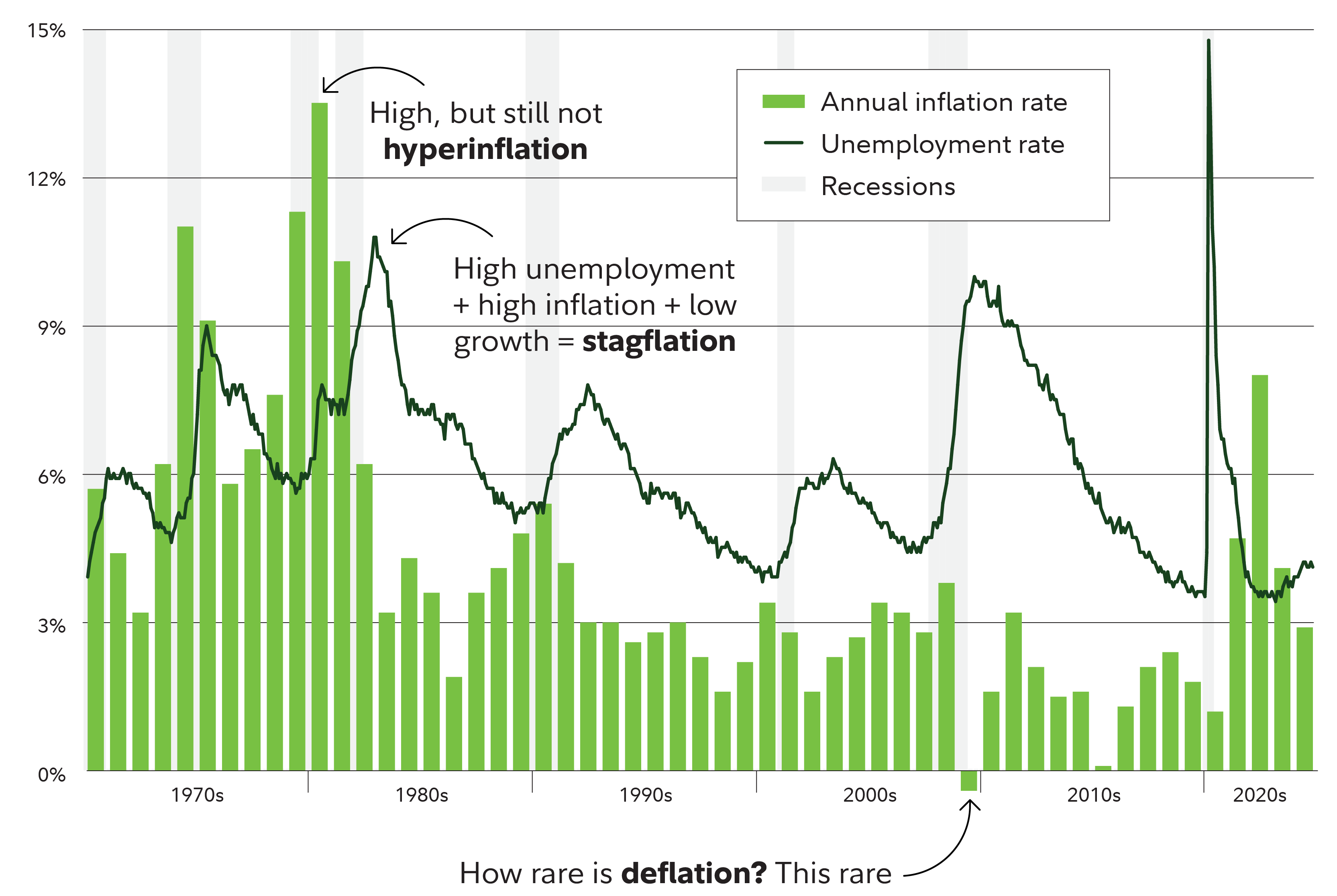

- And then there's the dreaded stagflation, a term that has been in the news a lot lately that refers to a combination of economic stagnation plus high inflation. (Usually, when growth slows and unemployment rises, inflation naturally comes down. But not always.)

All of these are terrible for the economy and, luckily, all of them are rare in modern developed economies. The following chart shows the interplay of inflation, unemployment, and recessions since 1970:

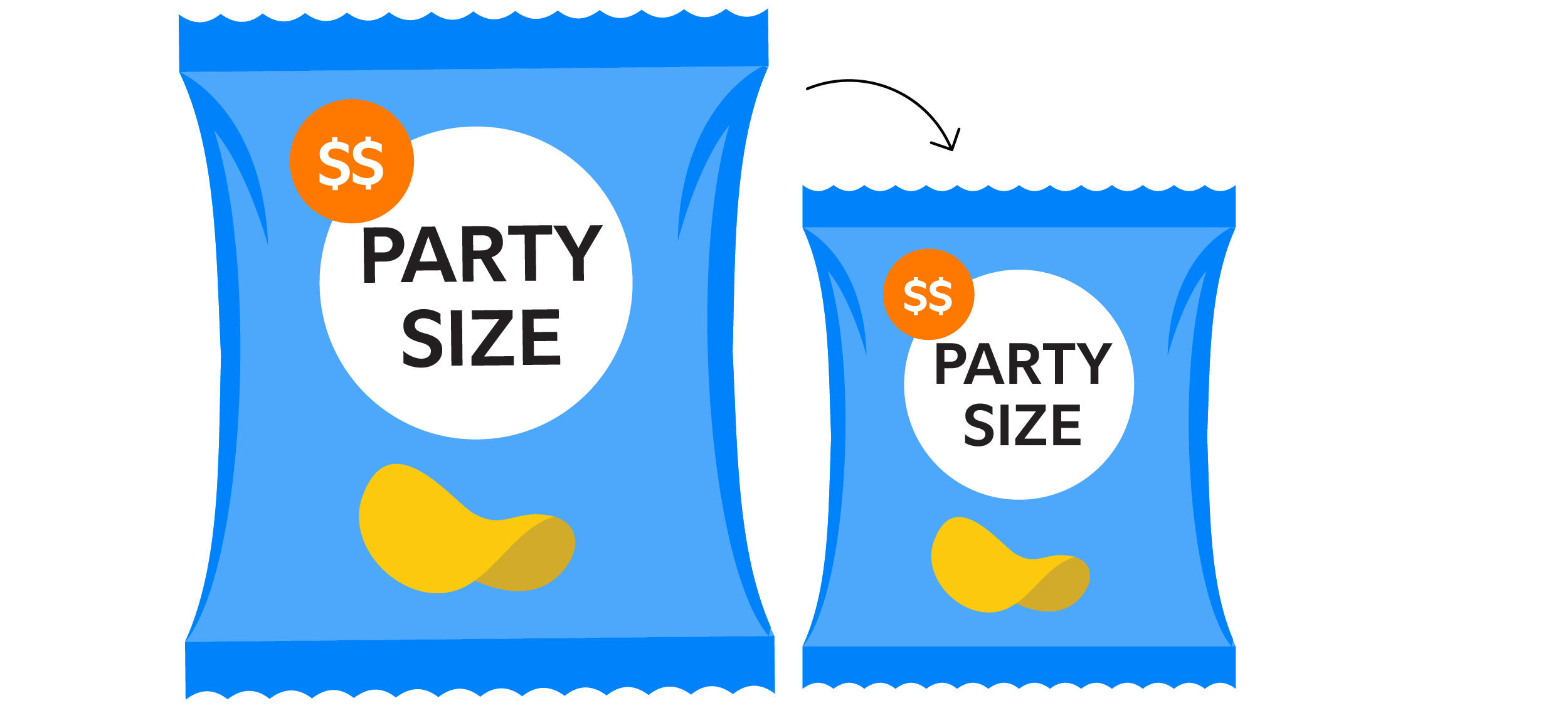

Another inflation term is getting a lot of consumer attention now: Shrinkflation, the practice of shrinking the size of a product but keeping the price the same. You've probably noticed your chip bags, candy bars, and cereal boxes all getting smaller, while prices remain the same or even go up. (Have you seen what they're calling a "party-size" bag of chips lately? Party of 2, maybe.)

How does inflation work?

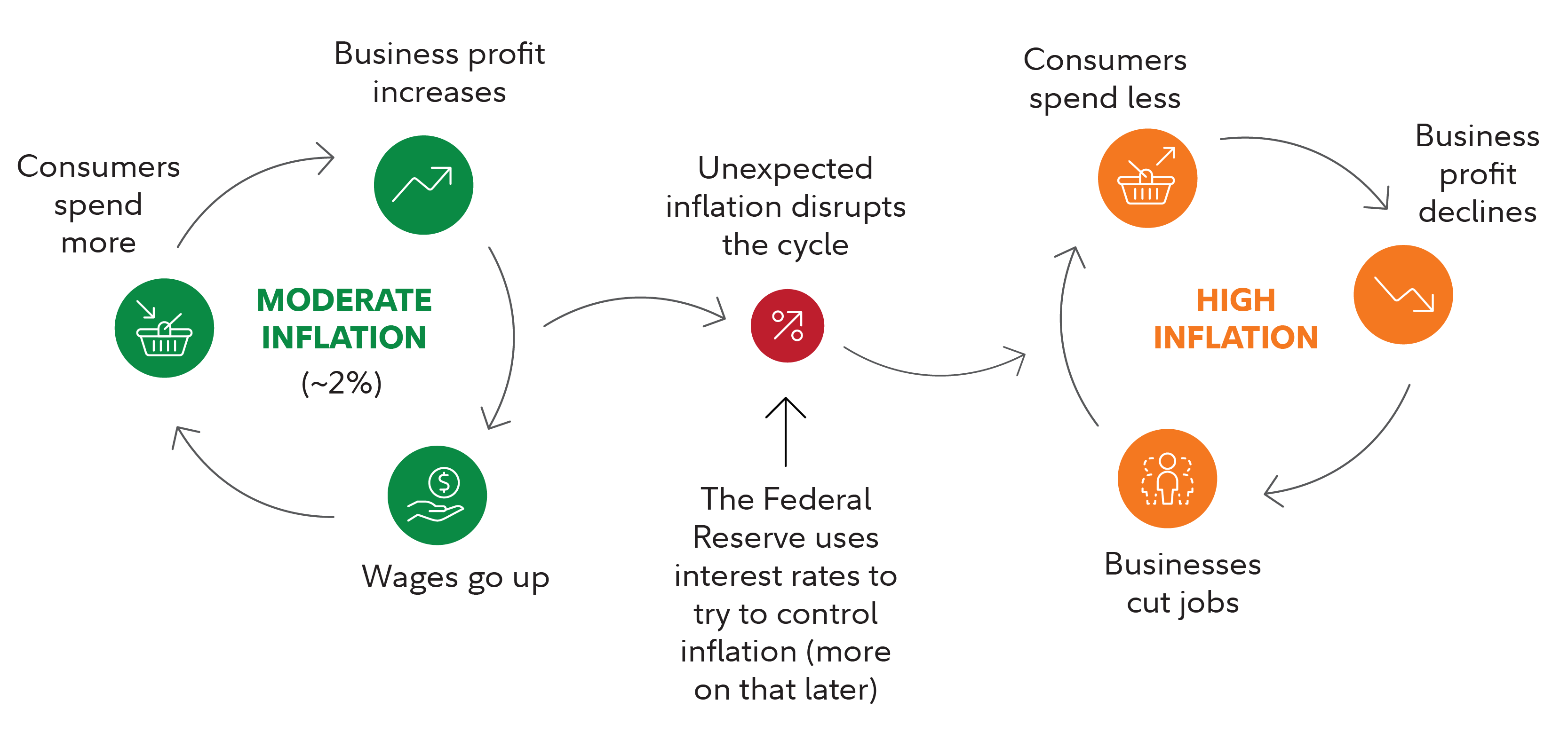

A little inflation is an important part of a healthy economy. Rising prices can mean higher revenue and earnings for businesses, if they can raise prices to keep up with their costs. This can also be good for investors. For workers, inflation is tied to higher wages, which go right in your pocket. But when inflation goes up too fast or is unexpected, that can throw a wrench in the works.

Inflation is just one of the things that can disrupt the economy. But when it does, it can disrupt the economy's healthy momentum.

What causes inflation

Inflation typically comes from 1 of 3 things: high demand from consumers and businesses, shortages of goods or services, or the expectation that inflation will continue.

- Demand-pull: When consumer demand is higher than the availability of a product or service, it pulls prices higher. Think about the post-pandemic summer of revenge travel when airfares skyrocketed because everyone you knew was going on vacation for the first time in 2 years.

- Cost-push: Supply constraints or an increase in the cost of production can push prices higher for consumers. We saw this in car prices driven higher by supply-chain bottlenecks with vital computer chips.

- Wage-price spiral: Sometimes referred to as "built-in inflation," this is what happens when people assume inflation is here to stay and start asking for wage increases and stocking up on goods before prices can go up even further.

How is inflation measured?

In general, the inflation rate is measured by comparing the price of a list of goods and services from one month to the next. Usually when you hear about inflation, it is measured by the Consumer Price Index (CPI), which is calculated monthly by the Bureau of Labor Statistics.

CPI is sometimes criticized because it doesn't accurately reflect increases in the cost of living. That's because people make substitutions when prices go up, maybe shopping sales more often, switching to store brands, or driving less. So the actual hit to your budget is slightly less than the inflation rate you see in headlines. (Consumers who prefer their name brands and better cuts of meat might quibble with this view.)

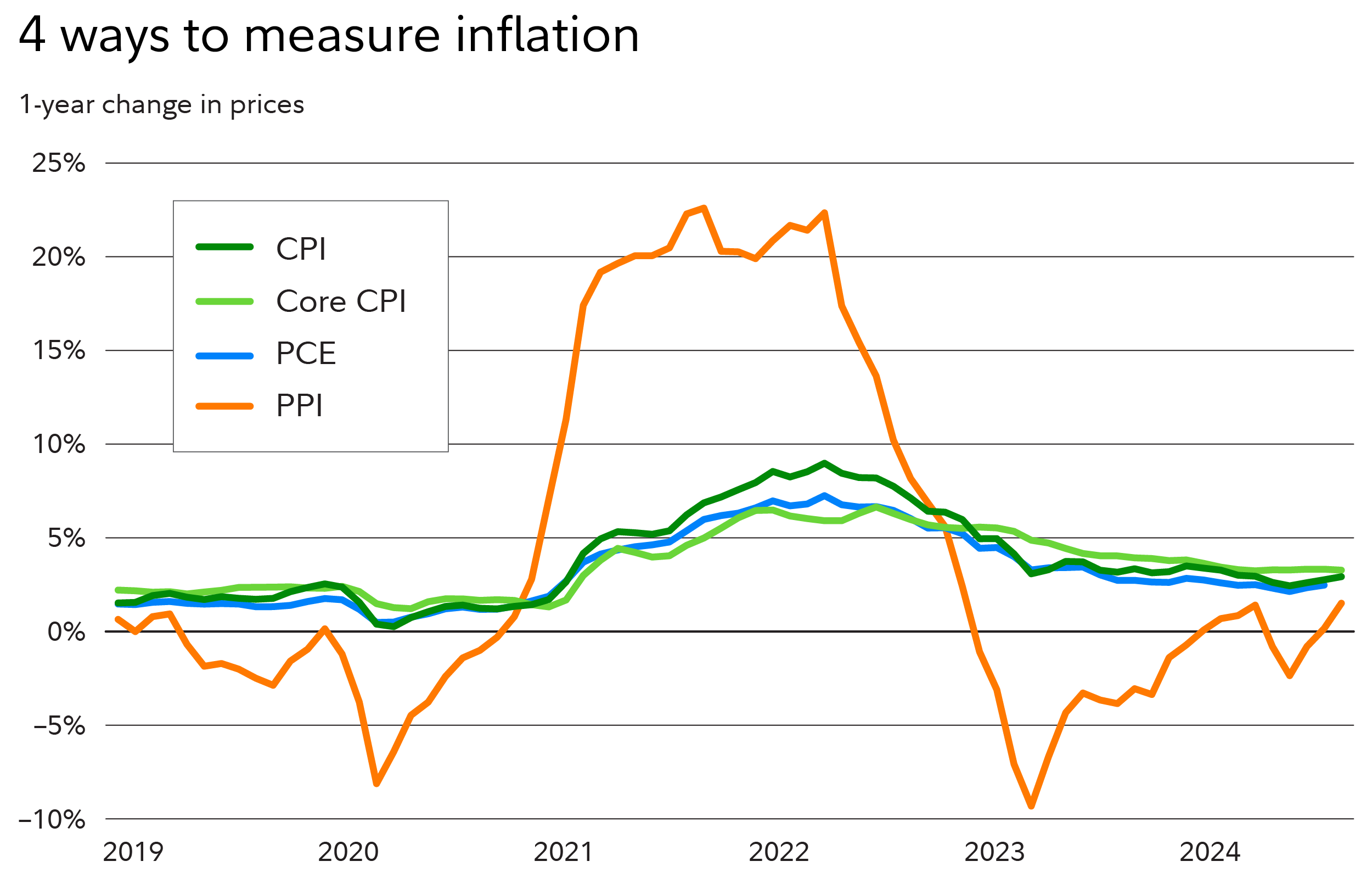

There are other ways to look at inflation:

- CPI minus food and energy ("core" CPI): Food and energy prices are both extremely volatile. They can drive inflation higher (or lower) even when other prices aren't changing much. So economists look at core CPI to see what underlying prices are doing.

- Personal consumption expenditures (PCE): The PCE price index also measures changes in the prices consumers pay for goods, but it accounts for changing consumer spending habits more quickly, so it tends to be a little lower than CPI. It also measures all spending, not just consumer spending. So while CPI includes what consumers pay for health care, PCE also counts what insurance companies and employers pay. The PCE is the preferred inflation measure for the Federal Reserve, the nation's central bank.

- Producer price index (PPI): The PPI is a measure of wholesale inflation, or the prices paid to manufacturers of goods and services. The PPI tends to foreshadow consumer inflation, because as producer prices go up, those increases will likely be passed on to consumers.

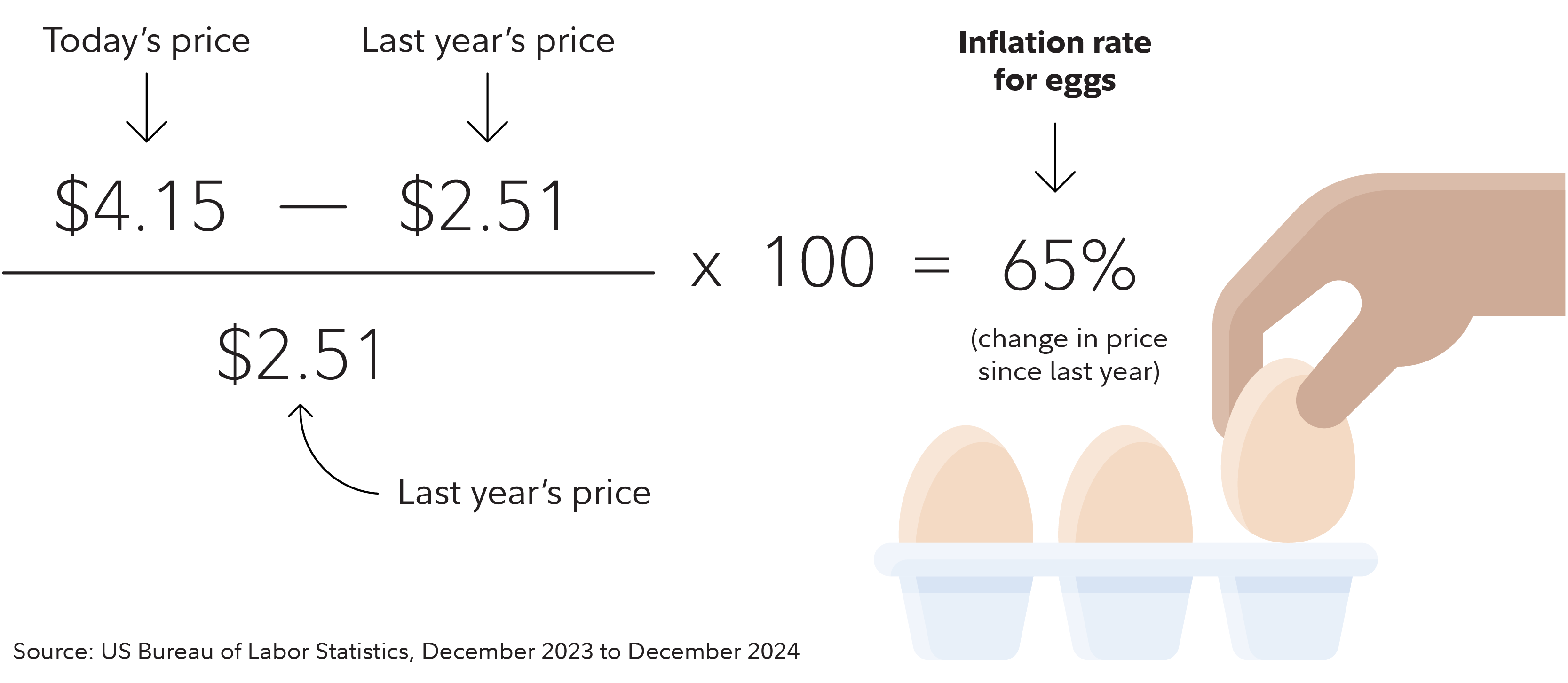

How to calculate the inflation rate

Government agencies calculate the inflation rate by collecting prices for hundreds of goods and services—from the price of milk and gas to the cost of housing—and comparing them month after month.

Let's use eggs as an example. In December 2023 you could buy a dozen Grade A large eggs for $2.51. One year later, the price was $4.15. Here's how you figure out the inflation rate for that carton of eggs:

That tells you the inflation rate for eggs. Apply that to 8,000 other items through a vastly more complicated formula that takes into account how much the average household spends on all these items in a given year, and you have the overall inflation rate.

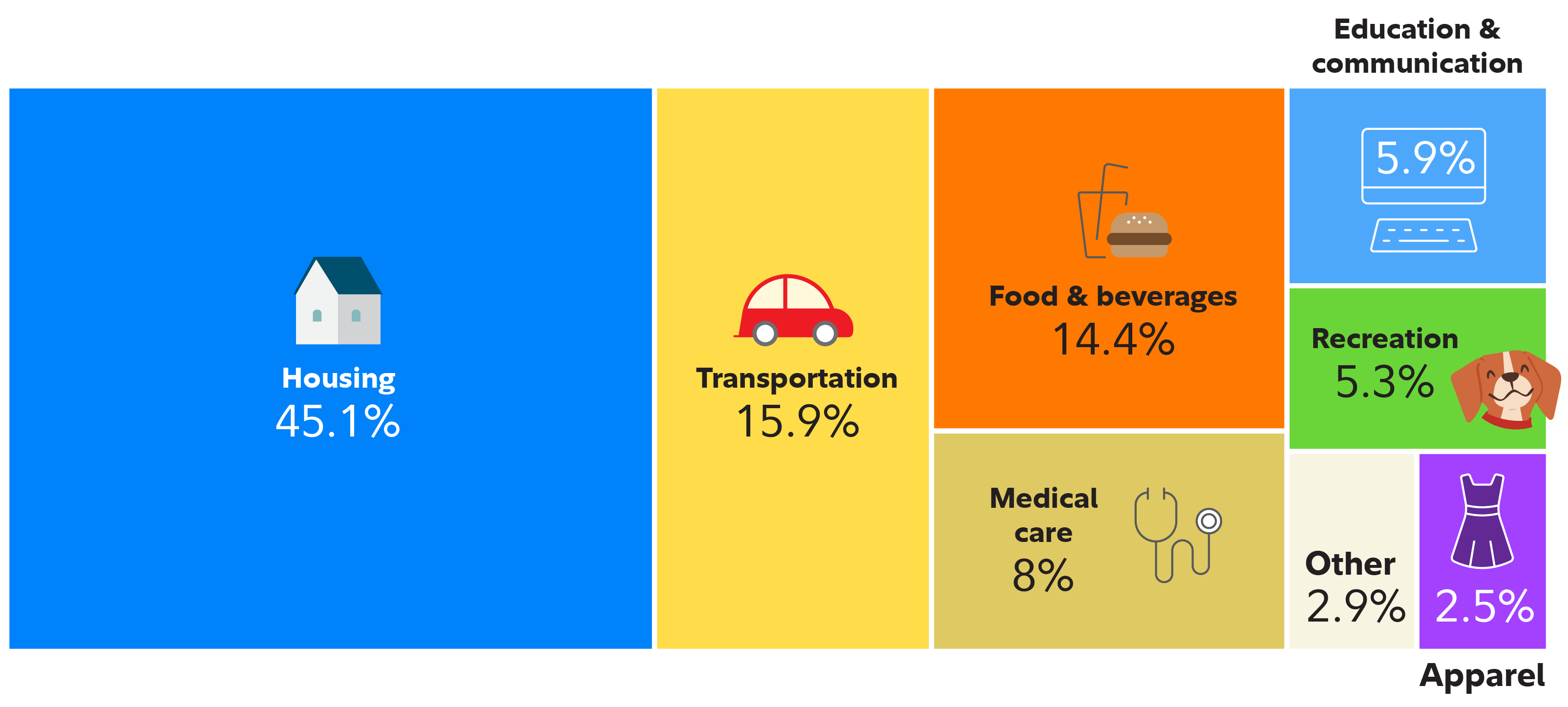

Here you can see how the 8 main categories of spending are weighted to make up the CPI. Think of this as roughly what percentage of a typical household’s spending goes to each category.

If you spend differently—maybe you don’t drive much or you have high medical expenses—your personal inflation rate may be different from the national inflation rate you usually hear.

How the Fed combats inflation

There are steps you can take to beat higher prices and protect yourself against inflation.

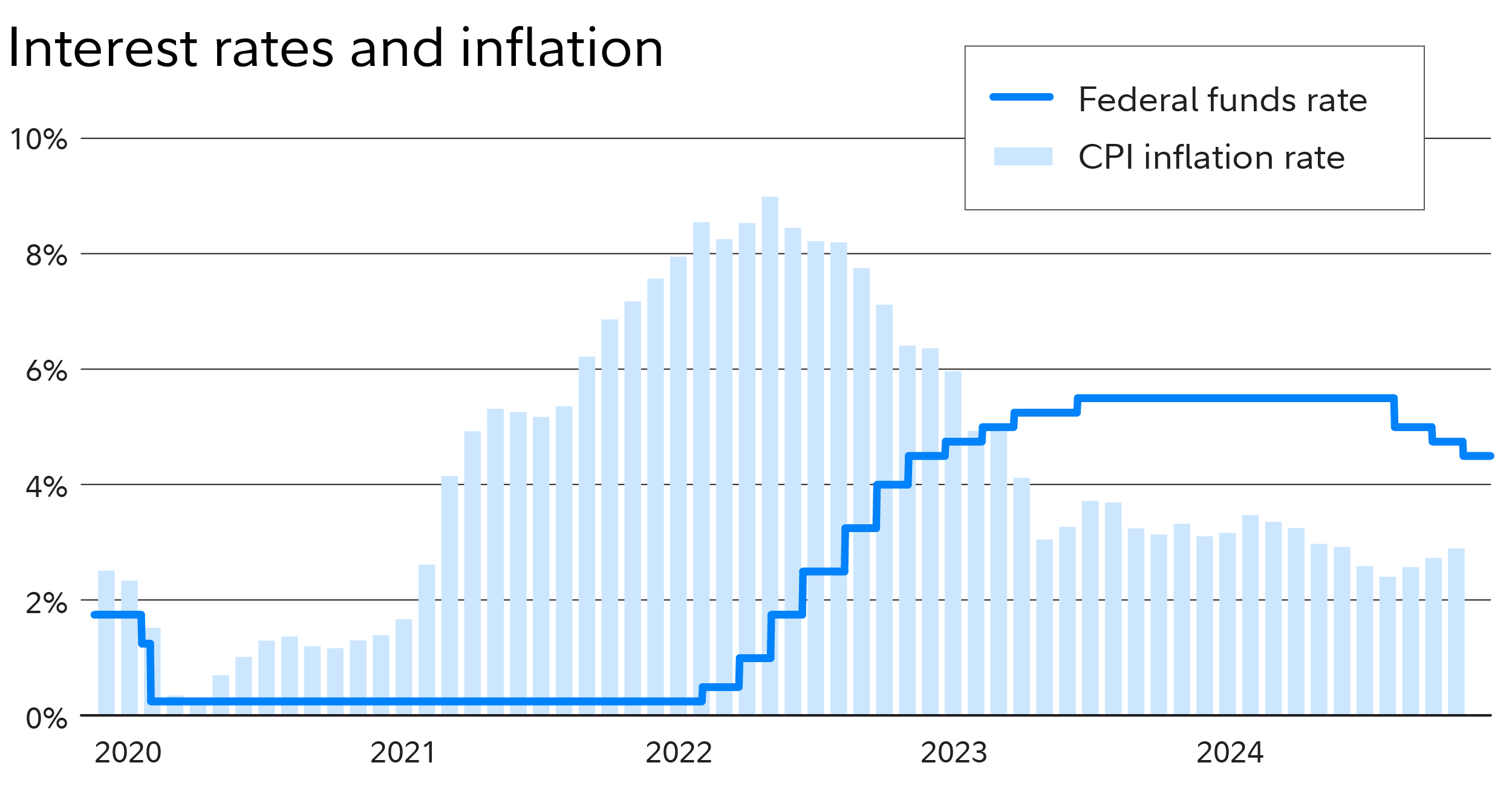

But it takes the government’s big gun, the Federal Reserve, to fight the impact of inflation on the economy. The US central bank aims to keep inflation to a target rate of about 2% (based on the personal consumption expenditures inflation rate, not the CPI). The Fed sets this target because it believes 2% inflation can help the economy maintain both maximum employment and a level of price stability.

The Fed’s top inflation-fighting tool: interest rates. Raising rates makes it more expensive to borrow money. That tends to dampen demand for goods and services, and put downward pressure on prices. But doing so without causing a recession is a delicate balancing act.

How can I protect my investments from inflation?

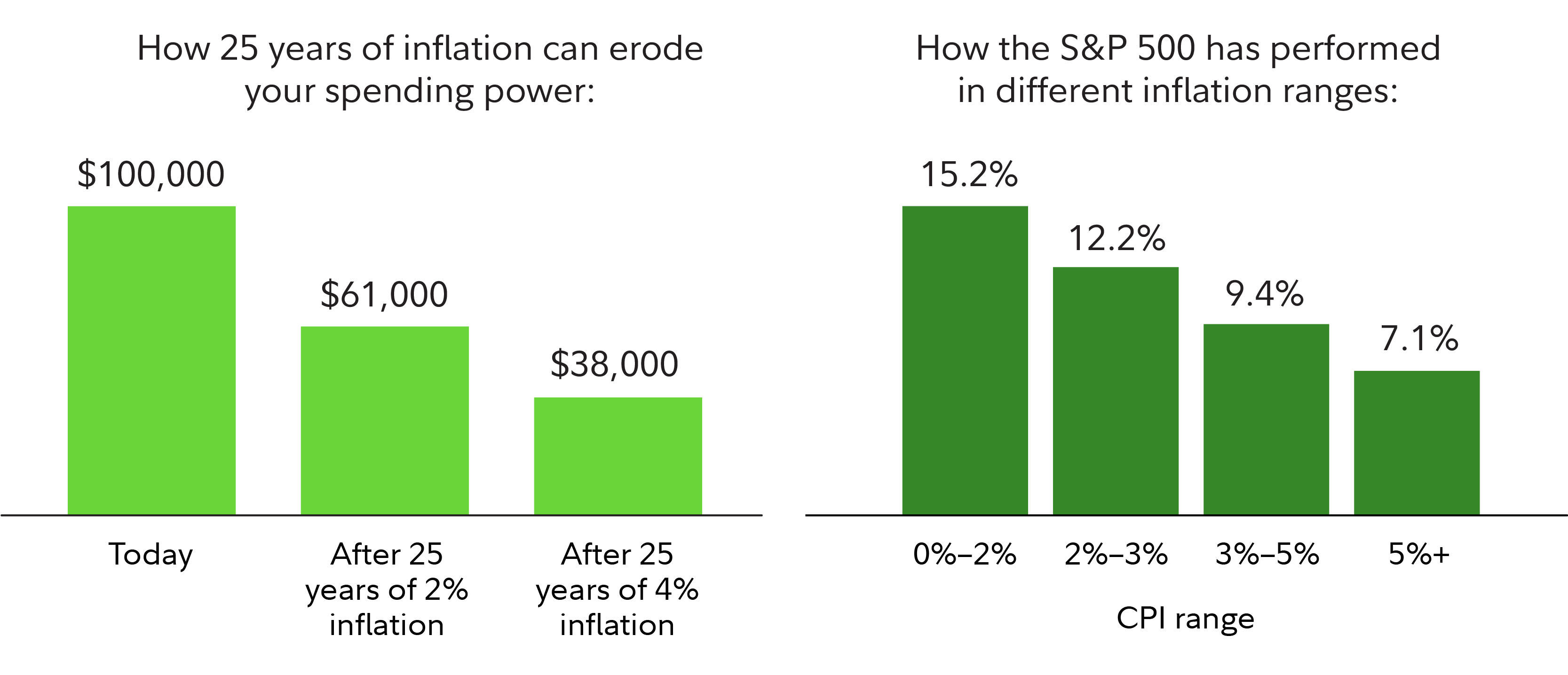

Remember that $100 we talked about earlier? Now imagine that’s your retirement savings. If you just put your savings in a bank account, the $100,000 you’ve saved during your working career might only be worth $60,000—or even less.

That’s why it is so important to invest appropriately. Invest your retirement savings too conservatively at a young age, and you run the risk that the growth rate of your investments won't keep pace with inflation.

Conversely, if you invest too aggressively when you're older, you could leave your savings exposed to market volatility, which could erode the value of your assets at an age when you have fewer opportunities to recoup your losses.

One way to balance risk and reward in your investment portfolio is to diversify your investments across a mix of stocks, bonds, and cash. Diversification doesn’t ensure profits or protect against losses, but it can mitigate the number and severity of stomach-turning ups and downs in your portfolio.

For investors hoping to inflation-proof their portfolio, some types of investments have historically kept pace with inflation better than others. Dividend-paying stocks, TIPS (Treasury Inflation-Protected Securities), and I-bonds tend to shine when inflation is high. Real assets like real estate and commodities can also provide some protection from inflation as well as diversification benefits.