Diversification is the concept of spreading your investing money around with many different types of investments.

Diversifying is typically considered an important strategy for long-term investors, because of the powerful way it can help reduce risk without sacrificing much in potential returns. Along with asset allocation, diversification is one of the most important concepts in successful long-term investing.

What is diversification?

Diversification is the idea of investing in a wide, diverse range of underlying investments.

It means making sure that you don’t have too much money in any one investment or type of investment. This can reduce your risk of losing money if one investment fails. With a wide variety of investments fueling your portfolio’s performance, it can also help provide more consistent potential returns.

Benefits of diversification

Experts may disagree about many aspects of the “best” way to invest. But they typically agree that diversifying can give investors a better shot at achieving their investing goals.

The benefits of diversification can include:

Smoother potential returns

While both stocks and bonds have historically provided positive returns over long periods, it’s very hard to predict how any individual stock or bond will perform in the near term. All investments can hit occasional bumps, and different individual investments tend to lead and lag at different times. Diversifying broadly increases your chances that at any given point in time, some parts of your portfolio are performing better than the laggards.

Reduced risk

When your money is spread around widely, there’s no single point of failure for your portfolio. If one company, or even an entire industry, goes through a rough patch, the impact on your total portfolio will be cushioned—because that one investment or group of investments will only make up a portion of your total investments.

Help in sticking with an investing plan

By reducing those portfolio bumps and giving investors more confidence that their money is invested appropriately, diversification can make it easier to stick with an investing plan over the long term—reducing the risk that, for example, an investor sells out of stocks when the market hits a temporary setback. It is important to note, however, that diversification and asset allocation do not ensure a profit or guarantee against loss.

Diversifying across asset classes

There are a few different ways of slicing diversification. At the highest level, investors should think about diversifying among asset classes—i.e., among the major categories of investments like stocks and bonds.

How you divide your money between stocks and bonds is called your asset allocation, and it’s important to understand that there’s no one-size-fits-all mix. Instead, you’ll need to come up with a mix that’s suited to your goals, time horizon, financial situation, and risk tolerance. Learn more about how to do this.

Diversifying within asset classes

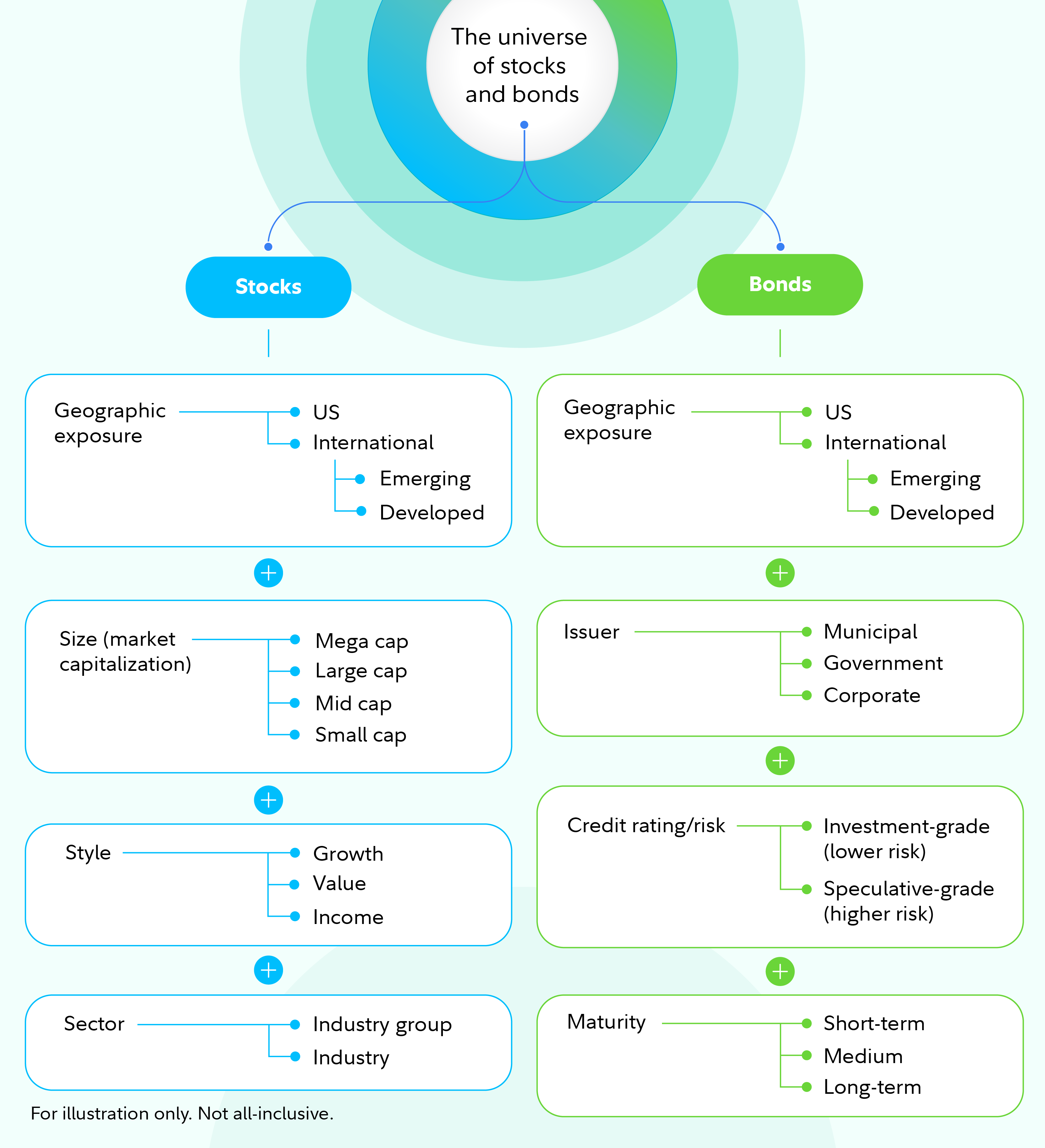

You can diversify further, within those major asset classes, by making sure you hold a variety of types and flavors of individual investments. Here’s what diversifying within stock and bond allocations might include:

Stocks

- Geographic exposure: In addition to US stocks, owning some international stocks, with a variety of exposures to specific regions and countries.

- Company size: Holding some shares of large, medium, and small companies (also called large, mid, and small caps).

- Stock style: Holding a mix of high-growth-potential companies and undervalued companies (also called growth and value stocks).

- Sector and industry: Owning different parts of the stock market, from tech, to energy, to health care and more.

Bonds

- Issuer type: Owning some bonds issued by the US government or government entities or corporations.

- Maturity date: Holding some bonds that come due in the next few years, and some that don’t come due for a decade or more.

- Company attributes: Within your corporate bonds, it can make sense to diversify among company types, just as you do with your stock holdings.

- Credit rating: Holding some bonds from highly rated issuers (which likely pay less interest), but also a bit from riskier issuers (which likely pay more).

- Bond structure: Bonds can vary widely in their specific structure and attributes—from inflation-protected, to convertible, to callable and zero coupon—so it can make sense to capture some of this diversity too.

How to diversify your portfolio

Diversifying your portfolio can be a lot of work, but it doesn’t have to be. Here are 3 ways to put diversification into practice:

1. Researching and choosing a diversified mix of individual stocks and bonds

This means picking each stock and bond in your portfolio one by one, and making sure it all adds up to a well-diversified mix. It’s possible, with the help of stock research and bond research tools, but it can be a heavy lift. (Note: Many individual bonds are sold with minimum face-value amounts of $1,000, which can make it particularly hard for the average person to put together a well-diversified bond portfolio.)

2. Investing with diversified mutual funds and ETFs

Mutual funds and ETFs are baskets of individual investments, and many of them are broadly diversified. Instead of having to choose potentially hundreds or thousands of individual stocks and bonds, many investors find they can build a well-diversified portfolio with a few mutual funds or ETFs. (Some mutual funds, like target date funds, are designed to provide diversification through a single fund.)

3. Handing the reins over to a professional

Many investors decide that they want to fully outsource the job of diversification to a pro. In this case, you don’t need to choose individual stocks and bonds, or even individual funds or ETFs—you just need to choose your professional and the kind of help you want. That could range from digital advice to a relationship with a dedicated advisor. In addition to easing your load, working with a professional can potentially provide broader benefits, such as seeking ways to improve your portfolio’s tax efficiency, and providing a sounding board when markets hit a rough patch.

Getting help with diversification

There are many resources that can help with diversification.

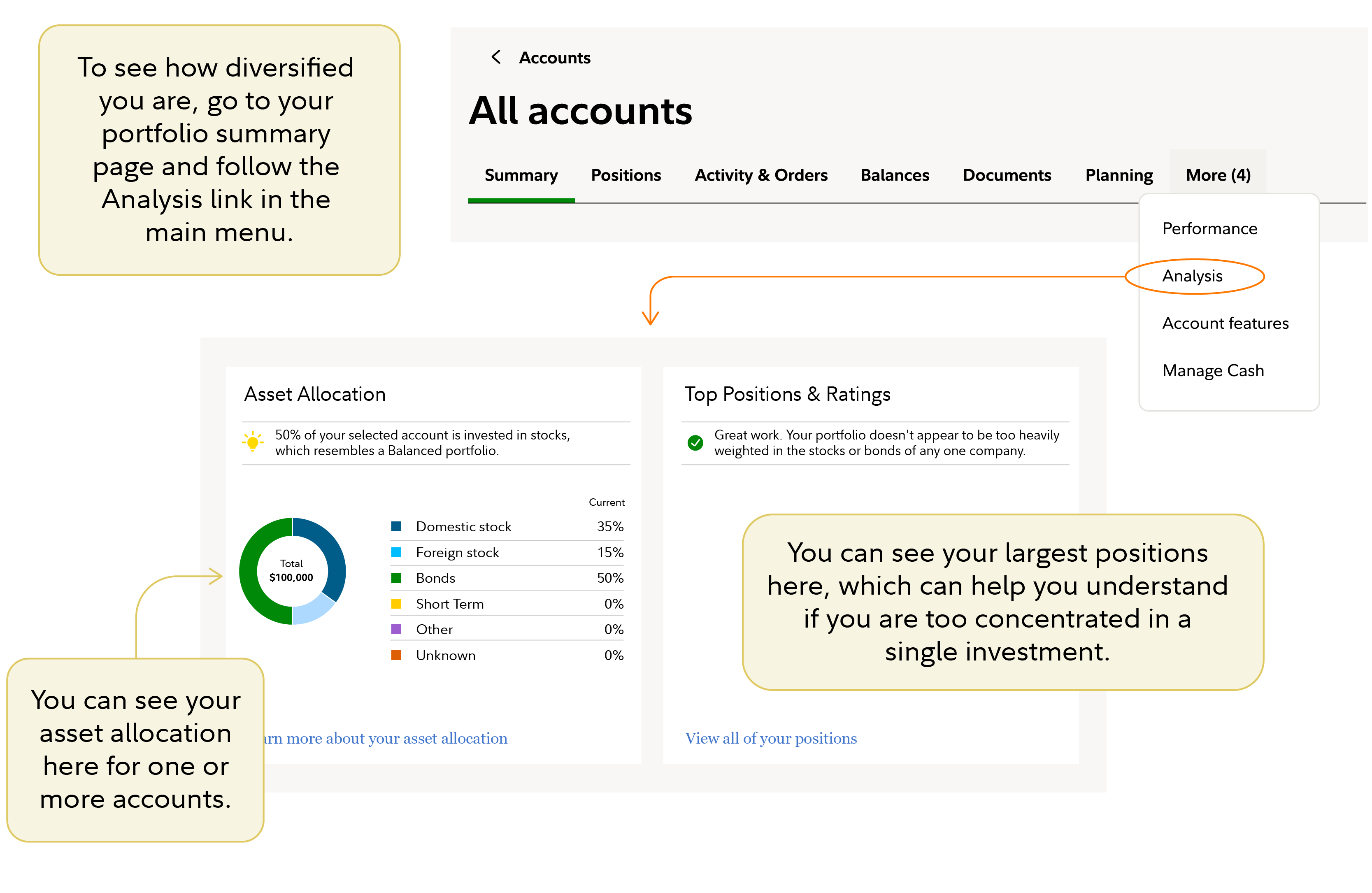

For starters, it’s important to understand whether you’re already diversified. Fidelity investors can drill into their asset allocation and diversification across all accounts, and also by individual account, by navigating to the Analysis section of their portfolio summary .

One clue that you’re not well diversified may be if you hold too much in one investment, in which case you may need to develop a plan to diversify that position.

If you’re struggling to understand your portfolio’s diversification or you’re not sure how to better diversify at this stage, consider bringing in professional guidance. Consider how we can work together, or take a quiz to see what type of professional management solution might fit your needs and goals.