Fixed Income, Bonds & CDs

Manage Your Fixed Income Portfolio

Build Your Fixed Income Portfolio

Fixed Income Alerts

Get timely updates on new issues, material events, and redemptions sent to your wireless device or Fidelity.com inbox.

Mutual Fund Evaluator

Find and easily compare fixed income mutual funds for any investment need.

Tools to be a More Informed Investor

Price/Yield Calculator

Calculate the estimated yield or price of a bond.

Tax-Equivalent Yield Calculator

Compare the yield between taxable and tax-exempt bonds.

Fidelity Auto Roll Service

Have your U.S. Treasury and CD investments automatically reinvested at maturity.

Preferred Security Screener

Preferred securities share characteristics of both stocks and bonds. Fidelity provides an array of criteria to help you filter these securities' unique attributes.

Other Income-Generating Products

Some companies pay out a dividend, or a portion of their profits, to stockholders. Dividends are not fixed and yields can vary because of increases or decreases in the share price.

Income Planning and Investment Strategy

Analyze your investment strategy, review asset allocation decisions, and create an income strategy.

Planning & Guidance Center

See how well your investments align with your financial goals.

Building Savings

Saving for big goals doesn't have to feel overwhelming. We'll help you get there, step by step.

Contact Us

- 800-544-5372 800-544-5372

- Fixed Income Service Messages

A bond ladder, depending on the types and amount of securities within it, may not ensure adequate diversification of your investment portfolio. While diversification does not ensure a profit or guarantee against loss, a lack of diversification may result in heightened volatility of your portfolio value. You must perform your own evaluation as to whether a bond ladder and the securities held within it are consistent with your investment objectives, risk tolerance, and financial circumstances. To learn more about diversification and its effects on your portfolio, contact a representative.

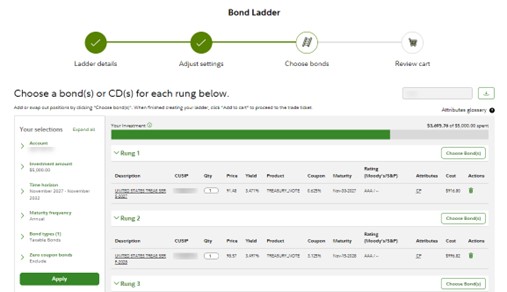

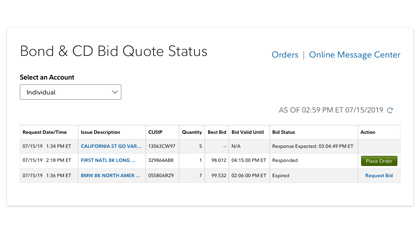

Screenshots are for Illustrative Purposes Only.