Asset allocation is one of the most important concepts in successful long-term investing.

Your asset allocation is your overall mix of major investment types, like stocks versus bonds.

While investors often get caught up in more granular decisions—like whether they should invest in this stock or that stock—in truth, your asset allocation is typically much more influential in driving your portfolio’s performance.

What is asset allocation?

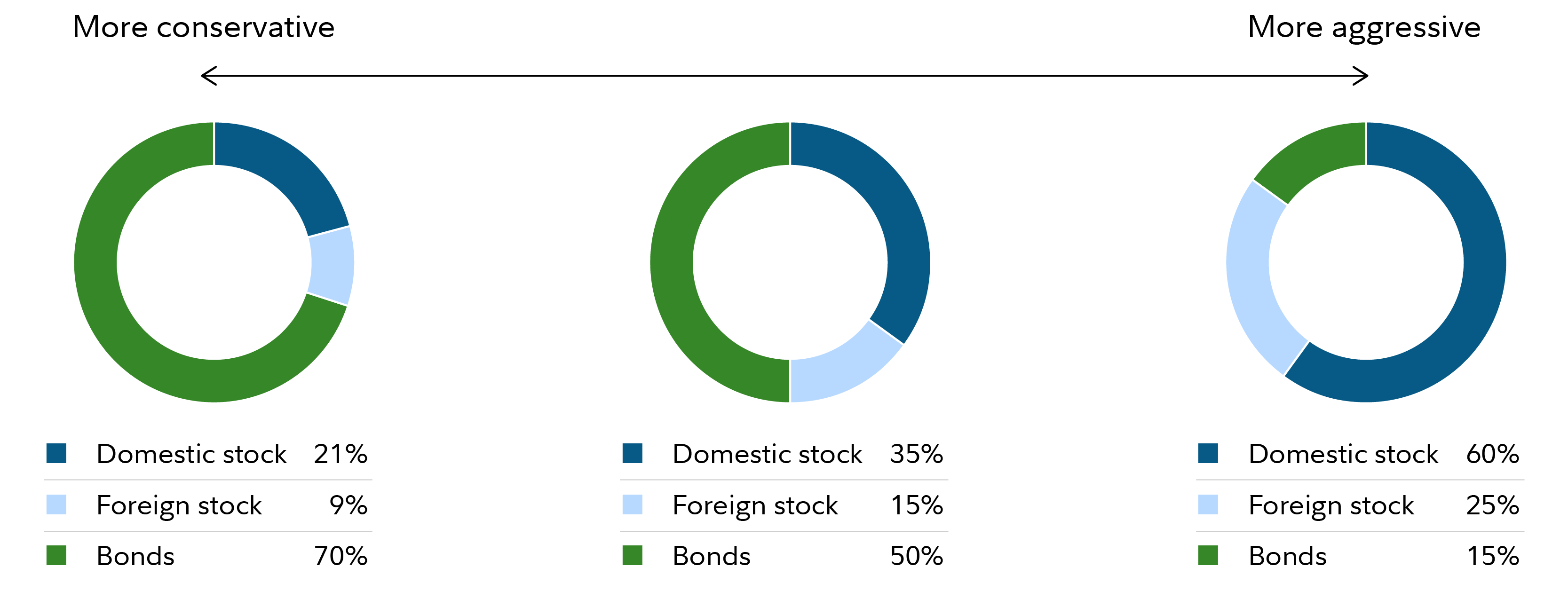

Your asset allocation is your big-picture mix of assets, meaning the percentage of your investments in stocks, bonds, and cash. Here are some examples ranging from very conservative asset mixes, with lots of bonds, to more aggressive ones, with a higher allocation to stocks.

Why is asset allocation important?

Asset allocation is so important because it tends to be a key driver of how your portfolio performs over the long term. For example, a portfolio that holds 80% in stocks and 20% in bonds is likely to perform very differently than a portfolio with 20% in stocks and 80% in bonds.

Asset allocation typically goes hand in hand with diversification—which refers to the mix of investments within each of the major asset buckets. Holding a wide range of individual investments within each bucket can reduce the risk that any one stock or bond could significantly undermine performance. When used together, asset allocation and diversification can provide a range of potential benefits, such as:

Smoother portfolio performance

US stocks, international stocks, and bonds have all historically provided positive returns over long periods. But they all can hit bumps along the way, and they tend to lead and lag at different times. By holding some money in each major category, you can increase your chances that any temporary poor performance in one group will be offset by strong performance in another. This can cushion the impact of those bumps on your total portfolio.

Better chances at achieving investing goals

By allocating money among different types of assets and diversifying among a wide variety of underlying individual investments, investors may reduce the chances of an extreme outcome—like significant loss—particularly over long periods. Using asset allocation appropriately can also help investors ensure they’re not taking on a level of risk that would jeopardize meeting their goals.

Help in sticking with an investing plan

By reducing those portfolio bumps and giving investors more confidence that their money is spread around appropriately, asset allocation and diversification can make it easier to stick with an investing plan over the long term—reducing the risk that, for example, an investor sells out of stocks when the market hits a temporary setback.

Asset allocation and diversification do not ensure a profit or guarantee against loss, and it’s always possible that the future could look different from the past. But these strategies can help put the odds of success on an investor’s side—particularly for long-term investors.

What is the best asset allocation?

There is no single best asset allocation, just as there is no single best investment.

Instead, for a given investor and their goals, there may be a range of reasonable asset allocations. Considering your preferences, needs, time horizon, and full financial picture can often help narrow that range, so you can zero in on a specific asset allocation to use.

How to choose an asset allocation

Developing an asset allocation is mainly about striking an appropriate balance between potential risk and potential return. There are 3 key factors that go into this:

1. What is your goal and how far away is it?

Investing professionals typically suggest developing a distinct asset allocation for each of your goals (like one allocation for your retirement money, but a separate one for your child’s college money). The further away a given goal is, the more risk you may be able to take on with that money—in pursuit of potentially higher returns. That’s because with a longer time horizon, your investments will have more time to recover from any short-term declines in value along the way.

2. How much risk can your financial situation support?

Similarly, this comes down to how well you’d be able to weather any temporary declines in your portfolio’s value. If you have solid emergency savings, sufficient insurance coverage, and a steady paycheck from a reasonably safe job, then you may have a relatively high capacity to take on risk. By contrast, if you have no emergency fund, and your job is unsteady or your income is unpredictable, you may have less.

3. How comfortable are you with market ups and downs?

This is also called risk tolerance. As mentioned above, one crucial aspect of successful investing is staying invested through market ups and downs—in particular, not selling your investments when the market goes through a downturn (which can be many investors’ instinct). Determining your risk tolerance means finding the right balance for you, so you capture enough potential gains over the long run, but not so much risk that you get anxious in the short run.

If these 3 factors point to taking on more risk, and pursuing higher potential returns, then your asset allocation should typically include more stocks and less bonds. If they point toward less risk and lower potential returns, then a mix heavier on bonds and lighter on stocks may be appropriate.

Asset allocation models and strategies

Model asset allocations are widely available online and can help you get a feel for what mix might be a fit for you. With Fidelity, investors can explore model portfolios using Fidelity mutual funds, or view model asset allocations with ETFs using the ETF Portfolio Builder.

Your investing strategy should also include periodically revisiting your asset allocation and updating it as necessary. You might need to revisit your asset allocation if there’s a change to a goal or your financial situation. As a given goal draws nearer, you’ll likely want to gradually reduce risk in your asset allocation for that goal. For example, many investors start gradually reducing how much they hold in stocks and increasing how much they hold in bonds as they near retirement.

How can you manage asset allocation?

Even after you’ve chosen an asset allocation for a given goal and gotten invested, you’ll still have to do some routine management to make sure your asset allocation is staying on course.

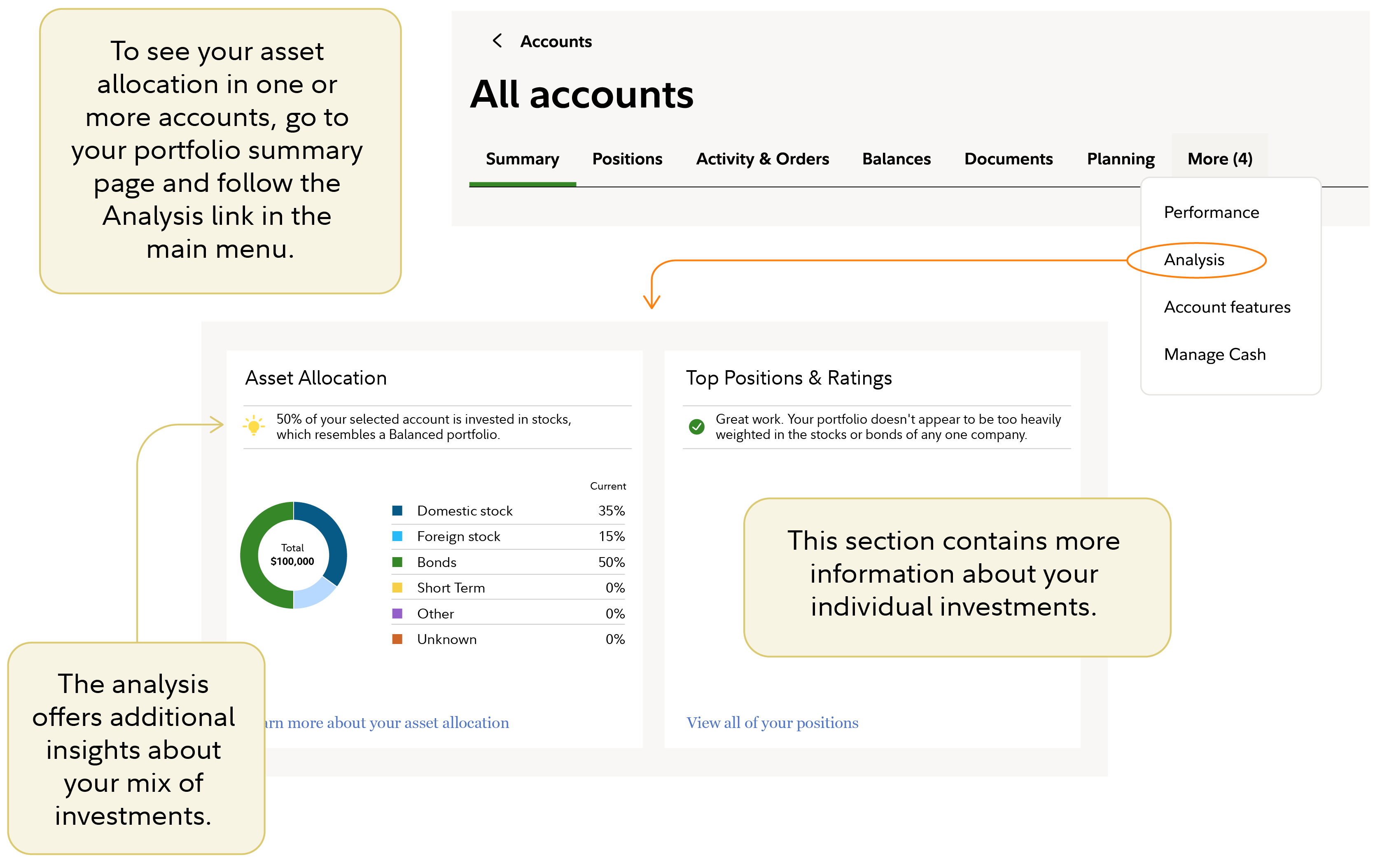

Fidelity investors can see their asset allocation across all accounts, and also by individual account, by navigating to the Analysis section of their portfolio summary.

If your asset allocation has drifted off course for one reason or another, consider rebalancing to bring it back on track.

Finally, many investors find that choosing and managing their asset allocation is overwhelming or confusing. Fortunately, there are plenty of options for professional help that can meet you where you are. Those include:

- Personalized service with a financial professional. By understanding your situation or your family's, a financial professional can help tailor your financial plan for multiple goals, such as retirement, education savings, and more. And they can support you through inevitable periods of market volatility, helping you stay on track when the going feels tough.

- All-in-one-funds. These are mutual funds that hold a mix of stocks and bonds. Many of these funds also automatically reduce their risk exposure over time. Target date funds are an example of all-in-one funds.

- Robo advisors. These are typically online services that use automation to provide asset allocation and portfolio management at a relatively low cost. Fidelity’s robo advisor is called Fidelity Go®.

If you’re interested in getting help with your asset allocation but you’re not sure what might be a fit, you can take a short quiz to better understand how we might be able to help.