It’s easy to focus on the most obvious advantages of health savings accounts (HSAs), such as their tax benefits. But don’t overlook another key trait: portability. Once you’ve had an HSA-eligible health plan and opened an HSA, the money in it is yours to keep and do with as you please (within plan and IRS rules), including transferring it to a new HSA at a different provider through what’s called an HSA rollover. This is not the only method of transferring your HSA, so be sure to research different ways to consolidate multiple HSAs.

What is an HSA rollover?

An HSA rollover is when you transfer your HSA from one provider to another. This could be an HSA that you open on your own at a financial institution or one that you get access to through a new employer.

The ability to carry your funds with you—across many jobs and different calendar years—makes HSAs a unique way to save for health costs. You may also be able to choose preferred providers even while tied to employer-sponsored plans. In contrast, money held in a flexible spending account (FSA), which similarly allows you to save pre-tax dollars for health expenses, is typically forfeited if it’s unused when you leave a job or when the calendar year ends. (For more on the differences between the 2 main types of tax-advantaged health-related accounts, check out our guide to HSAs vs. FSAs.)

Taxes and HSAs

Typically, HSA consolidation is tax-free. You don't owe taxes for rolling over cash or securities. If investments are potentially sold, however, state taxes may be owed on capital gains (depending on where you live).

Specifically, for residents of California and New Jersey, HSAs don't receive special state tax treatment. In these states, HSAs are viewed like typical brokerage accounts, and state taxes may be owed on dividends, interest, and capital gains.

In New Hampshire, HSAs don’t receive any state tax benefits on the sale of investments, but capital gains aren't taxed in this state. That means consolidating accounts won’t result in additional taxes (although dividends and interest earned remain taxable in New Hampshire).

Benefits of HSA rollovers

You can consolidate your health savings in one place.

Because each job change typically means a new health plan, you may accumulate quite a few HSAs by retirement. Managing all of those details, logins, and investments could be a chore. If you value centralization, it may be worthwhile to consolidate your HSAs.

You may minimize account fees.

Even if you didn’t have to pay fees while working for the employer that sponsored your HSA, that company may charge fees once you part ways—taking a bite out of your savings over time.

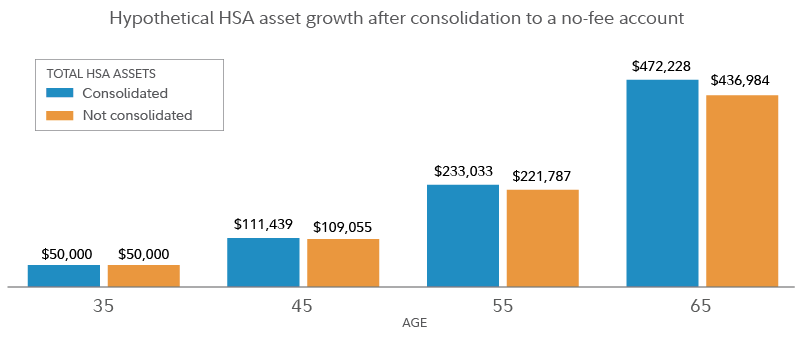

To show the potential benefit of rolling over an HSA with fees to a no-fee HSA provider, take this hypothetical example. Consider a 35-year-old with $50,000 saved between 2 HSAs. She holds $20,000 in a no-fee HSA and $30,000 in another with a 0.50% annual fee. If she consolidated her HSAs into the no-fee account, she could potentially have almost $40,000 more over 30 years.

You can get access to investments that suit you.

The ability to invest HSA money and potentially benefit from compounding returns over time is a significant benefit of HSAs. However, when you open an HSA through your employer, you’re limited to the investments available in that plan. If those investment options don’t meet your needs or line up with your goals, it may make sense to move your HSA to a provider that offers investments you do like.

Your current provider may also have requirements regarding how much money you need in the HSA before you can start investing, such as a minimum balance of $2,000. Rolling over your HSA may allow you to find a different provider without similar barriers.

How to perform an HSA rollover

- Find a new HSA provider.

Make sure to evaluate investment options, minimums, and any fees at new HSA providers. If you recently moved to a new employer and are enrolled in an HSA-eligible health plan, look into your employer-sponsored HSA. Even if you decide to roll over old HSAs to a different provider, it may be worth also opening an HSA through work if your company makes employer contributions on your behalf. Note that only HSA contributions deducted from payroll allow you to avoid Social Security and Medicare taxes, so keep this in mind when deciding whether to contribute to a workplace or retail HSA. Unsure how to proceed? Consult a tax professional with questions.

- Request that your old HSA provider rolls over the cash to your new provider.

HSA rollovers can be performed in a few different ways:

- Your old provider may directly transfer your funds and any investments to your new provider.

- Your old provider may ask you to sell off your investments and then transfer only cash to your new provider.

- Your old provider may ask you to sell your investments and then send a check or electronic transfer with your HSA funds directly to you.

If you receive a check or electronic transfer, you must deposit the funds yourself with the new provider within 60 days. If you don’t, the IRS considers this a taxable withdrawal, which means you may owe taxes and a 20% penalty. Also, be aware that if you use the check-based method for your rollover, you can only perform one rollover per 12 months if the check is sent directly to you. If you wish to roll over multiple accounts, it could take longer than a year to move them all if the check is addressed to you. Recall that there are different ways to consolidate multiple HSAs, however, so be sure to reach out to your HSA providers and a tax professional to determine what options are available and how to proceed.

- Keep contributing to and investing through your HSA.

As long as you remain in an HSA-eligible health plan, you can contribute to an HSA, even if your new employer doesn’t offer one. If you are no longer in an HSA-eligible health plan, you still maintain ownership of your HSA and can manage any investments in it, though you won’t be able to add new dollars until you’re back in an HSA-eligible plan. If you had to sell your investments as part of the rollover process, make sure to reinvest the proceeds to take advantage of potential investment growth over time.