There are plenty of ways to help make the most of your money at the end of one year and the beginning of another. Start here for tips on investing, taxes, saving, and spending.

1. Ramp up your investing

Whether you have a 401(k) or just an extra $401, this Smart Money playbook could teach you how to help your money work harder for you and get started with investing. Think: choosing an account, building your first portfolio, and creating an investing game plan.

2. Book medical appointments and spend FSA money

Consider getting health checkups before the end of the year. That way, if you’ve met your insurance plan’s deductible, you could pay less for services before the January reset. If there’s money left in your FSA, spend it on eligible expenses, then submit those receipts before your employer’s deadline (usually December 31) to get reimbursed. You might also double check if your employer offers a grace period to use your funds after the year ends or allows you to carry dollars over. Have a health savings account (HSA)? Those funds don’t expire—here are some little-known ways to spend them.3. Plan for charitable giving

These tips could help you make a difference in 15 minutes or less. If you plan on donating money and itemizing your deductions, you could potentially reduce this calendar year’s tax bill if you contribute to an eligible organization before December 31. (Do a quick search here.)4. Contribute to tax-advantaged accounts

You could reduce your taxable income—and save for retirement—by putting money in an eligible retirement account before the end of the year. Most accounts, like 401(k)s and 403(b)s, have a year-end deadline. But other account types, such as IRAs and HSAs, allow contributions up to the annual limit for the past year until the tax-filing deadline in April. However, for HSAs, waiting until April could mean making a contribution outside of payroll deductions, potentially incurring FICA taxes that could have otherwise been avoided if the contribution had been made through payroll deductions by December 31 of the previous year.

If you're also saving for education, keep those deadlines in mind too. Some states' 529 plan accounts have a year-end deadline to get state tax breaks.

5. Book your tax-prep appointment

Speaking of tax breaks, if you plan on getting a tax preparer's help with filing taxes for 2025, reserve your appointment in December or January before your preferred date is booked up. Wondering when to file taxes yourself and when to call in a pro? Here are your tax-filing options, explained.

6. ... and plan to file early

Some tax preparers offer deals early in the tax season when they have more time. Filing ASAP might also help you avoid filing late, which could come with penalties if you owe taxes. Even if you don't file early, now's a good time to gather receipts for expenses/donations you plan to itemize. And whether you go solo or with a tax pro, the IRS says you'll get a refund faster (if you're owed one) by filing electronically and including your direct deposit info. Just watch out for these 8 tax pitfalls.

7. Ghost your holiday shopping cart

You might get a deal if you don’t check out immediately. When retailers see that you’ve abandoned something in your cart, they might email you a coupon to encourage you to complete your purchase. Here are 12 other ways to stay on budget with gifts.8. Plan your PTO

If you plot out certain days you want to take off work in the year ahead, you might be more likely to use all your time off. Plus, if your manager allows you to put in requests early, you might get first dibs on popular days off (hello, Labor Day weekend). Also check if your employer will pay out your PTO if you don't roll it over.

9. Automate money transfers

Consider a New Year's resolution to save and invest. Taking the decision-making out of it through auto transfers could help ensure you do both regularly. Yeah, you'll have to decide how much to stash and where that first time, but after that, you can forget about it for a while—and be sure your money's working for you. Saving and investing any amount could help kickstart a savings habit. Here are 8 other ways to snowball your savings.

10. Pay quarterly taxes

If you don’t have an employer withholding taxes on your behalf (because you’re a freelancer, side gigger, self-employed, or have substantial investment income) the quarterly deadline to pay taxes is January 15, 2026 for the September 1 to December 31, 2025 income period. You might need to make these quarterly estimated payments if you expect to owe more than $1,000 when you file your tax return or if you owed taxes last year.11. Make a plan for your bonus (or tax refund)

If you're expecting some extra green, consider how to use it to get closer to your money goals. Maybe that's paying off high-interest debt, adding to a rainy-day fund, or putting more toward long-term savings. Whichever you decide, plan to enjoy some of it too. Celebrating small milestones, such as with a fancy dinner out or a weekend away, could help reinforce your good habits and motivate you to keep making wise money decisions over time. Here are some options for your windfall.

12. Think through a big purchase

Before you start thinking about a home down payment or bucket list trip, do a budget audit. Look at last year’s income, expenses, and what was left over to anticipate how this year could go. (Psst … if you’re a Fidelity customer, Fidelity’s Budgeting Tool can whip up a personalized budget for you.)

Next, figure out how much you need to save and how long you’ll need to get there. Consider trying Fidelity Goal Booster, which can do the math for you. You can also learn more about options for potentially growing your money, such as by investing in a certificate of deposit (CD) or money market funds for goals under 3 years away, or with certain investment allocations for goals more than 3 years away.

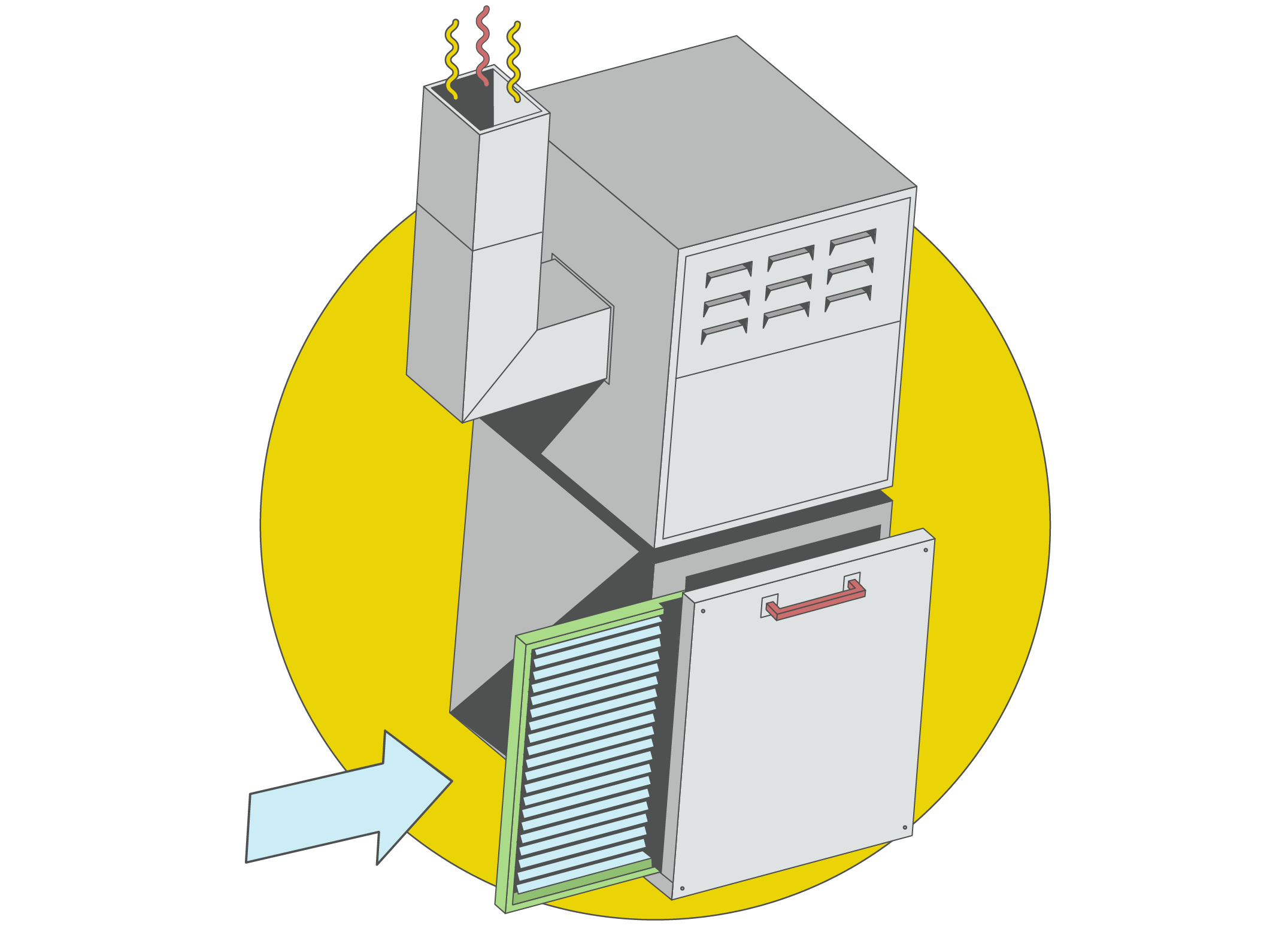

13. Heat your home for less

You might be able to save with these simple tips:

- Change your furnace filters every 90 days.

- Spin ceiling fans clockwise to push hot air down.

- Close vents in rooms you're not using.

- See if your utility company offers a discount for switching to paperless billing.

Get more ways to save on utilities.

14. Do a credit check

You now get 1 free credit report per week from each of the 3 credit agencies (Experian, TransUnion, and Equifax) at Annualcreditreport.com. Consider checking your report a few times a year to keep regular tabs on your credit. Review and note any errors, such as misspellings; incorrect addresses; on-time payments reported as late; and credit cards, credit checks, and loans in your name that you don't recognize. Dispute any errors with the credit-reporting agency. If you're wondering how to boost your credit score, try these 8 tips.

15. Price your prescriptions

Spring is right around the corner ... and so are spring allergies. Let this be a reminder to check your prescription costs (allergies or not), especially if you've picked up a new health insurer for 2026. See if your health plan offers an app or online calculator that estimates prescription costs. Some also compare prices at a brick-and-mortar store vs. mail-order pharmacy. This could be handy at the doctor's office. If they prescribe a med the app says is expensive, you might be able to request a cheaper alternative right then and there. Here are more ways to save on prescriptions.

16. Challenge yourself

If you're serious about getting your savings on track, try the 52-week money challenge. You save a specific amount based on which week it is. So, start with $1 in week 1. In week 2, save $2. In week 3, save $3, and so on through week 52. By then, you'll have a total of $1,378. Consider celebrating by exploring your options for where to stash savings.