Sometimes, unsettling things happen to stock prices. They go down, by quite a lot in some cases.

"History reminds us that the country, the economy, and the financial markets have recovered from uncertainty. And for younger people particularly, market ups and downs can also create opportunities for a brighter future," says Ann Dowd, CFP®, and vice president at Fidelity.

Here are 4 smart strategies to consider.

1. Check your emergency savings

If anyone needed a reminder of the value of emergency savings, COVID-19 certainly provided it. Our general rule is to start by setting aside $1,000, then aim to save enough cash to cover 3 to 6 months' worth of essential expenses. If you're the sole income earner for your household or your employment status could potentially change soon, you may want to put away a bit more if you can.

Read Fidelity Viewpoints: How much to save for emergencies

2. Invest with discipline or with help

If you are saving and investing for a retirement that may not begin for decades, it makes sense to take the long view of a market pullback. That means, instead of panicking and selling when the market drops, choose a mix of investments based on your timeline, financial situation, and feelings about risk, and then stick to that long-term approach.

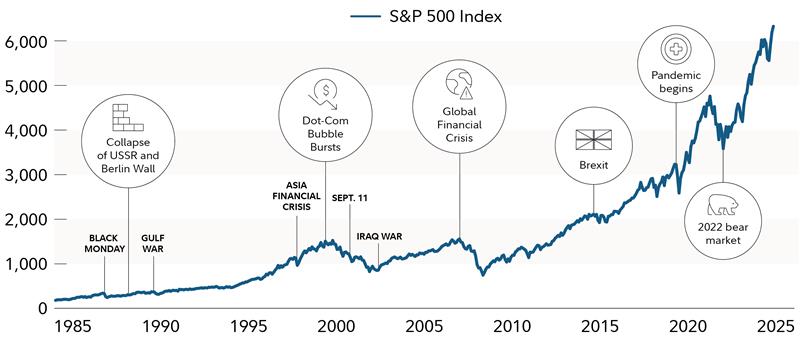

Remember that over long periods of time, the US stock market has gone up, despite many periods of dramatic selloffs. Consider the chart below that shows all of the market pullbacks since 1985. Even the 2008 financial crisis, when stocks fell nearly 50%, was just a bump in the road for the stock market with a long enough perspective. The past is in no way a guarantee of future performance, but at the time, stocks suffered a sharp move down and many investors may have considered trying to sell stocks to avoid losses. However, over the course of decades, it became a small blip in a long uptrend.

Despite market pullbacks, stocks have risen over the long term

If you don't feel comfortable or capable of managing your portfolio through volatility on your own, you may want to consider products or services that can help. You could work with an advisor. Or you could check out a robo advisor. A robo advisor is a low-cost, digital financial service that uses technology to automatically manage an investment account. A hybrid robo advisor is a financial service that combines a professionally managed account (through the help of a robo advisor) with the added benefit of affordable, direct access to professional financial advisors who could help you manage your financial life.

Fidelity offers several ways to get help investing, which includes assisting you in setting up your investment mix or hands on help from our team of financial professionals: How we can work together.

3. Consider saving more and rebalance

If possible, a downturn can be an opportunity to invest. If you are financially secure and have savings to cover an emergency, that could mean increasing the amount you deduct from your income to save for retirement until you hit the maximum for workplace savings plan contributions.

It’s important to consider how you may feel if you buy an investment, and the value falls due to market volatility. Some people do find it discouraging but going in with a plan and a long-term perspective may help you stick with it until the market recovers.

You could also consider rebalancing back into stocks. For example, say your investment strategy calls for about 75% stocks, and 25% bonds and cash. During a downturn, your asset mix may have moved away from stocks. You could reallocate back to your mix. That will help rebalance your portfolio over time, and position your investments to benefit from a market recovery. But it is important to remember to regularly revisit your contributions as part of an overall financial review, in case you need to adjust your contributions now and again in the future to stay on track for your plan.

4. Explore tax-loss harvesting opportunities and upgrade your portfolio

A realized loss on the sale of a security can be used to offset any realized investment gains, up to $3,000 in ordinary income annually. If you will have taxable gains this year and you have unrealized losses on investments that are currently worth less than when you bought them, you may want to sell them for a loss to lower your tax bill. If you choose to implement tax-loss harvesting, be sure to keep in mind that tax savings should not undermine your investing goals. Be sure to comply with Internal Revenue Service (IRS) rules on wash sales and the tax treatment of gains and losses.

If you have a tax advisor, they may already be doing your tax-loss harvesting. If you're doing it yourself, it's always a good idea to consult a tax professional.

Read Fidelity Viewpoints: How to cut investment taxes

The bottom line

When you are working and saving for the future, a downturn can be unsettling, but it shouldn't be a reason to panic. It may present an opportunity to review expenses, try to boost your savings, revisit your contributions, and invest in light of recent market action. Overall, if you have a solid plan based on your situation, sticking with that approach even through the scary times is a best practice.