Many people spend their working lives saving what they can for their future retirement. But once you get to retirement, the landscape begins to shift. Now you'll be spending rather than saving and that can be uncomfortable for some people. You'll want to have a plan to help make sure your essential expenses are covered.

One way to make sure you have money available to pay for essential expenses is by adding guaranteed income to your retirement portfolio.1 The 3 main benefits of guaranteed income in retirement are peace of mind, simplicity, and protection. There can be a sense of comfort in knowing that no matter what life brings or how the markets move, you’ll have some income you can count on.2

There are typically 3 sources of lifetime income available to support retirement: Social Security, pensions, and income annuities. Investing in an income annuity can help cover essential expenses that aren’t already met by Social Security or pensions. “Say you're in your 60s or retiring soon,” says Stefne Lynch, vice president, annuity product management and client engagement for Fidelity Insurance Agency. “An income annuity could help you cover your essential expenses with steady income that is guaranteed to last for as long as you live.”

To learn more about the benefits of income annuities, read Viewpoints on Fidelity.com: How to feel financially secure in retirement.

Once you’ve determined that an income annuity fits your financial goals, the next question is often: When should you buy one? Timing can depend on several factors—your age, when you’ll need the income, and the risks of delaying. But in many cases, the best time to purchase an annuity is as soon as you need income to begin covering essential expenses.

When should you consider an income annuity?

Choosing the right time to invest in an annuity depends on several important pieces of your personal financial puzzle. Below are the main components that will determine the payout from an income annuity.

- Age: The older you are when the annuity starts to make payments, the higher your payout is likely to be since the insurance company expects to make payments for a shorter period.

- Gender: On average, women tend to live longer than men. That’s why women may have a longer payout period, which generally results in lower payouts than men receive.

- Interest rates: In general, higher interest rates mean higher annuity payouts.

If you're considering waiting to invest in an annuity, it makes sense to evaluate the potential costs and benefits.

The 4 factors below may be valuable to consider when making your decision:

4 factors to consider

Using your savings while you wait: If you decide to wait before purchasing an income annuity, you’ll need to cover your essential expenses from your own savings. This could leave you with less to invest in an annuity in the future.

Your return on investments: By waiting, you can keep your principal invested. However, with a short time frame, you will want to invest in more conservative assets, such as cash or high-quality bonds. Though you are less likely to lose money in conservative investments, market volatility always poses a risk. Potential returns may also be more modest with lower-risk options.

The cost of an annuity: The purchase amount for guaranteed income may change based on interest rates, market conditions, and other factors. It could go up or it could go down.

How old you are: The older you are, the higher your income payment could be.

If you choose to wait to purchase an income annuity, these 4 factors could result in a higher or lower cost, but it’s not possible to know which. As a result, it can make sense to purchase an income annuity based on your retirement goals and need for guaranteed income, rather than market timing.

The impact of interest rates

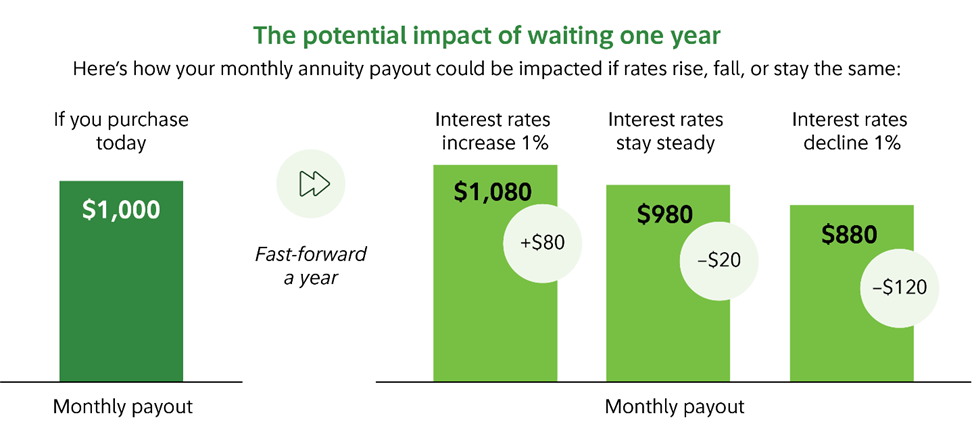

Rising interest rates have the potential to lead to higher payouts from an income annuity, while declining rates have the opposite effect. Below is an example of how a $1,000 monthly annuity payout today would look if you waited a year.

If interest rates increase by 1%, it may be beneficial to wait a year before making the purchase. However, waiting a year may result in less favorable income annuity payouts if interest rates stay steady or decrease by 1%. Without knowing which way interest rates will move, it can make sense not to delay purchasing an annuity.

Decades of uncertainty in interest rates

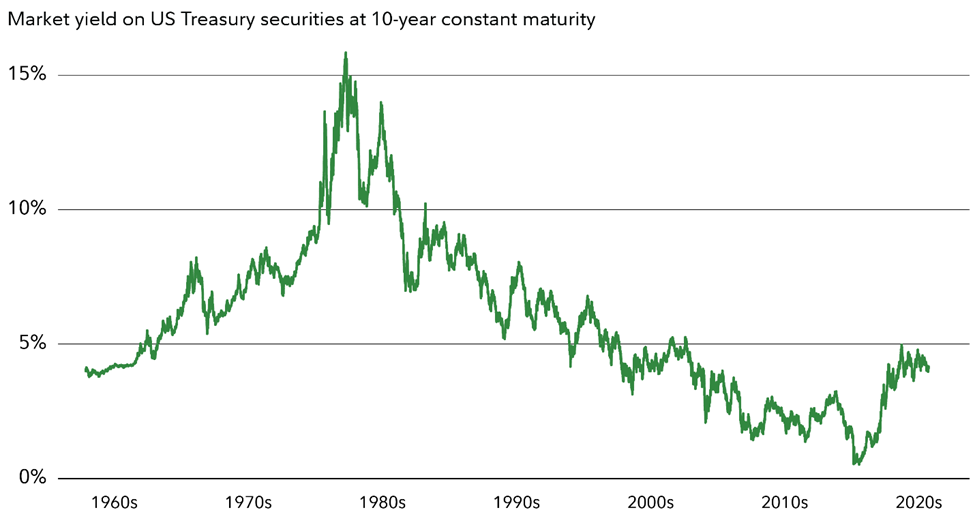

Interest rates have risen and fallen dramatically over the past several decades. Below is a historical demonstration of the movement in the 10-year US Treasury yield, which can be a key indicator of income annuity payout rates.

Because no one knows with certainty where interest rates will go next, it’s important to base retirement income decisions on your needs and goals rather than trying to time the market. If you remain unsure about the timing, you don’t have to commit all at once. Starting with a smaller purchase can give you guaranteed income today while maintaining flexibility to add more later—a strategy similar to dollar-cost averaging.

What if I invest the money instead?

The above perspectives assume that a person considering an annuity would keep their principal in cash (or cash equivalents), and they would cover their essential expenses by withdrawing from that account before purchasing an annuity the following year.

But what if you invested in bonds? If interest rates increase, the increasing rate environment could lead to losses in the bond portfolio—offsetting much of the expected increase in the annuity rate. Note: The reverse would also be true, and decreasing interest rates could lead to gains in the bond portfolio, and a decrease in the annuity rate.

What about investing in stocks? For an investor with years or decades to stay invested, stocks can be a great investment option.4 However, directing cash into the stock market that's earmarked for an annuity in a year could be even riskier than bonds. Generally, Fidelity does not recommend investing in the stock market with money you may need within 3 years or less.

Read Viewpoints on Fidelity.com: Thinking of retiring into this market?

The bottom line: If you’ve determined that the security of an annuity can help you cover your essential expenses in retirement, it can make financial sense to purchase an annuity for when you need income to begin, rather than waiting and trying to time the market. Doing so can provide peace of mind, and help you feel more comfortable about spending money in retirement, while offering protection against market volatility.