If you are age 65+, you may be one of the approximately 55 million people who are currently enrolled in Medicare plans that provide the Medicare Part D drug benefit—and you are likely concerned about the cost of prescription drugs.

With Medicare, the options can seem overwhelming. Costs and coverages can vary widely, so as part of your retirement income planning, it's important to get the Medicare decisions right.

Many older Americans are working longer and continuing to earn income well into their 60s and 70s. This income can help boost their retirement security, but it may also mean they face higher Medicare premiums.

The high(er) cost of Medicare Part B and Part D

Medicare is made up of several parts. Most have monthly premiums, which is the amount you pay each month for coverage.

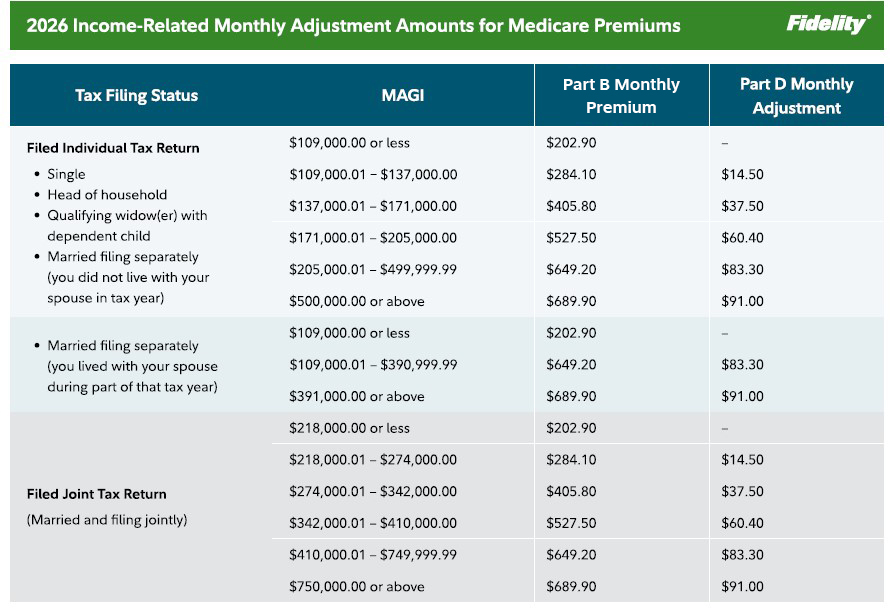

Part B has a standard premium amount that most people pay each month. That amount changes from year to year, but it's generally consistent for most Medicare enrollees. (For 2026, the standard Part B premium amount is $202.901)

However, the premiums for Part B (medical insurance) and Part D (prescription drug insurance) can vary between individuals based on their income level.

If your income is above a specific limit, the federal government adds an extra charge to your monthly premium. This charge is known as the Income-Related Monthly Adjustment Amount (IRMAA). Think of IRMAA as a surcharge or a Medicare surtax, as some refer to it.

To determine IRMAA, Social Security looks at the modified adjusted gross income (MAGI) amount reported on your IRS tax return from 2 years ago to determine whether you'll pay IRMAA. This charge may be applied to your Part B and Part D monthly premiums.

The following chart shows how Medicare calculates IRMAA based on income level1:

Unlike Medicare Part B, which the federal government provides, Part D prescription drug plans are provided by private health insurance companies that Medicare approves. Part D monthly premiums can vary a great deal from one health insurance company to another.

To determine how much Part D plans may cost in your area, visit Medicare.gov to get the latest monthly premium costs for Part D plans. If you're a high-income earner, your Part D IRMAA charge is added to the premiums you'll see quoted on Medicare.gov.

Keep in mind that IRMAA isn't considered part of your Part B and Part D premiums. It's a separate charge most Medicare enrollees have taken out of their Social Security payment, or they pay directly to Medicare. If the amount isn't taken from your payment, you should receive a quarterly bill in the mail. And if you're not taking Social Security retirement benefits, you'll get a bill in the mail for the standard Part B premium amount, plus any IRMAA you owe.

Getting notified about IRMAA—and what to do about it

Each year, Social Security works with the IRS to determine who must pay the IRMAA surcharge and sends out notices to individuals explaining IRMAA in detail, including:

- The information used to compute IRMAA

- What you can do if the tax information is incorrect or out of date

- What you can do if your tax filing status changed, or you faced a life-changing event (LCE) that caused a reduction in income

Examples of LCEs include:

- A work stoppage (getting laid off, retiring, etc.) or work reduction

- The death of a spouse

- Divorce

IRMAA for Part B and Part D is based on information from the past two years, but what if your current income level has changed, making it more challenging to pay IRMAA charges? What can you do?

There are 3 things to do to first:

- Visit the Social Security website or call Social Security at 800-772-1213 (TTY users can call 800-325-0778) for help or to request an appeal. The Social Security website states you should submit an appeal within 60 days from the time you receive an IRMAA notice.

- You may need to download Social Security Form SSA-44, Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event. It provides steps for what you need to do if an LCE has affected your income.

- Read the information from the Social Security Administration FAQs about verification notices that might be of help.

Taking steps to lower your income

IRMAA affects about 8% of Medicare recipients who are high-income earners. How can one lower their income to avoid potential IRMAA charges? While some individuals might see their income decline as they move into retirement, there are strategies for high-income earners to consider.

Generally, it would be advisable to avoid significant income-generating financial transactions as you approach Medicare eligibility that could increase your income level. Transactions would include:

- Selling real estate

- Taking distributions from retirement accounts (and paying related taxes)

- A transaction that nets a significant capital gain (such as selling shares in a stock, ETF, or mutual fund) that have appreciated in value

- Converting funds in an IRA to a Roth IRA

Alternatively, how and when you choose to withdraw from various accounts in retirement can impact your taxes in different ways. Be sure to check with a tax professional and have a plan to manage withdrawals from retirement accounts.

Some also make qualified charitable distributions (QCDs), such as to a 501(c)(3), using distributions from their retirement accounts. However, you must be age 70.5 or older to do this. QCDs do not directly impact your IRMAA payments, but they can do the following:

- If your IRS-mandated required minimum distributions (RMDs) have not started, QCDs can help reduce your retirement account balances, thus implicitly reducing your future RMDs and the income they generate.

- If RMDs have begun, QCDs can count toward your current year's RMDs, thereby reducing the amount of income you need to distribute from your retirement accounts this year.

Taking a distribution from a qualified retirement account to make these kinds of charitable donations does not count as income when it comes to IRMAA.

One final possible option is setting up a qualified longevity annuity.2 The IRS allows individuals to use their 401(k) or traditional IRA to buy an annuity that offers regular income but reduces the amount of required minimum distributions. However, this approach might not be a good option for everyone. Talk to your financial professional about these and any other options that might lower your income. Read Viewpoints on Fidelity.com: A way to secure retirement income later in life

Summary

If you're eligible for financial assistance for your Medicare costs, or your income level has lowered in the past 2 years due to a life-changing event, you may be able to appeal IRMAA. You could also consider ways to lower your income before enrolling in Medicare, if possible.

To learn more about IRMAA and its effects, Medicare.gov provides additional information about:

Get help

Looking for help to navigate your health care and retirement needs? Working with a financial professional can help you plan the course that's right for you.