Uncertainty over economic conditions and other headwinds may be making headlines but your personal finances can be a refuge from economic anxiety. It’s always important to plan for the long term, and that can start with a budget that helps you keep more of what you earn.

Controlling your discretionary spending is one way to do that. Another way to put more cash in your wallet could be identifying ways to reduce your taxes, pay less in fees, and save smarter.

1. Review tax withholding

If you get a tax refund each year, it may make sense to have less of your income withheld for taxes. With a little more money in each paycheck, you may be able to funnel more money into savings throughout the year.

You can ask your employer to withhold less of your income for taxes using Form W-4. Read Fidelity Viewpoints: Guide to the W-4

2. Look for tax credits

A tax credit directly reduces your tax bill. For example, if you’re eligible for a $1,000 tax credit and owe $2,000 in taxes, the tax credit would cut the amount of taxes you owe to $1,000.

Common tax credits

Many people qualify for these credits, all of which could help lower your tax liability if you meet the eligibility requirements.

- Earned Income Tax Credit is a refundable credit intended to help low- and moderate-income workers, especially those with dependent children.

- Child and Dependent Care Credit is a nonrefundable credit that can help parents—and certain caregivers of adults who can’t care for themselves—offset the cost of care while the caregivers work or look for work.

- The Child Tax Credit could help qualifying taxpayers lower their tax bills by up to $2,000 per qualifying child. A portion of this credit, called the Additional Child Tax Credit, is refundable.

- Saver’s Credit provides a tax credit of up to $2,000 to low- and moderate-income taxpayers saving for retirement.

- American Opportunity Tax Credit is a partially refundable tax credit of up to $2,000 per eligible student for qualified education expenses during a student’s first 4 years of higher education. Students might also qualify for the nonrefundable Lifetime Learning Credit.

3. Axe unused subscriptions, high fees, and high-interest debt

Ever received an email confirming a subscription renewal that slipped your mind? Tracking your subscriptions along with the prices and renewal dates can help avoid unnecessary financial dings.

Fees can be another unwelcome surprise. Interest charges on credit cards, banking fees, and even investment fees can compound over time and eat away at your money. Fees are of course how companies make money—but there’s no reason to pay more than necessary.

Make sure you’re getting your money’s worth and that the fees are reasonable.

Read Fidelity Viewpoints: How to balance debt, saving, and investing

4. Contribute to tax-advantaged accounts

Contributing to tax-advantaged accounts may provide a deduction for the tax year of the contribution or tax savings while the money is invested.

Health savings account (HSA)

If you’re enrolled in a high-deductible health plan, you’re likely eligible to save and invest in an HSA.

HSAs are tax-advantaged in 3 ways:1

- If your HSA is through your employer, you can make pre-tax payroll contributions.

- If you've opened an HSA on your own, contributions using after-tax money may be tax-deductible when you file your taxes.

2. Any potential investment growth is also federally tax-free.

3. Withdrawals are free from federal income taxes when spending on qualified medical expenses (QMEs).

Employers may offer a contribution to the account too—which is like free money. In the year you turn 55, catch-up contributions become available. You can contribute an additional $1,000 each year starting at age 55, as long as you aren't enrolled in Medicare. If you’re married and covered by a family HSA-eligible health plan, your spouse can also contribute $1,000 extra for a catch-up contribution if they are 55 or older and not enrolled in Medicare, but must contribute to an HSA opened in their name.

And you can reimburse yourself for qualified medical expenses anytime after the HSA was established. If you pay a doctor bill out-of-pocket today but need the cash in the future, you can withdraw the funds from the account federally tax-free. Just be sure to save your receipts.

At age 65, you can take withdrawals at any time, penalty-free. Withdrawals used for non-medical expenses are subject to ordinary income tax. Before age 65, withdrawals taken for nonqualified medical expenses may be subject to an additional 20% penalty.

Bottom line: You may be able to lower your tax bill in the year the contribution is made, not pay federal income taxes, and turn after-tax qualified medical expenses into pre-tax expenses, with the potential to receive tax-free investment earnings, with potentially tax-free withdrawals.

Visit Fidelity Learn to read more about HSAs and managing health care.

Workplace savings plan (e.g., 401(k)/403(b)

Workplace plans like 401(k)s or 403(b)s are also tax-advantaged accounts that offer potential tax benefits in exchange for saving for retirement.

Contributions can be made pre-tax and Roth contributions may be available. Many employers offer a matching contribution up to a certain dollar amount or percentage of your salary. Try to contribute at least enough to capture any match that’s available—again, it’s like free money. Generally, Fidelity suggests saving 15% of pre-tax income for retirement.

- Pre-tax contributions are made through your employer before taxes are taken out of your paycheck. Contributing to a 401(k) throughout the year generally reduces your taxable income and, in turn, lowers your tax bill. Any potential earnings grow tax-deferred. Withdrawals from a 401(k) or 403(b) are taxed at ordinary income tax rates in retirement.

- Roth contributions are made with money that has already been taxed (your contributions don't reduce your taxable income). Withdrawals of earnings are potentially tax-free in retirement.2

There are several considerations when deciding which type of account to save in. For more tips, read Fidelity Viewpoints: Traditional or Roth IRA, or both?

IRAs

IRAs are retirement accounts you set up on your own. There are 2 types of accounts, traditional IRAs and Roth IRAs. The main difference between them is the potential tax benefit.

Traditional IRA contributions may be tax-deductible for the year in which they are made.3 That may lower your tax bill.

- Like a 401(k), any earnings grow tax-deferred; and withdrawals are taxed as ordinary income in retirement.

Roth IRA contributions do not offer a tax deduction. Instead, any earnings have the potential to grow tax-free with tax-free withdrawals in retirement.4

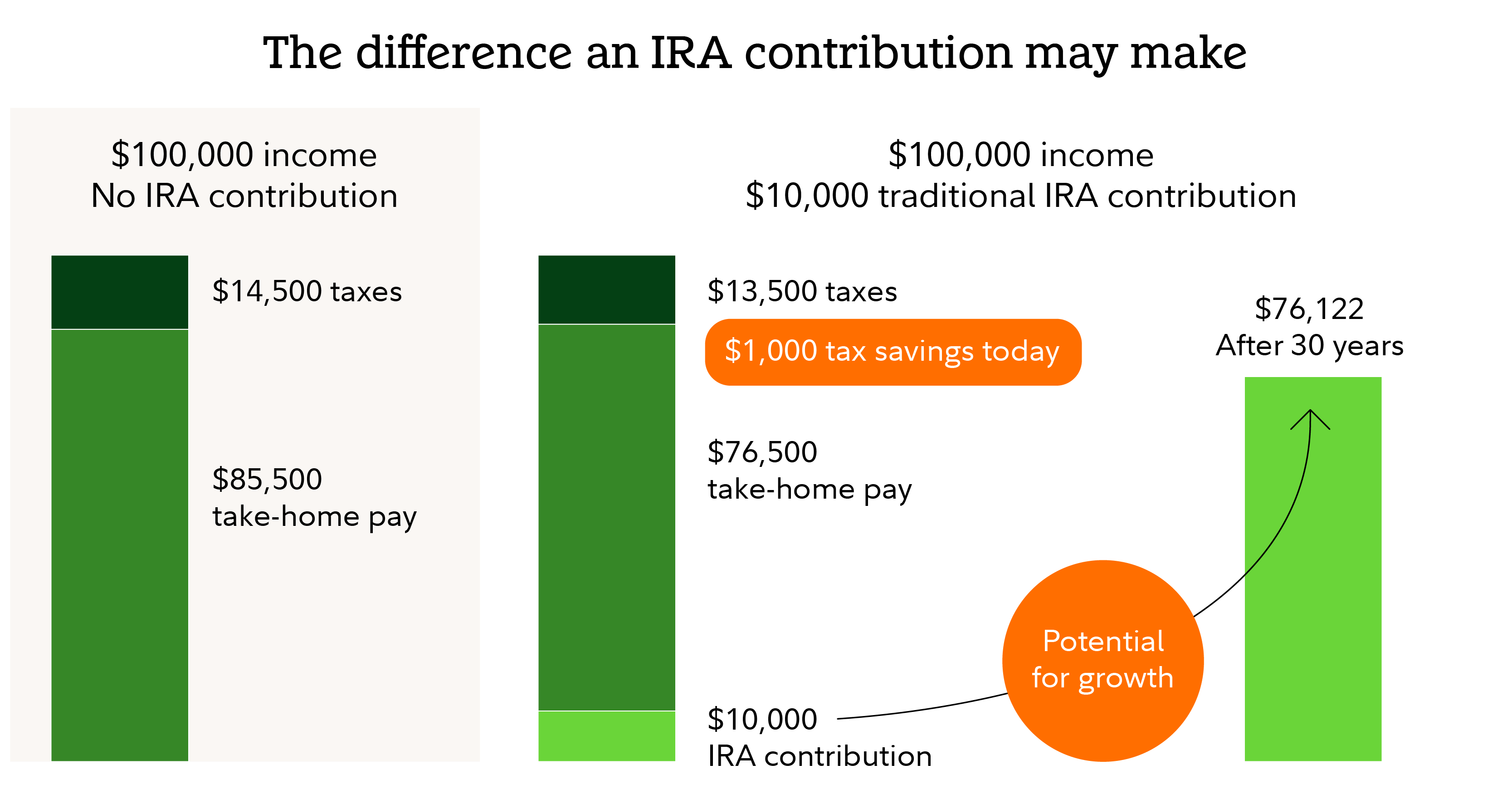

Here’s an example of the potential impact and benefit of saving in IRAs.

To visualize the impact, let's compare 2 scenarios. Assume this is a couple filing a joint tax return:

1. Without contributions:

- Annual income: $100,000

- Taxable income after 2025 standard deduction: $68,500

- Taxes (assuming payroll taxes and a 10% federal and state tax rate): $14,500

- Take-home pay: $85,550

2. With $10,000 combined contribution to traditional IRA

- Annual Salary: $100,000

- Taxable income after 2025 standard deduction and $10,000 ($5,000 IRA contribution for both the planner and the spouse): $58,500

- Taxes (assuming payroll taxes and a 10% federal and state tax rate): $13,500

- Take-home pay: $76,500

In this example, their tax savings were $1,000.

After growing at a hypothetical rate of 7% for 30 years, assuming no other contributions or withdrawals, $10,000 could grow to $76,122. In retirement, when the money is withdrawn, they will owe income taxes on withdrawals.

If $10,000 was contributed to a Roth IRA instead of a traditional IRA, the withdrawal of $76,122 could potentially be tax-free, but they would have to give up $1,000 in tax savings today.

For more to consider, read Fidelity Viewpoints: Traditional or Roth account? 2 tips to help you choose

5. Build or bolster your cash cushion

Keeping emergency savings of at least $1,000 can help head off financial setbacks. Being able to cover minor emergencies with cash can reduce the amount you need to borrow or withdraw from less liquid accounts. Once you hit $1,000, keep saving until you have enough to cover essential expenses for 3 to 6 months.

Read Fidelity Viewpoints: How much to save for an emergency

6. Try to avoid early withdrawals

Building up your 3 to 6 months’ of essential expenses can help ensure that you won’t need to take an early withdrawal from a tax-advantaged account. But emergencies happen. If you do need to access money quickly, try to consider the lowest cost options first. Read Fidelity Viewpoints: Where to find cash, fast.

Unfortunately, taking money out of a tax-advantaged account early often results in IRS penalties and taxes.

- For IRAs and workplace retirement plans like 401(k)s, the early withdrawal penalty is 10% of the amount withdrawn, plus income taxes.

- For Roth IRAs, there is no penalty for withdrawing contributions, but withdrawals of earnings before age 59½ and before the 5-year aging rule has been met may be subject to the 10% penalty, plus income taxes. Similar tax treatment applies for workplace plans but plan rules may apply regarding when you can take withdrawals.

- A withdrawal from an HSA that is not used for qualified medical expenses may be hit with a 20% penalty from the IRS in addition to taxes. After age 65, there is no penalty; however, you will incur normal income taxes.