When you have a family, protecting them is job number one—and that includes planning in the event of your death. Would your family be able to pay the bills, send the children to college, keep the business running without you? Fortunately, life insurance can provide your loved ones with necessary resources in their time of need.

A life insurance policy provides payment to your beneficiaries in the event of your death. They will generally receive the income tax-free payment1 directly from the insurance company, usually without the delays that come with settling a will or estate. This makes life insurance a dependable way to provide for those you love—no matter your age.

1. What types of life insurance are available?

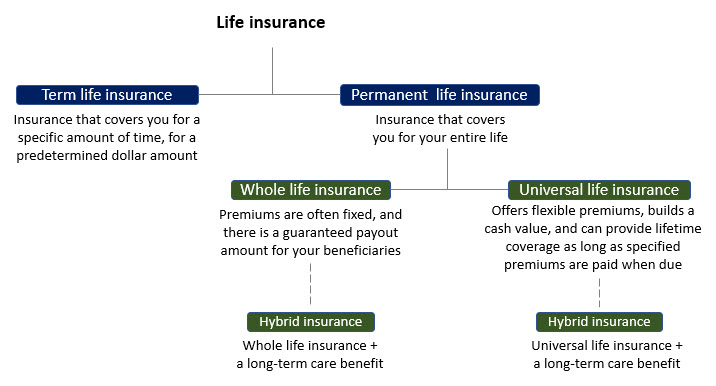

Life insurance generally falls into 2 categories: Term and permanent.

Term life insurance covers a specific period of time, such as 10, 15, or 20 years. Some providers offer 25 and 30 year terms, and the premium payment amount stays the same for the coverage period you select. It can be a good choice if your goal is to give your loved ones a lump sum to help replace the loss of your income; they can use it to pay for housing, college, or other financial necessities. Visit: Term Life Insurance Quote Tool

You can purchase term life on your own, through a group policy (such as an employer or professional group), or both. Individual policies allow you to have more control over the amount of the policy and the length of coverage, but they usually require a health assessment to determine the premium cost.

Group policies are generally set for a predetermined coverage and premium (both usually lower than individual coverage), but unless you opt for additional coverage, they rarely require a health assessment. However, if you were to leave your employer, the group life insurance coverage generally ends.

Permanent life insurance has 2 subcategories, whole and universal, and both cover you for your entire life as long as your premiums are up to date. Whole and universal life insurance also have potential benefits for wealth transfer.

Universal life insurance generally lets you choose from a single or flexible payments, and builds cash value over time. You can choose how much you pay within certain limits. You must pay at least enough to cover the cost of insurance and the administration charges.

Whole life insurance generally has fixed premiums and a guaranteed payout amount for your beneficiaries. This can be a good choice if you have a lifetime need for insurance and/or you are considering transferring wealth to your beneficiaries. Additionally, some whole life policies are eligible to earn dividends based on the company's earnings. Though not guaranteed, those dividends can help increase the death benefit and cash value of the policy.

Some permanent life policies, referred to as Hybrid life insurance, provide a combination of insurance coverages. For instance, a long-term care benefit may be attached to a life insurance policy, usually whole or universal life. A long-term care rider can help you cover the cost of certain types of care while you are still living (for example, nursing home costs or in-home assistance). If your insurance needs change, you may be able to surrender a portion of the policies cash value, or your beneficiaries will receive a death benefit upon your passing.

2. How much life insurance do I need?

First, calculate your family's day-to-day needs—the entire amount of money it takes to run your household each month. Next, plan for larger expenses such as college, paying off student loans, a mortgage, or potential medical issues. One simple guideline is to aim for 10-12 times your annual salary and bonus.

If you have a spouse/partner, it's also important to have coverage for both people, no matter how much each person earns. If something were to happen to either of you, you might need to cover unexpected costs such as additional caretaking of children or parents, or time off to settle the estate.

Don’t forget to include the group life insurance that may be available from your employer when determining your total coverage need. Be sure to factor how the policy premiums will fit into your budget. "It's better to buy a smaller policy with premiums you can comfortably afford than to buy a bigger policy that you have to let lapse because you can't pay the premium," says Tom Ewanich, a vice president and actuary at Fidelity Investments Life Insurance Company.

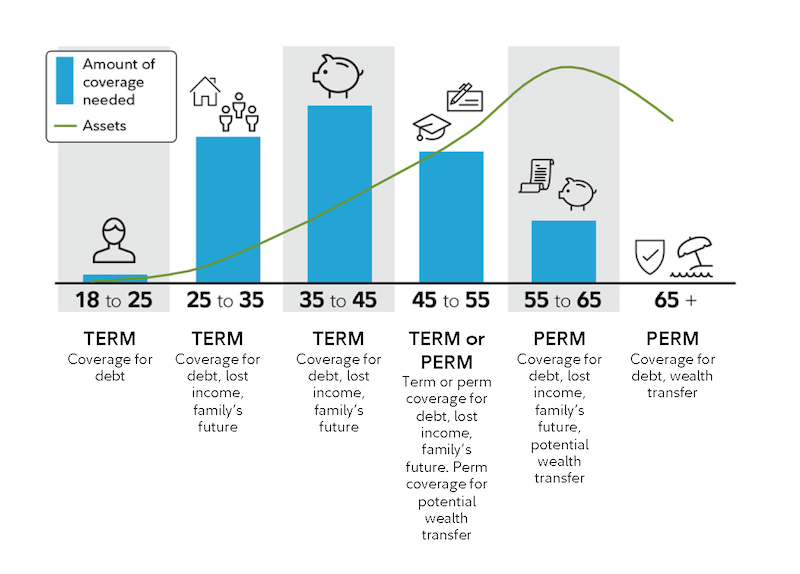

3. When should I revisit my insurance needs?

It's a good idea to review your need for life insurance whenever a major life event occurs—a new home, marriage, child, or job. Additionally, the cost and accessibility of life insurance can vary depending on your age and health: Generally speaking, life insurance becomes more expensive to purchase as you age. Keep in mind that term life insurance is typically less expensive than permanent insurance and it is designed to provide coverage during your working years. As you reach the age when you are interested in transferring some of your wealth to the next generation, then it might be time to consider permanent life insurance.

Tip: As you age, it may be more difficult and more expensive to qualify for and purchase life insurance.

Insurance frequently asked questions

How much life insurance do I need?

- Enough to cover loss of income—consider term life insurance

- Enough to transfer your assets to your heirs—consider permanent life insurance

- Enough to cover both loss of income and transfer your assets to your heirs—consider permanent life insurance

How long should my policy cover me?

- Until your children are old enough to support themselves—consider term life insurance

- For a specific time period—consider term life insurance

- Until your death, whenever that may be—consider permanent life insurance

Over the course of your life, you'll likely have a series of short-term and long-term financial needs that change over time. Consider working with your financial professional to explore term and permanent life insurance options as part of your overall financial planning process.