The tax benefits of Roth accounts are clear: Tax-free growth potential and tax-free withdrawals in retirement.1 If you aren't able to contribute to a Roth IRA because of the income limits,2 a Roth conversion of eligible retirement assets is another way to fund a Roth account.3 But does it make sense if you are retired or plan to retire soon? Maybe. A Roth account, even via a conversion, has the potential to benefit your retirement and legacy planning.

While your situation is unique and should be discussed with a tax professional, here are 7 things to keep in mind when thinking about a conversion.

1. Where you will live in retirement

Are you planning to move to another state after you retire? Even if you expect your federal tax rate to stay the same in the coming years, the difference between your current and future state's tax rates may matter. And some states partially or entirely exclude retirement income—such as distributions from a traditional IRA or workplace plan—from state income tax. So if you live in, or plan to live in, a state that excludes retirement income from state income tax, a conversion from traditional to Roth accounts may be less attractive.

If your future state of residence has a higher state income tax rate than that of your current one, it might make sense to convert at least some of your eligible assets to a Roth before you move. Similarly, if you're moving from a state with a higher tax rate to one with a lower rate—or no income tax—you may want to avoid a conversion, or at least consider waiting to convert until you've established your new residency.

2. Required minimum distributions (RMDs)

Beginning in 2024, designated Roth accounts in employer plans do not have required minimum distributions during the life of the original owner. But traditional IRAs, and, generally, traditional 401(k)s, 403(b)s, and other employer-sponsored retirement savings plans do, starting at age 73.4

Note that as of January 1, 2024, RMDs are no longer required from Roth 401(k)s and other workplace plans while the original account owner is still alive due to a provision of the SECURE Act 2.0.

If you don't need the income from these distributions to meet current retirement expenses, RMDs may feel like a nuisance: They need to be calculated each year, may provide unnecessary taxable income, and, if you miss taking one, can result in stiff penalties.

Converting from eligible accounts to Roth may reduce your RMDs and may also allow you to pass more of your retirement account savings on to your heirs (see No. 4). When considering whether to convert to Roth, however, keep in mind that the potential benefits of doing so are largely reliant on your current tax bracket being lower now than in the future. Otherwise, you may be accelerating tax bills that you could otherwise defer.

Consider this hypothetical example: Mark, 75, had $100,000 in a traditional IRA at the end of last year. His wife, Ann, the sole beneficiary of his IRA, is 6 years younger than he is. Mark's RMD for the year would be $4,065.5 If Mark didn't need this money, a Roth conversion of the assets remaining in the traditional IRA could allow him to avoid successively larger RMDs in the years ahead, and provide an opportunity for his money to grow tax-free instead. Of course, Mark would need to factor in the tax payment triggered from a conversion to see if this strategy makes sense for his situation (see #7).

3. The 3.8% net investment income tax

Married couples (filing jointly) with a modified adjusted gross income (MAGI) of more than $250,000 may be subject to a 3.8% net investment income tax. (The MAGI thresholds are $125,000 for married taxpayers filing separately and $200,000 for single filers or head of household.) The tax applies to net investment income (which includes income from interest, dividends, capital gains, annuities, rents, and royalties, among other things); or MAGI in excess of the income thresholds, whichever is less.

The taxable portion of the amount you convert from a traditional account to a Roth account is treated as income—just like all taxable distributions from pretax qualified accounts. Therefore the conversion amount is part of your MAGI, and it may move you above the tax's thresholds. This may cause you to incur the net investment income tax on your investment income.

But, once your money is in a Roth account, the shoe is on the other foot. Because qualified withdrawals1 from a Roth account aren't part of your MAGI, a Roth conversion may potentially enable you to limit your exposure to the net investment income tax down the road.

4. Leaving money to others

If you're planning to leave retirement savings to heirs who are not eligible designated beneficiaries (EDBs), there are many details to consider. First, think about how this may affect the inheritors' taxes. Due to the SECURE Act, heirs will be required to withdraw the full account balance of an inherited IRA or workplace retirement plan by the end of the 10th year following the year of the original owner's passing.

Inherited traditional account withdrawals generate taxable income, and heirs may be forced to take these withdrawals during their peak earning years. These distributions could either incur taxes when heirs would rather avoid them or unintentionally push them into a higher tax bracket. Consult with a financial professional to see how current IRS regulations affect your situation.

In one respect, inheriting Roth assets, which generally don't incur any income taxes, could be a benefit to your heirs: The income taxes paid on a Roth IRA conversion could help reduce the size of a taxable estate. Note that in order for earnings to be tax-free, assets must be in the Roth for 5 years. Also, when doing a conversion, you will want to weigh the potential importance of providing your heir(s) with tax-free income versus the impact to your current year’s tax liability and the longer-term impact in the form of reduced RMDs. Roth IRAs do not have RMDs, which means that assets can stay in the account and grow: This may make up for any downside to the inheritor.

If your heirs are likely to be in a much lower tax bracket than you are, it may be more advantageous to leave them a traditional account. That's because it may be better for your heirs to pay lower taxes in the future than for you to pay higher taxes now.

Also, Roth conversions may be disadvantageous to those who intend to leave at least some of their assets to charitable institutions. Traditional accounts can typically be left to charity without having to pay income tax (although estate tax may apply). So, in that case, conversion will mean that the income tax was paid needlessly.6

If leaving money to others is part of your plan, no matter what your goals are, be sure to consult an estate planning attorney and think carefully before taking any action.

Read Viewpoints on Fidelity.com: An all-in-one wealth transfer checklist

5. Workplace retirement plan options

There are two different considerations to make when planning the timing and size of a Roth conversion from your workplace retirement plan, as opposed to a conversion from an IRA: company stock held in the plan; and plan rules around the Roth option, if applicable.

If you're retiring and have appreciated company stock in your traditional 401(k) or other qualified workplace savings plan, it may not make sense to convert these assets to a Roth IRA. Special tax rules on net unrealized appreciation (NUA), if you qualify, allow you to take a lump-sum distribution from your plan of the entire account balance and pay income tax (and a 10% penalty, if you're under age 59½) on your cost basis. You can then defer taxes on the NUA—that is, the appreciation of the stock since you bought it—until you sell the stock. At that time, the NUA would be taxable as long-term capital gains. Assuming the sale is more than one year since you purchased the stock, this will probably cost you less than having it taxed as ordinary income, as it would be in a Roth IRA conversion.

Read Viewpoints on Fidelity.com: Make the most of company stock

Roth options

If you’re still working, moving money from a workplace plan to a Roth IRA generally requires that you first be eligible for a distribution under your plan’s rules (for example, after severance from employment or after reaching age 59½, if the plan permits in‑service withdrawals). Once you receive an eligible distribution, you can generally roll it over, subject to the rollover rules. Moreover, if your plan allows, you may be able to consider one of 2 options: Contribute to your company’s Roth 401(k) if offered by your employer, or do an in-plan conversion to a Roth 401(k).

Not all employers offer in-plan conversions, and, even when they do, a Roth 401(k) lacks a few of the features of a Roth IRA. If you are unable to convert to a Roth IRA, the Roth 401(K) option may be worth exploring. This is especially true for those who have made after-tax contributions (also called nonqualified contributions) to their 401(k) plan.

On the other hand, 401(k)s may offer benefits that IRAs do not, such as institutional pricing on investment products, greater legal protection under ERISA, and the ability to take loans.

Discuss your situation with a tax and financial professional to help you make a fully informed decision.

6. College-age children

If you have children who are currently in—or are close to starting—college, and who are applying for financial aid, a Roth conversion may have an impact. Because the amount converted is treated as income, it's included in the needs test on the Free Application for Federal Student Aid (FAFSA) and can potentially raise a parent's expected financial contribution (EFC) and reduce aid. If you request it, some universities may adjust their calculation to account for Roth conversion income in their private financial aid formulas, but federal aid formulas do not. So if you're seeking financial aid, especially federal, it may make sense to wait to convert until your children are out of college.

7. How you would pay for the conversion

A Roth conversion has a cost, which is the income taxes on the taxable portion of the amount you convert. It generally makes sense to use taxable assets rather than proceeds from a converted account to pay the tax cost of a Roth conversion (and you may be able to reduce taxes owed through deductions and credits, thus avoiding a sale of assets to cover the bill). This is because, all things being equal, the net rate of return is generally higher for a Roth account than a taxable account because no taxes are due for any gains in a Roth account—and taxes reduce the returns you achieve. Consequently, it usually makes sense to pay for a conversion with the assets that will earn a lower after-tax return (taxable assets already outside of the Roth account). This is particularly true for those under age 59½, because, for them, paying for a conversion using proceeds from a qualified account could also result in a 10% tax penalty and further reduce the potential benefit of converting.

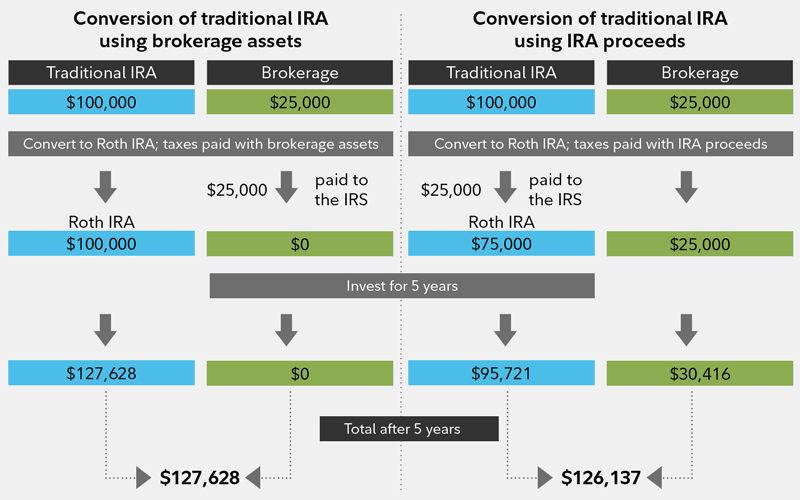

Consider this hypothetical example: Elaine is 62 and has $100,000 (all pretax) in a traditional IRA and $25,000 in a brokerage account. Her current marginal tax rate is 25% and she expects it to remain there. What would she have after 5 years if she converts her traditional IRA to a Roth IRA and uses proceeds to pay the taxes? How would that compare with using money from her brokerage account to pay for the conversion? (To keep it simple, the example assumes investment returns of 5% compounded annually in the Roth IRA, 4% compounded annually in the brokerage account after accounting for federal income taxes, and does not take state income taxes and other tax considerations or inflation into account.)

Pay conversion taxes from a taxable account, so more of your money is tax-free

If Elaine uses money from her brokerage account to pay taxes on the conversion, she could wind up with nearly $1,500 more in her total assets after 5 years. That's because returns on money in the brokerage account are reduced by taxes (for example, taxes on dividend and interest distributions), while returns on money in her Roth IRA are not—they earn a pretax rate of return. So, using the brokerage account to pay for the taxes due from the conversion means her remaining assets in the Roth IRA earn the higher, pretax rate of return. Using conversion proceeds to pay the taxes means that less of her total assets earn the higher, pretax rate of return.

If Elaine could use money from a bank account rather than from a brokerage account to pay for the conversion, that would tend to make the benefit even larger, because bank accounts typically offer lower rates of return than brokerage accounts. If Elaine's investment horizon were longer than 5 years, that too would increase the benefit of using assets other than proceeds from the IRA to pay for conversion. That said, always consider the broader context: If, for example, the money in the bank account is your emergency savings, using it for a Roth conversion may not be appropriate, despite the benefits.

Read Viewpoints on Fidelity.com: Answers to Roth conversion questions

Any evaluation of a potential conversion should include input from a financial professional, along with a tax and/or estate planning attorney.